Doucefleur/iStock via Getty Images

Man is the only creature who refuses to be what he is.“― Albert Camus

Today, we put Agile Therapeutics, Inc. (NASDAQ:AGRX) in the spotlight for the first time since a piece we did in January of 2021. The name comes up from time to time in comments from Seeking Alpha followers. Yesterday, H.C. Wainwright doubled its price target on the stock to five bucks a share. The analyst there sees this contraceptive drug concern being a winner on the back of the recent SCOTUS decision to overturn Roe vs. Wade. Given that, it seems to a good time to “circle back” on this small cap biopharma. An analysis follows below.

Company Overview:

Agile Therapeutics is based out of Princeton, NJ. This small cap concern develops and commercializes prescription contraceptive products for women. Its first approved product on the market is called Twirla. This is a once-weekly prescription combination hormonal contraceptive patch. The company is also developing a pipeline of Twirla line extensions and other products. These product candidates are all in early stage development and have been placed on hold. Therefore, they will not be part of this analysis which will center on Twirla.

This patch uses the company’s Skinfusion technology to deliver the proper dose of active ingredients via the skin. The patch consists of 5 different layers and is less than 1mm thick. Twirla is less invasive than other options available such as injections, implants, and intrauterine devices. The addressable market for the drug is estimated to be worth just north of $4 billion.

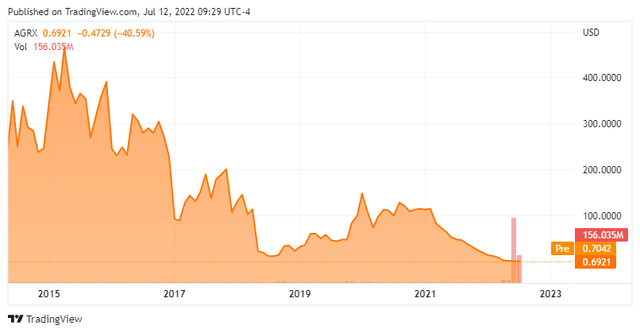

The stock sells for around 70 cents a share and has an approximate market capitalization of just north of $25 million.

First Quarter Results:

On May 12th, the company posted first quarter numbers. Agile Therapeutics posted a GAAP loss of $3.76 a share on revenues of $1.76 million. Both top and bottom line numbers beat the limited consensus. The company provided these metrics around sales traction on Twirla

- Total cycles dispensed grew 29%

- Total prescriptions grew 27%

- New prescriptions grew 22%

- Refills grew 31%

- Total prescribers grew 26%

The company provided updated second quarter guidance this morning. Among other items, the company expects 26% to 30% sequential growth from Twirla above first quarter results.

Analyst Commentary & Balance Sheet:

Besides Wainwright, only two other analyst firms have chimed in around Agile Therapeutics so far in 2022. On March 31st, Oppenheimer maintained its Buy rating but cut its price target from four bucks a share to just $1.50. In mid-May, Maxim Group maintained its Hold rating around the shares. Just over one percent of the company’s outstanding float is currently held short. There has been no insider activity in the shares so far in 2022 despite a large pullback in the stock.

After burning through just over $15 million of cash during the quarter, the company ended the first quarter with just $3.7 million of cash and marketable securities on its balance sheet. The company added cash of $4.7 million in April from the sale of its New Jersey Net Operating Losses. Earlier this month, the company raised an additional $24 million via a 26.67M share secondary offering which included one share issued at 90 cents per, attached to a warrant exercisable at 90 cents per share.

Verdict:

Only one analyst firm has sales projections on Agile Therapeutics that I can find. They see sales doubling to $8.3 million in FY2022 and rising to just over $25 million in FY2023.

While the company is focusing its sales efforts in California (the biggest state or contraceptive sales), Agile Therapeutics also launched a co-promotion program with Afaxys, through their group purchasing organization early this year. Finally, the company recently launched its first connected TV (or CTV) advertisement, focusing on women in the targeted Twirla age demographic of 18-24 years old. However, the company continues to bleed cash. The recent cash raises gives the firm another two quarters of funding at current burn rates. In addition, it was accomplished only through what was a significantly dilutive capital raise taking into consideration the warrants that had to be issued to get the offering done.

In addition, the contraceptive space is very competitive with numerous competitors in the market. One of these, Evofem Biosciences (EVFM) we did a piece on last week. It is similar to Agile in that it is seeing significant revenue growth with a recently approved product but is facing cash burn issues. The company also did a dilutive capital raise this year and shareholders have not been rewarded with their faith in the company.

The simple fact is this is a mass market that will never have the margins found in other parts of biopharma/biotech like oncology and rare diseases. It reminds me of the antibiotic space in that most small caps have a hard time ever achieving profitability, and shareholder destruction is par for the course. This sub-sector would probably benefit from consolidation as it is quite fragmented.

Outside of a buyout, it is hard to see how further dilutive capital raises are not on the horizon. One also has to keep in mind that H.C. Wainwright was the exclusive placement agent for the recent $24 million secondary offering. Therefore, I would take their recent upward price target revision with a large grain of salt.

Finally, Agile Therapeutics has destroyed a ton of shareholder value over the years (see above). Therefore, I have no investment recommendation around Agile Therapeutics at this time.

Judge a man by his questions rather than by his answers.”― Voltaire

Be the first to comment