sankai

The semiconductor sector continues to be the worst performing cohort in equities this year. The combination of softening PC demand in the post-pandemic era and weakening consumer spending amid rising recession risks have already led to a flurry of performance warnings from chipmakers in recent weeks. And a recent tally of global PC shipments in the third quarter, which showed a rapid decline in demand from -6.8% y/y in 1Q22 and -15% y/y in 2Q22 to now -19.5% y/y in 3Q22, was enough to send the Philadelphia Semiconductor Index on its way “to the lowest since October 2020” during Tuesday’s session (October 11), underscoring the dour outlook ahead.

In addition to unravelling demand within the semiconductor sector that rapidly turned a multi-year boom into a rapid bust this year, recent regulatory changes driven by intensifying geopolitical tensions have only compounded pains. AMD (NASDAQ:AMD) and Nvidia (NASDAQ:NVDA) became the two most high-profile American fabless chipmakers being entangled in the U.S. government’s latest decision to ban the export of certain chip technologies to China, with both companies having already suffered a marked slowdown to their respective fundamental performances in recent quarters, snapping earlier runs of upbeat reports.

Despite cyclical and geopolitical headwinds in the near term, both chipmakers remain the backbone of critical next-generation technologies, and industry leaders within their respective expertise – namely, PC CPUs and server processors for AMD, and GPUs and AI for Nvidia. And accordingly, both are expected to emerge better than most that have been impacted by the near-term demand slowdown and recent regulatory changes.

But with the semiconductor sector’s valuations still higher than historical lows last observed in 2018, and a current macro backdrop that remains weak with mounting uncertainties spanning recession risks, entrenched inflation, and monetary policy tightening that have yet to resolve, we expect further volatility in both AMD and Nvidia shares. Market response to their respective earnings results and peers’ commentary on the industry’s forward outlook given the added complexity of recent export restrictions to China could weigh on the stocks’ performance further over the coming weeks and months, potentially creating compelling entry opportunities.

The following analysis will provide a detailed discussion over the context of the U.S. government’s ban of chip technology exports to China, and its potential implications on both AMD and Nvidia’s near-term fundamental and valuation prospects. While we remain optimistic on both chipmakers’ long-term upsides, we believe AMD makes a better buy for now on the basis that its exposure to the recently imposed export restrictions, as well as its valuation premium to peers, are relatively lower compared to Nvidia’s.

The U.S. Drops the Axe on China in the Semiconductor Arms Race

Following the U.S. government’s notice to chipmakers of interest – including Nvidia and AMD – last month over its intentions to curb exports of advanced semiconductor technologies to China, Washington has laid out details over said restrictions last Friday. Aimed at curbing China’s growing influence over the supply chains of key semiconductor end-markets, and limiting the rival economy’s military advancements, the latest export restrictions are primarily levied on innovative chips for AI and high-performance computing (“HPC”), as well as related manufacturing equipment:

- Restricted chip technologies: Chips used for AI and HPC – two of the fastest growing applications – are restricted from being exported to China. This is consistent with licensing requirements levied on Nvidia last month for exports of next-generation AI-enabling hardware to China – including its best-selling Ampere architecture-based A100 server GPUs and the newest Hopper architecture-based H100 server GPUs shipping later this year. In addition to Nvidia, the latest export restrictions on AI and HPC chips would deal a huge blow to the broader sector, including AMD which has only recently made a name for itself in supercomputing. Although ongoing digital transportation is expected to spur global demand for AI and HPC hardware – including processors – into a $1.7 trillion market by 2030 and $40 billion market by 2025, respectively, the latest restrictions will inevitably dwarf Nvidia and AMD’s exposure to the related TAMs, considering China makes one of the largest and fastest-growing end-markets for said technologies.

More than half of corporations are expecting cloud adoption to account for a significant portion of investments in the next two years, driving the global cloud-computing market towards a projected value of more than $800 billion by 2025. Meanwhile, the market for supporting AI hardware, such as data center processors, is expected to expand at a CAGR of 43% towards $1.7 trillion by the end of the decade.

