Editor’s note: Seeking Alpha is proud to welcome Mark Pierce as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

400tmax/iStock via Getty Images

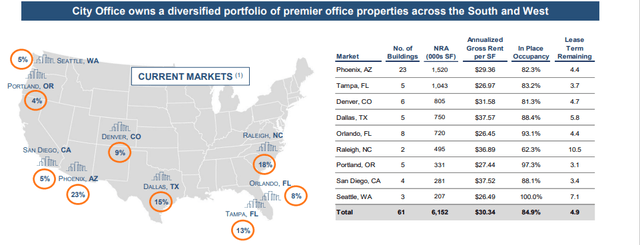

City Office REIT, Inc. (NYSE:CIO) is riding on a decades-old demographic shift of the population to the South and West of the country. During the pandemic, this shift was accelerated as businesses looked for more modern, more flexible, more resilient office spaces in the fast growing cities of the South and West. The company has a valuable portfolio that still has scope for value to be unlocked. The company’s forward guidance suggests that the company is significantly undervalued.

Demographic Shifts Will Make City Office’s Properties More Valuable

City Office is a small cap real estate investment trust that owns properties in the South and West of the United States.

Source: February 22 Investor Presentation

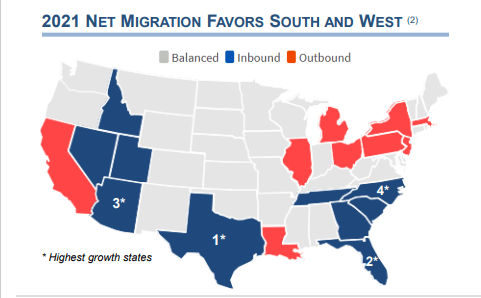

The original colonies of the United States set the tone for the population concentration of the country in the North and East. Data from the Census Bureau shows how from 1790 until 1900, there was no meaningful presence of Americans in the West, and the South was still a minority of the population. In the period since 1950, the proportion of Americans living in either the South or the West has dramatically increased.

The Census Bureau notes that historically, agriculture in the South and West was heavily reliant on irrigation, and so, settlements tended to be small in size. As large-scale dam projects were completed in the early 20th century, the resulting water and electricity unlocked the possibility of large cities to develop in the West. With air conditioning emerging in the 1970s, the hotter parts of the United States became more tolerable.

The South and West have attractions over the North and East: As the North and East became more populated, land values rose, and rent and office spaces became more expensive. The South and West remained relatively cheaper, with more space for more spacious developments.

The pandemic added more fuel to the fire. With remote work, where a person lives is no longer tied to where their job is. Untethering work from residence freed people to move in search of bigger homes and cheaper living expenses. As a result, the market for homes in the South and West took off. The pandemic also shifted priorities for businesses, who shifted from large headquarters in traditional metropolises, for smaller satellite offices in places where workers were moving to. These are also places where even with traditional office spaces, businesses have found advantages.

According to WSP, older office spaces are likely to suffer as businesses demand more modern, more flexible, more resilient spaces with lots of services. Precisely the kind of offices that City Office has on offer. The company’s recent acquisitions of office properties in Raleigh, Phoenix, and Dallas is an example of the company’s portfolio of premium, modern offices in great locations, with superior amenities and many new services.

City Office refers to its market as “18-hour cities,” and they offer the kind of high-quality living standards that have attracted so many people since the pandemic. These are cities with diverse labor pools, educated workforces, low-cost business centers. Transportation infrastructure is sound and traffic congestion is much lower than in the North and West. Furthermore, these cities have strong growth in employment due to the presence of universities and government departments that require new workers. This makes these cities attractive places to begin businesses or to open branches.

All these cities are located in states with low or no state income taxes. According to the Tax Foundation, Florida, Washington, and Texas have no income tax, whereas Arizona, California, and Oregon have a graduated-rate income tax, and Colorado and North Carolina have a flat income tax.

These factors have led to net migration in favor of the South and West.

