Nikolay Pandev

Thesis

City Holding Company has had strong financial performance and stock performance over the past year, but unfortunately, stock performance has outpaced financial performance and has resulted in the company being overvalued compared to peers, on both a price to sales and price to book basis. Therefore, we are seeing a potential downside of around 45% from current prices (unless we see material changes over the next 3-6 months), and therefore recommend selling the stock.

Intro

CHCO is a regional bank providing products and services to consumers and businesses in West Virginia, Ohio, Kentucky, and California. The company was incorporated in 1997.

The bank’s share price has performed well over the past year, marginally outperforming the broad market, up almost 20 per cent. The share price currently sits at around $95 USD, where the company has a market cap of around $1.4bn.

Seeking Alpha

(Source: Seeking Alpha)

Financial Analysis

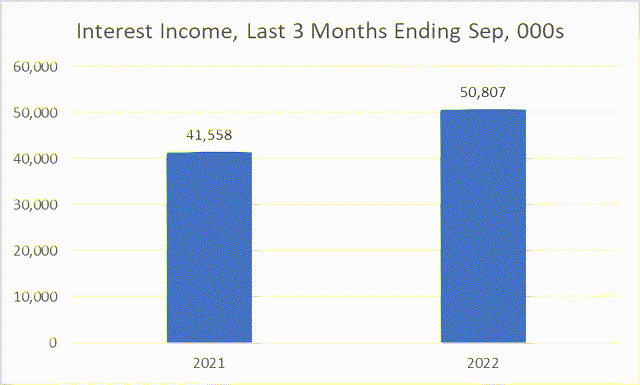

The company has experienced strong financial performance over the last 3 months compared to the same period a year prior.

For starts, interest income grew by more than 22% over the period, reaching just above $50m, driven by solid increases in both interest & fees on loans and interest received on investment securities. Income from loans increased by around $5 million and income from securities increased by approximately $3 million.

Seeking Alpha

(Source: Seeking Alpha)

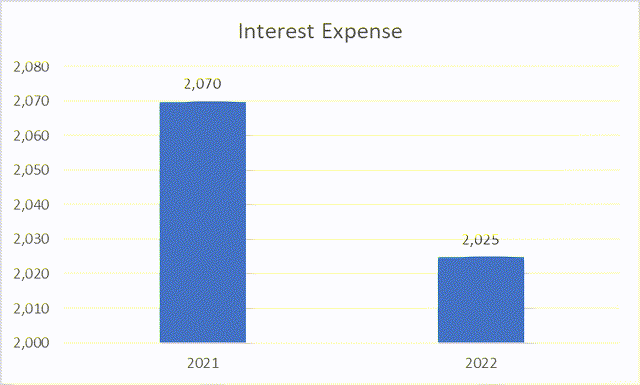

And while interest income increased, interest expense decreased, dropping from $2.07m to $2.025m, roughly declining by around -2%. While it is a small drop and remains a fraction of the total PnL, it is still beneficial. This decrease was primarily driven by a large decrease in interest on deposits (while being partially offset by increases in interest on short term borrowings).

Seeking Alpha

(Source: Seeking Alpha)

Unfortunately, however, provisions for credit losses increased by more than double for the period.

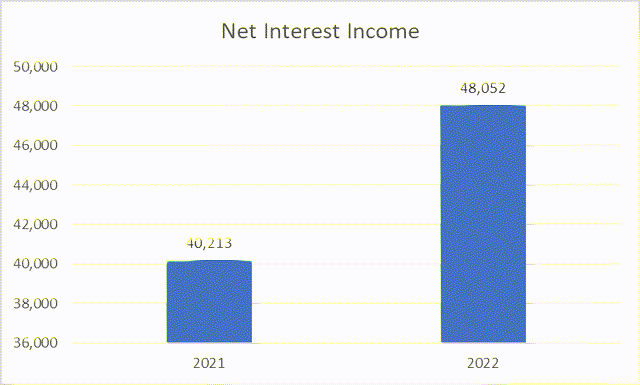

On the other hand, due to the very large increase in interest income plus the decrease in interest expense, net interest income eventually increase by almost 20% for the period compared to the year prior, increasing from around $40m in 2021 to almost $50m in 2022.

Seeking Alpha

(Source: Seeking Alpha)

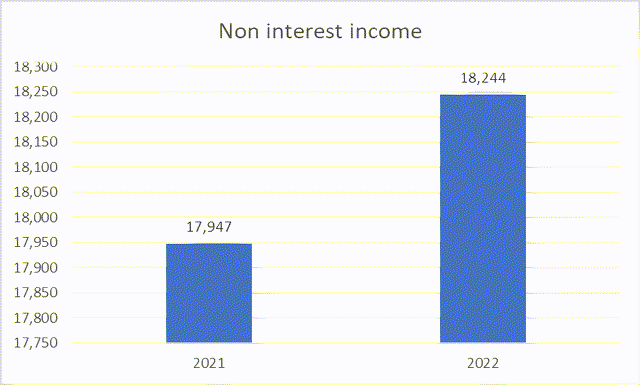

In terms of non interest items, non interest income grew by only 1.7% for the period, which was driven by increases in service charges and bankcard revenue. Unfortunately, other income dropped significantly during the period, hence only the marginal increase in non interest income overall.

