bjdlzx/E+ via Getty Images

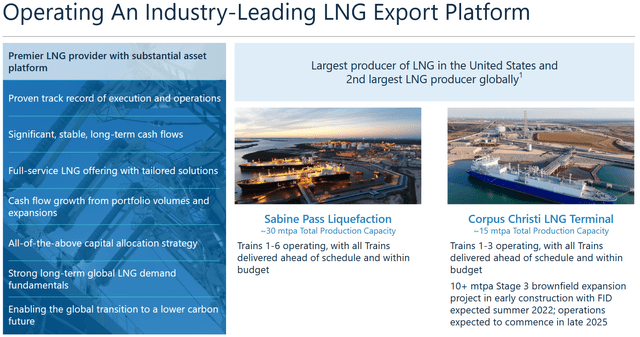

Cheniere Energy, Inc. (NYSE:LNG) is the largest producer of liquefied natural gas in the United States and the second-largest producer of the compound in the world. As I discussed in a previous article, this is a rapidly-growing segment of the energy industry, which is exemplified in Cheniere’s recent deal with Norway’s Equinor (EQNR). Despite the high growth potential and today’s prevailing strength in energy prices, Cheniere Energy remains substantially undervalued at its current level as we will see over the course of this article. This undervaluation is true despite the stock being up 44.50% over the past twelve months, making Cheniere one of the few companies to reward investors with a positive return in recent months. As it still appears undervalued, Cheniere Energy may be worth adding to your portfolio today, particularly considering the growth rate of the overall demand for natural gas.

About Cheniere Energy

As stated in the introduction, Cheniere Energy is the largest producer of liquefied natural gas in the United States, boasting a total production capacity of approximately 45 million tonnes annually. It accomplishes this through its ownership of two liquefaction plants along the Gulf Coast:

As is the case with midstream companies, liquefied natural gas plants operate under very long-term contracts. This is necessary to ensure that the plant is economically viable to construct as such facilities are incredibly expensive to construct. This is one reason why American liquefied natural gas is not a good solution for the European gas crisis as Europeans are not willing to commit to the contract length that would be required. In short, the way this works is that a buyer of natural gas imports (usually a large energy company like Equinor) will commit to purchasing a specified amount of liquefied natural gas produced by the plant over an extended period of time. In the case of Cheniere Energy, its current contracts have a weighted average remaining life of seventeen years, which means that they will generally last well into the late-2030s. Fully 90% of Cheniere Energy’s production is covered by such contracts, which is obviously a very high percentage of its overall revenue. This presents an attractive situation for investors because it ensures that Cheniere Energy should enjoy very stable cash flows over the long term as well as provides the company a source of support for its dividend. The more important thing though is that it provides the company with a steady stream of incoming cash that it can use to carry its debt, which helps to offset the fact that Cheniere Energy is incredibly heavily leveraged.

We can see this leverage by looking at Cheniere Energy’s net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well the company’s equity can cover its debt obligations in the event of a bankruptcy or liquidation, which is arguably more important. As of March 31, 2022, Cheniere Energy had $28.358 billion of net debt compared to a negative $1.259 billion in shareholders’ equity. This gives the company a negative net debt-to-equity ratio, which is quite concerning. This essentially guarantees that the shareholders will be completely wiped out in any kind of bankruptcy filing. Fortunately, Cheniere Energy is using its sizable and sustainable cash flow to address this situation. The company has recently stated that it intends to repay approximately $1 billion worth of debt annually until it achieves investment-grade credit ratings but that pace is nowhere near as fast as I want to see. Fortunately, there may be a reason to believe that Cheniere Energy will be able to do much better than this. In the first quarter of 2022, Cheniere Energy reported a record $3.2 billion of adjusted EBITDA and paid off $800 million worth of long-term debt. If it is able to repeat this feat going forward, then it will be paying off much more than $1 billion annually. This impressive financial performance prompted Moody’s to upgrade Cheniere Energy to Ba2 with a “positive” outlook. Thus, the company’s strong and stable business model may reduce the inherent risk of the company’s leverage.

