utah778/iStock via Getty Images

After penning an update article on Portman Ridge (PTMN) last week, one of the comments from reader Raj Mehta asked my opinion on another BDC that he is invested in. I was not previously familiar with CION Investment Corporation (NYSE:CION), so I did some research. What I learned is that CION is an externally managed, closed-end investment company that has elected to be regulated as a BDC (business development company). The investment advisor is registered affiliate, CION Investment Management, LLC aka CIM (not to be confused with Chimera Investment Corp).

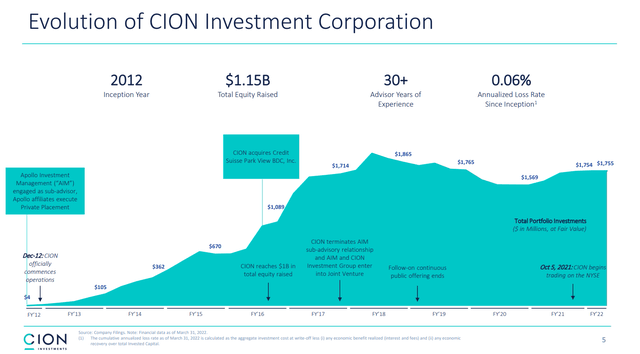

CION went public in October 2021 and has $1.8B in total assets with 115 portfolio companies as of March 31, 2022. The portfolio consists of 94% senior secured loans and 85% floating rate debt instruments. The stock offers a 14% yield and trades at more than a 40% discount to NAV. With investor sentiment near historic levels of pessimism, the timing for this BDC to go public could not have been worse.

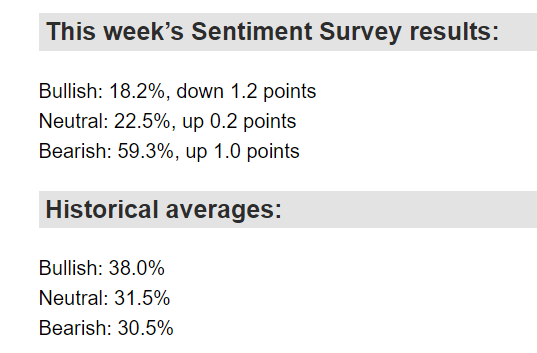

Continued volatility in the major stock indexes along with inflation, corporate earnings and increased chatter about the possibility of a recession are all likely weighing on individual investors’ short-term expectations for the stock market. Also influencing sentiment are monetary policy, the coronavirus pandemic, politics and the ongoing invasion of Ukraine by Russia.

From the fund’s About page on the company website, the investment strategy relies on financing mostly senior secured loans and first lien, second lien and unitranche loans, as well as equity co-investments. The businesses that they target are typically mid-range businesses with annual EBITDA averaging $50M.

The co-investment opportunities are one aspect of CION that sets them apart from other BDCs. Before going public as a private entity, they were able to freely engage in equity co-investments with their affiliates. Now as a publicly held BDC, the SEC must approve an exemption for them to continue co-investment activities. They describe this issue in the proxy statement for the upcoming annual meeting:

Co-investments made under the exemptive relief, if granted, would be subject to compliance with the conditions and other requirements contained in the exemptive relief provided by the SEC. The Company is limited in its ability to engage in co-investment transactions with CIM and its affiliates without exemptive relief from the SEC. Even if the Company receives exemptive relief, CIM’s investment committee may determine that the Company should not participate in a co-investment transaction.

Company History and Strategy

CION Investment Group is a vertically integrated alternative investment manager and retail distribution company founded in 2011. With headquarters in New York, they have two key products and $4.9B in AUM (assets under management). The two products include CION Investment Corp (CION) founded in 2012, and CION Ares Diversified Credit Fund, founded in 2017 which is co-managed with Ares Management (ARES).

Evolution of CION (company website)

In a Seeking Alpha interview with co-CEO Michael Reisner, he describes the differences between the two CION products. This article is focused on the BDC CION, which he states is their attempt to “democratize investments” for retail investors and is managed by CIM directly. The differentiated investment platform of CION is driven by four key factors:

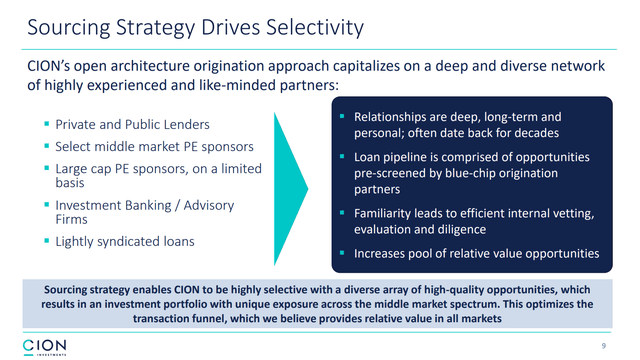

- Sourcing powered by a strong network – direct first lien investments based on long-standing partner relationships and a robust origination funnel.