Source: February 22 Investor Presentation

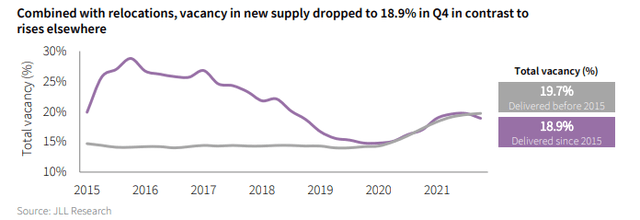

The underlying demographic shifts provide support for the company’s total weighted average occupancy rate, which was 84.9% in 2021, compared to occupancy rates of 81.1% for offices delivered post-2015, and 80.3% for offices delivered prior to 2015, as per the JLL Office Outlook for Q4 2021.

Source: JLL Q4 2021 Office Outlook

Strong Financial Results

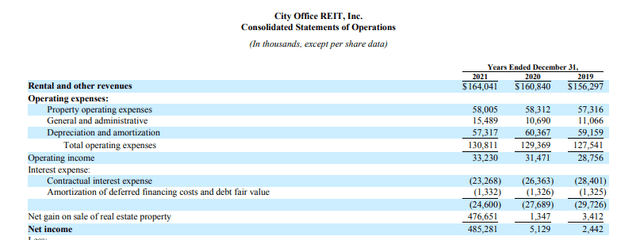

According to City Office’s 2021 10-K, the company has grown revenue from more than $156 million in 2019, to over $164 million in 2021. In that time, net income has risen from $2.4 million in 2019, to more than $485 million in 2021. The dramatic rise is due to the $576 million sale of the Sorrento Mesa life science portfolio for a gain of $429 million. City Office redeployed those funds into $614 million worth of acquisitions in Raleigh, Phoenix, and Dallas. These properties have strong tenancies with long weighted average lease terms, and will generate long-term, stable cash flow for the company. More indicative of the operational side is that City Office oversaw net operating income (NOI) growth of 2.2% in 2021, compared to the prior year. This is a modest level of growth, although the company’s recent acquisitions and the scope for cash generation in 2022 suggest that this NOI will be significantly higher at year end.

The company earned a return on invested capital (ROIC) of 41.29%, but this is anomalous. The previous year’s ROIC was 1.57%, and the 5-year average ROIC of 5.43% is more reflective of the company’s profitability. City Office’s ROIC trails that of peers, who have an average ROIC of 10.71%. This is a significant level of underperformance and is caused by the company’s acquisition strategy and the lag in generating cash from its properties. The company hopes that its acquisitions and its cash-generation measures will lift its profitability in 2022. Investing in high-ROIC firms per se is not a winning strategy, investing in firms with unexpected improvements in ROIC is where the money is and I believe that City Office’s ROIC is set to rise in 2022.

City Office generated a gross margin of 64.64% in 2021, in line with the company’s 5-year gross margin of 62.29%. That is a high degree of money-making ability. The company made approximately $7.49 million in free cash flow in 2021, up from about $6 million in 2020. Considering the economics of REITs, that is an impressive level.

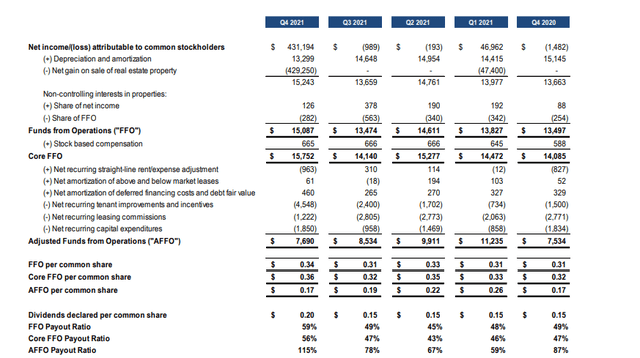

The company currently has $0.36 in core funds from operations (FFO) and $0.17 in adjusted-FFO (AFFO). In 2021, City Office had an AFFO payout ratio of 79.75%. This shows that the 33.3% dividend increase from $0.15 per share to $0.20 per share (for a dividend yield of 4.62%) is supportable. In other words, the company generates sufficient funds to back up a dividend policy which should increase its attractiveness.

