lechatnoir/E+ via Getty Images

About Citius Pharmaceuticals

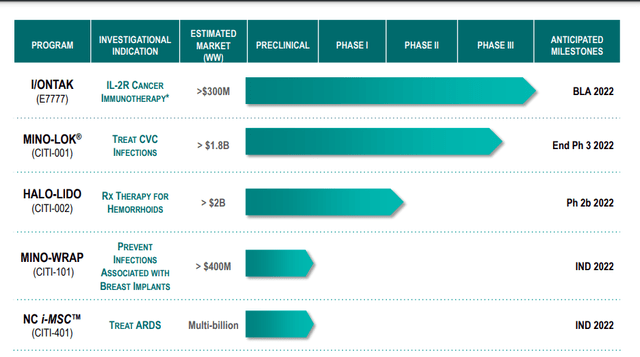

Citius Pharmaceuticals Inc. (NASDAQ: NASDAQ:CTXR) is a late-stage biopharmaceutical company focused on the development and commercialization of first-in-class critical care products, with a diversified pipeline of anti-infectives in adjunct cancer care, oncology, stem cell therapy and unique prescription products. Three of its five pipeline candidates would be the first and only prescription treatments in their indications if approved by the FDA. The Company has two late-stage product candidates, I/ONTAK (E7777), a novel IL-2R immunotherapy for an initial indication in cutaneous T-cell lymphoma (CTCL), which has completed treatment in its Pivotal Phase 3 trial and Mino-Lok®, an antibiotic lock solution to salvage infected central venous catheters (CVCs) of patients with catheter-related bloodstream infections (CRBSIs), which is currently enrolling patients in a Phase 3 Pivotal superiority trial.

I/ONTAK has received orphan drug designation by the FDA for the treatment of CTCL and peripheral T-cell lymphoma (PTCL). Mino-Lok® was granted Fast Track designation by the U.S. Food and Drug Administration (FDA). Through its subsidiary, NoveCite, Inc., Citius is developing a novel proprietary mesenchymal stem cell (i-MSC) treatment derived from induced pluripotent stem cells (iPSCs) for acute respiratory conditions. Citius’s two additional product candidates are Halo-Lido, potentially the first and only FDA-approved prescription treatment for hemorrhoids, and Mino-Wrap, potentially the first and only FDA-approved product to prevent infection in tissue expanders and breast implants post mastectomy.

About I/ONTAK

I/ONTAK (E7777), is a purified reformulation of denileukin diftitox (ONTAK®), a previously FDA-approved cancer immunotherapy for the treatment of persistent or recurrent cutaneous T-cell lymphoma (CTCL), a rare form of non-Hodgkin lymphoma. Improvements to the original formulation resulted in a therapy that maintains the same amino acid sequence, but features greater purity and bioactivity. I/ONTAK is a novel targeted oncology asset with an attractive near-term revenue opportunity and a substantially de-risked path to support commercial success. Patient enrollment in a global, multicenter, open-label, single-arm Pivotal Phase 3 study of I/ONTAK in participants with persistent or recurrent CTCL was completed in December 2021. Citius plans to further explore the potential of I/ONTAK to treat larger patient populations with additional indications in peripheral T-cell lymphoma (PTCL) and immuno-oncology. I/ONTAK has been granted orphan drug designation (ODD) by the FDA for the treatment of CTCL and PTCL.

E7777 received regulatory approval in Japan for the treatment of CTCL and PTCL in 2021. Citius’s exclusive license include rights to develop and commercialize I/ONTAK (E7777) in all markets except for Japan and certain parts of Asia.

Program Highlights

- Phase 3 Pivotal trial completed December 2021

- Top Line Data released very soon. We are targeting April.

- Biologics license application (BLA) submission expected to be filed in the second half of 2022 for an initial indication in CTCL

- Considered a new biologic by the FDA, I/ONTAK would be eligible for 12 years of exclusivity, if approved

How It Works

I/ONTAK is a recombinant engineered fusion protein that combines interleukin-2 and diphtheria toxin. The agent specifically binds to IL-2 receptors on the cell surface, causing diphtheria toxin fragments that have entered cells to inhibit protein synthesis. Its unique mechanism of action targets both malignant T-cells and immunosuppressive regulatory T-cells (Tregs). Transiently eliminating Tregs has the potential of unleashing potent immune responses by the patient’s immune system against their tumors.

In recent preclinical studies, denileukin diftitox has demonstrated the ability to deplete murine Tregs in-vivo and human Tregs ex vivo. In addition, the combination of denileukin diftitox with anti-m-PD1 showed improved tumor response and very significant improvement in survival in the combination groups relative to either therapy alone in a syngeneic mouse solid tumor model.

