Igor Kutyaev/iStock via Getty Images

Originally posted on June 1, 2022

By Han Peng, CFA, Quantitative Strategist, Seema Shah, Chief Global Strategist

China’s ongoing struggles with COVID-19 and the country’s lackluster policy response have dismayed investors. In fact, by the end of April, MSCI China had dropped 18% since the start of 2022, credit spreads had widened meaningfully, and the renminbi (RMB) had depreciated almost 4%. However, a series of weak economic numbers appear to have alerted policymakers to the urgency of stabilizing growth. On May 20, 2022, the People’s Bank of China (PBoC) announced a surprisingly forceful response, cutting the five-year loan prime rate (LPR) by 15bps – the largest cut in this rate since LPRs were introduced in 2019. Following the stimulative policy action, investors are now wondering if the tide has turned on Chinese equities and its battered housing market.

COVID-19: A masterclass in economic damage

Over the past two months, China has been wrestling with its worst COVID surge since March 2020. Although infection rates have now started to decrease, strict adherence to its zero-COVID policy has meant that around40 cities are still facing restrictions, accounting for nearly 25% of China’s GDP and 20% of their population.

Unsurprisingly, China’s zero-COVID policy has cratered the economy, severely hampering mobility and discouraging consumer spending on services.1 In addition, it has extended economic uncertainty for businesses and caused significant disruption to supply chains. Industrial production plunged 2.9% in April compared to the same time last year – its worst decline in the last three decades, while retail sales dropped to their worst reading since early 2020 when COVID-19 first hit. With still further lockdowns threatening to roll across the country, upcoming data could be similarly weak.

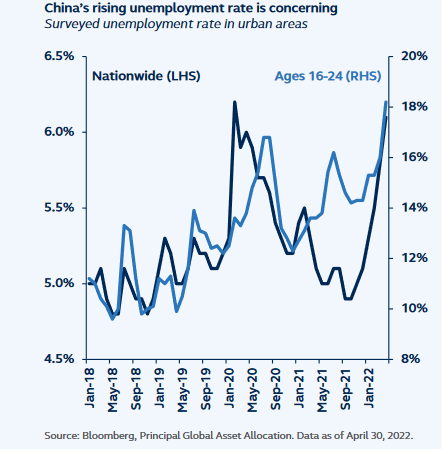

The labor market also looks dismal. Since January, the national unemployment rate has risen to 6.1%, the highest since early 2020, while a spike in the unemployment rate for ages 16-24, from 14.3% to 18.2%, is even more concerning. With over 10 million graduates entering the labor market this summer, generating enough jobs will be crucial for maintaining both economic and social stability.

China’s Rising Unemployment Rate

Unfortunately, just as the external environment was a key factor for the growth of China’s economy during that last two years, today, the weakening global economy is weighing it down. The rollover in global demand – as households and businesses struggle with higher inflation rates and deteriorating spending power – coupled with supply chain normalization outside China, has started to meaningfully dent China’s export performance.

The ongoing policy dilemma

China’s policymakers have made multiple attempts to counter the economic headwinds from their zero-COVID policy by introducing tax cuts, expedited infrastructure investment, targeted relending programs, and multiple rates and reserve requirement ratio (RRR) cuts. However, these actions – particularly the monetary actions – have fallen short of the mark, hamstrung by global financial conditions.

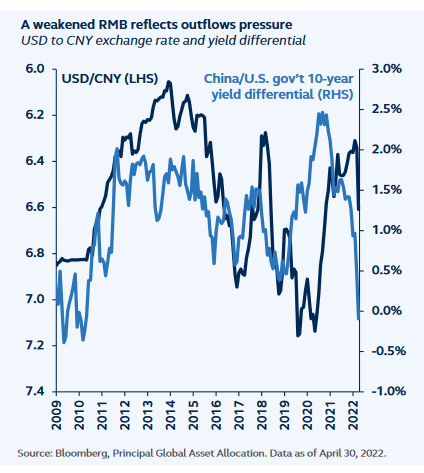

High inflation and aggressive United States Federal Reserve tightening have introduced a major constraint on China’s policy options. Global bond yields have been driven up as the Fed moves forward with its rate hiking path, eradicating the yield advantage of China’s government bonds over U.S. Treasurys, fueling capital outflows and renminbi depreciation.2 While additional cuts in China’s reverse repo rates, the Medium-term Lending Facility(MLF) and LPRs would inject liquidity and reduce borrowing costs to stimulate the economy, they also reduce the attractiveness of the yuan and encourage further outflows. As a result, the scope of the PBoC’s easing policies is limited and, consequently, monetary easing has so far been insufficient to stem the economic bleeding.

Weakened RMB Reflects Outflows Pressure

Monetary policy 2.0

The tide may be turning. During a nationwide video conference on May 25, Premier Li Keqiang underscored the importance of stabilizing the economy.He noted that current economic challenges “are in some ways and to a certain extent even bigger than the pandemic shock of 2020.” In recognizing that their unwavering commitment to zero-COVID policy means that a more proactive policy response is warranted, this may potentially open the door for more aggressive stimulus measures to be deployed.

