Olemedia

Investment thesis

The exponential growth in 5G technologies in the mobile and automotive market will provide opportunities for semiconductor companies especially Skyworks Solutions, Inc. (NASDAQ:SWKS) and QUALCOMM Incorporated (NASDAQ:QCOM). Both of the companies struck deals with automakers and smartphone makers to ensure they will capitalize on the growth of these markets. Which company should investors choose if they wish to benefit from this growth combined with stable dividend payments?

Highlights of SWKS and QCOM

SWKS

Skyworks is a semiconductor company that designs, develops, and manufactures proprietary semiconductor products, including intellectual property. The bulk of their revenue is from the mobile (especially 5G) market. Almost all of the major mobile manufacturers use Skyworks products in their supply chain. The management started to open to the automotive industry because they expect 650 million connected cars by 2030 and each vehicle will require substantially more data than any smartphone. At the moment more than a quarter of the company’s revenue comes from this segment and I expect this to rise in the future. As electric vehicles start to come off the production lines by the largest manufacturers such as General Motors Company (GM), and Ford Motor Company (F), more and more semiconductors will be needed and Skyworks will be a major beneficiary of the shift from combustion engines to electric engines.

The biggest risk for SWKS is customer concentration. Apple (AAPL) provided approximately 55% of its total revenue in 2022, this figure was a bit lower (53%) a year ago, and Samsung provided more than 10% of Skyworks revenue. In the near future, I cannot see that Apple will bring the design and manufacture of RF devices in-house, simply because they likely do not have the know-how and SWKS can manufacture them at a much better price than Apple could. I believe that original equipment manufacturers rely heavily on Skyworks products and intellectual properties, Sky5 architecture, and the spread of 5G technology has just started. The management expects a CAGR of 15-17% and I also expect some kind of revenue diversification in the upcoming years because of the aggressive growth of the cloud segment and due to SWKS being aligned with top 10 data center interconnect providers. Despite this diversification, I cannot see that the share of SWKS’s revenue from Apple can go down significantly.

QCOM

Qualcomm operates in the semiconductor industry, and develops, supplies integrated circuits and system software based on 4G/5G and other technologies for use in mainly mobile devices. 62% of their revenue comes from products sold for use in mobile handsets. The company is also growing its automotive segment rapidly (now it only represents approximately 4%) but the management struck a deal with the automotive software supplier of Volkswagen Group (OTCPK:VWAGY) passenger car brands, CARIAD. This will give QCOM the necessary leverage to capitalize on the growing electric automotive market. Volkswagen Group predicts EV sales of 2.5 million vehicles by the end of 2025. Although Qualcomm’s automotive segment contributed just 4% of revenues to the total during the first 9 months of 2022, investors saw an almost 40% growth year-on-year in the third quarter, and with this VW deal, this figure will keep increasing in the upcoming years. Qualcomm’s management is confident that they can surpass $4 billion in automotive revenues by 2026 which means this segment will contribute 6.5-7% of the total revenue. Qualcomm is also in a strong position with Android smartphones. They prolonged their strategic partnership with Samsung until 2030. “Qualcomm will deliver leading premium consumer experiences for Samsung Galaxy devices. Samsung has agreed to extend their patent license agreement for 3G, 4G, 5G, and upcoming 6G mobile technology through the end of 2030”.

Except for the external risks of the whole semiconductor industry, there is an internal risk that has not been priced in just yet: the ARM legal case. ARM does not make chips, Qualcomm is the customer of ARM. In a nutshell, Qualcomm acquired Nuvia and the company had an architecture license agreement. ARM terminated the Nuvia license on March 1 but Qualcomm kept using it, so ARM is suing QCOM now. For ARM the sooner it gets settled the better and for Qualcomm the longer it drags on the worse it is. Within the next months, investors might see a clearer picture of what will happen in this legal case.