- Organizational flexibility to generate efficiencies – a flat organizational structure that is highly focused on pre-screening and front loading of critical underwriting issues using an iterative approach.

- Size and scale to provide a competitive advantage – including flexibility to invest across a borrower’s capital structure without limitations.

- CION is the exclusive focus of the investment team.

They place particular emphasis on the sourcing strategy used to identify the pipeline of opportunities as illustrated in the following slide from the Q122 investor presentation.

CION Sourcing Strategy (Q122 Investor presentation)

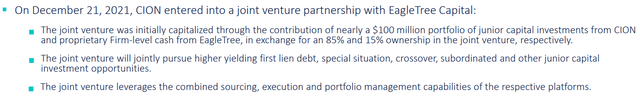

The core investments in the portfolio include primarily senior secured loans and companies with EBITDA between $25M to $75M. Approximately 94% are senior secured loans (as of March 31, 2022). They also opportunistically pursue higher return/special situations in the secondary loan market. And they have a joint venture with an affiliate of Eagle Tree Capital. The principals of Eagle Tree and CION have worked together and partnered for more than 25 years.

Eagle Tree JV (Q122 Investor presentation)

Stock Performance

In the past six months the share price has dropped by -39% and about -30% since going public in October. The YTD total return sits at -34%. The last reported NAV as of March 31, 2022, was $16.20 (compared to $16.34 at the end of Q4 2021). At the current share price of $8.19, and assuming that the NAV has not dropped considerably more in the past two months, the stock is trading at nearly a 50% discount to NAV.

CION Price to Book value (Seeking Alpha)

Even if the NAV has dropped below $16, the discounted share price offers a unique buying opportunity for this under-followed BDC that went public at the top of the bull market. As it turns out, the timing was bad but there was no way to know that at the time.

AAII Sentiment Survey, June 23, 2022 (AAII website)

Distribution rate of about 14%

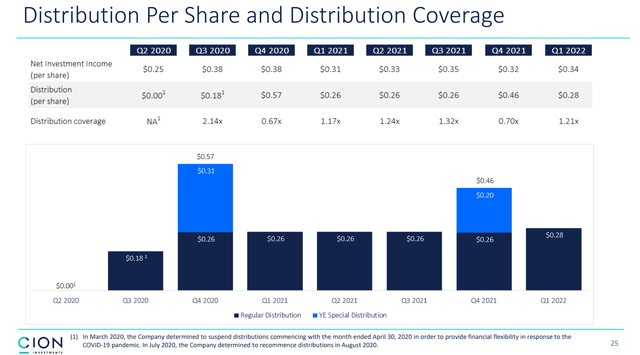

According to the company website, the current distribution rate is 15.24% based on the past 12-month dividend payments and closing market price of $8.46 on June 17. On March 10, 2022, a regular quarterly dividend of $0.28 was declared, in-line with the previous quarter. As of June 24, 2022, the closing price was $8.19. If the four quarterly dividends in 2022 amount to $1.12 ($0.28 x 4) then the forward yield would be 13.67%. Therefore, I will round up to a 14% yield rather than the 15% shown on the website, which included the special dividend paid in December 2021.

CION Distribution History (Q122 Investor presentation)

Share Repurchase Policy

Prior to going public the company authorized a share repurchase policy that allows for up to $50M in shares to be repurchased at the company’s discretion.

On September 15, 2021, the Board, including the Independent Directors, approved a share repurchase policy authorizing the Company to repurchase up to $50 million of its outstanding common stock after the listing of its shares of common stock on the New York Stock Exchange, which occurred on October 5, 2021 under the symbol “CION”. Under the share repurchase policy, the Company expects to purchase shares of its common stock through various means such as open market transactions, including block purchases, and privately negotiated transactions. The number of shares repurchased and the timing, manner, price and amount of any repurchases will be determined at the Company’s discretion.

As part of the share repurchase policy, the Company intends to enter into a trading plan adopted in accordance with Rule 10b5-1 of the Exchange Act based in part on historical trading data with respect to its shares. The 10b5-1 trading plan would permit common stock to be repurchased at a time that the Company might otherwise be precluded from doing so under insider trading laws or self-imposed trading restrictions. The 10b5-1 trading plan will be administered by an independent broker and will be subject to price, market volume and timing restrictions.

In my opinion it would be wise to repurchase shares at the current market price at the now substantial discount to NAV. That would help boost investor confidence and potentially improve the price performance in the second half of the year. I will be interested to read about any share repurchases that may occur during the second quarter when they report results in August.

First Quarter Highlights

The first quarter of 2022 represented only the second quarter reporting as a public company. It is therefore somewhat difficult to understand how the results compare year over year, or for any time period longer than the previous quarter for that matter. The results were somewhat mixed.