Based on these data, two investigator-initiated trials will evaluate the potential safety and efficacy of: 1) I/ONTAK in combination with Pembrolizumab (anti-PD 1) in patients with recurrent or metastatic solid tumors; and 2) I/ONTAK given prior to lymphodepletion (LD) chemotherapy and KYMRIAH® (tisagenlecleucel) CAR T-cell therapy for the treatment of relapsed/refractory diffuse large B-cell lymphoma (DLBCL) considered at a high risk for failure from KYMRIAH® alone.

Market

Based on Surveillance Epidemiology and End Results ((SEER) data from 2001-2007, the estimated incidence rate of MF/SS in the U.S. is 0.5/100,000 or about 2,500-3,000 new cases per year representing about 25% of all T-cell lymphomas.

We estimate that there are 30,000 – 40,000 patients living with CTCL in the U.S. with approximately 16,000 – 20,000 having mycosis fungoides. Of those, we believe the addressable population for I/ONTAK will be the approximately 10,000 patients with later stage, relapsed or refractory CTCL who require systemic therapy, resulting in an estimated addressable U.S. market of approximately $300,000,000. I/ONTAK has been granted Orphan Drug Designation by the U.S. FDA.

I/ONTAK may also have substantial upside as a therapy for peripheral T-cell lymphoma (PTCL) and possibly in combination with check-point inhibitors such as pembrolizumab or CAR T-cell based therapy (e.g. KYMRIAH®) based on its ability to transiently eradicate Tregs from the suppressive tumor microenvironment.

Top Line Data

Citius has stated they expect topline results anticipated by the end of June. However, we are targeting this release to happen in April. While data, might come in May or June, we are betting it happens much sooner.

The timeline for the I/ONTAK program remains on track, with topline results anticipated in the first half of 2022, followed by a planned BLA filing in the second half of the year. Moreover, the FDA confirmed that no pediatric study will be required for I/ONTAK, further de-risking this asset,” stated Myron Holubiak, President and Chief Executive Officer of Citius Pharmaceuticals.

About Mino-Lok

Mino-Lok is an antibiotic lock solution used to treat patients with catheter-related bloodstream infections (“CRBSIs”). CRBSIs are serious issues, especially in cancer patients receiving therapy through central venous catheters (“CVCs”) and in hemodialysis patients where venous access presents a challenge. In the Phase 3 trial, Mino-Lok was being tested with the primary endpoint being catheter failures.

Mino-Lok is intended to salvage the CVC, reducing the need to remove and replace (“R&R”) the catheter. This is a recognized unmet medical need. R&R is the Standard of Care (“SOC”) for CRBSI and will occur about 95% of the time after infection, according to CEO Myron Holubiak. There are few alternatives to removing and replacing the CVC once it becomes infected. Studies show that removal and reinsertion of CVCs have a 15% to 20% complication rate, including pneumothorax, misplacement, and arterial puncture. R&R is also not a sustainable strategy. With repeated R&R, patients develop sclerosis of the vessels, and progressively have more limited anatomic locations for vascular access.

Mino-Lok contains a proprietary combination of minocycline, edetate (disodium EDTA), and ethyl alcohol, all of which act synergistically to break down bacterial biofilms, eradicate the bacteria, provide anti-clotting properties to maintain patency in CVCs, and salvage the indwelling catheter. The Mino-Lok product is used in two-hour locking cycles, allowing the CVC to be used for its intended purposes for the remaining 22 hours each day. The product is infused into the CVC, held for 2 hours inside the catheter (i.e. locked), and then withdrawn. This occurs for 5-7 days until the catheter is clear.

SOC antibiotic lock therapies (“ALT”) require that the ALT be locked for several hours per day, depending on the antibiotic, with durations of therapy from 8 days to 3 weeks. In many patients who need continuous IV access, it may be difficult or impossible to lock the catheter for several hours. The optimum ALT must have a short duration of therapy and not need to be locked for a long period of time. Thus, the clinical and economic advantage of Mino-Lok.

Inside intensive care units (“ICU”) doctors must have central line access continually. If the catheter becomes blocked, and cannot be cleared, it will be immediately removed and a new catheter will be placed somewhere in the body. Having a central line is vital for ICU patients and can be the difference between life and death.

Their most recent Corporate Presentation is here.

Standard of Care & Target Market

Current SOC is to R&R the CVC, while treating with systemic antibiotics. Catheter R&R causes physical and psychological symptoms in 57% to 67% of patients. R&R is difficult for many patients, due to unavailability of other accessible vascular sites and the need to maintain infusion therapy. The cost to R&R a CVC is around $10,000. However, if the patients get an infection, the costs and potential patient harm increase significantly.