The same statement can be made for both SWKS and QCOM as well: The massive automotive industry, 5G growth, and IoT markets ensure the current earnings and free cash flow will grow in the upcoming years. Investors have to take into consideration the geopolitical risks associated with the semiconductor industry which are the Taiwan-China relations and the likelihood of a war between those nations. I analyzed this risk more in-depth in my article about Texas Instruments (TXN).

Valuation comparison

Investors can agree on one thing: both SWKS and QCOM are undervalued. Skyworks’ stock price has been declining for more than 15 months while Qualcomm’s stock price has been declining for 11 months. So the question is, from a valuation point of view which stock is a better buy?

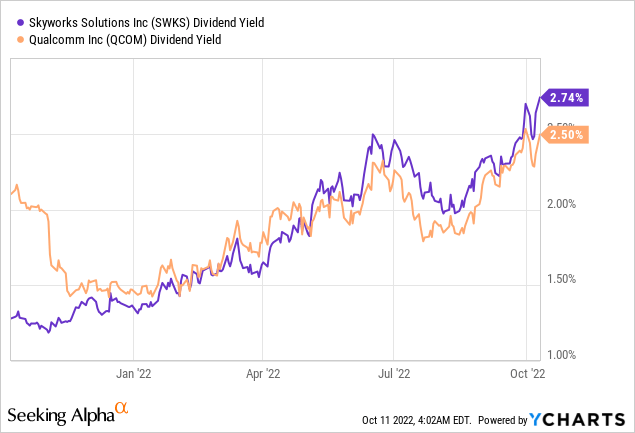

From the dividends perspective and applying the dividend yield theory SWKS is better valued. For blue-chip dividend stocks, dividend yields tend to revert to the mean. SWKS trades significantly over its average dividend yield. SWKS had an average yield of 1.59% over the last 4 years and now it is trading on close to 3%, the best it has ever been. Although investors can buy QCOM with the best yield in the last 12 months, it is trading almost at its 4-year average yield of 2.6%.

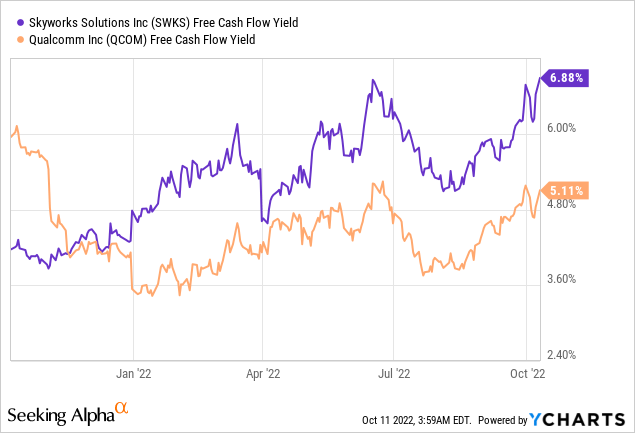

From a growth point of view, QCOM is the better choice. QCOM’s management expects an approximately 30% increase in revenue in the next year and at the same time, SWKS expects approximately 19%. Looking at the EPS growth they seem a bit closer but that is because SWKS has been buying back shares at a rapid pace compared to QCOM (more on this later). QCOM has a forward free cash flow per share growth rate of 50% while SWKS has a forward FCF/Share growth rate of 35%. This might seem significantly lower but keep in mind that both of these figures are in the top 25% of the semiconductor industry. In terms of the FCF yield, Skyworks is in a better position and has a 1.5% better yield than Qualcomm. This does not make a significant difference in the companies’ valuation but rather a good-to-know factor. Based on only analysts’ estimates SWKS has an average target price of $131 with the lowest estimate is $97 and QCOM has an average target price of $183 with the lowest estimate of $140.

