imaginima

Pure-play liquefied natural gas (or LNG) company, Cheniere Energy, Inc. (NYSE:LNG) has been a stock market darling for the last five years, easily outperforming it. As supply tightens, the LNG market gives producers a base for sustainable future profitability. However, as we shall see, Cheniere’s profitability has deteriorated with time, and does not provide the basis for a confident and safe investment.

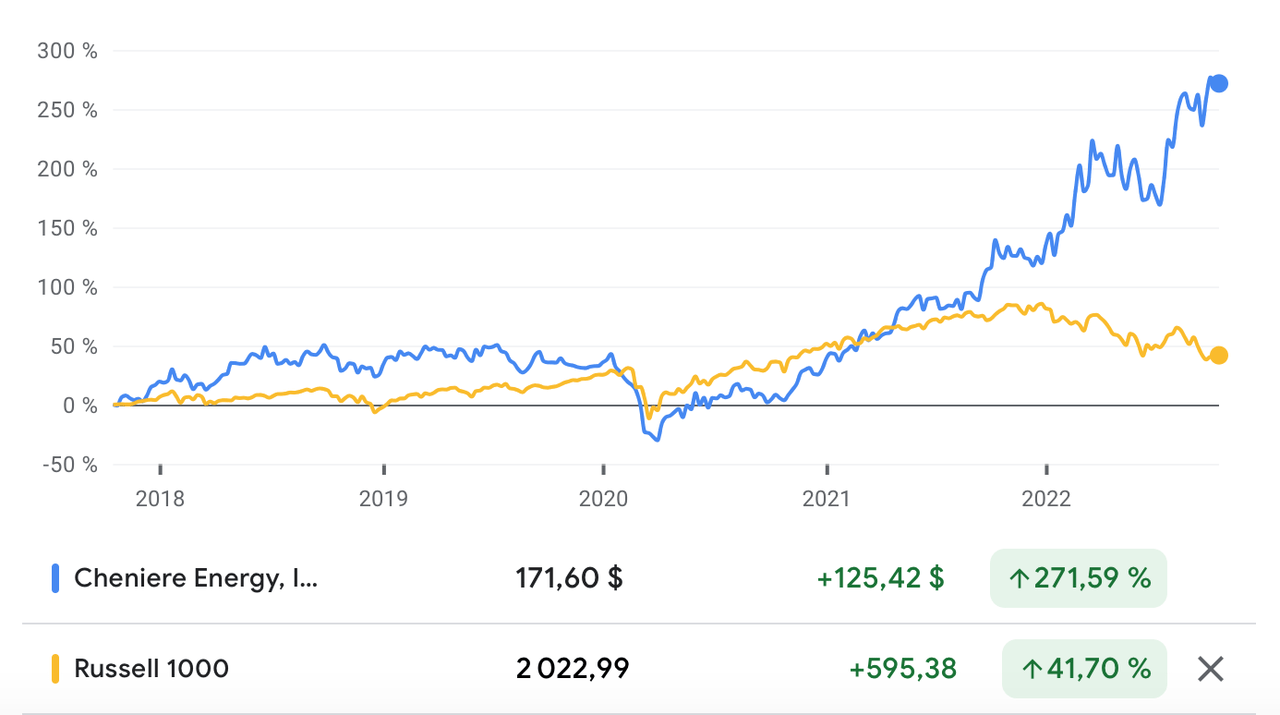

Outperforming the Market

In the last five years, Cheniere has crushed the market, with its share price soaring nearly 272% compared to nearly 42% for the Russell 1000. Cheniere’s strong performance has continued this year, with the stock up 67.43% for the year-to-date, compared to a decline of 23.97% for the Russell 1000.

Source: Google Finance

The company’s stock market success reflects its strong fundamentals.

