ablokhin/iStock Editorial via Getty Images

2021 was a difficult year for investors in the restaurant space (EATZ), with many names finishing the year in negative territory. However, Chipotle (CMG) was one of the few sanctuaries, helped by its steady unit growth and superior margin performance. With steadily increasing average unit volumes [AUVs] and new store concepts to help boost margins, Chipotle is easily a top-5 story in the restaurant space. At current levels, I remain neutral with a limited margin of safety baked into the stock at $1,410. However, if we were to see a dip below $1,255 where CMG would trade at ~23x EBITDA, I would view this as an attractive entry from a swing-trading standpoint.

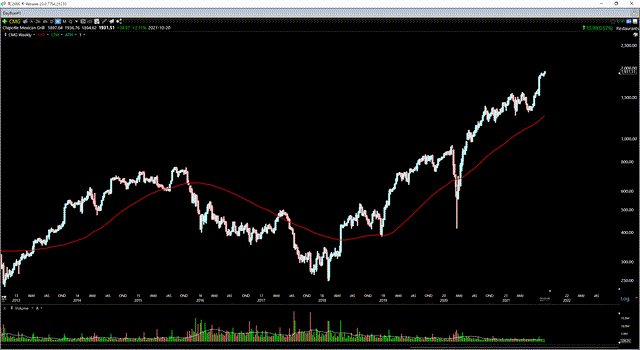

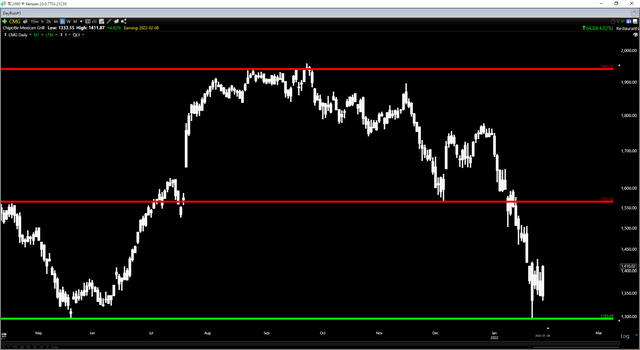

Just over four months ago, I wrote on Chipotle, noting that the stock was priced for perfection above $1,900 per share. Not only was the stock trading at nearly 60x FY2022 earnings estimates, but it was hovering 55% above its 85-week moving, a level of extension that it’s had trouble with previously (negative 9-month forward returns in previous instances). Since then, the stock has pulled back more than 30% and come back to reality, partially attributed to continued inflationary pressures and the emergence of Omicron, which has weighed on sentiment sector-wide. Let’s take a look at recent developments below:

CMG Technical Chart – August 2021 TC2000.com

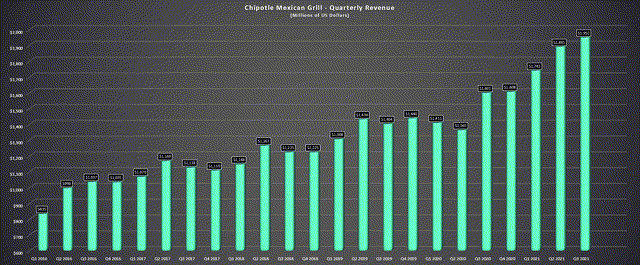

As discussed in my most recent article on Chipotle, the company had another blow-out report in Q3, reporting revenue growth of 22%, and earnings growth of 87%, despite lapping difficult year-over-year comps. This is because the company was a clear pandemic winner like Wingstop (WING) and Domino’s (DPZ), benefiting from not relying on dining rooms and a strong digital presence. Since then, Omicron has spooked many investors in the restaurant industry, which is understandable given that the industry was already coming up against difficult year-over-year comps in Q1 after lapping government stimulus.

Chipotle Quarterly Revenue Company Filings, Author’s Chart

When it comes to Chipotle, I don’t foresee Omicron being much of an issue relative to casual dining names, which are likely to see a dip in December/January traffic due to anxiety about the virus. This relative outperformance from a traffic standpoint could see a little help from the company’s recent menu innovation. The first new item that is being tested in select markets is Pollo Asado, Chipotle’s first innovation in the chicken department in its history. The new offering launched at 95 restaurants in Cincinnati and Sacramento, and it features the “unique taste of garlic, fresh lime, guajillo peppers, and hand-chopped cilantro”.

