hocus-focus/E+ via Getty Images

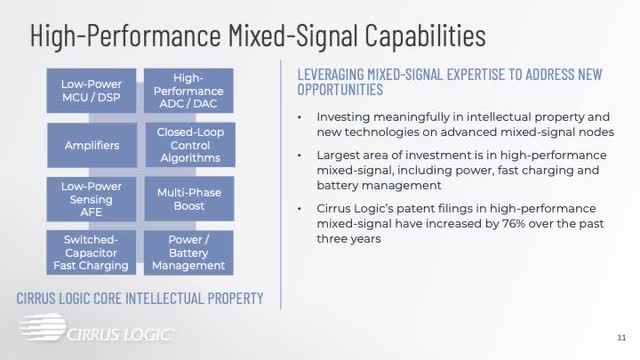

Sometimes management plays its cards early. At the last earnings conference, Cirrus Logic’s (NASDAQ:CRUS) management either purposely or inadvertently played an ace. For quarters, Cirrus offered little insight into a future business using single words, like sensing. At last, the ace played appears targeted at an enormous market, Analog Front End Sensing (AFE), which likely includes a critical piece for battery management. Cirrus’ already rich line includes power control, switched capacitor charging, codecs, haptics and amplifiers designed for mobile devices including laptop computers. Where cameras are involved, the company also provides an impeccable solution with its Closed Loop Control product. The family approach offers consumers lower bill-of-material costs and design in engineering simplicity. Since cruising with Cirrus is always adventurous, let’s grab the AR/VR glasses, and go!

One New Product(s) Line, AFE Sensing

Continuing, at the Cowen conference with Matt Ramsey on June 1st, John Forsyth, Cirrus’ CEO, stated:

The flip side of that is from where we’re standing, we can see a great pipeline of growth and content expansion year-on-year as we get into fiscal 2024 and beyond. And in terms of other markets, we have a list. We’re not going to go into that in more detail right now, partly because I [believe] these things take time to develop.

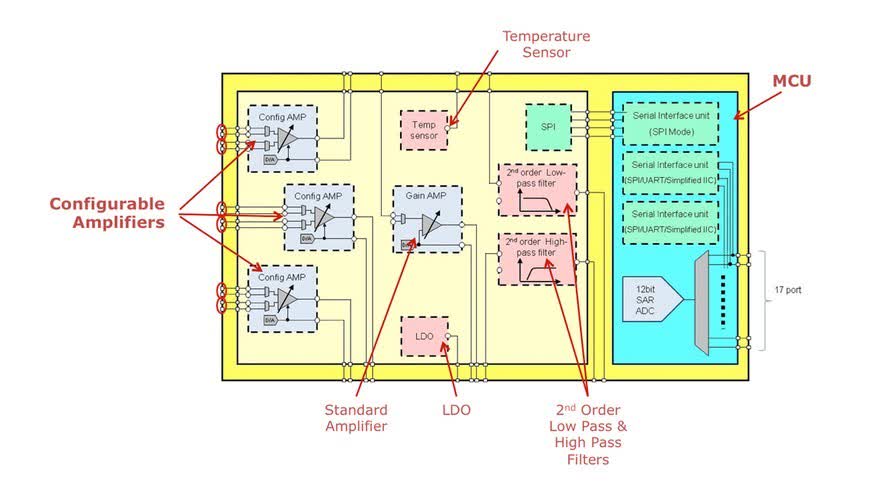

Beginning with the new product line, AFE Sensing, a slide from the last presentation follows:

Stated above, the term, AFE, equates to analog front end technology, which includes an analog sensors being made meaningful when accompanied with heavy digital computations. An article from the past states:

Most analog sensor systems comprise three key elements: the analog sensor that measures a specific form of energy, the microcontroller (MCU) that processes the digital equivalent of the sensor’s signal, and between them is the Analog Front End (AFE) system.

Usually these are very application specific. Sensors, in general, can’t attach directly to a digital device for a variety of reasons include analog strength (must be amplified) and issues with non-linearity.

The following illustration lays out some basic designs for a combined AFE/Micro Controller Unit (MCU). Designing combined AFEs creates two fundamental challenges amplifying sensors and providing cost effective, small sized, low power and complex digital computational functionality.

Latest AFEs Designs

Continuing, the market place today includes: radio frequency interfaces, battery management, and many other applications.

So why and what is Cirrus Logic planning with a broader entry into AFEs? We begin by including portions from an employment opening that Cirrus has include multiple times concerning teardown engineering.