Story of a Growth Company

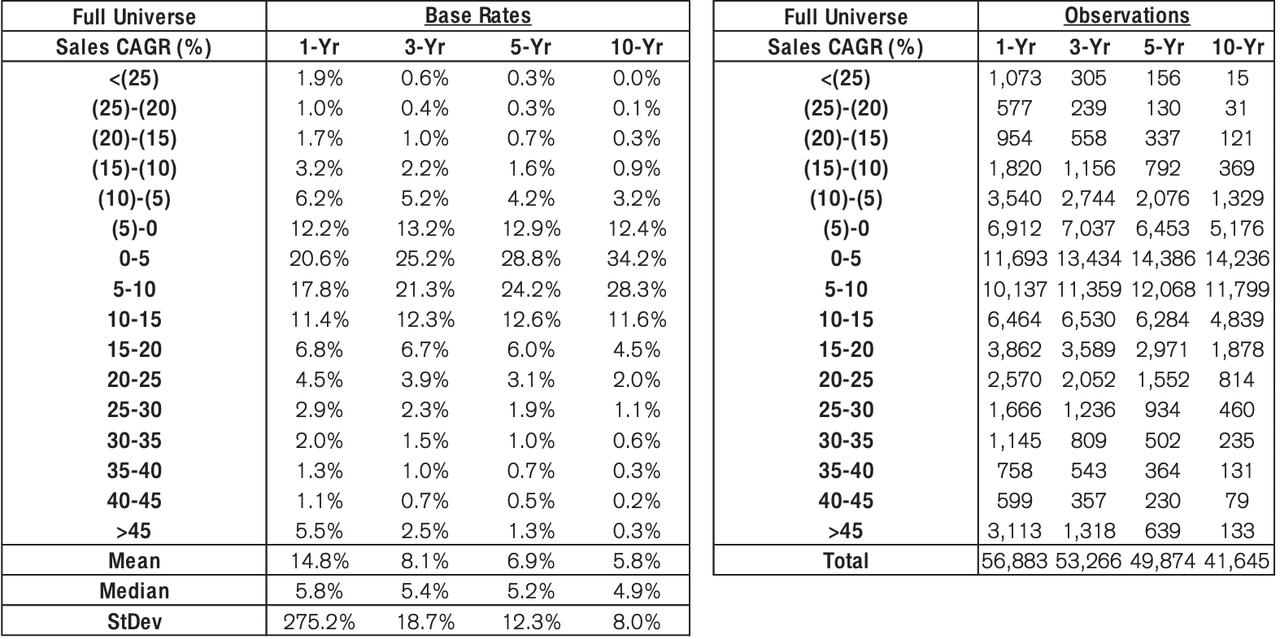

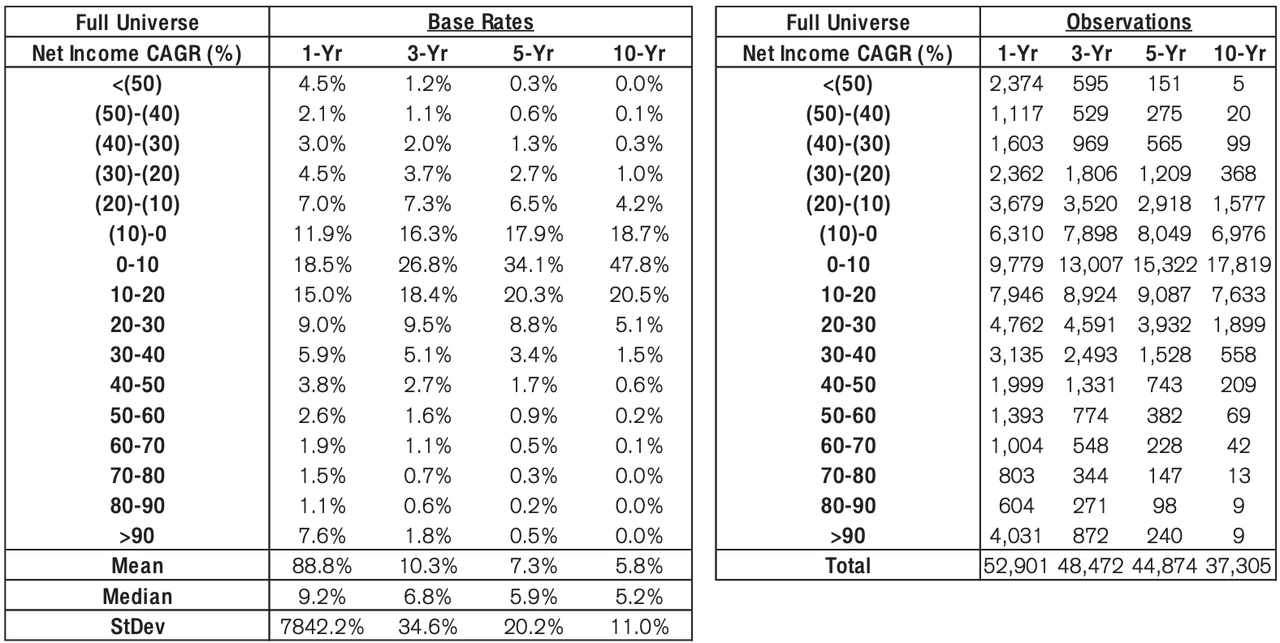

Revenue has grown from $5.6 billion in 2017, to $15.86 billion in 2021, for a 5-year compound annual growth rate (or CAGR) of 23.15%. According to Credit Suisse’s The Base Rate Book, between 1950 and 2015, just 3.1% of firms have experienced a similar rate of growth. In the trailing twelve months (or TTM), amidst the European gas crisis and rising LNG prices, revenue has soared to $25.25 billion. A possible supply deal with the United Kingdom is likely to bolster revenues even more.

Source: Credit Suisse

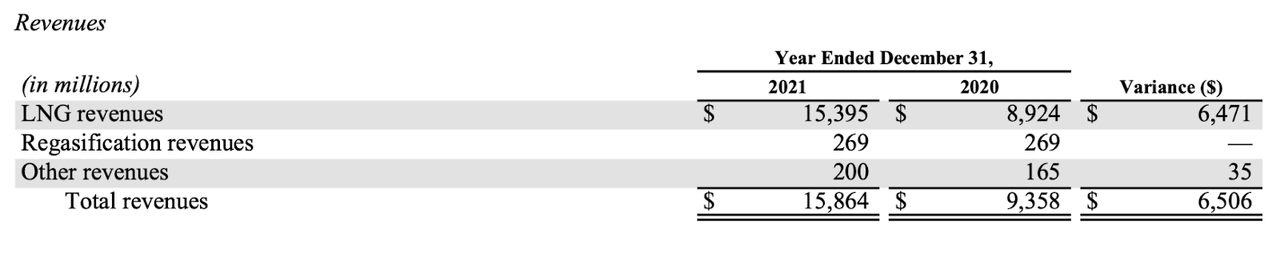

The bulk of revenues come from LNG, with a fraction coming from regasification and other segments.

Source: 2021 Annual Report

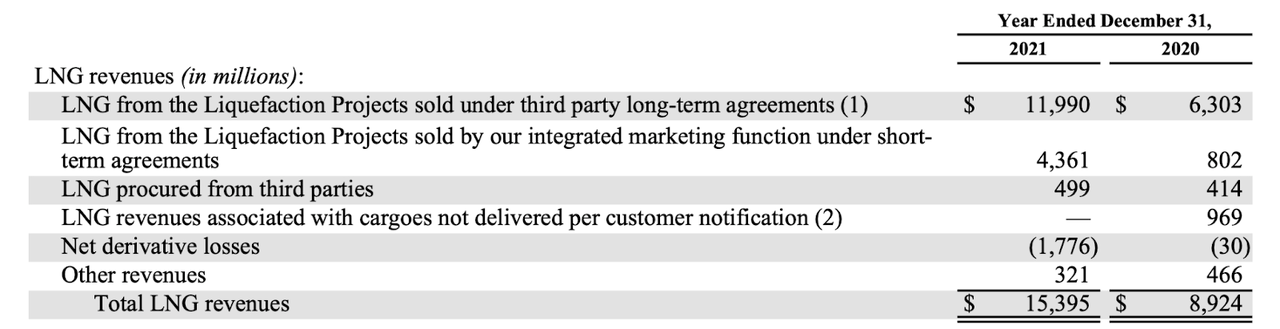

LNG revenues are largely from liquefaction projects sold under third party long-term agreements, and the second largest component coming from liquefaction projects sold by the company’s integrated marketing function under short-term agreements.

