William_Potter

I have followed the cannabis sector for a couple years, and I have been investing a small portion in my portfolio in some of the multi-state operators because I think the long-term risk/reward is favorable, especially for some of the better run companies like Trulieve (OTCQX:TCNNF) and Green Thumb Industries (OTCQX:GTBIF). I have invested a larger portion into REITs focused on the cannabis industry. This includes REITs like Innovative Industrial Properties (IIPR) and NewLake Capital (OTCQX:NLCP), which primarily own cultivation properties across the US. I also own a chunk of mortgage REIT Advanced Flower Capital Gamma (AFCG), which lends directly to operators and has an impressive portfolio yield. Today’s article will be covering Chicago Atlantic Real Estate Finance (NASDAQ:REFI), which went public at the end of 2021 and has a similar operating strategy to AFCG.

Investment Thesis

REFI is a small cap cannabis lender that holds a portfolio of loans to companies in the growing cannabis sector. The company has grown its portfolio of loans rapidly since the IPO and is able to get huge yields on their loans due to the lack of capital available to the cannabis sector. The biggest red flag to keep an eye on is the external management, which is the main reason I will keeping my position in REFI small. Swinging back to the bullish side of things, the company has hiked the dividend each quarter since going public. If they can maintain the current dividend, the yield is sitting at 12.2%. If they can continue their pattern of quarterly hikes, the yield will be even higher. I’m bullish on REFI due to the high yield and structural lack of capital available to the cannabis industry and I recently bought a starter position in this young REIT.

The Cannabis Lending Business

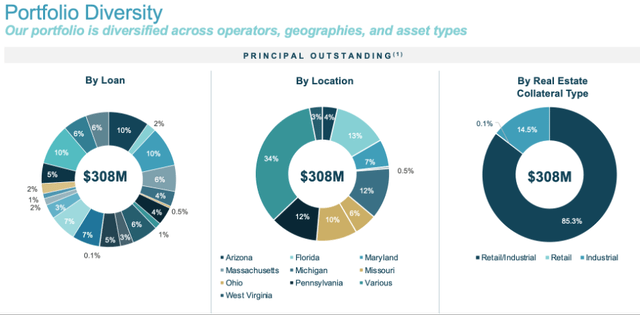

The mismatch in supply and demand when it comes to capital available to the cannabis industry is what has drawn me to the cannabis focused REITs. The operators that own the real estate like IIPR and NLCP are lower risk in my opinion, but the lenders like AFCG and REFI have me interested in their large dividends that have grown significantly since their IPOs. I haven’t looked into REFI that closely until recently, but I like their portfolio of loans which is well diversified by operator and geography.

REFI Loan Portfolio (Chicago Atlantic Real Estate Finance)

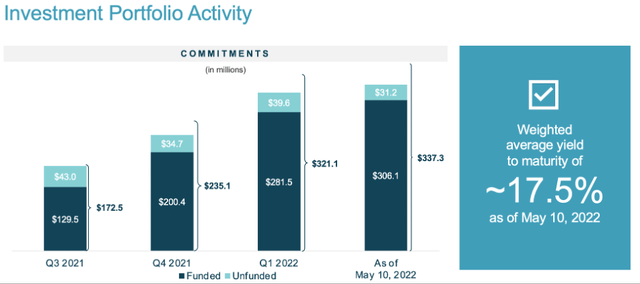

REFI’s portfolio has grown significantly since the IPO gave them with a lot of dry powder to work with. Like other REITs focused on the cannabis sector, they can get attractive terms on their loans due to the lack of capital available to the industry. There aren’t many places offering double digit yields, and like AFCG, the yield on the portfolio of loans is huge.

REFI Loan Portfolio Growth (Chicago Atlantic Real Estate Finance)

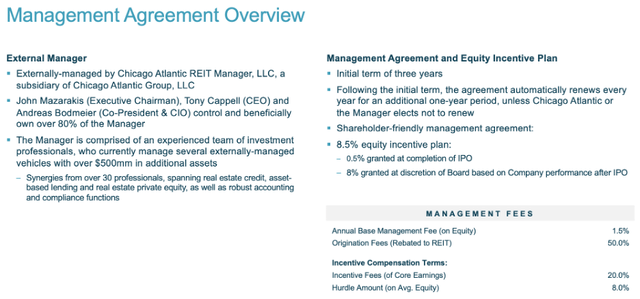

The most notable drawback for the cannabis mortgage REITs is their external managements. Plenty of research has been done and externally managed REITs consistently underperform internally managed ones. I think we will eventually see AFCG become internally managed based on some of the language from one of their filings.

REFI has a three-year term with their external manager, which is set to expire on 4/30/2024. After that, the agreement will be renewed for one-year periods unless the company or the manager elect not to renew. I’m hopeful that the company will eventually decide to internalize management, but it looks like REFI will be externally managed for the foreseeable future.

External Management Agreement (Chicago Atlantic Real Estate Finance)

While I think the returns could still be attractive with the cannabis lender REITs, the external management for AFCG and REFI (which I bought a small position in last week) is why I have larger positions in IIPR and NLCP. After market declines, you aren’t giving up that much in yield, and you get internal management along with the actual ownership of the real estate. However, the dividend growth has got my attention and was the main reason I recently bought a couple shares of REFI.

The Dividend

The dividend growth has been impressive for REFI. Since going public, they have raised their dividend every quarter. The first dividend was $0.26, and it has been hiked in both quarters since then. The most recent hike was from $0.40 to $0.47. Since the company hasn’t even public for a year, I’m not going to make any projections or guesses on dividend growth, but I’m optimistic that the pattern of raises will continue. The current yield is 12.2% if they can maintain the current $0.47 dividend. If they continue to raise it in the coming quarters, the yield on cost could be even higher.

Conclusion

I recently bought a starter position in REFI. I’m bullish on the company and I think the long-term returns could be significant, but I also know that I follow companies closer once I have some skin in the game, even if it is a small position. I like the company’s portfolio approach, the portfolio growth, and I especially like the yield on their portfolio loans. The biggest and most obvious drawback is the external management. I will be watching to see what happens with AFCG and REFI, but based on REFI’s external management agreement, it will be at least two and a half years before we see even the possibility that management is internalized.

I want to be clear that REFI is definitely closer to the speculative side of the risk curve when it comes to cannabis REITs. The biggest reason I’m bullish on the whole sector is the huge imbalance between supply and demand when it comes to the capital available to businesses operating in the cannabis sector. We might see changing regulations in the coming years, but the cannabis REITs will be capitalizing until banking regulations change and lead to more competition. The second reason I’m bullish on REFI is the dividend growth. While it’s not a long track record, you get a 12.2% yield if the dividend is maintained and even more if it is raised. So, while I’m bullish on Chicago Atlantic Real Estate Finance, the external management is why I’m keeping my position small for now.

Be the first to comment