Joe Raedle/Getty Images News

Today’s article assesses whether Chevron (NYSE:CVX) stock could sustain momentum after an illustrious showing during parts of this year. Our thesis aims to identify Chevron’s cyclical patterns and measure how they intertwine with today’s market climate. Furthermore, a qualitative overlay is provided to remind readers of the company’s current headwinds and tailwinds.

Chevron’s year-over-year performance has been remarkable, but can it sustain its upward trajectory? Let’s find out.

Chevron & Momentum

The Momentum Anomaly Explained

In 1997 Mark Carhart discovered that investors could outperform the broader market by rotating in and out of 12-month measured momentum stocks. Carhart’s finding is branded by many as the momentum anomaly, partially because it exhibits abnormal returns.

Momentum investing is most often executed via the following two methods. First is a cross-sectional approach, which simply entails buying the previous twelve months’ market outperformers and selling the previous twelve months’ losers.

The second method is a time series approach, which measures a stock’s momentum relative to its own past returns. Thus, you’d consider a stock to be a momentum play if it rose in value during the previous twelve months of trading.

Chevron’s Momentum Characteristics

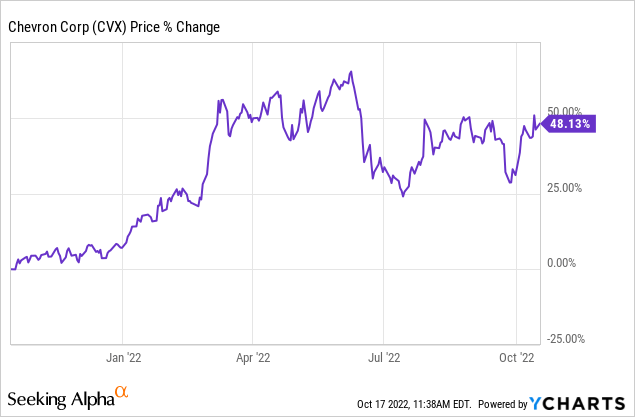

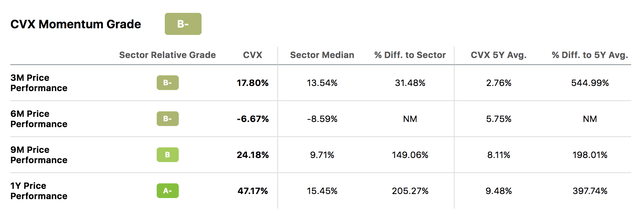

At first glance, Chevron is considered a momentum stock. A time series analysis reveals that its stock price skyrocketed during the past twelve months, making it highly likely that it could benefit from the momentum anomaly.

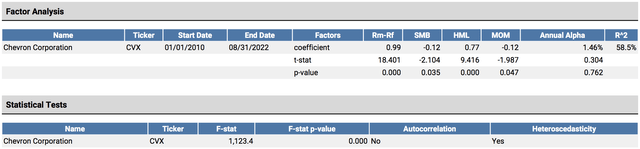

Upon analyzing Chevron stock in more depth, we realized that its historical momentum attributes are weak. For example, on a cross-sectional basis, the stock tends to underperform the high-momentum stocks whenever they’re on a bullish trend.

- Note: The denotation MOM measures Chevron’s historical returns to high-momentum stocks.

Qualitative Overlay

Key Drivers Assessed

Energy Shortages & Political Divide

Much of Chevron’s current tailwinds derive from the global energy shortage, which has called for fossil fuel production to be ramped-up. As a result of rising demand, Chevron achieved record-breaking second-quarter profits. In addition, supply and demand disequilibrium has caused oil and gas prices to surge, contributing to Chevron’s $11.62 net earnings.

The fossil fuel debate has caused much division in the political sphere. For instance, some politicians want limited fossil fuels and windfall taxes imposed (for example, the Biden administration in the U.S.). While others argue that fossil fuels are necessary to produce/reproduce goods and services at affordable prices (for example, Liz Truss’ UK Tory party). Thus, it is hard to tell whether oil and gas will be politically acceptable in the longer term.

In addition, various renewable energy solutions are being eyed to fuel global energy shortages. Nuclear energy is the word on many strategists’ lips. Will alternative energy solutions restore equilibrium in the energy market, or will fossil fuels be ramped up even further? As things stand, we believe it is a coin toss.

Critical Operating Features

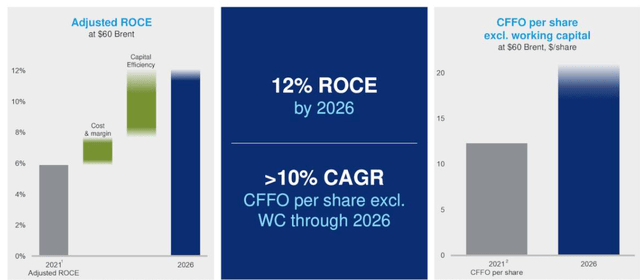

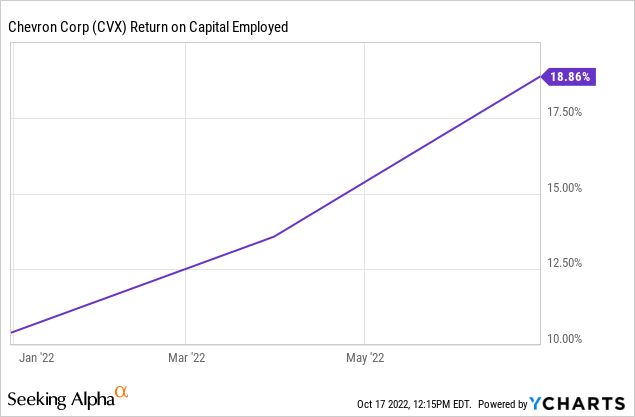

The first thing that catches the eye when looking at Chevron’s key operating metrics is its capital efficiency. The company’s ROCE (return on capital employed) of 18.86% indicates that it monetizes its working capital to full effect. Chevron expects this ratio to level off to the 12% handle by 2026. However, we believe that a 12% rate would still be very respectable.