Source: “AMD vs. Marvell Technology Stock: Which is the Better Buy?”

This comes at an opportune time as the sector continues to expand at a rapid pace – HPC is expected to grow into a $40 billion market over the next five years, driven by the need for solutions to solve increasingly complex problems ranging from climate forecasting to energy security.

Source: “Can AMD Stock Reach $200? What Investors Should Consider”

- Restricted chip manufacturing equipment: In addition to advanced chips for AI and HPC applications, related manufacturing equipment will also be banned from being exported to China. The restrictions also carry over to the manufacturing equipment and tools for “logic chips using so-called nonplanar transistors made with 16nm technology or anything more advanced, 18nm DRAM chips, and NAND flash memory chips with 128 layers or more”, which take aim at China’s growing dominance in the supply of memory chips for high-demand consumer electronics like laptops and smartphones. This restriction would primarily impact foundries and manufacturers of chipmaking equipment based in U.S. allied jurisdictions with manufacturing facilities in China – including Samsung Electronics (OTCPK:SSNLF / OTCPK:SSNNF), SK Hynix, and ASML (ASML).

- Restricted partners: The new rules implemented by the U.S. government would also preclude semiconductor companies from working with sanctioned Chinese companies on the “Entity List” and the “Unverified List”. The Entity List includes “a list of parties for which the U.S. Government maintains restrictions on certain exports, reexports, or transfers of items” unless exemptions have been approved – the list includes high-profile Chinese tech firm Huawei, which has long been “at the heart of U.S.-China tensions”. Meanwhile, the Unverified List is similar to the Entity List to the extent that identified parties in the Unverified List are also subject to trade restrictions, but the grounds of their restricted status have not yet been verified to a “satisfactory level” due to reasons beyond the U.S. government’s control. The newly implemented chip technology export ban has accordingly expanded the Unverified List to include some of China’s “chipmaking champions”, which can be migrated to the Entity List if “[identified] firms do not clarify their status within two months”.

Earlier last month, Nvidia had anticipated a $400 million impact to its revenues in the current fiscal quarter alone due to the newly implemented export restrictions, while AMD said it “does not expect a significant impact”. And with the U.S. government’s recent release of further details over the restrictions on Friday, Nvidia affirmed that it is not expecting a “material impact on its business” as a result. This is further corroborated by Nvidia CEO Jensen Huang’s latest remarks that there is still significant opportunity for the company in China, with “the vast majority of [its] customers not affected by the specification”.

Implications on AMD

China remains a core end market for AMD, with its sales to the region averaging close to 25% in recent years. Although AMD said last month that the impact ensuing from the U.S. latest restrictions on exports of its processors used in AI and HPC to China is immaterial, intensifying geopolitical tensions risk derailing its plans to compensate for the near-term macro-driven slowdown with its better-performing data center segment sales, nonetheless.

While China’s data center market share is a far cry from the size that the U.S. commands, it is a prominent player still, given the region’s growing cloud-computing capacity to support the development of next-generation technologies such as connected autonomous mobility. The newly implemented ban on exports of advanced chip technologies used for AI and HPC applications, though primarily intended to curb China’s military development, risks thwarting advancements in other innovative sectors. This is also corroborated by market’s forward expectations on China’s data center market growth prospects, which is currently forecast to expand at a five year compounded annual growth rate (“CAGR”) of close to 24% through 2025.

In the case of AMD, which unlike Nvidia has yet to receive instructions from the U.S. government on any specified product restrictions, it becomes difficult to gauge the quantified impact of the new export ban, especially after it shutdown speculations by asserting that the new rules would not levy a material impact on its operations. Yet, given its growing prowess in HPC in recent years, AMD has inevitably become a major support to critical developments like autonomous driving, though it does not directly make computing platforms aimed at said end-market. AMD’s exposure might not be material, but it is certainly substantial considering its industry-leading global market share in server processor sales. For instance, AMD’s latest partnership forged with Chinese EV maker NIO (NIO) on the supply of its EPYC server processors to support the latter in vehicle R&D efforts highlights the increasingly critical, though indirect, role it plays in HPC worldwide.