The position asks for experience in the following technologies:

- Experience with multiple applications/technology used in electronic products such as audio, autofocus and optical image stabilization, voice coil or other motor drive/control, MEMS, inertial/light/pressure/magnetic/touch/force/temperature sensors, haptics, wireless radios/protocols, USB or other complex serial bus protocols, etc.

The request rich with sensors technology experience suggests once again the wide breath the company is seeking for a future expanded AFE market place.

We also know that Cirrus produces several products designed for battery management systems (BMS) on both sides of mobile device batteries. BMS involves managing temperatures and voltages to protect long-term battery health. The fast charging, less than a half hour, creates an enormous responsibility in controlling constant and prioritized voltages for charging or discharging. Of critical importance is temperature management. Adding AFEs for battery management in particular for mobile devices seems like a given.

But, we also don’t believe that this will be the only target. Logic brings unique hardware technology into this arena with its 55 nm and 22 nm design, low power, small size and a reputation for impeccable products. Its analog capabilities bundled inside the mixed signal chips are second to none. The 22 nm chip carries an extraordinary computational capacity while small in size and extreme low power consumption. Although not completely so, customization with these products will be driven heavily by software.

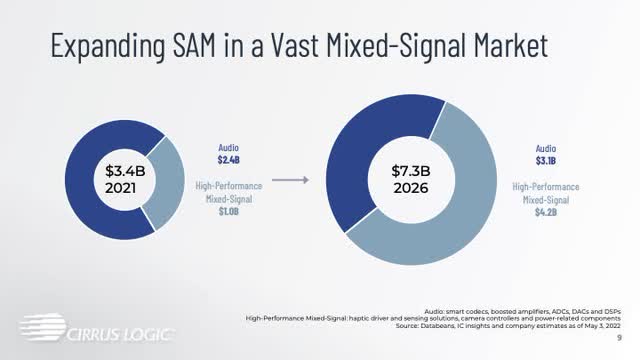

The company hasn’t hinted at the ASP for the sensors, but other similar products such as amplifiers, or haptics sell between $0.50-$0.60. We suspect that ASPs for AFEs will be similar. We aren’t sure what the complete product line consists of, but it appears with the company increasing its SAM slide (the latest one shown below) by almost $1.0 billion quarter over quarter, that these applications are many.

Coming Products & Applications

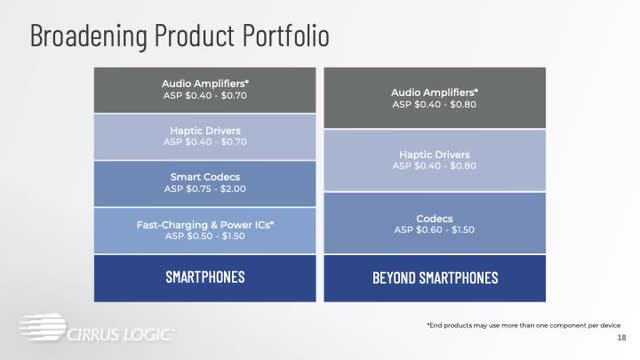

We begin by including an ASP table which Cirrus always includes with its slides.

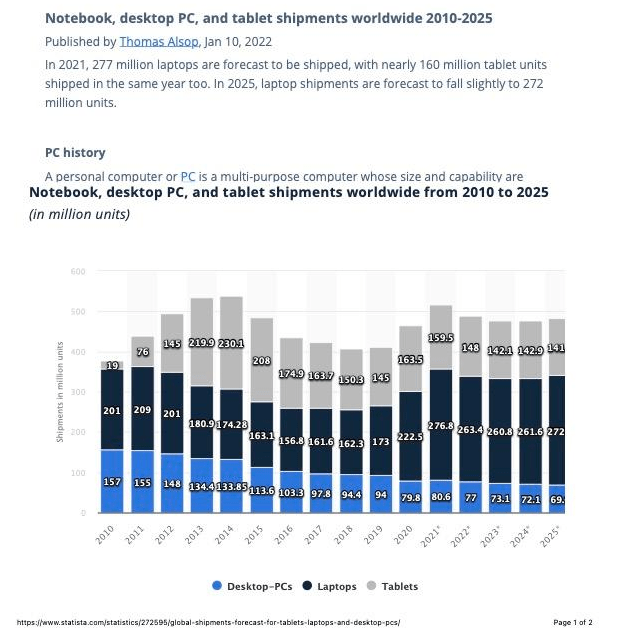

Two growth vectors seem forth right, argumentative reality/virtual reality (AR/VR) headsets and a deeper penetration into laptop computers. Portable computer markets aren’t small. Cirrus’ ASP opportunities aren’t small either. The next chart from Statista summarizes the market size opportunities.

