structuresxx

I always find myself drawn toward unique companies. And few companies are as unique in terms of what they do and how they operate as Civeo Corporation (NYSE:CVEO). This business, which provides accommodation services to companies in Canada, Australia, and even the US, is not your typical accommodation business. Instead, it builds facilities in remote locations for the purpose of catering to businesses that are out there and dedicated to extracting natural resources. Recently, the picture for the business has looked remarkably strong. Sales are rising and profits are robust. On top of this, the shares still look cheap despite being up 60.6% so far this year, and I can’t help but to keep it as a solid ‘buy’ at this time.

A great business

The last time I wrote an article about Civeo was in early August of this year. In that article, I talked about how the company’s shares had seen something of a pullback in the prior few months. That came even at a time when fundamental performance for the company remained strong. Overall, I concluded that the near-term outlook for the company was favorable, especially after it had won a sizable renewal in the form of a 10-year contract. And after factoring in how cheap shares were, I ended up rating it a ‘buy’, reflecting my belief that the stock should outperform the broader market for the foreseeable future. So far, that call has proven to be really great. While the S&P 500 has dropped by 9.3%, shares of Civeo have generated upside of 11.3%.

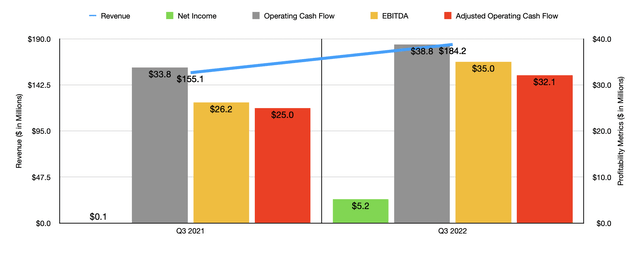

Author – SEC EDGAR Data

This return disparity is not without cause. In fact, it is entirely warranted. To see what I mean, we need only look at financial results covering the third quarter of the company’s 2022 fiscal year. This is the only quarter for which data is now available that was not available when I last wrote about the firm. Sales during that time came in strong at $184.2 million. That represents an increase of 18.8% over the $155.1 million the company reported only one year earlier. Strength for the company came across the board. For instance, revenue from Canada where the company generates most of its value, jumped by 22.5%. In Australia, sales grew a more modest 13.3%, while in the US sales climbed 25.9%.

In Canada, the company saw the average daily rate for lodges remain virtually unchanged, climbing only from $98 to $99. Instead, what it benefited from was an increase in the total billed rooms for lodges, a number that grew from 613,017 to 730,708. In Australia, the average daily rate for villages dropped from $78 to $73. At the same time, however, the total billed rooms for villages jumped from 491,218 to 525,359. The U.S. market is less significant for the company because it represents only a small portion of the company’s revenue. But according to management, the wellsite operations of the company experienced nice upside, as did the offshore operations that it offers.

This improvement on the top line was also instrumental in pushing up profits. The company went from generating $62,000 in profit in the third quarter of 2021 to generating $5.2 million in profit in the third quarter this year. Operating cash flow rose from $33.8 million to $38.8 million. If we adjust for changes in working capital, it would have risen still, climbing from $25 million to $32.1 million. And finally, EBITDA for the business increased from $26.2 million to $35 million.

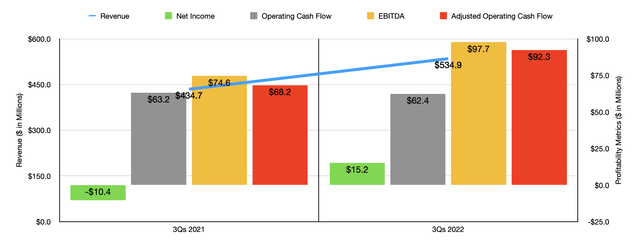

Author – SEC EDGAR Data

This strength in the third quarter has proven instrumental in helping results for the 2022 fiscal year in its entirety. Revenue in the first nine months of the year came in at $534.9 million. That stacks up nicely against the $434.7 million reported one year ago. The company went from generating a net loss of $10.4 million to generating a profit of $15.2 million. Admittedly, operating cash flow did fall year over year, declining from $63.2 million to $62.4 million. But if we adjust for changes in working capital, it would have risen from $68.2 million to $92.3 million. And finally, EBITDA for the business also improved, rising from $74.6 million to $97.7 million. Using this improved profitability, management is starting to make some rather interesting maneuvers. For instance, just recently, the company announced it was acquiring back 40% of its Class A Series 1 preferred stock. The total purchase price on this stock is $30.6 million. However, instead of funding it with cash, the company is funding it with a revolving credit facility. Although the distribution on this preferred stock is only 2%, a number that is certainly lower than the interest the company is paying on the debt, the firm is doing this in an attempt to reduce future dilution for shareholders. In effect, the company has actually bought back around 10% of its stock outstanding inclusive of this deal. This should serve as a testament to how undervalued management believes shares are today.

When it comes to the 2022 fiscal year in its entirety, management believes that revenue should come in at between $675 million and $685 million. At the midpoint, that would translate to a 14.4% increase over the $594.5 million generated in 2021. The only profitability metric that management provided guidance on was EBITDA. This should come in at between $110 million and $115 million. By comparison, the number last year was $109.1 million. If we assume that operating cash flow will rise at the same rate that EBITDA is slated to at the midpoint, then we should anticipate a reading there of $99.2 million.

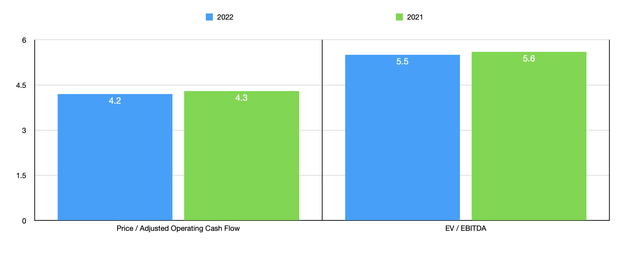

Author – SEC EDGAR Data

Based on this data, shares of the enterprise look incredibly cheap. The forward price to adjusted operating cash flow multiple of the firm is only 4.2, while the EV to EBITDA multiple comes in at 5.5. For context, using the data from the 2021 fiscal year, these multiples should be 4.3 and 5.6, respectively. After factoring in the effective equity for debt swap, the firm has a forward net leverage ratio of 1.31. That compares to the 1.35 reading that we get using data from last year. This is certainly low enough to qualify the company as a low-risk operator. Normally, I would also like to compare a business to similar firms. But as unique as Civeo is, there aren’t any that I would deem appropriate.

Takeaway

The data we have available to us tells me that Civeo continues to be a robust business that should generate continued upside for the foreseeable future. Yes, the firm could suffer in the event that energy prices fall materially. But the firm has already made it through that kind of crisis once before. So long as there exists demand for energy production out in remote areas, this particular firm should have the opportunity to thrive. So because of that, I feel comfortable keeping my ‘buy’ rating on the stock for now.

Be the first to comment