Dividend comparison

SWKS

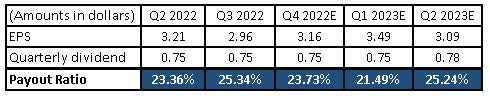

Skyworks has been paying dividends for 8 consecutive years and the management has been increasing the dividend for 8 years as well. They have been returning cash to investors since 2014 and the management has the intention to continue in the future. The company announced a 10.71% dividend increase in the third quarter. It is less than its 5-year average of 14.5% but taking into consideration the share buyback program this figure is almost in line with its long-term average. Analysts estimate an approximately 3-4% dividend increase in the upcoming years but in my opinion, this figure is below the management’s opportunities and planned cash return. I expect a minimum of a 5-6% increase every year in the next 2-3 years. In every earnings call, the management reassures investors that they will keep paying and increasing dividends and they have no intention or external pressure not to do so. In their second-quarter earnings call Skyworks CFO, Kris Sennesael said: “We definitely are continuing to generate strong free cash flow. And we will use that cash flow to, of course, continue to pay the dividend.” In addition, the CEO and CFO proudly announced every dividend increase in the last years, the recent one was no exception: “given our conviction in Skyworks long-term strategic outlook and consistent cash generation, we announced an 11% increase to our quarterly dividend” – Kris Sennesael CFO, “we announced an 11% increase to our quarterly dividend that marks our eighth consecutive year of dividend increases” – Liam Griffin CEO. The management has room for future increases because their dividend is well covered, and their current payout ratio of approximately 21.5% matches the company’s 5-year average of 22.5%.

The chart is created by the author. All the figures are from the company’s financial statement and Seeking Alpha estimates.

QCOM

Qualcomm has been paying and increasing its dividends for 18 consecutive years. I believe that they are heading to become a dividend champion within the next economic boom cycle (dividend champions have to increase their dividends for at least 25 consecutive years.) The company’s last increase was in the second quarter of 2022, the management increased the dividend by 10.3%. This is better than Intel’s (INTC) 5% increase or TXN’s approximately 7% increase in 2022 but worse than SWKS’ increase. Analysts estimate only a 2.5% increase in 2023. Because I expect no major share repurchase program this figure might be slightly higher, (4-5%) but that is the upper end I see at the moment. The dividend is well covered (24% payout ratio), and lower than its 5-year average payout ratio of approximately 55%. The management made no comments about the dividend in 2022 so far so that is a message to me that no changes can be expected in the current dividend policy.

The chart is created by the author. All the figures are from the company’s financial statement and Seeking Alpha estimates.

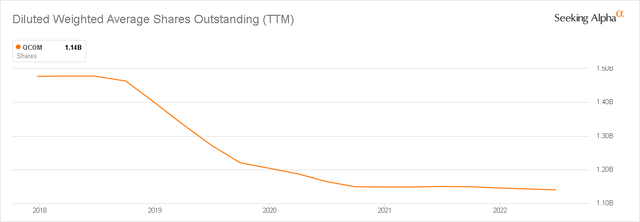

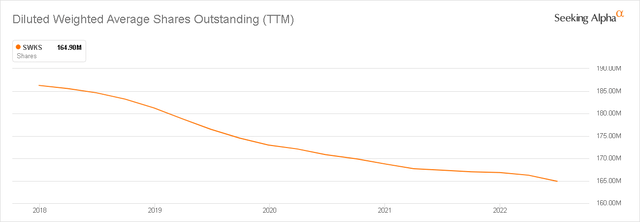

In the last 5 years, QCOM decreased its shares outstanding by 23% while SWKS bought back 11.3% of its shares. However, if we look at what happened since the pandemic, QCOM almost stopped the share repurchase program while SWKS continued.

Investor takeaway

I believe both of the companies have their advantages for long-term growth and income investors. In my opinion, SWKS and QCOM are buying opportunities at these undervalued prices. Investors need to take into consideration 2 things when thinking about capitalizing on EV chipmakers and 5G growth. Do they prefer a better-diversified, larger but lower dividend yield company or a more customer-concentrated smaller company trading at a record dividend yield? What do you think?

Be the first to comment