Sally Anscombe/DigitalVision via Getty Images

For many people, pets become a part of the family. And as a member of that family, the pet owners in question only want what’s best for all parties involved. Unfortunately in this world, providing the best comes at a cost because it requires the purchase of goods and services such as food, health products, and so much more. Although there are many general retailers both online and brick and mortar on the market, one company has managed to seize for itself an interesting niche in the online space dedicated to providing pet products to pet owners. This business is Chewy (NYSE:CHWY). Over the past few years, the company has exhibited tremendous revenue growth. Although profitability remains an issue, the business is now generating strong positive cash flows. It is unclear what the future holds for the company. But given how rapidly it continues to expand even today, it very well could make for an attractive opportunity even though shares look, at current pricing, to be rather expensive.

A rapidly growing niche firm

Dating its roots back to 2011, Chewy has grown into a behemoth in the pet supply space. Today, the company has over 20,400,000 active customers buying from its platform a variety of goods provided by around 2,500 different brands that, collectively, offer over 70,000 products to their customers. Though some may think that the pet market is a small space with little potential, the fact of the matter is that, between 2014 and 2020, the overall pet market expanded from $73 billion to $98 billion. This translates to an annualized growth rate of 5%. Current forecasts call for this market to continue growing at a rate of about 6% per year through 2024, implying a market size at the end of this timeframe of $123.7 billion.

This sizable and growing niche market has proven advantageous for a company like Chewy. On top of this, the company also benefits from the fact that, from 2014 through 2020, the percentage of pet products sold in the US that came from online purchases expanded from 4% to 27%. That represents a 40% annualized growth rate over that timeframe. Some of this expansion was likely attributable to temporary impacts resulting from the COVID-19 pandemic. But Packaged Facts believes that the overall trend will continue long term.

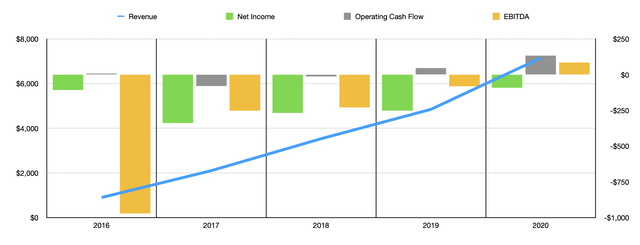

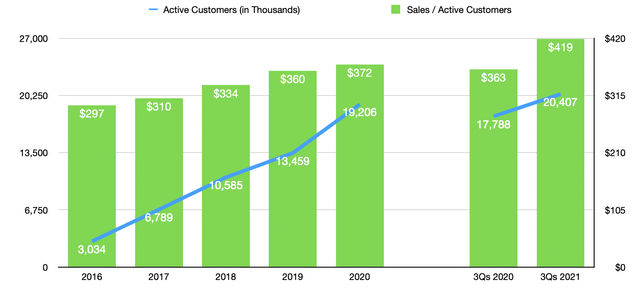

Thanks to this strong paradigm shift in the market, the management team at Chewy has succeeded in growing the company at a rapid pace. Back in 2016, for instance, the company generated revenue of just $900.6 million. This number increased each year since, eventually climbing to $7.15 billion in 2020. This works out to an annualized growth rate of 67.8%. According to management, there really were two big factors driving sales here. The biggest was an increase in the number of active customers the company has on its platform. In 2016, this number was just 3.03 million. At the end of 2020, it had grown to 19.21 million. The other growth contributor, meanwhile, was a rise in sales per active customer. In short, the people on the company’s platform were spending more, on average, than they had in the past. In 2016, this figure came out to $297. By 2020, it had grown to $372.

As with most high-growth companies, Chewy suffered some on its bottom line. However, this suffering has become less severe over the timeframe covered. After seeing a net loss of $107.2 million in 2016 jump to $338.1 million in 2017, the overall trend for the business started to improve. Each year after, the companies in that loss narrowed. And in 2020, the business generated a loss of just $92.5 million. Other profitability metrics for the company also showed improvements. For instance, we need only look at operating cash flow. After turning from a positive $7.3 million in 2016 to a negative $79.7 million in 2017, it began to improve year after year. In 2020, the figure came out to $132.8 million. A similar trend could be seen with EBITDA, with the metric improving from a negative $251.2 million to a positive $85.2 million.

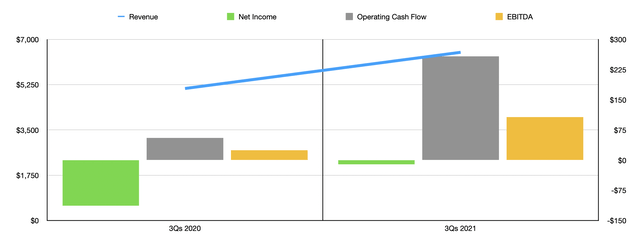

Subsequent to the end of the 2020 fiscal year, the company has reported financial results covering the first nine months, which works out to the first three quarters, of the firm’s 2021 fiscal year. The data shows that robust performance has continued. Sales, for instance, have come in at $6.50 billion. That is 27.4% higher than the $5.10 billion reported one year earlier. This, in turn, was driven by an increase in the number of active customers from 17.79 million to 20.41 million. It was also attributable to a rise in sales per active customer from $363 to $419. Just as has been the case with revenue, profitability and cash flows have also risen. The company isn’t that loss went from $113.5 million to $10.2 million. Its operating cash flow surged from $55.3 million to $257.7 million. And the company also saw its EBITDA jump from $24.4 million to $106.7 million.

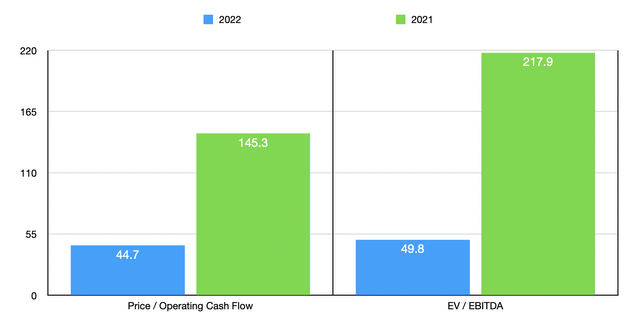

Management has not provided any real guidance for the 2021 fiscal year as a whole. However, if we annualize financial results experienced so far for the year, we shouldn’t end up with operating cash flow of $618.9 million and EBITDA of $372.6 million. For the operating cash flow number, if we make an adjustment covering working capital changes, then this would be a more reasonable $431.6 million. Taking these numbers, we can essentially value the business. Using the company’s 2020 results, the firm is trading at a price to operating cash flow multiple of 145.3. This drops considerably to 44.7 if our 2021 estimates are accurate. Meanwhile, the EV to EBITDA multiple for the company would decline from 217.9 to 49.8 over the same timeframe.

These 2021 estimates still place the company as being tremendously pricey. However, that doesn’t necessarily mean that the business is overvalued. The rapid growth rate currently being experienced by the company could make the valuation not all that bad in due time. For instance, if we apply the idea of the PEG ratio to operating cash flow and EBITDA, the company could well be undervalued if cash flow growth can continue to be 45% or higher and if EBITDA growth can be 50% or higher. Long term, this is certainly out of the question. But as we saw just over the past couple of years, strong performance on both the top and bottom line could persist for a while.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Chewy | 44.7 | 49.8 |

| Amazon (AMZN) | 36.5 | 21.8 |

| Alibaba Group Holding Limited (BABA) | 11.8 | 17.5 |

| BARK Inc. (BARK) | N/A | N/A |

| eBay (EBAY) | 14.4 | 30.2 |

| PetMed Express (PETS) | 19.6 | 15.7 |

Gauging expectations

Though it is impossible to know what the future holds, we will get at least some insight as to how the company performed for the rest of the 2021 fiscal year rather soon. This is because, on March 29th of this year, after the market closes, the management team at Chewy is due to report financial results covering the final quarter of the company’s 2021 fiscal year. At this time, analysts do have generally positive expectations regarding the company’s performance. For instance, analysts are anticipating about $2.42 billion in sales. If this comes to fruition, it would imply a 275.8% increase over the $644 million reported one year earlier. On the bottom line, analysts also anticipate some improvement. The current forecast is for a loss per share of $0.09. This compares to the $0.15 last generated in the final quarter of its 2020 fiscal year.

As for setting the stage for longer term growth, we do still need to rely on attractive active customer growth and on sales per active customer. Because of this, investors should definitely pay attention to what these two metrics look like when management reports their financial results. However, other factors are starting to become important for the company as well. For instance, in September of last year, the company ventured into yet another new business line when it opened up a marketplace dedicated solely to veterinarians for the purpose of allowing them to handle their pharmacy operations and increase their own net revenue. And in December, management announced a partnership with Trupanion to offer medical and Wellness insurance plans for pets aimed at both treating accidents, illnesses, and chronic conditions, as well as providing preventive care. It is unclear how these types of operations, and more that the company has entered into over the years, will add to its top and bottom lines in the long run.

Takeaway

Based on the data provided, I can say that I am quite bullish on Chewy. Yes, the company does look rather expensive at first glance. And it could become far more expensive if management fails to achieve the cash flow results I estimated in this article. But growth has been incredibly robust and a continuance of that growth it could result in shares experiencing further upside down the road. All things considered, I would consider the company to be an attractive opportunity for investors who want a growth play at what is probably a reasonable price.

Be the first to comment