From the Q1 2022 Investor presentation these were the highlights:

Q122 Highlights (Q122 Investor presentation)

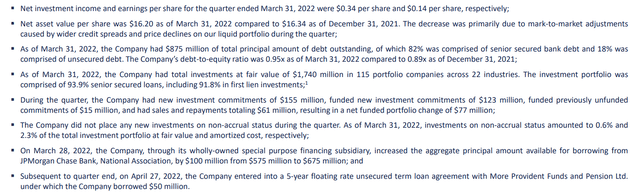

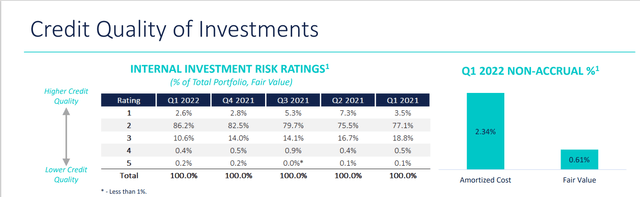

Based on this one quarter, it appears that NII of $0.34 per share does cover the quarterly distribution of $0.28 with room to spare, so that is one positive. The NAV dropped from $16.34 in the previous quarter to $16.20 in Q1. Other BDCs have experienced similar or in some cases larger declines in NAV during the first quarter, so that is a negative but not enough to justify the significant drop in price that followed, in my opinion. Non-accruals remain low and did not increase in the quarter, and the borrowing capacity was increased by $50 million.

The credit quality of their investments also improved in the quarter.

Credit Quality of Portfolio (Q122 Investor presentation)

Financial Summary and Interest Rates

With a healthy balance sheet, solid first quarter results, and very few debt maturities before 2024, this BDC looks well positioned for capital growth and a steady distribution payout in the second half of 2022. New commitments of $155M were realized in the 1st quarter along with $61M of repayments and total debt capacity was raised by $150 million.

From the first quarter earnings call transcript, the financial summary was described by CFO Keith Franz:

We ended the quarter with a strong and flexible balance sheet with $400 million in unencumbered assets, low leverage, a strong debt servicing capacity and solid liquidity. We had over $33 million in cash in short-term investments and access to another $105 million under our current facilities to finance our investment pipeline. Our current debt mix is 82% senior secured and 18% unsecured. The weighted average cost of our debt capital is about 3.7%, with the majority of our senior secured facilities maturing in 2024 and all of our unsecured debt maturing in 2026 and beyond.

At quarter end roughly 90% of the performing loan portfolio was in floating rate investments. On the liability side the rising rates will have a detrimental effect on borrowings but a net positive impact on net investment income as rates continue to rise.

Upcoming share offering?

From the company’s proxy statement on June 1, one of the items to be voted on in the upcoming shareholder meeting on July 28 is to approve a share offering at a price below NAV.

To consider and vote upon the approval of a proposal to authorize flexibility for the Company, with the approval of the Board, to offer and sell Shares at a price below net asset value (“NAV”) during the next 12 months following shareholder approval, subject to certain limitations described in this proxy statement (the “Share Issuance Proposal”)

There is no indication yet when they plan to offer new shares, but I would expect that they will likely wait for the discount to narrow before they do as any share offering generally causes a short-term drop in share price. That could spook retail investors who may then panic sell if they see the share price drop further, which would lead to an even steeper decline.

Summary and Conclusions

I believe that Michael Reisner summed it up succinctly in his opening comments during the earnings call.

In a crowded and competitive field, we believe our niche position has served us well in sourcing high-quality investment opportunities and in turn generating solid investor returns through current yield. Our listing on the New York Stock Exchange last fall gave us the opportunity to provide enhanced liquidity to our shareholders and to position us for potential growth. During the quarter, we took initial steps to increase our borrowings to support this planned growth objective after receiving shareholder approval to reduce our asset coverage ratio to 150% at year-end 2021. Despite challenging market conditions, we are pleased to have successfully increased our total available borrowing capacity by $150 million from two of our existing lenders, consisting of an increase in the total committed principal amount available for borrowing from JPMorgan by $100 million in March and the closing of a $50 million 5-year floating rate unsecured term loan in April.

Although this BDC has been publicly traded for less than a year, CION has more than a decade of experience as a non-public entity with specialized lending of senior secured, primarily first lien notes with a differentiated approach characterized by deep relationships and a focused advisory team.

I rate CION a Buy here due to the deep discount to NAV, the well covered high yield distribution, and a well-capitalized, market efficient strategy for capturing growth in the portfolio during these volatile market conditions. Caution is warranted for any new investors who may be considering this stock for their portfolio, especially in the short term, since the market bearishness has not yet fully subsided. There is not a lot of history yet as a publicly traded company, but the investor resources website does have a great deal of information available for reviewing past results (as a non-public company), some of which is included in this article.

I welcome any comments or additional thoughts from readers who may have additional information to share. Based on my own investing objectives and risk tolerance, I may decide to initiate a long position in CION now that I have done my own due diligence and I like what I am seeing so far. But please do your own due diligence prior to making any trading decision.

Be the first to comment