In addition to thwarted data center opportunities – a stark downside risk in the near term, considering the segment is currently one of its few bright spots ahead of continued weakness in consumer end-markets – the newly implemented ban on chip exports to China also risks introducing further turmoil to AMD’s already-battered client segment, which primarily houses PC processor sales. AMD is currently a core supplier of chips applied in both of Chinese PC giant Lenovo’s (OTCPK:LNVGY / OTCPK:LNVGF) data center operations and desktop/notebook PCs. The company’s fourth generation Genoa EPYC server processors will soon be deployed across Lenovo’s “Chinese market-only servers”, while its high-performing “Ryzen Threadripper PRO 5000 WX-Series” CPUs are currently used in powering Lenovo’s desktop workstations, including the “ThinkStation P620 Tower”.

Although Lenovo is not currently on the Unverified or Entity List, and remains a prominent PC seller in the U.S., its exposure to risks of interference by intensifying U.S.-China tensions is gradually increasing, which will inadvertently spill-over to AMD too. In early May, China issued orders across its public sector and state-owned corporations to “replace foreign-branded computers with domestic alternatives within two years” as part of efforts to bar the U.S. from any potential access to sensitive information that could put its national security at risk. This accordingly favours “local champion” Lenovo, which amps up the world-renowned PC maker’s risk of being caught in the heart of intensifying U.S.-China tensions, a path that could lead it to becoming the next Huawei in the worst-case scenario and impact AMD’s revenues from China.

Fundamental Sensitivity Analysis – AMD

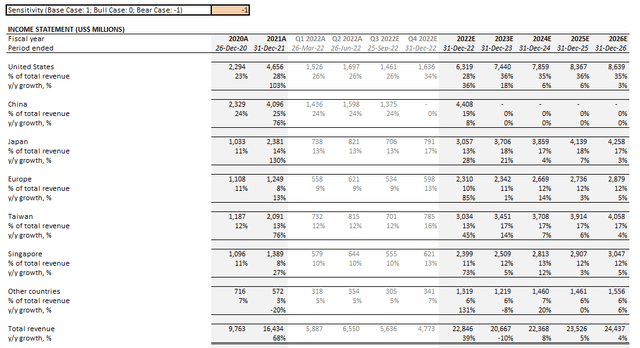

To estimate the potential impact of the U.S.’ newly imposed restrictions on doing business with the Chinese semiconductor industry on AMD’s near-term valuation prospects, we have performed a sensitivity analysis on the company’s fundamental outlook under three scenarios:

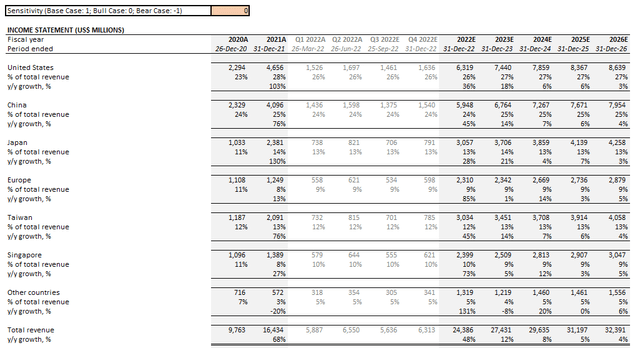

- Bull case: This scenario maintains the same key assumptions discussed in our most recent analysis on the AMD stock, which takes into consideration AMD’s performance in the first half of the year, adjusted for recently released preliminary 3Q22 results, as well as broader near- and longer-term semiconductor demand trends. Bull case assumptions applied expect the company’s China operations to continue at status quo without material adverse impact from the newly imposed chip export ban to the region.