Source: 2021 Annual Report

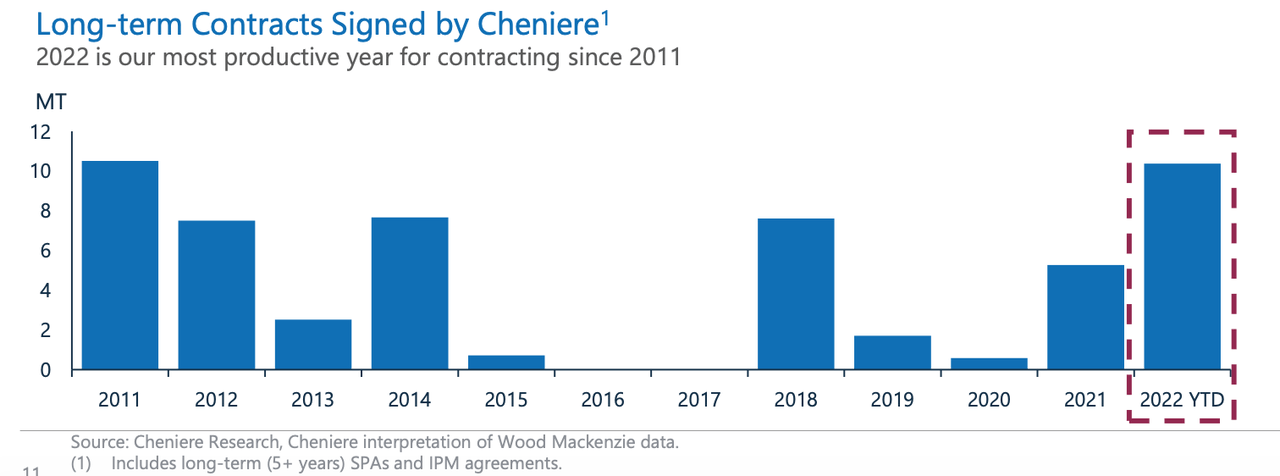

2022 revenues are likely to be the highest that the company has ever received, on the basis of contract activity.

Source: Cheniere Q2 2022 Earnings Presentation

Gross profitability in 2017 was 0.073, far below the 0.33 threshold found to be attractive by Robert Novy-Marx. In 2021, gross profitability plunged to 0.016. In the TTM period, gross profitability further declined, to 0.009. In other words, the company’s ability to make money has declined in the last five years. Gross profitability is highly persistent in the short to long term. Projecting into the future, Cheniere’s future profitability is unlikely to be attractive.

There is an inverse relationship between asset growth and future returns. Total assets have risen from $27.9 billion in 2017, to nearly $39.26 billion in 2021, for a 5-year total asset CAGR of 7.06%. So far, Cheniere has avoided the effects of the asset growth effect, with the share price doing so well. However, this is a warning that the “supply” of future returns may decline.

Operating margin has declined from 24.8% in 2017, to -4.4% in 2021. This again reflects on the company’s declining profitability over time. In the TTM period, operating margin has declined further, to -4.1%.

Cheniere’s net income has fallen off a cliff, from -$393 million in 2017, to over -$2.343 billion in 2021, giving a 5-year net income CAGR of -42.91%. This gives us a base rate of 1.3% of firms. In the TTM period, the company has declined further, to -$2.531 billion.

Source: Credit Suisse

Cheniere’s free cash flow (FCF) has improved, from -$2.126 billion in 2017, to over $1.57 billion in 2021. This has risen to nearly $4.72 billion in the TTM period.

Finally, Cheniere’s return on invested capital (or ROIC) has declined from -0.7% in 2017, to -2.5% in 2021, echoing the theme of declining profitability. In the TTM period, ROIC has fallen to -2.9%.