It won’t be straightforward, and the policy tools are limited. Expect that any new measures will need to be increasingly targeted, focusing on generating demand and lowering costs, without further diminishing China’s yield advantage and encouraging additional capital outflows.

Unlike many of its global counterparts, the PBoC can pull multiple levers on interest rates. If required, policymakers can be more selective, venturing away from the traditional policy action of indiscriminate cuts to all lending rates and instead focusing their attention on individual rates with specific durations, thereby directly impacting particular parts of the economy.

For example: Repo rates and MLF usually impact interbank liquidity, 1-year LPR is typically the benchmark for corporate lending, and five-year LPR is the benchmark for mortgage rates and long-term infrastructure loans. The PBoC can adjust each rate individually, while additionally using “window guidance” (a method for directly asking banks to adjust their lending practices in line with policy goals) to influence lending activity.

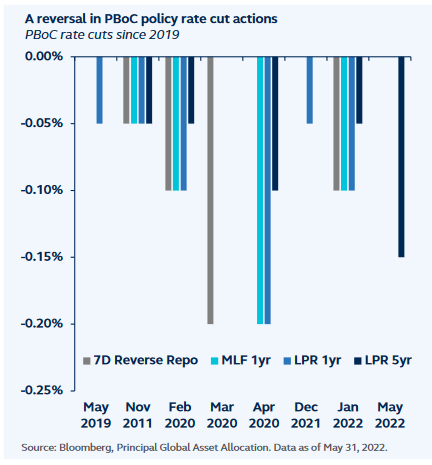

Since late April, the PBoC has started to take a more targeted approach to reduce borrowing costs. They have been guiding banks to cut deposit rates, lowering the mortgage rate floor and, most recently, rather than cutting multiple lending rates simultaneously, they have cut the 5-year LPR. Historically, the PBoC has focused more of their policy actions on the 1-year rather than the 5-year LPR, reflecting their reluctance to ease mortgage rates. This most recent policy move is a reversal of that thinking and clearly designed to stabilize the devastated property market.

Reversal In PBoC Policy Rate Cut Actions

In addition to monetary policy measures, the new realization that further intervention is needed will likely lead the government to seek additional avenues to stabilize growth and boost demand. These could include:

- Government bond issuance to support infrastructure investment/COVID-related spending. Projects ranging from traditional transportation, urban renewal, logistics, and water facilities to new infrastructure such as data centers and 5G networks are speeding up after President Xi, during the Central Financial and Economic Affairs Commission meeting in late April, called for “all out efforts” to boost infrastructure construction.

- A consumer subsidy program to increase durable goods consumption. Some cities across China have already started to provide supplementary subsidies to new energy vehicle (NEV) buyers.

- A gradual relaxation of home purchase restrictions to boost property demand. Initial expectations are for the removal of restrictions to extend to more tier two cities (and potentially even tier one cities if real estate dynamics deteriorate significantly).3

- Top leaders in China have also recently vowed to improve the regulatory environment for large platform companies, albeit plans remain obscure. A reversal in regulations could help alleviate some economic pains, especially for the job market, and would be welcomed by market participants.

A full circle back to COVID

While the government may very well endorse more targeted stimulus now, the only way economic momentum is likely to accelerate is through additional support.

Indeed, the window for rolling out additional stimulative policy is closing fast. It typically takes around six months before policy stimulus starts to impact a real economy, although consumer-targeted support could have a quicker read-through than either infrastructure or housing-related stimulus. The next few weeks will be critical – to get even close to China’s 5.5% GDP target for 2022, policymakers will need to act with urgency.

Ultimately though, even proactive rate cuts, subsidies, and improved credit availability may not stimulate loan demand until the COVID situation stabilizes. If other countries’ Omicron experience is any indication, China’s COVID infection rates should begin subsiding rapidly, enabling the government to ease lockdown restrictions. However, China’s likely continued adherence to the zero-COVID policy, even within a new regime of frequent testing, implies that worries about economic disruption may persist.

2022 could mark the turning point for China as policy responses become more effective. However, a sustained rebound in China markets will require a clear breakthrough in growth. Until then, investors will likely remain cautious, and the optimism spurred by the policy shift could prove short-lived.

********

1 Officially, the zero-COVID policy is called the “dynamic clearing policy” by China’s government. The policy doesn’t seek to eliminate COVID completely, but instead, to swiftly and accurately stamp out each outbreak before it gains momentum.

2 Read more about China’s policy challenges in Quick takes on capital markets: “China markets – a policy predicament.”

3 Tier one cities typically have a have a developed and established real estate market, while tier two cities are typically in the process of developing their real estate markets.

____________

Risk considerations

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. International and global investing involves greater risks such as currency fluctuations, political/social instability and differing accounting standards. Fixed‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise. Equity investment options involve greater risk, including heightened volatility, than fixed-income investment options.

Important Information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell,or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would becontrary to local law or regulation.

© 2022 Principal Financial Services, Inc. Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world. Principal Global Investors leads global asset management at Principal®.Principal Global Asset Allocation is an investment management team within Principal Global Investors.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment