onurdongel/E+ via Getty Images

Chesapeake Energy (NASDAQ: NASDAQ:CHK) has had one of the strongest emergences from the pandemic with its market capitalization crossing $10 billion. The company performed incredibly well throughout 2021, and as we’ll see throughout this article, supported by long-term demands for natural gas, we expect substantial shareholder returns.

Chesapeake Energy 2021 Performance

Chesapeake Energy achieved strong results through 2021, backed by an impressive asset portfolio.

Chesapeake Energy Presentation

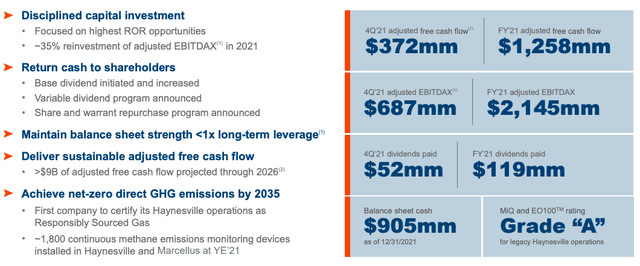

Chesapeake Energy 2021 Performance – Chesapeake Energy Investor Presentation

Chesapeake Energy achieved a 35% reinvestment on its capital with $1.25 billion in FCF and $2.15 billion in adjusted EBITDAX. The company paid a mere $120 million in dividends (just over 1%) and it continues to have an incredibly strong balance sheet with more than $900 million in cash. The company earned a 13% FCF yield through the year that can be expected to grow.

The company expects >$9 billion in adjusted FCF over the next 5-years or a strong double-digit yield while maintaining balance sheet strength with <1x long-term leverage. The company’s strong 2021 performance could continue in the upcoming years, if not expand.

Chesapeake Energy 2022 Guidance

For 2022, the company expects its performance to expand significantly from 2021.

Chesapeake Energy Presentation

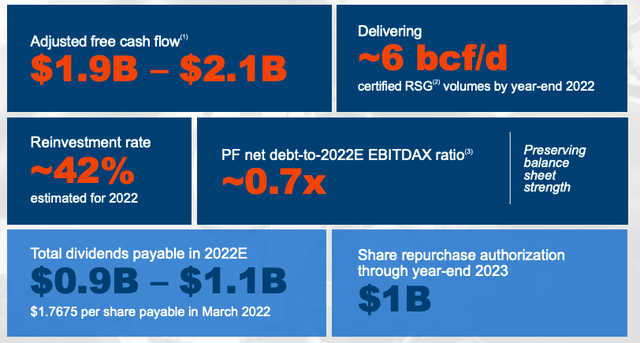

Chesapeake Energy 2022 Guidance – Chesapeake Energy Investor Presentation

Chesapeake Energy forecasts $2 billion in FCF with a 42% reinvestment rate and a 0.7x net debt-to-2022E EBITDAX ratio. The company expects roughly $1 billion in dividends, or a roughly 10% dividend yield and still has a $1 billion share repurchase authorization. That’ll save the company on dividends and enable more substantial shareholder rewards.

The company has strong assets and its incredibly strong 2022 financials will enable continued shareholder rewards. The company is expanding its base dividend by only 14%, but its variable dividend is expected to make up the majority of its returns.

Chesapeake Energy Capital Program

Chesapeake Energy is rapidly expanding its capital program going into 2022 with substantial opportunities available.

Chesapeake Energy Presentation

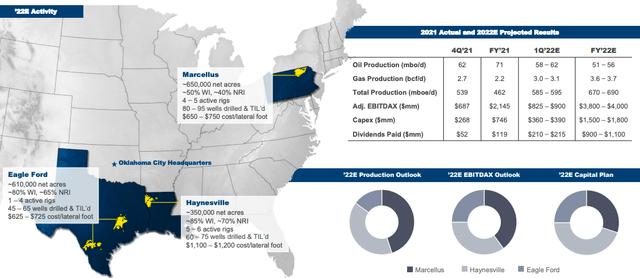

Chesapeake Energy Capital Program – Chesapeake Energy Investor Presentation

The company is expecting oil production to decline slightly from 71 thousand barrels / day to 53 thousand barrels / day. However, gas production is expected to expand significantly from 2.2 Bcf / day in FY’21 to 3.6 Bcf/day in 2022. That will result in total production from FY’21 growing by roughly 50% going into FY’22.

The company expects $3.9 billion in adjusted EBITDAX and with $2.7 billion in long-term debt the company doesn’t need to worry about paying down debt. The company is increasing capital expenditures significantly from $750 million to $1.65 billion, which will substantially remove available cash flow for rewards, however, long term we expect it to pay off.

Chesapeake Energy Financial Hedging

Chesapeake Energy has built up a respectable and well hedged portfolio of assets.

Chesapeake Energy Presentation

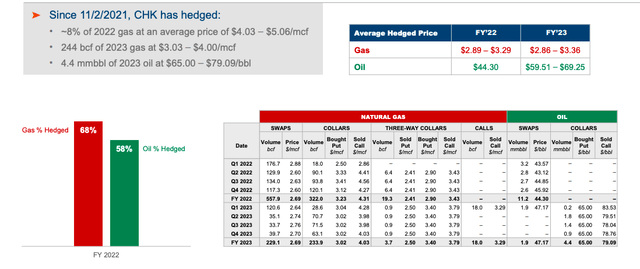

Chesapeake Energy Financials – Chesapeake Energy Investor Presentation

The company has hedged 68% of its gas and 58% of its oil for FY’22. The company’s average hedged price for gas is roughly $3.1 / mmbtu. That’s well below current price but with the company’s breakeven at roughly $2 / mmbtu it’s at least protecting a minimal part of its earnings and preventing the company from moving into bankruptcy again.

We expect the company to continue a hedging program at low costs, such as the moves described since Nov. 2021, to protect its worst case downside while continuing some shareholder rewards.

Chesapeake Energy Shareholder Returns

Chesapeake Energy will continue generating double-digit shareholder returns for those who invest now.

The company’s forecast 2022 dividend yield is expected to be double-digits by itself, supported by much higher natural gas prices. The company’s estimated dividends over the next 5-years is >$5 billion implying that those double-digit dividends will continue for those who invest today. These dividends alone justify investing in the company.

On top of this, the company is continuing to invest in its business. The company is spending $1 billion on share buybacks, or roughly 10% of its outstanding shares. The sooner the company does that the stronger the payback for investors based on the company’s dividends. Additional buybacks could support the company’s yield even further.

The company also has a modest debt yield. Any debt payback will pay back shareholders through saved interest and long-term financial stability. Regardless of how the company spends its cash we expect strong shareholder returns.

Thesis Risk

The largest risk to the thesis is natural gas prices. Natural gas prices have been higher than they’ve been in a long time. With continued European natural gas demand and continued LNG growth, we expect prices to continue their strength. However, historically, prices have been very volatile, which is an important risk to pay attention to.

Conclusion

Chesapeake Energy is in a volatile industry, one that’s forced the company into bankruptcy before. The company, in our view, still trades with a “bankruptcy downside factor” one that’s limited its appreciation so far. However, despite this, management has continued to focus on shareholders and is committed to providing double-digit shareholder returns.

The company expects a $5 billion dividend payout over the next 5 years, implying a double-digit dividend yield alone. Additionally, the company has been responsibly buying back shares, although we’d like to see that expand. The company’s debt is minimal and overall, regardless of how it spends the cash we expect strong double-digit returns.

Be the first to comment