Like other new offerings, Chipotle offered a $0 delivery fee for a week via the Chipotle app/website. This incentivizes guests to try the item, while boosting Chipotle’s digital penetration, where it enjoys a higher average ticket. More recently, Chipotle announced its national launch of Plant-Based Chorizo, a previous test that saw encouraging results and is now available in all U.S. restaurants. Not only does this give existing vegan guests another option on the menu, but it also opens Chipotle up to a new guest that may not care for tofu (Sofritas) at a time when the company is coming up against difficult Q1 comps (no benefit from government stimulus).

Chipotle Pollo Asado Company Website

In addition to recent menu innovation, Chipotle continues to build its loyalty program, with more than 24 million members, or roughly 8,000 members per restaurant. The ability to continue migrating members to digital and onto its loyalty program through its limited-time offering and points is very strategic, with Rewards members getting an early look at new menu items. This is a differentiator for the company, which should help with industry-leading brand loyalty, and ultimately pricing power, given that guests are more than willing to pay a little more at Chipotle to collect the points, and enjoy menu freshness vs. some of its competitors. Of course, the other major benefit to this growing digital penetration is new store concepts, which Chipotle has been embracing.

Chipotle Rewards Company Website

For those unfamiliar, Chipotle recently announced that it would be opening its first digital-only kitchen in Ohio, a store concept with a Chipotlane and walk-up window for digital order pick-up. This will provide a savings on labor and reduced development costs, with it being smaller than a traditional Chipotlane with no dining room access for guests, and no front line. Instead, it will solely be a kitchen make line dedicated to digital orders (online or App) and patio seating for those that want to pick up and stay to eat. In an inflationary environment where development costs are higher, this move will benefit upfront costs to build restaurants. Meanwhile, it will also allow for less staff, with no need to clean dining rooms, and a smaller roster given that this will be similar to a Ghost Kitchen concept.

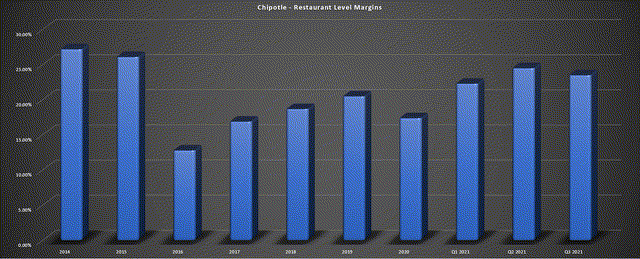

Chipotle Digital Kitchen Company Website

As noted previously, Chipotle is already seeing margin expansion ahead of this move, and as AUVs improve to closer to $3 million, the company expects restaurant margins to increase to the high 20% range. Therefore, for investors that were worried about inflationary pressures and wage increases to retain/attract talent weighing on margins, this should help to offset some of these pressures, if the concept proves successful. To date, Chipotle’s portfolio of ~300 restaurants with Chipotlanes offers best in class margins, and this new concept should offer even better margins, with digital pick-up orders being the company’s highest margin transaction.

Chipotle Margins Company Filings, Author’s Chart

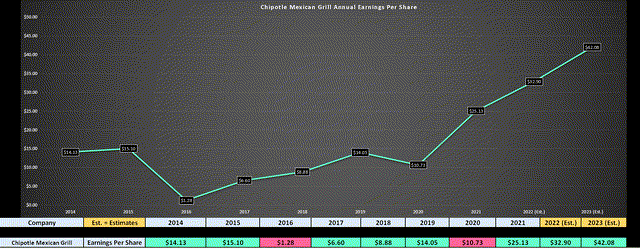

Earnings Trend & Forward Estimates

As shown in the chart below, Chipotle is on track for a record year, and should have a solid Q4 report, with annual EPS estimates sitting above $25.00 per share. This would translate to quarterly EPS of ~$5.30, or 52% growth vs. the $3.48 reported in Q4 2020. If we look at FY2022 estimates, this growth is expected to remain robust, with annual EPS set to more than double vs. pre-COVID-19 levels to $32.90. Not only does this represent more than 30% growth vs. FY2021 estimates, but it would represent a slight acceleration in the company’s compound annual EPS growth rate vs. FY2014 levels.