Geopolitics Has Tightened LNG Supply

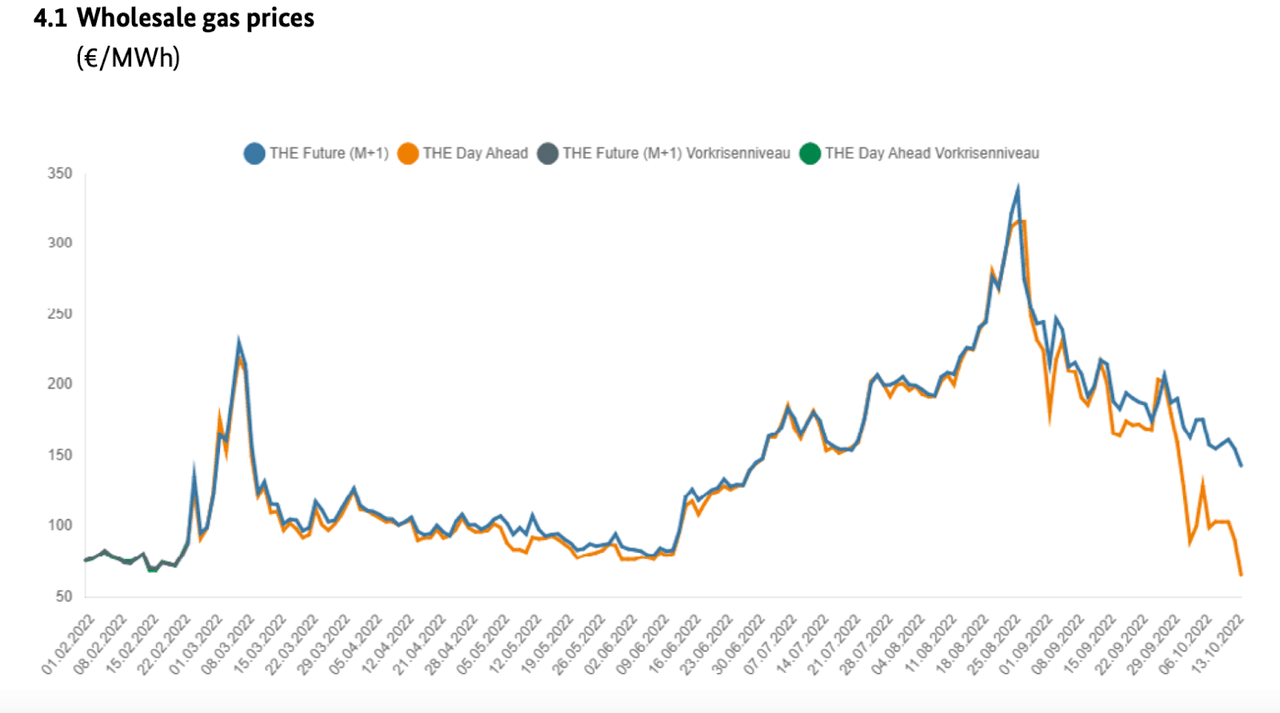

The asset growth effect tells us that you want to invest in industries with tight supply economics. Tight supply supports future profitability. LNG supply has been disrupted by geopolitical forces. The Russo-Ukrainian War has taken Russia out as a supplier for Western countries. The chances of a rapprochement with the West in which trade is restored between Russia and the European Union, are very low. Not only has the European Union sanctioned Russia and indicated its intention to be free of Russian gas in the near-term, but Russia has responded by indefinitely shutting off the main gas turbine. German energy regulator Bundesnetzagentur’s last Gas supply status report, shows that Germany has been able to stock up for the winter, and the situation remains stable. As a result of European efforts, wholesale gas prices have declined.