According to PubMed in 2011 the cost of CRBSI is between $33,000 and $44,000 in the general adult ICU, between $54,000 and $75,000 in the adult surgical ICU, and approximately $49,000 in the pediatric ICU. These figures are estimated total costs associated with CRBSI infections. These procedures are costly, and 15% to 20% of the procedures are associated with significant morbidity.

There are currently no FDA-approved therapies to salvage infected CVCs. Citius has the worldwide rights to Mino-Lok so the market opportunity is significant.

DelveInsight estimates that the annual US incidence rate of CRBSI is 325,000 in 2017. They state that the Asia-Pacific region had over 3,000,000 CRBSI the same year. In total they estimate the global market to be ~4.1M in 2017 and grow to ~4.23M in 2028. When assessing the total addressable market, it is very important to recognize that despite gradually improving global health care protocols, and a multitude of prevention strategies such as catheter lock solutions to prevent biofilm formation, bactericidal/static caps, etc., CRBSI rates are not going down.

We expect a quick ramp-up of sales, if approved, due to the fact that CRBSIs are an unmet medical need with the current SOC and R&R costing hospitals and insurers tens of thousands of dollars. Hospitals are also penalized for high infection rates (which are preventable) and will see their Medicare and Medicaid reimbursement dollars negatively affected. With alternative payment models incentivizing reduced total cost of care, hospitals will be quick to implement a proven solution to disinfect and clear CVCs.

Citius is optimistic that with a conservative pricing model, the uptake of Mino-Lok should be swift. Pricing should have upwards elasticity, given the surgical alternative. The Company believes the total US annual sales will be >$800M. The company also estimates greater than $1.8B annual worldwide sales are possible by 2028 for CRBSI. Mino-Lok sales potential is impressive.

Phase III Trial

Phase III started in February 2018. It is a randomized, open label, assess-blind study to determine the efficacy of Mino-Lok. 144 patients diagnosed with CRBSI are randomized 1:1 into 1 of 2 treatment arms. The primary endpoint is Time to a catheter failure. The secondary outcome measures are: Proportion of subjects with overall success in the modified intent to treat (“MITT”) and clinically evaluable (“CE”) populations, Time to catheter failure in the MITT and CE Populations, Microbiological eradication, Clinical Cure, All-cause mortality and safety and tolerability.

Also interesting is the control arm for this trial. Here is how it reads on clincicaltrials.gov.

The antibiotic lock should be comprised of the best available therapy at the sites based on standard institutional practices or recommendations from the Infectious Diseases Society of America guidelines.

This means each clinical site can use its best available “home brew” to salvage the CVC for the control arm. Citius believes Mino-Lok is the best CRBSI product and willing to put it up against any clinical site’s concoction.

IDMC Meeting

Following a unblinded data review of safety and efficacy in June 2021, the independent Data Monitoring Committee (DMC) for the Mino-Lok® Phase 3 Pivotal Superiority Trial has recommended proceeding with the trial as planned. The DMC did not identify any safety concerns and no modifications were recommended to the protocol-defined sample size or power to achieve the primary endpoint.

- DMC interim safety and efficacy review of Mino-Lok® Phase 3 Trial concluded with favorable recommendation to continue the trial as planned, with the protocol-defined sample size and power to achieve the primary endpoint

- Citius to proceed in conducting largest controlled clinical trial to salvage infected catheters with no modifications requested by the DMC and no safety concerns identified

We had expected a trial halt due to positive efficacy, but alas it didn’t occur.

Competition

As stated earlier, CRBSI is an unmet medical need. There is no FDA-approved method for treating infected CVCs.

There are products that are designed to prevent CVCs from getting infected such as antimicrobial caps. One is ClearGuard HD Antimicrobial Barrier Cap. While the approach is good (prevention is better than treatment), plenty of CVCs still get infected. Also, the caps are only approved for Hemodialysis catheters. In summary, the caps are for a specific indication and pose little threat to Mino-Lok since there are still plenty of infections that occur daily.

CorMedix (NASDAQ:CRMD) has a product called Defencath. Defencath is a proprietary formulation of taurolidine 1.35%, citrate 3.5%, and heparin 1000 units/mL that is currently being investigated for use as a catheter lock solution. Its aim is reducing the risk of infections from indwelling catheters for hemodialysis (“HD”) patients. Note this important distinction – It is for prevention, and not treatment. It cannot be used once a CVC is infected. Also, note this product is for hemodialysis patients and not for oncology patients. CorMedix’s goal is to have Defencath incorporated into the SOC for the HD patient group. Changing the SOC is no small task and requires extensive FDA review.

Defencath finished its Phase 3 clinical study, known as LOCK-IT-100. According to its latest investor presentation, the final results showed that Defencath reduced CRBSI by ~71% with SAE nearly identical to the control. The review board also recommended early termination.

