Lazy_Bear/iStock Editorial via Getty Images

Introduction

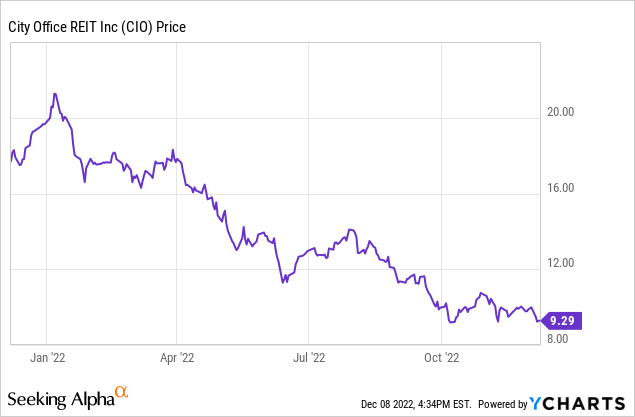

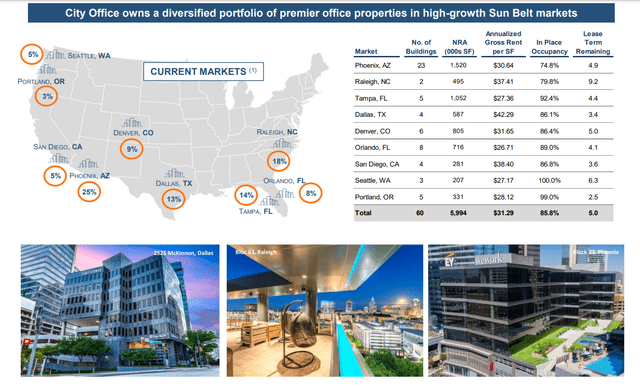

In June, I thought the preferred shares of City Office REIT (NYSE:CIO) were relatively cheap as they were yielding 7.1%. I was too early and as the Federal Reserve continued to increase the interest rates resulting in the share price of the preferred shares continuing to slide. The yield is currently around 9% so I wanted to check up on City Office’s recent performance to see if there’s any reason for concern for this office-focused REIT.

The FFO performance remains strong

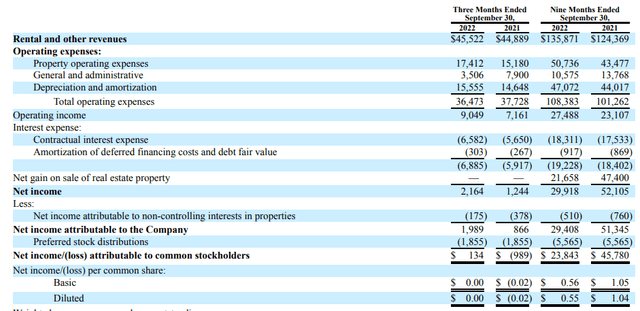

During the third quarter, the total revenue came in at $45.5M while the property operating expenses came in at $17.4M. After deducting the $36.5M operating expenses (including $15.6M in depreciation and amortization expenses), the operating income was approximately $9.05M.

City Office REIT Investor Relations

About $6.6M was needed to cover the interest expenses and after also deducting the $0.3M amortization of deferred financing costs, the bottom line showed a net income of $2.2M. From that amount, we still need to deduct the $0.2M in net income attributable to minority interests and the $1.86M in preferred dividend payments. The end result was a net income of just over $100,000 for an EPS of $0.

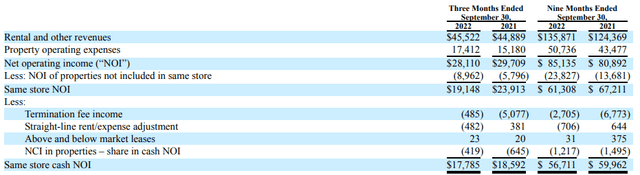

Of course, we all know the net income is not important for REITs and I’m more interested in City Office’s NOI (to double-check if the book value of the assets is realistic) and the FFO and AFFO. The NOI in the third quarter came in at $17.8% and the 9M 2022 NOI was $56.7M. While that is lower than in the preceding year, keep in mind City Office sold assets in 2021 and that’s why it makes more sense to use the “same store” results.