Source: Bundesnetzagentur

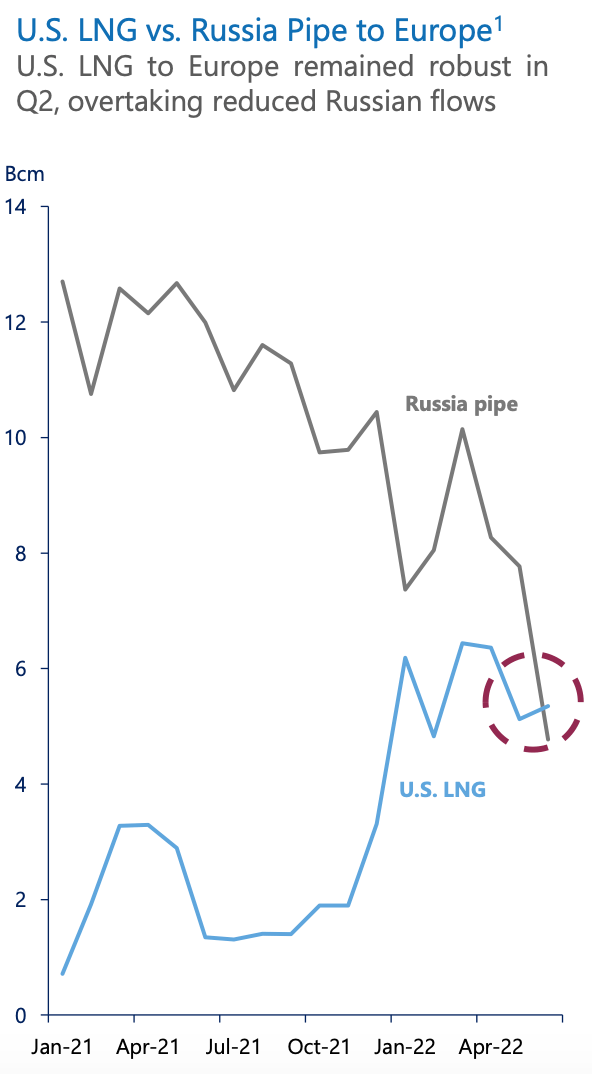

However, after the winter, Europe will still face a problem: where to access its LNG. Europe will have to shift its focus from Russia, to the United States, and other regions, and this provides a significant opportunity for American LNG companies. Although this does imply that Europe will have to accept higher gas prices going forward, in an era where geopolitics dominates, economic decisions will be less driven by cost analysis and more by geopolitical considerations. Already, we have seen US LNG supply overtaking Russian gas supplies. In the first half of the year, Europe increased LG imports by 51%.

Source: Cheniere Q2 2022 Earnings Presentation

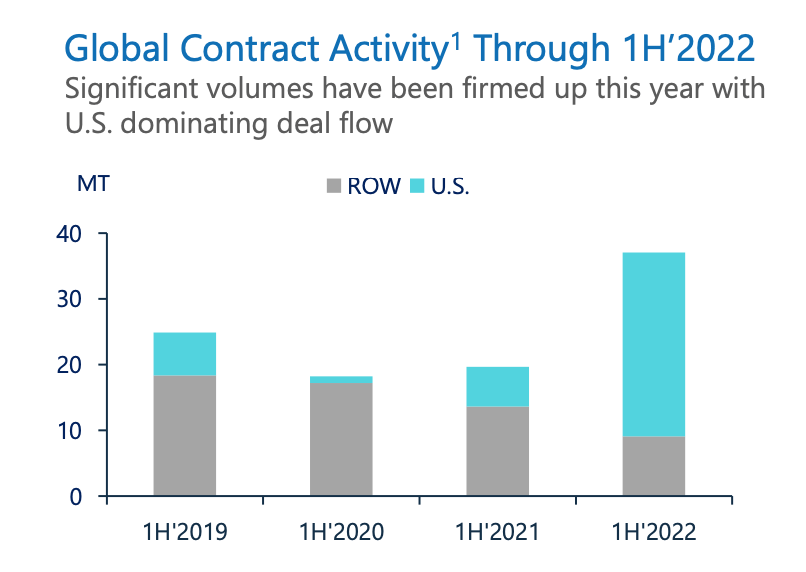

In addition, as relations between the United States and OPEC+ have fallen to new lows, Europe is unlikely to be able to have its energy needs met by OPEC+. It should be remembered that, economically, it makes sense for OPEC+ to keep supply low, and, given waning Western influence, the West does not have as much to offer OPEC+ as it did before, or the coercive ability necessary, to get OPEC+ to take any kind of hit. That again points to Europe becoming more dependent on the US for its gas needs. Global contract activity in the first half of the year shows this shift toward the United States, compared to the rest of the world (ROW).

Source: Cheniere Q2 2022 Earnings Presentation

Valuation

With FCF of $4.72 billion in the TTM period, and an enterprise value of $70.23 billion, Cheniere has an FCF yield of 6.72%. That is attractive, especially when you consider that New Construct estimates that the FCF yield of the 2000 largest listed companies in the US is 1.5%. However, it has to be balanced by the poor gross profitability of the company, which continues to decline. The poor and declining profitability and the mildly attractive FCF yield, are not enough to suggest that the company will be able to maintain its run on the market. There are gas firms with stronger signals.

Conclusion

Cheniere has performed very well on the stock market, outperforming the broad market throughout the last five years. However, the company’s growth has been profitless, and profitability continues to deteriorate. While it may be argued that this is because the company is investing in the business. improving supply conditions should have made it easier for the firm to become more profitable. Wider industry trends are positive, but the company’s own fundamentals are not convincing.

Be the first to comment