AMD Bull Case Financial Forecast (Author) AMD Bull Case Financial Forecast (Author)

- Base case: Our base case forecast has adjusted AMD’s China exposure from the bull case forecast by 25%, taking estimated lost sales of $400 million in the current fiscal quarter projected by Nvidia and $400 million in 4Q22 projected by Applied Materials (AMAT) as proxies. This projected discount applied over AMD’s base case forecast is considered reasonable given the company has said it does not expect a material impact to its overall business under the newly imposed export restrictions. As a result, consolidated revenues under the base case are expected to expand at a five-year CAGR of 4.8% from $24.0 billion by the end of this year towards $30.4 billion by 2026. Anticipated growth from all other core regions of AMD’s operations (i.e. U.S., Japan, Europe, Taiwan, Singapore, and other countries) are held constant from the bull case forecast.

AMD Base Case Financial Forecast (Author) AMD Base Case Financial Forecast (Author)

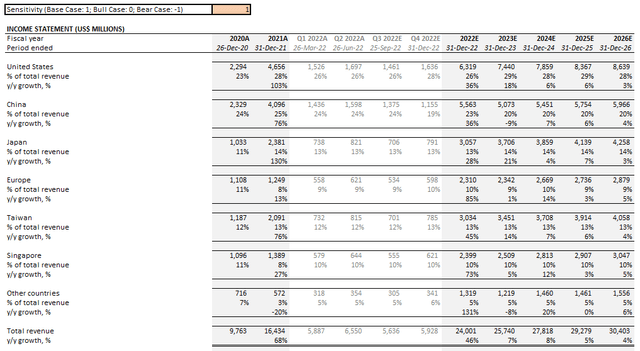

- Bear case: The bear case scenario takes into consideration the remote likelihood that AMD’s China sales will collapse to nil within the near term. The adverse assumption applied is consistent with earlier discussions of what a potential worst-case scenario would look like if AMD’s core Chinese partners / clients, such as Lenovo, become entangled in the heart of what looks to be the most “acrimonious” era of U.S.-China relations. Under the bear case scenario, AMD’s consolidated revenues are expected to expand at a muted five-year CAGR of 1.4% from $22.8 billion in the current year towards $24.4 by 2026. Anticipated growth from all other core regions of AMD’s operations, ex-China, are held constant from the bull case forecast.

AMD Bear Case Financial Forecast (Author) AMD Bear Case Financial Forecast (Author)

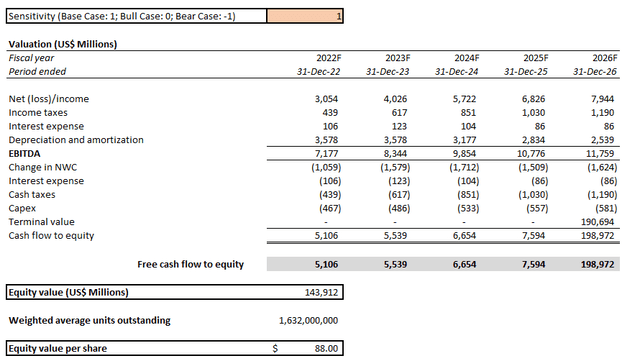

Valuation Sensitivity Analysis – AMD

Drawing on the above scenarios over AMD’s fundamental prospects sensitized for varying degrees of impact stemming from the newly imposed restrictions, paired with broad-based multiple contraction across the sector under the near-term macroeconomic outlook, our base case price target for the AMD stock is now set at $88. This represents upside potential of 53% based on the stock’s last traded price of $57.55 apiece on October 12. The base case PT assumes an exit multiple of 16.2x EV/EBITDA, which represents a perpetual growth rate of 8%, consistent with market expansion across AMD’s core operating segments and end-user markets, as well as an added premium to peers to reflect its growing market leadership in the provision of chips used in HPC.

