Eric Middelkoop

Investment Thesis

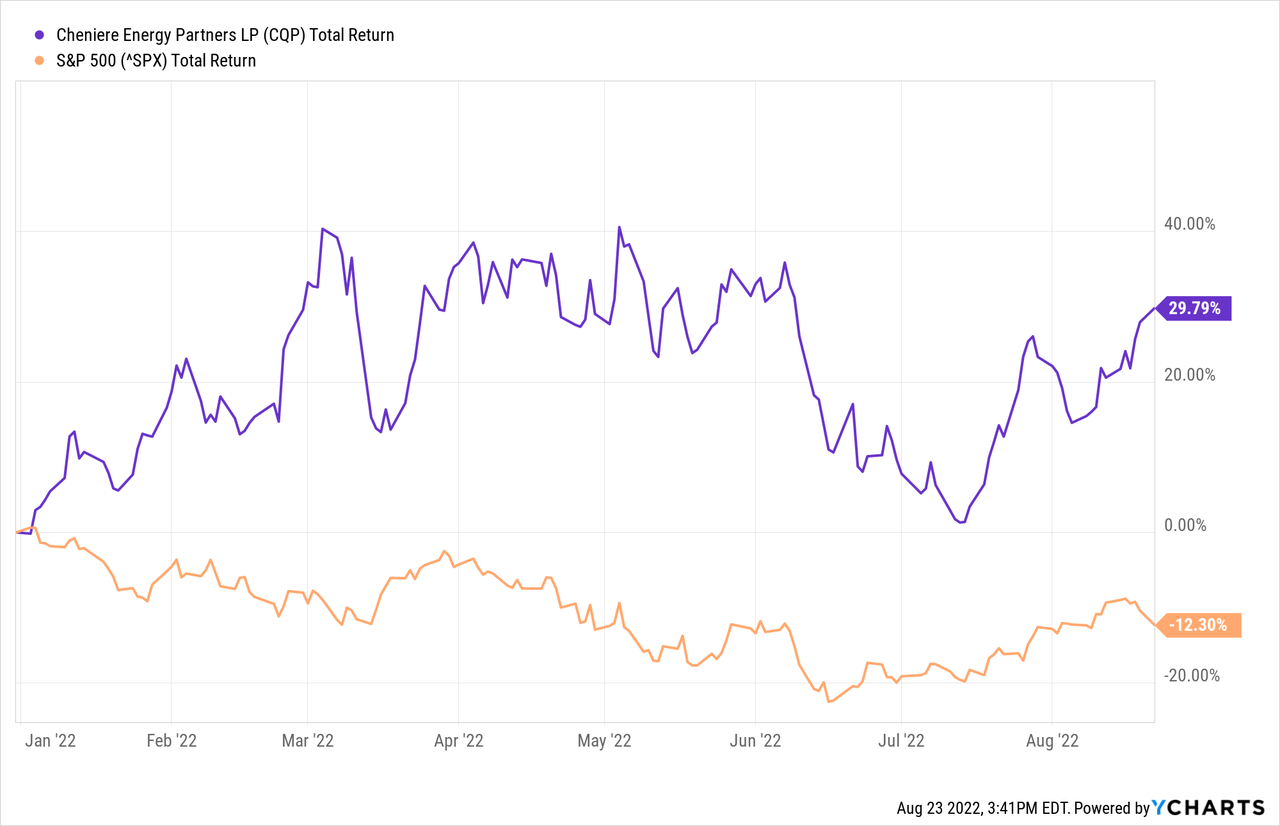

Cheniere Energy Partners, L.P. (NYSE:CQP) has outperformed the market in virtually all the previous milestone markers, including a 22% gain in the third quarter, compared to the market’s 8%.

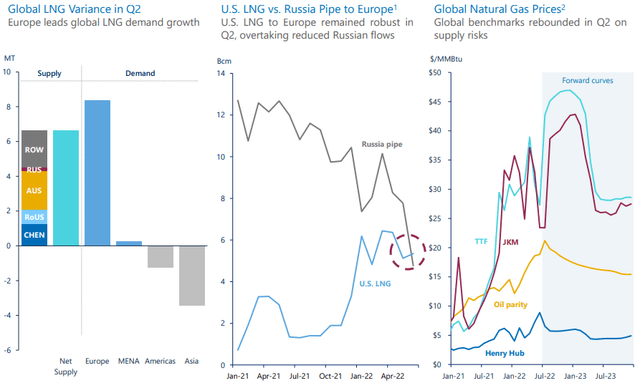

This is primarily because of the European energy crisis due to the Russian conflict, resulting in the continent pivoting away from Russian gas imports toward LNG imports. This has caused a surge in the U.S. LNG exports, significantly benefiting CQP, which owns and operates the largest gas export terminal in the U.S.

The company has set up long-term contracts with a strong customer base and growth potential, extending into the second half of the century, with 2022 being the most successful contracting year in over a decade.

An unrealized noncash derivative loss makes the stock seem very expensive as it weighed heavily on the company’s earnings. Still, the stock holds significant upside potential for long-term investors because of the strong market demand, commodity pricing, and volumetric growth prospects.

The Company

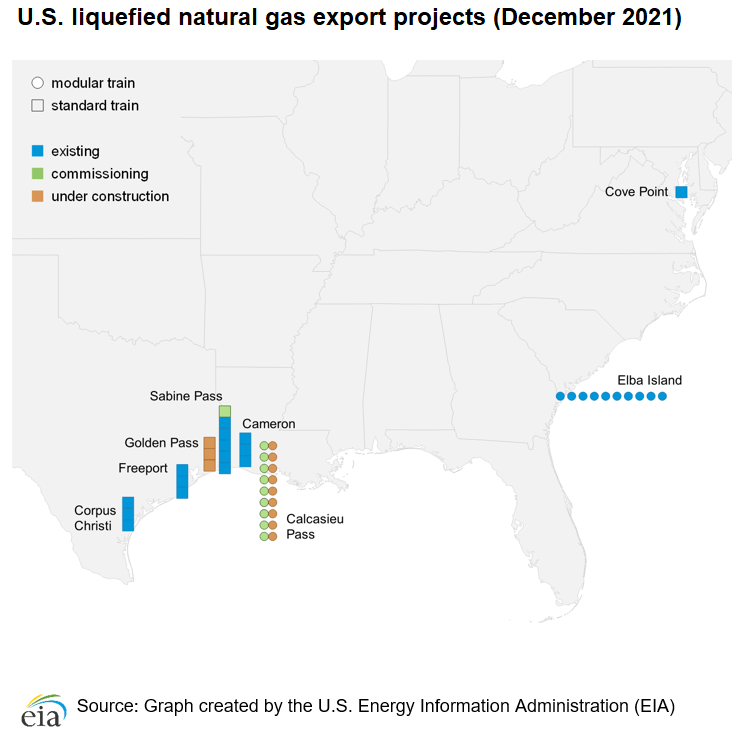

Cheniere Energy Partners is a global midstream company providing LNG to integrated utilities, energy, and energy trading companies. It owns and operates the Sabine Pass natural gas liquefaction and export terminal in Louisiana, on the coast of the Gulf of Mexico. The company also owns the 94-mile Creole Trail Pipeline, interconnecting the LNG terminal with several large interstate pipelines.

EIA

The terminal has six operational LNG liquefication units, “Trains,” with Train 6 achieving substantial completion in February 2022, for a total production capacity of about 30 million tons per annum (mtpa) of LNG. The terminal also operates regasification facilities, including 5 LNG storage tanks, vaporizers, and two marine berths, with an additional marine berth under construction.

The company works closely with its sister company, Cheniere Energy, Inc. (LNG), the largest US exporter of natural gas. At the same time, its major third-party customers include Shell (SHEL), Naturgy (BME: NTGY), KOGAS (KRX: 036460), GAIL (NSE: GAIL), Total (EPA: TTE), Centrica (LON: CNA), PETRONAS (OTCPK:PNAGF), and Vitol.