PC Unit Volumes

Total unit volumes equal approximately 500 million units per year with 80% being tablets and laptops. Cirrus’ approach is targeted at the latter two.

The company’s products, summarized in the following table, targeted for these computers are many.

| Part | Amps | Haptics | Codec | Power | Fst Chge | AFEs | Total |

| ASP * | $0.50 | $0.60 | $1.75 | $1.00 | $1.25-$2.50 | $0.50 | |

| No. | 2-4 | 1-2 | 1 | 1 | 1 | 1-2 | |

| Total Value | $1-$2 | $0.60-$1.00 | $1.75 | $1.00 | $1.25-$2.50 | $0.50-$1.00 | $6 – $8 |

* From above slide.

Future ASPs may range between a few dollars to $8 for fully loaded laptops with a range average of $4. In the past, Cirrus targeted approximately 40% of total markets which equals approximately 150 million units per year. Total revenue might range between $600 – $1200 million. We also believe that there is likely additional AFE products coming that are targeted at the laptop market.

With respect to AR/VR products, it appears that Apple (AAPL) is finally entering the market with a beginning product. Prolific Apple analyst Ming-Chi Kuo expects Apple to sell about 2.5-3.5 million units of the first-generation headset in 2023. The second-generation headset will launch sometime in the second half of 2024. Apple expects demand to accelerate as the product gets both more feature-rich and more accessible, with second-generation unit estimates approaching 10 million.

As part of a sweeping report released today, analyst Ming-Chi Kuo says that the long-rumored Apple AR/VR headset will feature as many as fifteen cameras. Among other parts possible, with Cirrus openly discussing a major entrance into the AR/VR world, the company likely won at least two closed loop controllers in each camera bringing an ASP to at least $8-$11. Selling in the beginning 3 million units equals revenue starting at $30 million. Kuo also notes that a second generation, one much cheaper, is already in development.

Picture from the Last Investor Calls

During two June conferences, management, among other things, unleashed for investors several important thoughts:

- “. . . for us is the big picture demand has remained very strong . . ..”

- “. . .continued to see pretty strong demand signals through the past few months.”

- “. . .demand signals have remained very consistent,”

- “(Ramsey) So, it sounds like the supply situation is really limiting socket growth . . .(Forsyth) right.”

- On Global Foundries capacity increase, it is about the high voltage domain: amplifiers, haptics, power management, power conversion.

- Seeking to achieve low 30% operating margins.

Investments & Risks

Like, in the movie, Seabiscuit, Charles Howard opined, “it’s about the future,” and in the case of Cirrus, it isn’t small. So we portray Cirrus’ future with a level of confidence. But, it is also about the present. It is getting through likely weakness over the next few quarters or longer that leaves us setting a hold recommendation.

Market warnings are appearing. Intel (INTC) and others are likely to warn, a belief garnered from a leaked internal memo reported by Reuters on Wednesday June 8th. It contented Intel was facing several issues that negatively impacted its coming quarterly earnings. From a recent Fortune magazine article, “Increased focus and prioritization in our spending will help us weather macroeconomic uncertainty, execute on our strategy, and meet our commitments to customers, shareholders, and employees,” Intel said in a statement provided to Fortune on Thursday, a day after Reuters reported a leaked internal memo announcing the hiring freeze at Intel.” The hiring freeze is expected to last for the rest of June. Analysts believe that perceived chip shortages resulting in overstocking by Intel’s customers and from lagging PC demand are the primary reasons. One analyst, Christopher Danely of Citi, believes that Intel will warn.

Samsung (OTC:SSNLF) just weighed in on its circumstance with this headlined story, Samsung Asks Component Makers To Delay Shipments Amid Build-Up In Inventories. From the article, “One person familiar with the situation said shipments of consumer goods from the company hadn’t been halted, but planned shipments in July have been halved.” It isn’t positive. How much Apple is drawing away is unknown. How much is general weakness from consumer cutting back from the effects of inflation isn’t known. What is known is that weakness exists from at least two sources, excess inventory build from supply chain issues and weak consumers due to inflation.

With these known, but still unknown weaknesses, Cirrus is likely also going to experience lower revenues than otherwise could be expected. Buying during extreme weakness might be in order, but for us, we’re on hold. It was nice though to cruise the future.

Be the first to comment