AMD Base Case Valuation (Author)

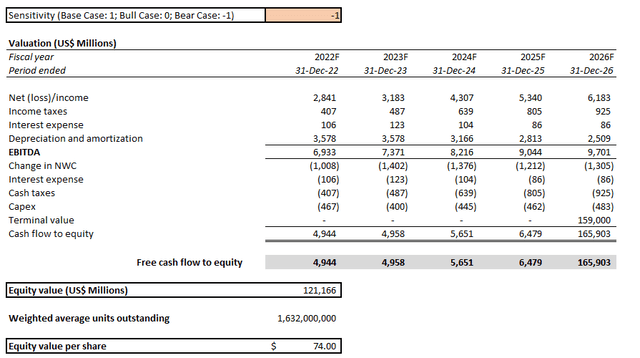

Our bull and bear case PT are $93 and $74, respectively, drawing on the fundamental forecast scenarios discussed in the earlier section, while holding key valuation assumptions (i.e. 8% perpetual growth) constant. Our bear case PT reflects that the stock remains undervalued even under the worst combination of the near-term macro-driven slowdown and more pervasive export restrictions to China. This indicates that the stock has likely suffered from a pronounced squeeze to its valuation multiple already amid this year’s rout observed across the semiconductor sector, which is not reflective of its longer-term growth prospects, let alone its premium to peers.

AMD Bull Case Valuation (Author) AMD Bear Case Valuation (Author)

AMD_-_Forecasted_Financial_Information.pdf

Implications on Nvidia

Meanwhile, the Nvidia stock has also taken a beating in recent weeks following the announcement of new export restrictions to China, which came on the heels of a weaker-than-expected fiscal 2Q23 and soft forward guidance. As mentioned in our latest coverage on the Nvidia stock, the company’s significant sales exposure in China, paired with the U.S. government’s specific restrictions levied over the export of its best-selling A100 and upcoming H100 server GPUs which would effectively preclude it from previously anticipated capitalization on opportunities stemming from the largest customer of semiconductors, draws significant uncertainties over the company’s forward growth prospects.

With data center sales being a core part of its business that has been providing some alleviation to macro-driven pressure weighing over its gaming segment, the new export restrictions could potentially derail Nvidia’s previous hopes of weathering through the near-term economic downturn with more resilient demand stemming from critical next-generation technologies such as cloud-computing and autonomous driving. As discussed in the earlier section, AMD’s indirect exposure to HPC needs in non-cloud end-markets such as connected mobility already risks severing a sizable chunk of its addressable market, which highlights the extent of greater risks to Nvidia given its more upfront and direct exposure to non-cloud end-markets in China given its global market leadership (> 90%) in the supply of AI solutions (both hardware in the form of processors and supporting software).

Although Nvidia’s CEO Huang has sought to downplay growing investors’ angst over its near-term operational risks in China by pointing to massive opportunities still for the company in the region, the stock’s recent declines imply that a simple positive comment will not be sufficient, and actual performance demonstrating resilience over coming quarters will be required to back the credibility of his statement. This, again, underscores the significant overhang on the Nvidia stock’s near-term performance, given the latest restrictions would not only impact its data center business – which was previously considered its lifeline amid the drastic slowdown in global PC demand – but also its auto segment.

Specifically, Nvidia had just started to see some improvements to its auto segment sales after a lacklustre showing in 1H22, despite the introduction of next-generation systems and platforms such as “NVIDIA DRIVE Orin” aimed at facilitating the development of next-generation autonomous mobility. The segment’s muted results earlier in the year was largely due to industry-wide supply chain constraints that have limited auto productions and their take-rates on Nvidia’s auto solutions. Although auto OEMs have recently observed easing supply chain snarls, which would drive further improvements to Nvidia’s growing auto segment sales, the latest export restrictions to China risks thwarting the emerging business’ potential:

During the fiscal second quarter earnings call, management had alluded to an “$11 automotive design win pipeline” that is expected to drive longer-term growth. Yet, this momentum is expected to experience some bumpiness ahead, as much of it is supported by partnerships with Chinese OEM partners, with the most notable being NIO (NIO), Li Auto (LI), XPeng (XPEV), JIDU, Human Horizons, as well as BYD (OTCPK:BYDDF / OTCPK:BYDDY). Even XPeng founder and CEO He Xiaopeng have recently expressed concerns about the future of autonomous vehicle technology development under the newly imposed U.S. chip export restrictions, underscoring the severity of uncertainties over how U.S.-China chip relations will play out.