Naturally, as investors, we are not merely content with stability. We also want to see growth. Fortunately, Cheniere Energy is positioned to deliver this. The primary driver of this growth is an expansion that the company has started construction on at its plant in Corpus Christi, Texas. The company’s plan is to add seven liquefaction trains that will be capable of producing about ten million tonnes of liquefied natural gas annually, bringing the total output of this plant up to at least 25 million tonnes annually. The nice thing about this project is that Cheniere Energy has already secured contracts for the entire output of this expansion. This is good because it ensures that Cheniere Energy is not spending a large sum of money to construct liquefaction capacity that nobody wants. The second benefit to Cheniere Energy is that the company knows in advance how much revenue and profit the expansion will generate so that it knows that it will generate a sufficient return to justify the investment. Unfortunately, the company has not publicly released these figures. The company expects that this project will come online in late 2025 so we should expect to see the impact of this additional capacity on the company’s financial performance as we enter 2026.

About The Deal With Equinor

As stated in the introduction, Norway’s Equinor recently signed a contract with Cheniere Energy under which the latter will supply the energy giant with liquefied natural gas. This helps to increase our confidence that the market for liquefied natural gas is quite strong and is likely going to be a source of growth for the energy industry over the next few decades. We will discuss the overall fundamentals of this sector in just a few minutes.

Unfortunately, the two companies have not revealed much about the agreement. This is certainly not unusual, however, as it is common practice for energy companies to keep details of their business agreements secret until the deal actually takes effect and money begins trading hands. From what we know, Equinor will purchase approximately 1.75 million tonnes of liquefied natural gas annually from Cheniere Energy over the course of fifteen years. As already stated, the weighted average remaining life of one of Cheniere Energy’s current contracts is seventeen years so this would be one of Cheniere Energy’s shorter contracts. This may be a sign that Equinor intends to use the natural gas to supply Europe considering that the continent wants to be converted to renewables by the middle of the century but neither company has specifically stated this.

Equinor will begin buying the liquefied natural gas under this contract in 2026, which positions it well to be provided by the new capacity that Cheniere Energy is bringing online in Corpus Christi. Jack Fusco, President and Chief Executive Officer of Cheniere Energy implied as much in the press release:

“Equinor is one of Europe’s premier energy companies, and we are excited to form a long-term relationship with another strategic customer that shares out ambitions for a sustainable future. This SPA further reinforces Cheniere’s leadership in providing the flexible, reliable, and cleaner burning long-term LNG supply sought by our customers across the globe focused on energy security and environmental priorities. The SPA also reflects the urgency in demand for investment in additional LNG capacity, not only for the Corpus Christi Stage III project, which is nearing FID, but also for capacity beyond the project’s initial seven trains.”

Cheniere Energy appears to be implying here that there may be even more projects beyond just the one that we discussed earlier. Thus, the company may have long-term growth potential. This should prove quite appealing for long-term investors.

Fundamentals Of Natural Gas

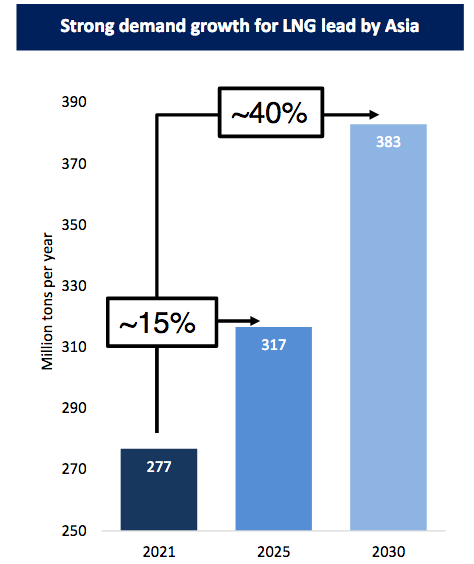

As stated a few times in this article, the fundamentals for liquefied natural gas are quite strong with growing global demand. I first pointed this out about two months ago (linked above) when I showed that the demand for the substance is expected to grow by 40% over the 2021 to 2030 period, primarily due to rising demand out of Asia:

Golar LNG

This demand growth is mostly caused by concerns about climate change. In the case of Asia, smog and other forms of air pollution are also a concern. As many people reading this are undoubtedly well aware, a significant amount of the electrical generation capacity in Asia is coal. Coal is by far the dirtiest burning fossil fuel, which has driven many of these countries to attempt to convert to natural gas and renewables with the goal of alleviating these problems. Unfortunately, they lack sufficient capacity to produce all of the needed gas domestically so the only solution is to import it from abroad. Well, natural gas is, as the name implies, a gas so it will expand to fill any container that it is placed in. Thus, the only way to transport it across large bodies of water like an ocean is to convert it into a liquid that can then be carried by specially-equipped ships. It is companies like Cheniere Energy that perform this conversion process.