Leveraging the LNG Export Market

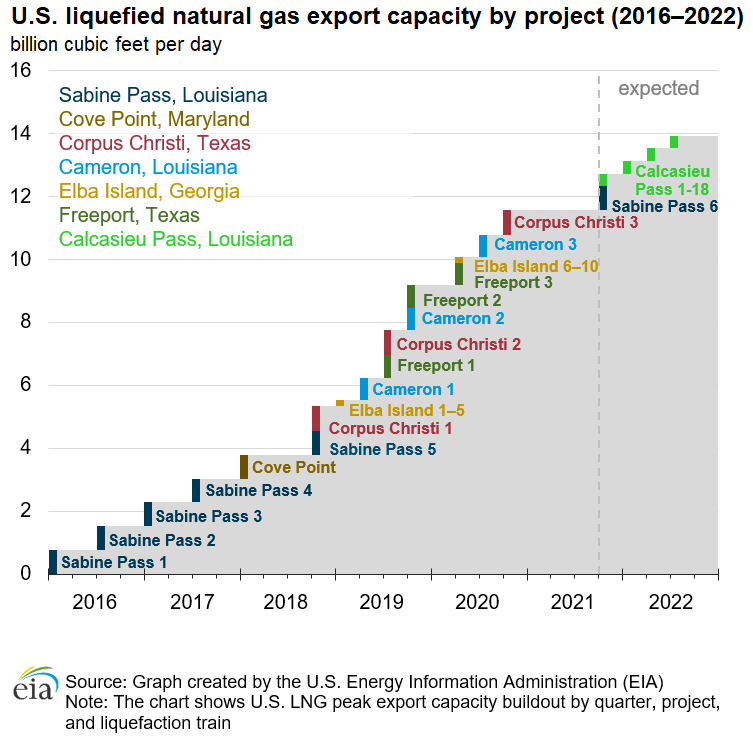

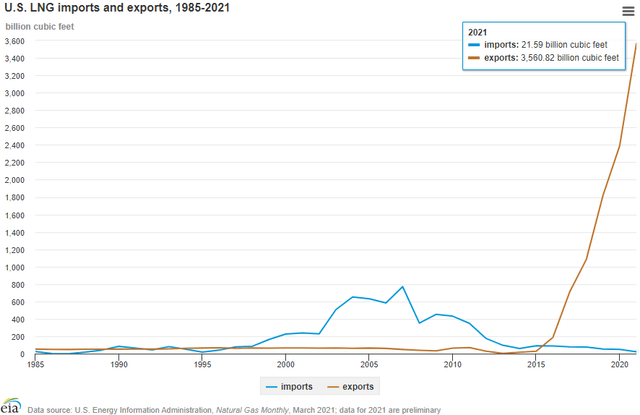

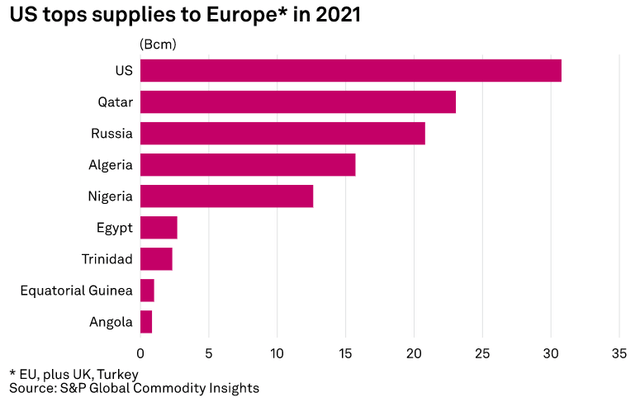

The United States has become a major LNG exporter since its export ascent started in 2016 when the Sabine Pass became the first operating LNG export facility in the Lower 48 states.

EIA

Subsequently, the country exported 12.98 bcfd at its peak in 2021. According to the EIA, U.S. LNG exports increased 12% YoY in H1 2022 to an average of 11.2 bcfd.

The United States is currently competing with Qatar to become the top LNG exporter in the world, expecting to reach a peak LNG production capacity of 13.9 bcf of natural gas per day with its 7 LNG export facilities and 44 liquefaction trains, including 16 full-scale, 18 mid-scale, and 10 small-scale trains at Sabine Pass, Cove Point, Corpus Christi, Cameron, Elba Island, Freeport, and Calcasieu Pass. Golden Pass LNG is expected to drive this capacity to 16.3 bcfd by 2024.

EIA

Natural gas deliveries to LNG export terminals are already increasing in the US, with natural gas deliveries to the US LNG export terminals increasing by 0.2 Bcf/d to 11.0 Bcf/d, including South Louisiana reporting an increase of 0.1 Bcfd week-on-week from August 11th to August 17th to 7.6 Bcfd.