However, the company reported the:

FDA cannot approve the New Drug Application (NDA) for DefenCath™ (taurolidine/heparin catheter lock solution) in its present form. FDA noted concerns at the third-party manufacturing facility after a review of records requested by FDA and provided by the manufacturing facility. Additionally, FDA is requiring a manual extraction study to demonstrate that the labeled volume can be consistently withdrawn from the vials despite an existing in-process control to demonstrate fill volume within specifications.

This is terrible news for CorMedix but great news for Citius. This gives Mino-Lok an unobstructed runway to build their brand!

The Mino-Lok Moat

While there is nothing supremely novel about the individual components in Mino-Lok, the Company did secure a formulation patent for Mino-Lok in 2018, which grants them protection until 2036.

Mino-Lok also received QIDP. This potentially qualifies Mino-Lok for additional FDA incentives in the approval and marketing pathway, including Fast Track designation and Priority Review for development and a five-year extension of market exclusivity. This means the product might tack on another 5 years of market exclusivity beyond its 2036 patent expiration date.

As outlined earlier, now that Phase III is successful, and assuming they do get FDA approval, they will be the only FDA-approved treatment for infected CVC for all CRBSI. Myron Holubiak stated there are no products being developed for the treatment of CVC. If approved, Mino-Lok will be the only treatment for several years.

Management & Insider Ownership

Citius’ Leadership is notable. Leonard Mazur is Chairman of the Board. His resume reads like a page right out of a chapter of Who’s Who in Pharma M&A. It is long, but worth the read.

-

He spent his first 10 years working for Cooper Laboratories, starting in sales and rising into positions of strategic planning, then acquisitions, and eventually head of one of the Cooper divisions. Cooper built its brand as an expert in developing medical specialty silos – acquiring companies and building business units around their medical specialties.

-

He put together the first strategic plan and got the first unit operational, which was in the ophthalmology space. In a matter of roughly seven years, the unit went from acquiring a tiny prescription eye-drop company to about $800 million in revenue as one of the largest eye care companies in the world, called CooperVision.

The takeaway from this list is that Mr. Mazur has extensive experience in launching & creating strong brands and is familiar with the M&A space.

Most notable is that insiders have invested $26.5M of their own money into Citius. Mazur & Holubiak hold about 13M shares. According to Fintel, insiders hold 10% of all shares. It is rare in clinical biotechs for management to have such a high percentage of ownership and it speaks to their confidence in eventual drug approval

Market Opportunity

The market potential for an effective antibiotic lock therapy (“ALT”) is estimated at $750 million per year in the U.S. and is projected to reach $1.84 billion globally in 2028. Currently, removing and replacing infected CVCs is the standard of care for most CRBSIs. CVCs are life-saving vascular access ports in patients requiring long-term intravenous therapy. Of the approximately 7 million CVCs used annually in the US, up to 500,000 become infected and lead to CRBSIs. Infected CVCs must be removed, and most need to be replaced. However, these procedures are costly and discomforting, and 15-20% of them are associated with significant morbidity. There are currently no approved therapies to salvage infected CVCs. Mino-Lok penetrates biofilm, eradicates bacteria, and salvages infected, indwelling vascular catheters while providing anti-clotting properties. Mino-Lok has the potential to change the standard of care for the management of these serious infections.

Price Targets

Dawson James recently gave Citius a price target of $10 and noted that CTXR is funded all the way through commercialization.

In addition, H.C. Wainwright has issued a price target of $6.

We believe a valuation of $10 is prudent. The valuation is based on a therapeutic models and associated assumptions projected to 2028. The lead product, Mini-Lok, is now in a Phase 3 trial, as is E7777. We use a 30% risk rate in our free cash flow, our discounted EPS, and sum-of-the-parts models on top of a 15% risk rate in our therapeutic models for both products.

Risks & Conclusion

Biotechnology is risky, and so is investing in it. A majority of all biotech trials fail.

As the primary endpoint is the open door to approval by the FDA, we believe there is a very high probability of success for these drugs and that Citius is currently deeply undervalued, given the potential of the drugs and the probability of success.

We strongly believe that both trials will be a tremendous success. Speculation on this stock may be prudent from the information presented, as it seems likely these treatments will succeed. A few risks to consider:

- Partnership risk. Citius Pharmaceuticals, Inc. is in discussions with possible partners today, but there can be no assurances that the company will be able to secure a favorable partnership.

- Commercial risk. There are no assurances that the company will be able to achieve significant market share and become profitable.

- Clinical and regulatory risk. Lead products have to complete clinical trials. Trials may not produce results sufficient for regulatory approval..

- Liquidity Risk. The stock is thinly traded. We note that management owns a significant percentage of the company. However, the Company has enough cash through 2023.

All those risks do remain, and a wise investor will consider them before making an investment decision.

However, we believe Citius will succeed.

Be the first to comment