City Office REIT Investor Relations

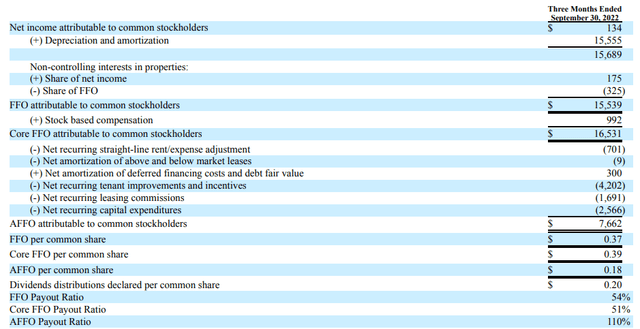

Looking at the FFO result, City Office REIT generated a total FFO of $15.5M during the third quarter and after adding back the (non-cash) stock based compensation, the so-called core FFO came in at $16.5M or $0.39 per share.

City Office REIT Investor Relations

That sounds great, but I’m not sure using “just” the FFO is the right metric here and using the AFFO, which includes sustaining capex and lease improvements, likely is a better metric here. While one could argue “tenant improvements” are non-recurring but in reality, City Office REIT has been spending approximately $4M per quarter on improvements and incentives for quite a while.

So while the current quarterly distribution paid by City Office exceeds 100% of the AFFO, I’m not too worried from the perspective of a preferred shareholder.

City Office REIT Investor Relations

The preferred shares continued their slide and are pretty attractive now

There are currently 5.6 million preferred shares outstanding. The A-series, trading with (NYSE:CIO.PA) as ticker symbol, offer a 6.625% cumulative preferred dividend which works out to $1.65625 per year, paid in four equal quarterly installments. These preferred shares are callable at any time.

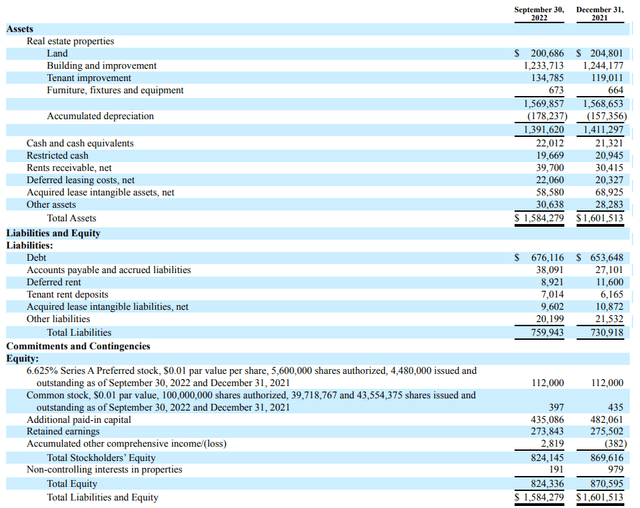

Looking at the balance sheet, the total equity value on the balance sheet is $824M. This means there’s in excess of $700M in common equity that ranks junior to the preferred shares. Or in other words, even if CIO would only receive 50 cents on the dollar based on the book value of its assets, the preferred shareholders could still be made whole.

City Office REIT Investor Relations

Also keep in mind the $1.4B book value of the assets includes an accumulated depreciation of $178M.

So, the asset coverage level appears to be more than sufficient as the common equity holders would absorb the first losses. A second element I care about is the dividend coverage ratio. We already know the quarterly AFFO comes in at around $7.6-7.7M per quarter. This already includes the $1.9M in preferred dividends which means the normalized AFFO excluding preferred dividends would be approximately $9.5M per quarter. This also means City Office only needs about 20% of that normalized AFFO to cover the preferred dividends and that’s a good enough ratio for me.

Investment thesis

I likely won’t buy the common units of City Office REIT anytime soon as the stock isn’t extraordinarily cheap based on the AFFO performance (which I think is a more realistic and conservative approach rather than looking at the FFO). But if I’m looking for an income security, the preferred shares meet my investment criteria anyway. The 9% preferred dividend yield is very attractive, especially given the strong asset coverage ratio and the acceptable payout ratio based on the AFFO performance.

I already have a long position in City Office’s preferred shares and I think the current share price of $18.40 provides me with an excellent opportunity to further increase my position.

Be the first to comment