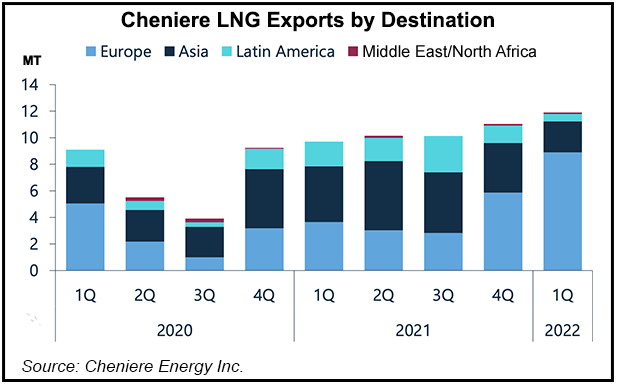

Even though the Russia-Ukraine situation is disastrous for the world, it has undoubtedly created a significant opportunity for the U.S. LNG market amid European energy crises. During the current quarter, US LNG exports have exceeded Europe’s natural gas imports from Russia and increased its LNG imports by 51% YoY during H1 2022 to support demand & storage injections.

Sabine Pass plays an integral role in this as Cheniere Energy, Inc. reported a significant surge of LNG production for European exports in Q1, as over 70% of the cargoes produced at Cheniere’s facilities landed in Europe compared to less than 40% in H1 2021. The management expects this trend to continue throughout the year as the continent looks to diversify its supplies away from Russia. In its Q2 earnings call, LNG’s CEO said:

We are just beginning. As Europe looks to reduce its dependency on Russian energy supplies and the administration looks to support our allies, the relevance, and criticality of energy security and the role of LNG and natural gas as reliable, flexible, and cleaner burning fuels have never been more evident to customers and governments the world over.

Cheniere Energy Inc.

Europe, including Turkey, currently has an import capacity of around 184 mtpa but may source an additional ~36 million tonnes (50 bcm) of LNG by Q1 2023. The US has pledged an additional ~11 million tonnes (15 bcm) of LNG to the EU in 2022, with prospects of a guaranteed longer-term demand for U.S. LNG of ~36 mtpa (50 Bcm/year) through 2030.

Accordingly, the company has entered into multiple long-term contracts between April and July for supplying about 140 million tonnes of LNG in aggregate through 2030. This strong demand has resulted in the company moving its 2022 annual guidance upward for the third consecutive quarter.

