_ultraforma_

In my last article on Citigroup Inc. (NYSE:C), I predicted that consensus EPS would be ~$1.55 to $1.60 compared with analysts’ earnings consensus of $1.44.

Citi delivered EPS of $1.60 ($1.50 on a non-GAAP basis), but the shares are selling off to the tune of ~2% in early pre-market trading.

This article is my initial reaction to the earnings release. I will update further, in the comments, my impressions of the earnings call.

So let us consider the details….the good, the bad, and the ugly.

(All slides below are extracted from Citi’s Investor Relations, Q3-2022 earnings release)

The Good

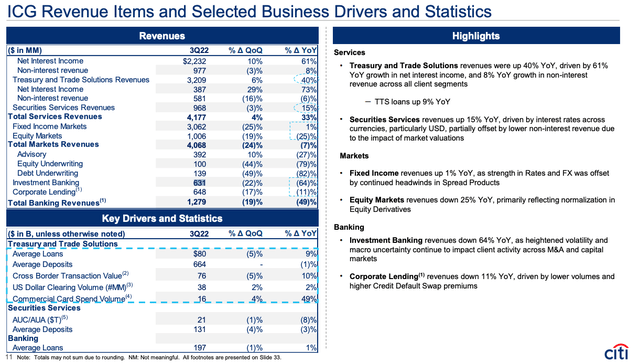

Starting with the good, Citi’s so-called Services business line delivered impressive revenue growth driven by Treasury and Trade Solutions (“TTS”) which is up 40% year-on-year and 6% sequentially.

This can be seen in the below slide from the Q3 earnings release:

Security services also delivered robust 15% year-on-year growth and delivered another quarterly revenue of close to ~$1 billion. The nice thing about TTS and Security Services is that these are accrual businesses and therefore less volatile. Both businesses are enjoying strong tailwinds of rising interest rates, and I expect these to continue and grow in sequential quarters.

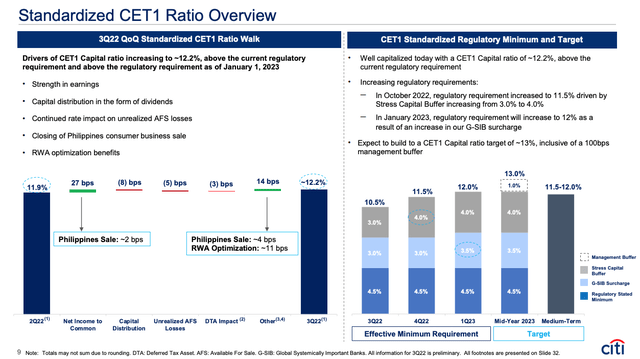

Another highlight of the quarter was the CET1 print of 12.2% for the quarter, in spite of headwinds from unrealized AFS losses on its liquidity portfolio.

Citi is rapidly building capital to its target CET1 of 13% and now expect to start buying back shares by the 1H of 2023 (I would expect more on this to come in the earnings call). Given Citi’s current valuation, being able to buy back shares is immensely important for the investment case in Citi.

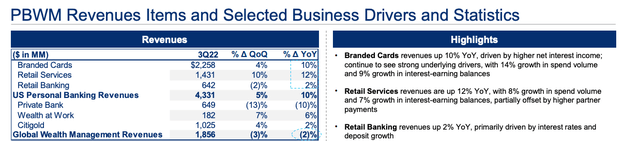

Finally, a large positive is the loan growth of 9% in Branded Cards and 7% in Retail Services, as shown in the below slide.

The Bad

I noticed two negative aspects in the earnings report. The first one is expected and included a reserve build of $478 million.

The second “bad” item is the underperformance of the Wealth Management division, which was down 2% year-on-year, driven by product sales headwinds in Asia. Even though, it benefited from higher net-interest income (“NII”) as well as a large investment in relationship managers. This is also not unexpected given the bear market in both equity and bond markets.

The Ugly

Without a doubt, the ugliest part of the report is the Investment Banking (“IB”) revenue picture. IB is down ~64% year-on-year and seems to be a much higher drop than the industry wallet (down about ~50%) and what Citi guided for just several weeks ago at the Barclays financial services conference.

I will be looking for answers for this item in the earnings call.

My Takeaway

Overall, the earnings report is, by and large, as I expected and may be described as satisfactory.

The positive highlights are TTS and Security Services as well as progress in accumulating capital towards its 13% CET1 goal.

IB and Global Wealth Management are clearly challenged, but that’s not unexpected given the macro settings and the bear market.

Assuming a more normalized environment for GBM and IB as well as excluding the reserves build, Citi is delivering well over 10% in RoTCE despite the massive restructuring it is going through.

At 0.5x tangible book, Citi is too cheap to ignore.

Be the first to comment