stevegeer/iStock via Getty Images

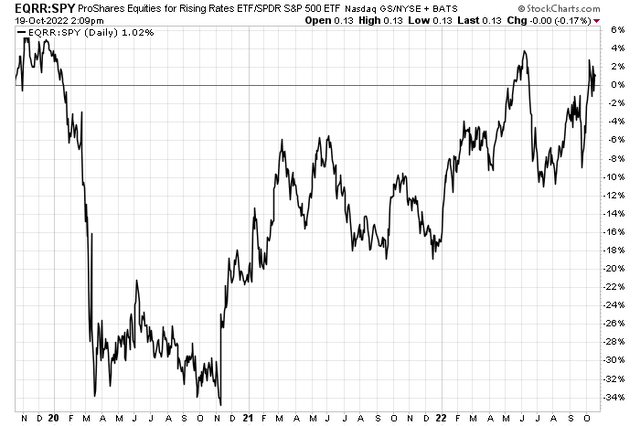

Interest rates jumped yet again to fresh highs on Wednesday. Long-duration assets struggled, while some value names outperformed. There’s an ETF to play rising interest rates, which is just now nearing its pre-Covid relative highs.

The ProShares Equities for Rising Rates ETF (EQRR) holds many defensive and cyclical stocks, and is obviously light on growth shares. Regional banks make up a chunk of the fund. One bank, based in the Northeast, reported solid earnings results Wednesday, but its stock was flat by late in the day. Is it a buy now? Let’s dig in.

Rising Rate ETF Continues Higher Versus The S&P 500

According to Bank of America Global Research, Citizens Financial Group (NYSE:CFG) operates 1,200 branches primarily throughout 11 states across the New England, Mid-Atlantic, and Midwest regions. It has consolidated total assets of $227 billion. CFG offers a broad range of retail and commercial banking products and services to more than five million individuals, institutions, and companies.

The Rhode Island-based $18.3 billion market cap Banks industry company within the Financial sector trades at a low 9.3 trailing 12-month GAAP price-to-earnings ratio and pays a high 4.6% dividend yield, according to The Wall Street Journal.

The bank has had a rebounding trend in its return on average tangible common shareholders’ equity (ROTCE) over the last several quarters. A new challenge is perhaps a peak in the net interest margin between deposits and short-term loans over the coming quarters. Growing spread income from here will be something to watch. A valuation discount to its competitors is a plus right now, given market conditions. Downside risks include a slowing macro environment and a reduction in lending along smaller NIM spreads.

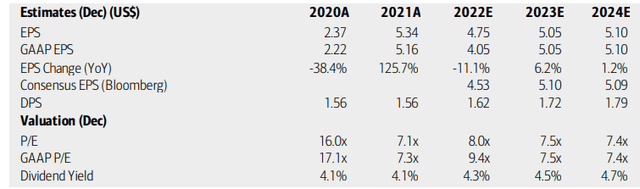

On valuation, analysts at BofA see earnings falling sharply this year before a 2023 and 2024 rebound. EPS surged in 2021 as a result of some deals finalizing, so this is more of a normalization process.

Meanwhile, the Bloomberg consensus earnings forecast is close to what BofA sees. The firm’s high dividend yield looks stable to increasing slightly in the coming quarters, too. Overall, with a low P/E and trading just 0.82 times book, well below the sector median and a slight discount to its 5-year average, the stock looks good on valuation.

Citizens: Earnings, Valuation, Dividend Forecasts

Citizens Financial reported better-than-expected Q3 earnings results Wednesday morning, as it was able to keep expenses in check and generally benefitted from rising interest rates during the quarter. Shares were little changed by the afternoon in a down tape. Quarterly EPS of $1.30 beat the consensus estimate of $1.27 and it was a year-on-year increase in per-share profits from the same period a year ago. Looking ahead to Q4, its management team sees continued strength in its NIM.

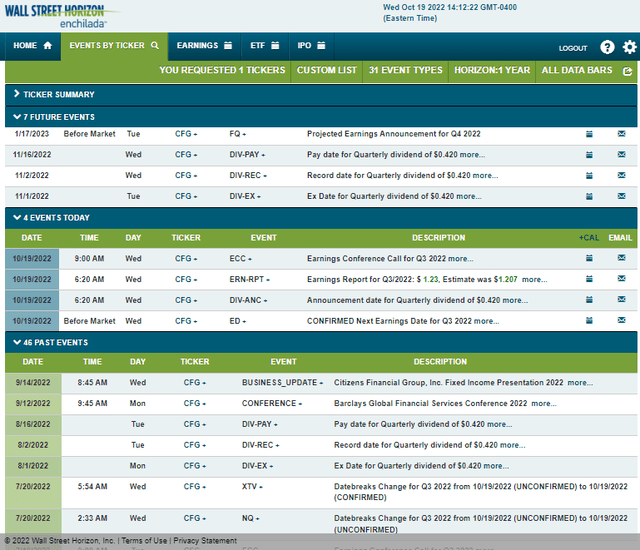

CFG’s corporate event calendar is light until its next earnings report projected to take place on Tuesday, Jan. 17 before market open, according to Wall Street Horizon.

Corporate Event Calendar

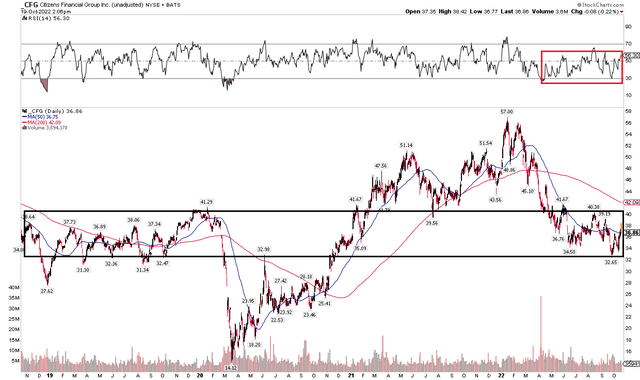

The Technical Take

CFG has not seen some of the relative strength that other regional banks have enjoyed. The stock is not far from its June and September lows. I see the current range of $31 to about $40 as an important congestion zone – a breakdown below it would be bearish while a breakout above it would be bullish.

I’d like to see an upward thrust send the RSI above the 60 level to help confirm a new bullish trend. Its 200-day moving average is negatively sloped, another technical signal that is in favor of the bears. Overall, it’s a mixed chart, but we have some key price areas to watch.

CFG: Shares Rangebound, Watching RSI

The Bottom Line

Citizens Financial Group looks good on valuation here and I like the dividend yield. The stock has struggled as some other short-duration names have perked up. Overall, I see the stock as a buy but certainly want to see the $31 to $33 range hold. A breakout above the low $40s should bring about a fresh bullish move.

Be the first to comment