Strong and Stable Revenues Stretching Beyond 2040

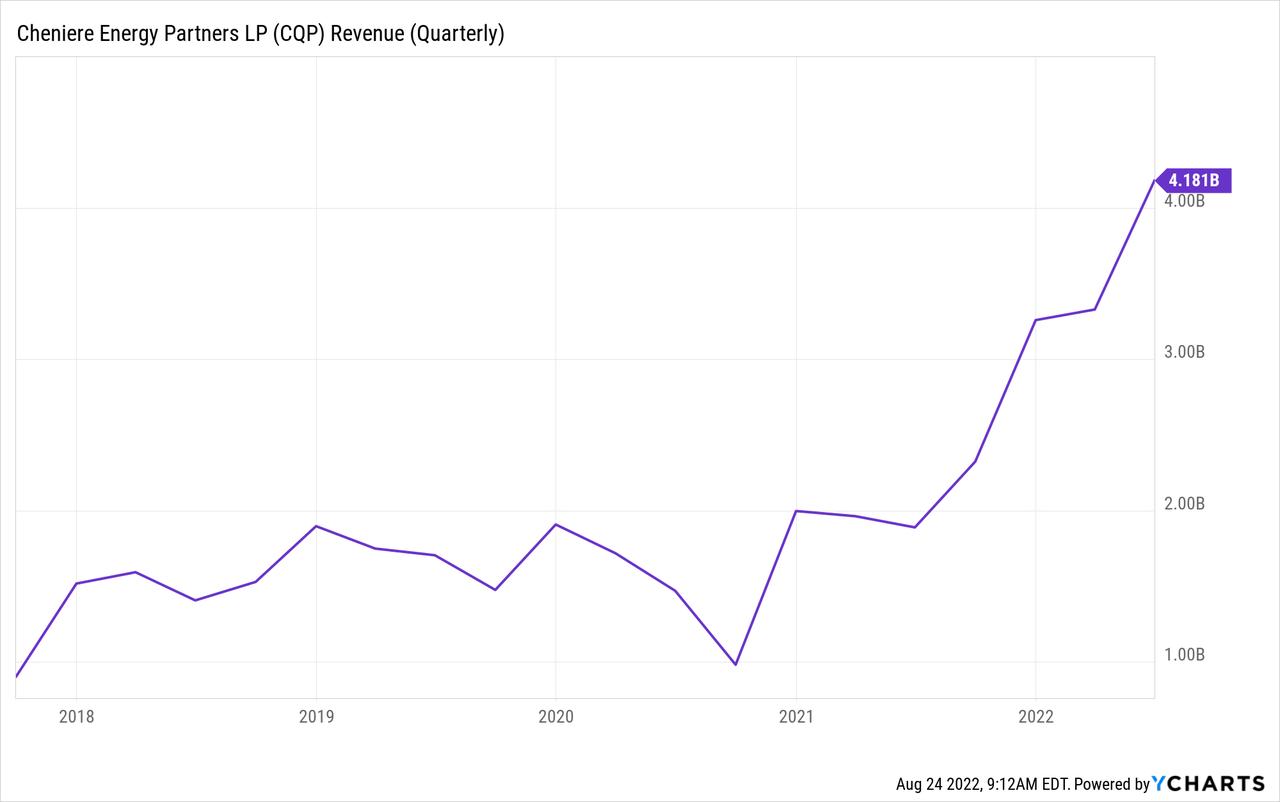

The company’s YoY revenues almost doubled during H1 2022 from $3.85 billion to $7.5 billion, driven by the high commodity prices and a volume increase of almost 21% from 630 to 760 TBtu.

