JHVEPhoto

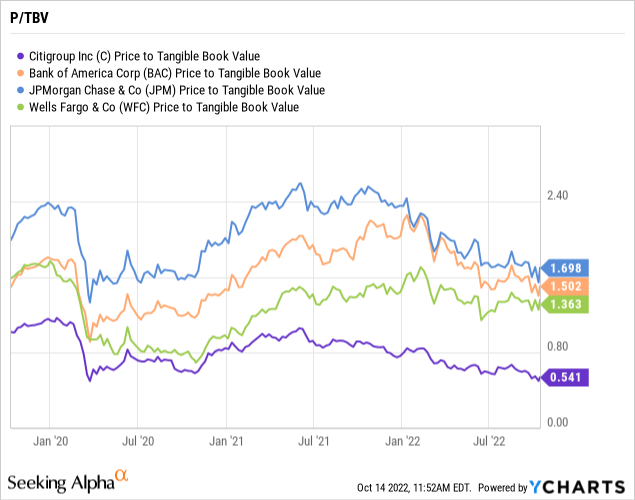

After another solid quarter, Citigroup (NYSE:C) has clearly just been left for dead by the market. The stock trades at 50% of tangible book value, but the large bank again smashed quarterly expectations. My investment thesis remains ultra-bullish on the large bank stock that the market just doesn’t appear to like.

Another Strong Quarter

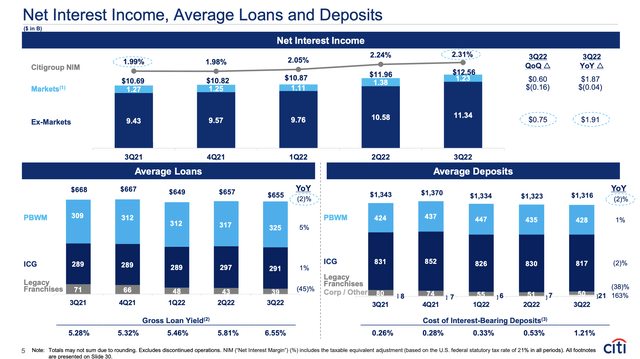

Citigroup reported a strong quarter with revenues up 6% over Q2’21 levels at $18.5 billion. Due to interest rate hikes by the Fed, the large bank reported NII up 18% YoY to $12.6 billion.

Of course, non-interest revenue was down 12% YoY to $5.9 billion. Investment banking was virtually dead during the quarter with revenues down over 50% YoY, leading to the total banking division revenues down $1.3 billion YoY to just $1.2 billion.

The only real issue in the quarter was higher credit costs. Citigroup built the allowance for credit losses by $478 million in the quarter versus a reserve release last Q2, leading to much higher credit costs last quarter. The actual NCLs were generally flat, with last year at $0.9 billion.

What the quarter provides is a much better view of a more normalized interest rate environment. Citigroup saw the NIM grow sequentially by 7 basis points to 2.31% leading to a $600 million boost in NII.

The large bank didn’t even benefit from growing loans, with the average loans down $13 billion YoY to $655 billion. Citigroup saw revenues grow from higher margins and in a normal environment, the large bank will see a revenue uplift in NII from higher loan volumes.

The large bank ended 2019 with a NIM of 2.63% and only produced $12.0 billion in quarterly NII. Citigroup is poised to far obliterate those NII levels, if the NIM can rise to prior levels.

As mentioned, the major risk is higher loan losses, and those are very contained right now. Citigroup still earned $3.5 billion in the quarter, with the higher ACL build of nearly $0.5 billion. The large bank has a ton of earnings power with higher NII to absorb more loan losses going forward.

Major Discount

Citigroup traded at a discount to their peer group of Bank of America (BAC), JPMorgan Chase (JPM) and Wells Fargo (WFC) back as COVID started. The discount only widened during this period despite Citigroup delivering another solid quarter. All of the other large banks are trading at 1.5x tangible book value while Citigroup trades at a meager 0.5x TBV.

The company is spending aggressively to deal with risk control initiatives. Citigroup has hired more than 8K people in technology to improve operations, causing spending to rise in an environment where other banks are looking to cut costs.

The efficiency ratio was an unreasonably high 69% due to this extra spending while the business environment was tough. Ultimately, though, this high ratio just provides an opportunity for Citigroup to use the technology investments to improve the efficiency of the business and boost profits.

The large bank is poised to improve profits when business normalizes at a higher NIM. The stock shouldn’t trade around $40 and offer a nearly 5% dividend yield while growing TBV to over $80 now.

Citigroup boosted the CET1 ratio to an unreasonably high 12.2% due to government regulations. Management has a goal of reaching a 13.0% ratio before returning to strong buybacks that will provide a substantial boost to earnings going forward.

Takeaway

The key investor takeaway is that Citigroup shouldn’t offer such a high yield when the bank isn’t even aggressively paying dividends. The stock is priced for the large bank to go out of business, yet Citigroup has delivered over $12 billion in profits this year so far.

The stock only trades at 6x EPS targets, and investors should use the weakness to buy Citigroup at a massive discount to peers.

Be the first to comment