Seeking Alpha

(Source: Seeking Alpha)

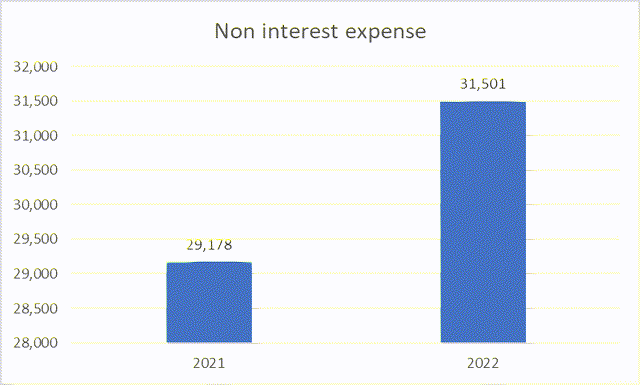

Unfortunately, non interest expenses grew by a fair amount for the period compared to the year prior, increasing by more than $2 million, or 8%, to reach around $31.5m for the period. This increase in non interest expense was primarily driven by an increase in staff costs, which increased by almost 14%. However, fortunately, net interest income growth outpaced the growth in operating expenses, as staff costs as a % of net interest income dropped from 38% in 2021 to around 36% in 2022, reflecting improving financial health for the company.

Seeking Alpha

(Source: Seeking Alpha)

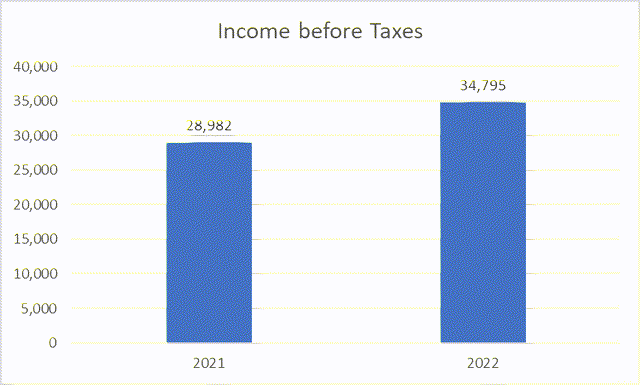

Overall, these improvements have led to an increase in income before taxes by around 20%, reaching almost $35 million for the period.

Seeking Alpha

(Source: Seeking Alpha)

For the 9 months ending Sep, the company increased their net interest margin from 2.87% in 2021 to 3.14% in 2022.

Valuation

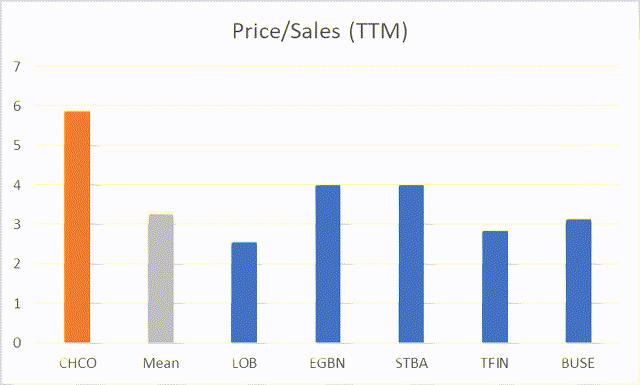

If we collate a set of peers, comparable regional bank stocks with similar market caps, we could potentially find if CHCO is undervalued, overvalued, or even fair valued.

On a price to sales valuation, CHCO looks to be fairly overvalued compared to peers, showing a potential downside of around 43%.

Seeking Alpha

(Source: Seeking Alpha)

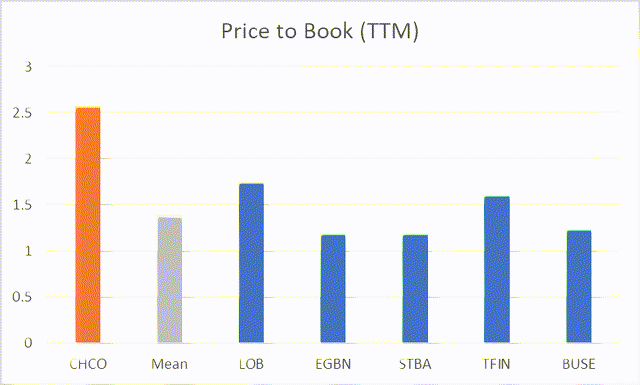

And on a price to book valuation, CHCO is currently trading at around 2.6x, whereas peers on average are trading at around 1.4x, implying that CHCO is overvalued by around 45%.

Seeking Alpha

(Source: Seeking Alpha)

Risks

- Risks to this thesis are if CHCO improves their growth potential. Net income has improved over the past year, but if it were to grow faster, and trickle down to the bottom line, then we could see CHCO’s valuation come more in line with peers as financial performance catches up with stock performance.

- As interest rates continue improving, we could see the company’s net interest margin also continue to improve as the quality of the balance sheet also improves. If this were to become the case, and the net interest margin continues to rise, then we could see CHCO become either fair valued, or even have potential upside.

Conclusion

Overall, CHCO has had strong financial performance over the past year, which has clearly been reflected in the share price, as both sales and the stock are up around 20% on the year. The strong financial growth of the company has led to too strong performance in the stock, resulting in the share price seen as overvalued. On both a price to sales and price to book basis, we believe that CHCO has around 45% downside potential from current prices. Therefore, unless we see some material changes and strong growth performance, we recommend selling the stock.

Be the first to comment