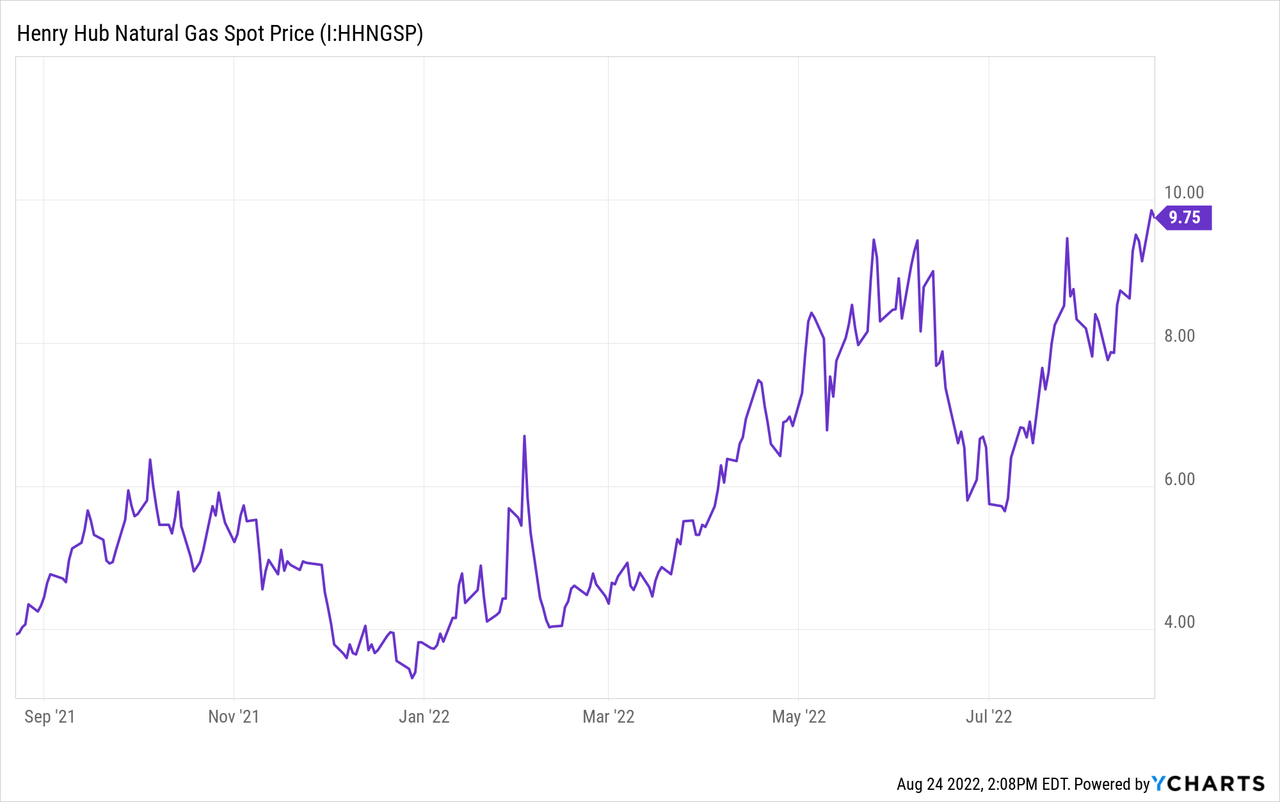

US natural gas prices crossed the $10/MMBtu mark for the first time since 2008, facilitated by the growing European import demands. The prices are further fueled by Gazprom’s announcement to halt natural gas supply through the Nord Stream 1 pipeline to Europe for three days of maintenance at the end of August. Trading Economics expects natural gas to reach new heights in the following 12 months, trading at $11.91/MMBtu in 12 months, 21% higher than the current quarter end’s estimates of $9.86/MMBtu.

Cheniere’s volumetric revenues are safeguarded through its long-term agreements. The company has signed over 15 mtpa contracts in the TTM, aggregating to over 240 million tons, including long-term contracts extending beyond 2040 with POSCO International (KRX: 047050), Equinor (EQNR), Chevron (CVX), PetroChina (PTR), and PTT. Its PetroChina contract extends beyond 2050. This will make 2022 the most successful contracting year for the company in over a decade.

Chevron is also liable to pay $765 million to Cheniere during 2022 for the early termination of an LNG Terminal Use Agreement with one of CQP’s subsidiaries, an integral transaction for the company’s increased 2022 guidance.

Additionally, the supply volumes in contracts with Equinor, Chevron, and PetroChina have already increased by 3 mtpa during July, as the company made a final investment decision to expand the Corpus Christi liquefaction facility beyond Phase 3, with further provisions for volume growth. The company’s Sabine Pass terminal has ample room for extensions, and the company is proactively pursuing these opportunities to fuel future growth.

Consistent and Sustainable Dividends

Cheniere has been paying a dividend for 14 consecutive years, including 5 consecutive years of growth with a CAGR of 11.5%. The expected annual dividend payout for 2022 of $4.125 at the midpoint currently yields 7.63%. The company has historically maintained an ample dividend with a 4-year average yield of 6.32%.

Since the company’s dividends are comprised of a base part, $3.1 per share per annum, and a variable part which depends on cash conversion and usage.

Accordingly, the significant earnings prospects in 2022 will likely result in a dividend increase, reaching the top of its distribution guidance at $4.25 per share. The dividend is safely covered with a free cash flow (“FCF”) yield of 8.5%, 43.5% YoY OCF growth, and a forward FCF per share growth rate of over 55%.

Valuation May Seem High, But It’s Not!

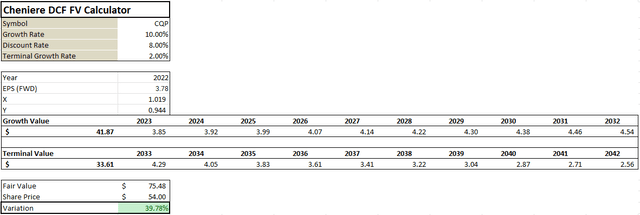

CQP stock has gained over 27% since mid-July, negatively affecting its relative valuation metrics, but it is still trading at a reasonable price for long-term investors. Due to the significant unrealized non-cash loss on its derivatives, the company’s P/E multiple has shot up to almost 31x, 192% higher than the sector median & 45.5% higher than its 5-year average. Excluding the loss, the P/E drops to about 12.2x, exposing a significant undervaluation.

However, since the loss is attributable to a long-term contract, it can’t be entirely ignored as it is likely to negatively impact the income statement in the future if the gas prices keep climbing. On the other hand, the most significant losses from the derivatives are likely finished as the volatility in gas prices will be relatively lower than in the previous period.

Going by its revenue and cash, the stock seems overvalued relative to the sector but undervalued compared to its historical averages.

Similarly, an EPS-based discounted cash flow (“DCF”) model, using an estimated EPS of $3.78 for 2022 and a conservative growth rate of 10%, compared to the expected EPS growth of 22%, also shows an upside potential of almost 40%, leading to a 12-month target price of $75 per share.

Conclusion

Cheniere is a strong player in the LNG market with strong ties across the board. The company has delivered strong post-pandemic topline growth, leveraging the market demand and the commodity pricing advantage.