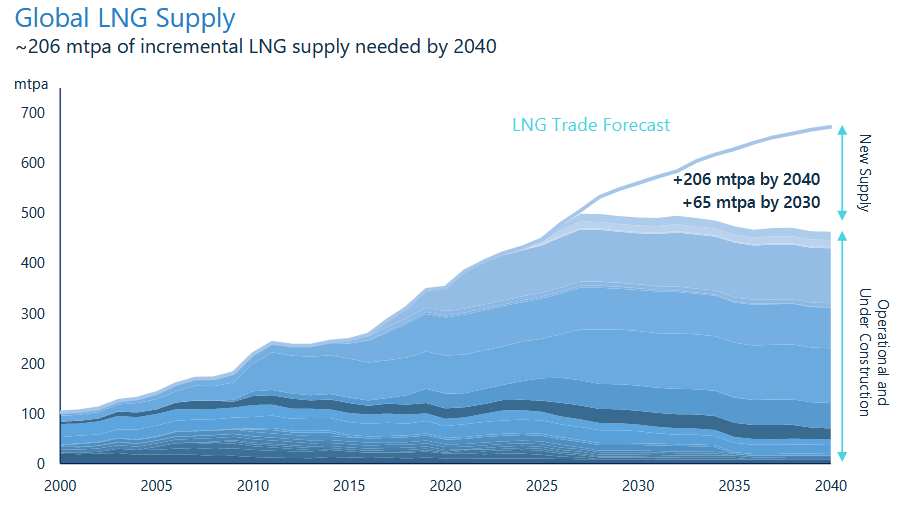

It appears likely that the demand growth for liquefied natural gas will accelerate beyond 2030. According to Wood Mackenzie, the demand for liquefied natural gas will increase by 65 million tonnes annually over the 2021 to 2030 period and by 206 million tonnes annually over the 2021 to 2040 period:

Cheniere Energy/Data from Wood Mackenzie

Thus, Cheniere Energy could very easily see itself boasting very solid growth prospects well throughout the next two decades. This should prove very appealing to long-term investors.

Valuation

It is always critical that we do not overpay for any asset in our portfolio. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. One metric that is commonly used to value companies like Cheniere Energy is the price-to-earnings growth ratio. This is a modified form of the familiar price-to-earnings ratio that takes the company’s earnings per share growth into account. Generally, a price-to-earnings growth ratio of less than 1.0 is a sign that the stock is undervalued relative to its forward earnings per share growth and vice versa.

According to Zacks Investment Research, Cheniere Energy will grow its earnings per share at a 54.55% rate over the next three to five years. That gives the stock a price-to-earnings growth ratio of 0.16 at the current price. This is a clear indication that the stock could be dramatically undervalued relative to its forward earnings per share. The fact that Cheniere Energy has a forward price-to-earnings ratio of 8.74 helps to reinforce this conviction as even with the current market turbulence, there are remarkably few stocks trading for any figure in the single digits. This ratio is implying a fair value of $799 per share for the stock, which is obviously substantially above the current price of $127.84 per share. I will admit that I am certainly not inclined to value it that high, but when we consider the strong industry tailwinds, the new capacity coming online, and the forward growth potential, it is still quite clear that the stock should be trading for well above its current level.

Conclusion

In conclusion, Cheniere Energy is the largest producer of liquefied natural gas in the United States and that is a very good place to be right now. The market for the compound is strong and is delivering phenomenal growth, which Cheniere Energy is moving to take advantage of with its expansion project in Corpus Christi. The company’s biggest risk is its very high leverage but it appears to realize that and is taking steps to address it. Finally, the stock appears to be substantially undervalued relative both to its forward earnings per share and forward earnings growth so it might be worth considering for your portfolio today.

Be the first to comment