Source: “Nvidia: When It Rains, It Pours”

Fundamental Sensitivity Analysis – Nvidia

Similar to the bull, base, and bear case scenarios laid out for AMD above, we have applied the same metrics to gauge the extent of potential impact on Nvidia’s near-term financial performance given the newly imposed export restrictions to China. The following scenarios are drawn from the same forecasts laid out and discussed in our latest coverage on the Nvidia stock, adjusted for management’s recent statement that they “do not expect the new controls, including restrictions on sales for highly dense systems [to China], to have a material impact on [Nvidia’s] business”, as well as market forecasts for an average 5% to 8% impact on the sector’s revenues:

- Bull case: This scenario maintains the same key assumptions discussed in one of our recent analyses on the Nvidia stock prior to the announcement of the latest export curbs imposed by the U.S. government, which takes into consideration the company’s historical streak of fundamental outperformance, adjusted for actual fiscal second quarter results and management’s guidance for the fiscal third quarter. Using the same sensitivity metrics discussed in the above analysis on AMD, the bull case assumptions applied assumes that Nvidia’s China operations will continue at status quo without material adverse impact stemming from the recent regulatory curbs.

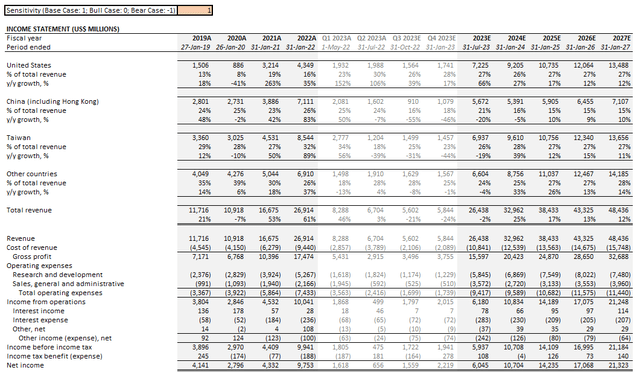

Nvidia Bull Case Financial Forecast (Author)

- Base case: The base case forecast for Nvidia considers a conservative slowdown in its China operations as a result of the recently imposed export curbs, which is consistent with management’s expectations for a $400 million impact to fiscal third quarter revenues and immaterial impact to its overall business going forward. This assumptions applied are similar to those discussed in our recent coverage on the stock, adjusted for consensus estimates on how much the latest export restrictions would cost the broader semiconductor industry. Under the base case scenario, Nvidia’s anticipated China revenues are expected to expand from $5.7 billion in fiscal 2023 towards $7.1 billion by fiscal 2027, resulting in consolidated revenue growth from $26.4 billion in the current year towards $48.4 billion by fiscal 2027. Anticipated growth from all other core regions of Nvidia’s operations (i.e. U.S., Taiwan, and other countries) are held constant from the bull case forecast.

Nvidia Base Case Financial Forecast (Author)

- Bear case: The bear case scenario takes into consideration the remote likelihood that Nvidia’s China sales will collapse to zero as a result of the latest export restrictions and escalating geopolitical tensions between the U.S. and China. Under the bear case scenario, Nvidia’s consolidated revenues are expected to expand from $24.4 billion in the current year towards $41.3 billion by fiscal 2027. Anticipated growth from all other core regions of Nvidia’s operations, ex-China, are held constant from the bull case forecast.