The company has solid revenue streams and ample resources to carry out its expansion plans for future growth. With the European energy crisis, the company is expected to sign further customer contracts with favorable terms and growth potential, fueling its topline and FCF growth.

The dividend is also a great incentive for investors to hold on to the stock while they wait for capital appreciation amid favorable market conditions. Additionally, the stock has a 24-month beta of 0.5x and a 60-month beta of 0.92x, indicating a stable stock capable of withstanding macroeconomic uncertainties.

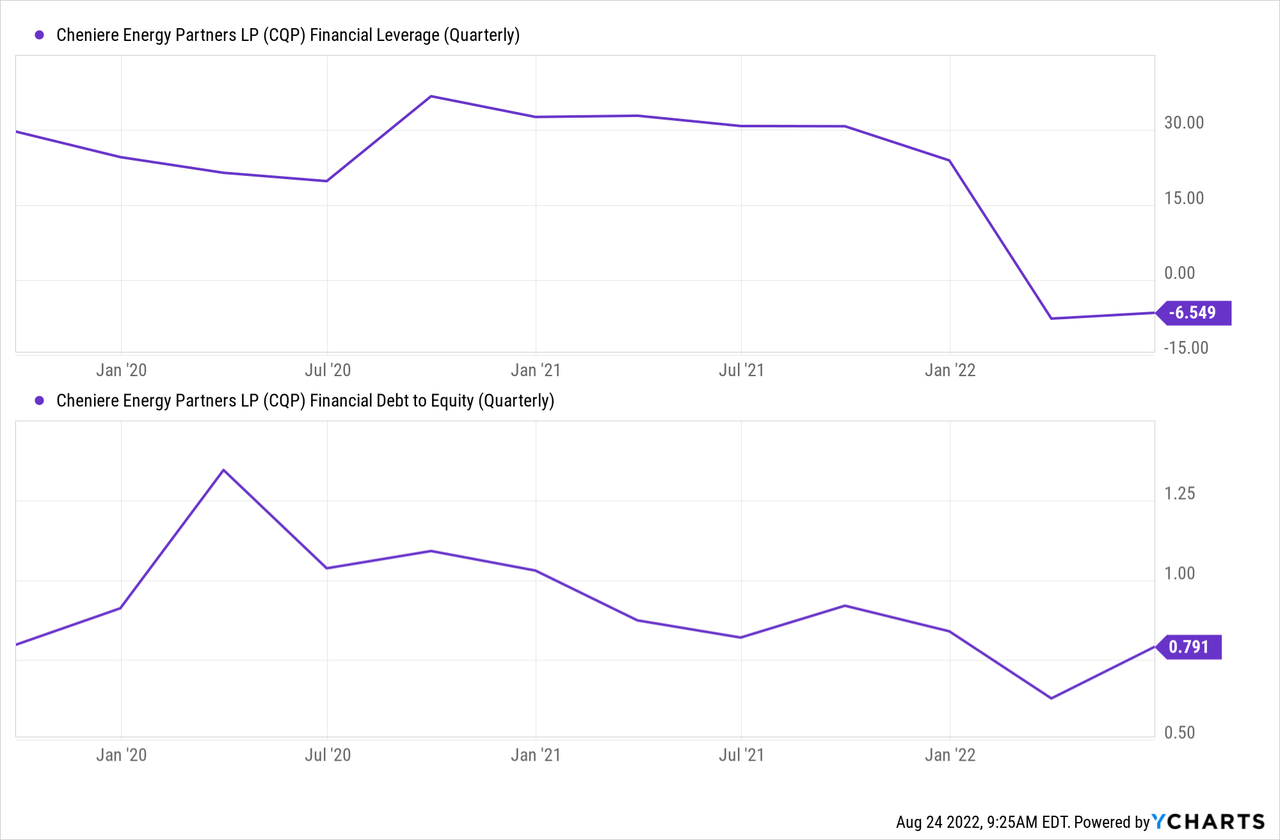

Even though the company’s LT debt of almost $15.7 billion may seem high, the company has made substantial progress in deleveraging itself during the previous years, adding to its financial health, which is likely to substantially improve by the end of 2022 through the significant expected cash inflows, including $765 million from Chevron.

I expect all these factors to amalgamate and result in substantial shareholder returns by the next 12 months while creating added value in the long term, making me rate the stock as a “Strong Buy.”

Be the first to comment