Bet_Noire

I’m going back to a Buy on the Calamos Global Dynamic Income Fund (NASDAQ:CHW), $5.90 closing market price, after downgrading and selling the fund on August 14th when CHW was at $7.99 and about an +11% market price premium.

That was over $2.00 or -26.4% ago, so that should give you an idea of how volatile CHW can be. In fact, up until yesterday’s moon shot with the S&P 500 (SPY), $394.69 closing market price, up +5.5%, CHW’s NAV was down -31.1% YTD.

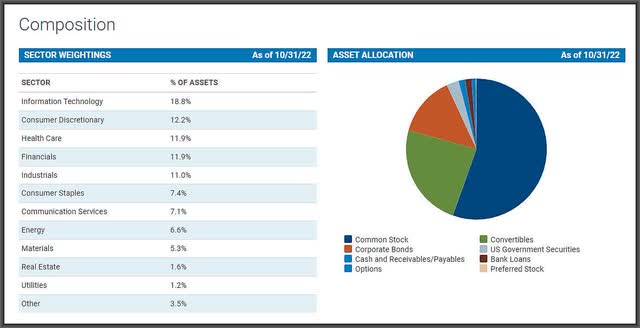

That’s because CHW is a highly leveraged stock, high-yield corporate bond and convertible bond fund that saw just about every component of its portfolio suffer this year.

But what can go down in a bear market can recover quickly in a bull market and both CHW and its sister fund, the Calamos Strategic Total Return Fund (CSQ), $13.80 closing market price, +3.3%, can quickly make up NAV with their heavily leveraged and risk-on portfolios.

The difference between the two funds is essentially that CSQ is a U.S. equity fund while CHW is a global (U.S. and international equity), while their high yield and convertible bond portfolios have more overlap.

The other major difference between the two funds is that CSQ is huge at $3.3 billion in managed assets (including leverage) while CHW is only about $663 million in managed assets.

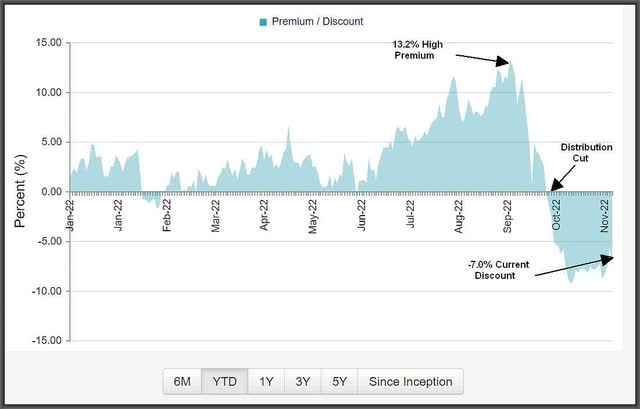

Smaller funds tend to be more volatile and because of CHW’s higher-yield back in August when I downgraded the fund due to an NAV yield it couldn’t cover, the fund was trading at a much higher price, $7.79, and a much higher premium, +10.7%.

I even asked in that article when CHW’s NAV was eroding under duress due to the bear market and the weight of a very high 12% NAV yield at the time,

Is that already contributing to CHW’s poor NAV performance this year and will Calamos have to cut CHW’s distribution? I think so.

And on October 3rd, that is exactly what happened when Calamos cut CHW’s distribution from $0.07/share to $0.05/share per month. But as I have often said, I don’t mind distribution cuts when it more properly aligns a fund’s income with its payout because in the long run, that will help the fund’s NAV grow back in a better market environment.

So by cutting CHW’s distribution -28%, CHW went from a very high 11.9% NAV yield to a much more achievable 9.5% today. That may not sound like much, but that can mean the difference between an NAV that is eroding to an NAV that is growing.

The only problem is that most shareholders are very short-sighted and don’t look at distribution cuts that way. The result was that investors sold off CHW and the fund went from an +13% premium in mid-September before the distribution cut, to a -7.0% discount today:

THAT makes CHW dramatically more attractive now as a risk-on fund and why I am raising CHW from a Hold to a Buy.

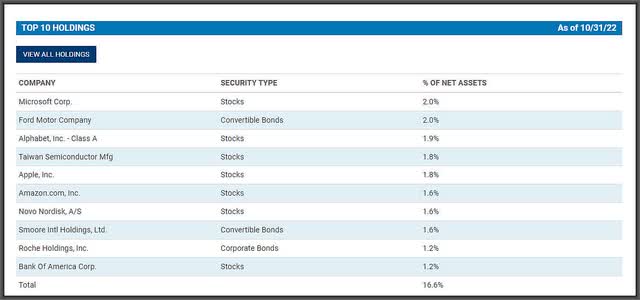

Here is a snapshot of CHW’s top holdings and portfolio composition:

Be the first to comment