Chevron

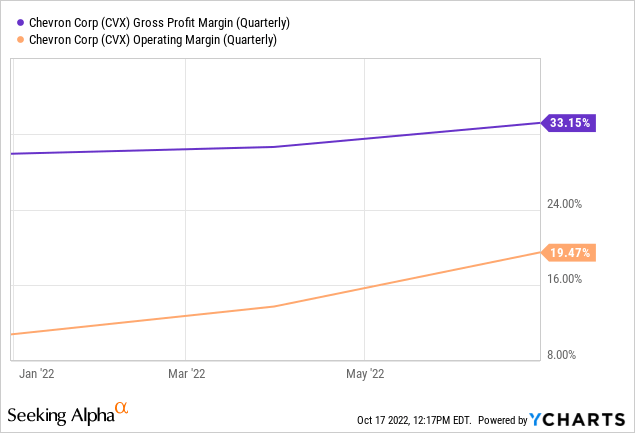

Furthermore, Chevron’s gross and operating profit margins are impressive. It might be borderline, but it seems as though the company is achieving economies of scale, providing it with pricing power prospects.

In our opinion, Chevron’s vertically integrated business model is undoubtedly a big plus. Vertically integrated businesses own their upstream. Thus, they’re able to leverage various price advantages.

Chevron anticipates an annual production growth rate of 3% until 2026, with efforts being made to expand its Permian Basin output. The firm does have a few receding business units, namely expiring operations in Indonesia and Thailand. However, other positives, such as a potential lower turnaround, could yield benefits.

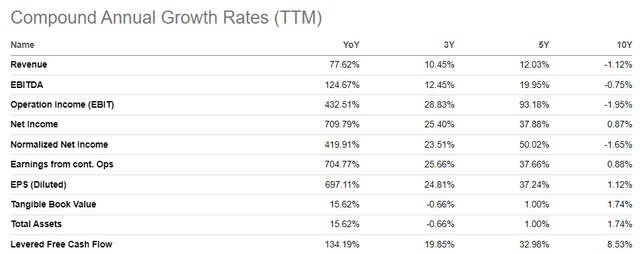

Chevron’s growth remains robust. However, investors should take note that this is a cyclical business, as conveyed by the disparity between the company’s short and long-term growth rates. In a way, this explains why Chevron’s cross-sectional momentum is poor; as such, we encourage investors to be cautious when deciding to invest in Chevron stock and to ensure it is not trading at its cyclical peak.

Relative Valuation & Dividends

Chevron’s relative valuation metrics are a mixed bag. We think the company’s price-to-earnings ratio is in good shape as its PEG ratio indicates that Chevron’s earnings-per-share is growing at a rate of knots.

On the flip side, Chevron’s price-to-book ratio is a concern. The price-to-book ratio is a helpful indicator when analyzing natural resource companies, as most of their assets are quoted in traded markets. Chevron’s high price-to-book ratio concerns us, leading us to believe that the market might have overbought the stock.

| Price-to-Earnings | 10.67x |

| PEG | 0.02x |

| Price-to-Book | 2.04x |

Source: Seeking Alpha

Chevron presents lucrative income-based investment prospects. A dividend yield of 3.50% is well covered by a strong dividend coverage ratio and a resilient cash flow statement.

| Dividend Yield | 3.50% |

| Dividend Coverage | 3.30x |

| Cash Per Share | 6.15x |

Source: Seeking Alpha

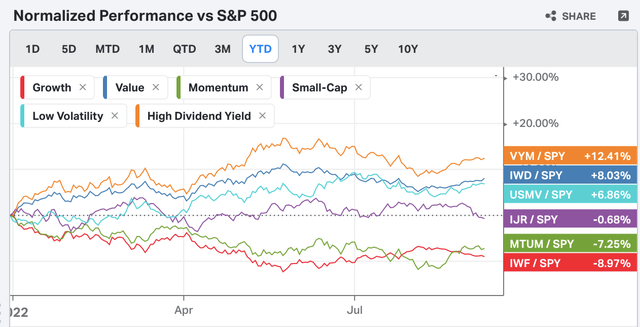

Chevron’s dividend yield also provides its stock with price support. Based on year-over-year factor performance, the market has preferred high dividend yield, low volatility, and value stocks. This is a normal occurrence for a bear market, as investors have drifted into a risk-off environment. Thus, Chevron’s dividend-paying capabilities could place it on most market participants’ watchlists until we reach a more risk-on market environment.

Concluding Thoughts – Is Chevron a Buy, Hold, or Sell?

We place Chevron on our hold list. The company is fundamentally strong, and its stock does not exhibit significant valuation concerns. However, quantitative research implies that it has rarely been a momentum play, which raises questions about the stock’s sustainability after gaining nearly 50% year-over-year.

Be the first to comment