Nvidia Bear Case Financial Forecast (Author)

Valuation Sensitivity Analysis – Nvidia

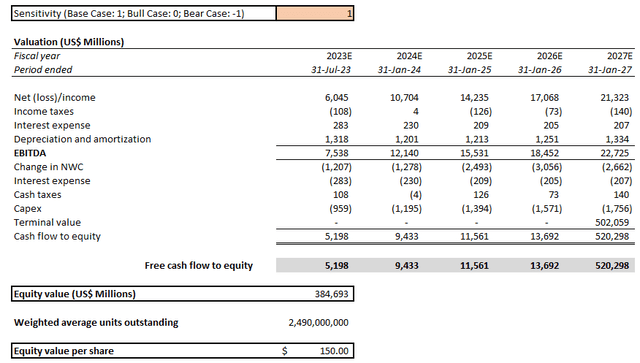

Drawing on the above scenarios over Nvidia’s fundamental prospects sensitized for varying degrees of impact stemming from the newly imposed restrictions, paired with broad-based multiple contraction across the sector under the near-term macroeconomic outlook, our base case price target for the Nvidia stock remains at $150. This represents upside potential of 30% based on the stock’s last traded price of $115.00 apiece on October 12. The base case PT assumes an exit multiple of 22.1x EV/EBITDA, which represents a perpetual growth rate of 8%, consistent with the rate applied to gauge AMD’s base case PT and in line with the forecast demand environment across Nvidia’s core operating segments and end-user markets, plus an added premium to peers to reflect its leading market share in the provision of graphics / AI processors.

Nvidia Base Case Valuation Analysis (Author)

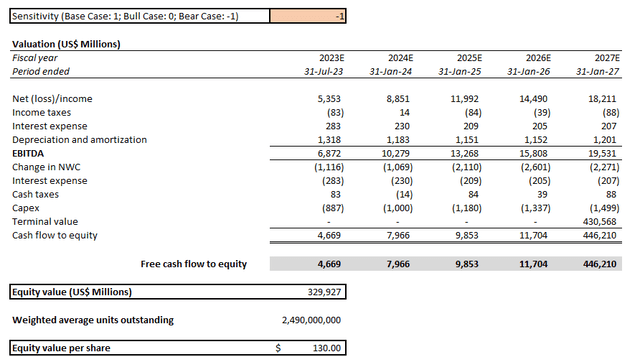

Our bull and bear case PT are $160 and $130, respectively, drawing on the fundamental forecast scenarios discussed in the earlier section, while holding key valuation assumptions (i.e. 8% perpetual growth) constant. Similar to the case of AMD, the bear case PT for the Nvidia stock implies that its market price today undercuts the company’s estimated intrinsic value even under the double-whammy of macroeconomic headwinds and regulatory challenges.

Nvidia Bull Case Valuation Analysis (Author) Nvidia Bear Case Valuation Analysis (Author)

Nvidia_-_Forecasted_Financial_Information.pdf

AMD vs. Nvidia: Which is the Better Stock Under the China Chip Export Curbs?

Based on the foregoing analysis, we believe AMD has less fundamental exposure compared to Nvidia under today’s operating environment, and based on the current extent of the newly implemented restrictions on chip technology sales / export to China. Specifically, AMD is currently less engaged in next-generation AI technologies that could potentially be used in China’s military-based developments in which the U.S. government seeks to curb. However, there is still a risk that the impact of fraying U.S.-China relations on AMD’s fundamental performance could increase over the longer term, given its increasing prominence in HPC. Meanwhile, for Nvidia, although management expects to mitigate adverse impacts from the new rules, its significant exposure to more than 90% of global market share in graphics / AI processors makes its financial performance more susceptible to a broader slowdown as a result of the decreased TAM access ex-China.

From a valuation perspective, we believe AMD continues to trade at a lower valuation multiple in proportion to its growth and profitability prospects compared to Nvidia, which will likely subject the latter to more downside risks in the near-term as market adjusts to the triple-punch from softening PC demand, the new export restrictions, and a broad-based risk-off environment in equities due to rising recession risks. While we believe both stocks remain favourable long-term investments given their critical roles in enabling next-generation high-growth innovations, AMD makes the better one from a valuation perspective under current levels.

Be the first to comment