CMG Earnings Trend FactSet, Author’s Chart

Assuming FY2021 annual EPS estimates come in at $25.13, Chipotle’s compound annual EPS growth rate vs. FY2015 levels ($15.10) would come in at ~8.9%, which is a very respectable figure. However, if the company meets or beats FY2022 estimates ($32.90), this would translate to a compound annual EPS growth rate of ~11.8%, with further acceleration to ~13.7% in FY2023 (annual EPS estimates: $42.08). This is helped by the company’s steady unit growth, improving margins, and strong comp sales growth. Most importantly, this is occurring in an industry where the average company is seeing margin compression due to labor and inflationary pressures.

Based on these growth rates, it is clear that Chipotle is one of a kind, and while it may not boast the same unit growth rates as a company like Shake Shack (SHAK), it is infinitely superior to SHAK. This is because it is not growing simply for the sake of growth, but actually expanding margins/comp sales in the process. So, for investors that are looking for growth in the restaurant space, Chipotle is easily a top-5 name, next to names like Dutch Bros (BROS), and Wingstop, which are also seeing strong unit growth.

So, is the stock a Buy?

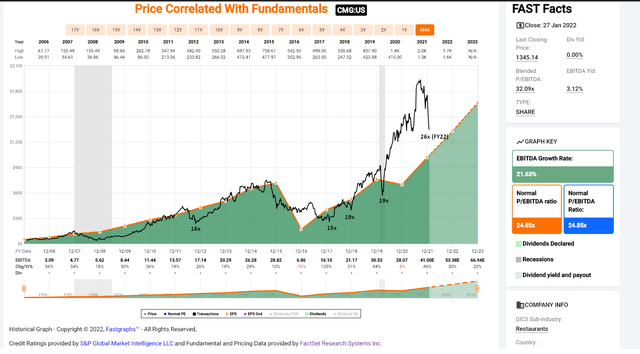

Looking at Chipotle’s valuation below, we can see that the stock has historically traded at ~25x EBITDA, with an EBITDA multiple that’s averaged ~30 since the E. Coli scare. Based on FY2022 EBITDA estimates of $53.40 and a share price of $1,410, Chipotle trades at 26.4x EBITDA, which is a slight premium to its historical multiple, and only slightly below its 5-year average EBITDA multiple. This suggests that while the valuation has improved from lofty levels in Q4, there’s still not much of a margin of safety baked into the stock here.

CMG EV/EBITDA Multiple FASTGraphs.com

Even if we use the 5-year average of ~30 and assume that Chipotle beats FY2022 estimates (EBITDA of $55.00 per share), this would translate to a fair value of $1,650, which does offer upside from current levels. However, the goal is to buy with a meaningful margin of safety baked in, and if we apply a 25% discount to this figure, Chipotle would need to dip below $1,238 to become attractive. To summarize, unless Chipotle was to undercut its recent lows, it’s hard to argue that the stock is attractive from a valuation standpoint, at just a ~4% EBITDA yield. This doesn’t mean that the stock can’t go higher; it simply means that there are better relative values elsewhere in the market.

CMG Technical Picture TC2000.com

Moving to the technical picture below, we can see that Chipotle has seen a sharp correction from its Q4 highs, sliding more than 30% and reversing below a key breakout level at $1,565. This has put a new short-term resistance level in place, which could be a sticky point for the stock. The good news is that the $1,295 level looks to be a new support zone, with above-average buying volume on January 24th, 2022, similar to what we saw on March 5th, 2021, in the same area.

However, I prefer at least a 4 to 1 reward/risk ratio to justify entering new positions, and with Chipotle trading at $1,410, the stock’s reward/risk ratio comes in at just 1.35 to 1.0. This is based on $155 in upside to short-term resistance and $115 in downside to support. So, while the stock has fallen sharply from its highs, I currently remain neutral from a technical standpoint. Having said that, if the stock were to undercut support to shake out weak hands, this would likely present a low-risk buying opportunity. So, I would strongly consider buying the stock at $1,255 or lower.

Chipotle Quesadillas Company Website

Chipotle is one name that has aged gracefully through the pandemic, posting strong unit growth and actually seeing restaurant margins increase more than 200 basis points in Q3 vs. pre-COVID-19 levels. Looking ahead, Chipotle confirmed the potential for high 20% margins if AUVs can climb closer to $3 million, making Chipotle one of the few margin expansion stories industry-wide. With continued menu innovation and new store concepts to help boost margins, Chipotle is a top-5 story in the restaurant space and one of the better buy-the-dip candidates. So, if we were to see a dip below $1,255 before March, I would view this as a low-risk buying opportunity from a swing-trading standpoint.

Be the first to comment