Source: February 22 Investor Presentation

Value Creation Will Continue Into 2022

City Office is growing aggressively in a part of the economy where growth can occur profitably, Land, as everyone knows, has a finite supply, and the company’s growth in a market undergoing secular trends that will appreciate land values, is a positive.

The company plans on creating more value in 2022, by increasing cash flow generation from its existing portfolio of properties, and utilizing more value-enhancing leasing. As the WPP report noted, the pandemic accelerated a shift toward modern office spaces that are flexible, resilient and have many services. City Office plan on investing more money into spec suites, upgrading common areas and select repositioning to increase their leasing market share. The company’s recycling of the proceeds of the sale of its Sorrento Mesa life science portfolio is indicative of its policy. The company will continue to recycle capital in order to drive value creation. In addition, the company also plans on acquiring premier properties in leading submarkets.

The company has scope to improve cash flow generation. For example, in its Bloc 83, Rayleigh property, the company will achieve a 62.3% occupancy rate by the end of the quarter, with 80.7% of the property leased out, and 96,000 square feet still unleased. Its Pima Center in Phoenix, Camelback Square in Phoenix, and Circle Point in Denver properties have all been upgraded and undergone improvements that will increase their leasing prospects.

The company plans on as much as $44 million in disposition in 2021. Management believes that it can grow NOI to between $113 million and $115 million in 2022, and increase from the approximately $100 million in NOI the company earned in 2021. City Office are confident that they can increase occupancy rates to between 86.5% and 88.5%. Management also believes that it can grow core FFO per share to between $1.56 and $1.60, the midpoint being 16% higher than 2021 core FFO per share.

The company has a price-to-FFO of 48.9. This suggests a rather frothy valuation, but the company’s forward guidance on FFO gives us a forward price-FFO 11.15. This suggests that the company is trading cheaply despite strong fundamentals.

Risks

There are concerns that the real estate boom is not sustainable. Prices are constantly being bid up and at some point demand will hit a ceiling. It’s easy to suggest that “this time is different,” but the history of real estate shows that prices have a limit and that that limit is tied to the ability of consumers to buy or rent real estate.

Typically, real estate booms burst with economic recessions. Famed economist Nouriel Roubini believes that markets are underestimating the financial and economic risks of Russia’s invasion of Ukraine and a host of other systemic risks. A decline in business activity and new business formation would hurt the market for offices.

According to the company’s audit report within the 2021 10-K (linked to above), City Office’s acquisition of “$632,317 thousand of real estate properties” in 2021 was a source of “critical audit matter.” These acquisitions were accounted for as asset acquisitions, with the costs allocated to individual assets and liabilities on a relative fair value basis. Fair value of tangible assets of an acquired property is estimated by valuing the property as if it were vacant. KPMG believes that this constitutes a critical audit matter. The estimates of fair value should have been done with the aid of an auditor and the assistance of specialized valuation professionals. This material event is troubling. Although KPMG worked with City Office to fix the problem, it brings into question the firm’s core competencies.

Valuation

City Office is trading at a price/earnings (P/E) ratio of 1.6 compared to its peers, who are trading at an average of 14.68 and compared to the market, which is trading at 25.77. This is a massive degree of underperformance for a business operating in a market with excellent economics.

Considering the achievable cash generation opportunities on existing properties, City Office’s underlying value will grow in 2022. Occupancy and lease rates will all improve and with them, the company’s NOI and operating funds. 1.6 represents a massive margin of safety for investors.

Conclusion

City Office has a high quality portfolio that benefits from secular demographic shifts of the U.S. population to the South and West. These trends were accelerated by the pandemic, as businesses looked for more resilient, more flexible, more modern office spaces in the fast-growing markets of the South and West. The company’s investments have added value to the portfolio. There is still significant value to be unlocked from the present portfolio, through higher occupancy rates and greater leasing activity. The company should be able to achieve this in 2022 and, as a consequence, increase core FFO. With a cheap valuation, strong fundamentals, and an executive compensation policy that is geared to increase TSR, City Office is a good investment pick.

Be the first to comment