JStuij/iStock via Getty Images

Dear followers/readers,

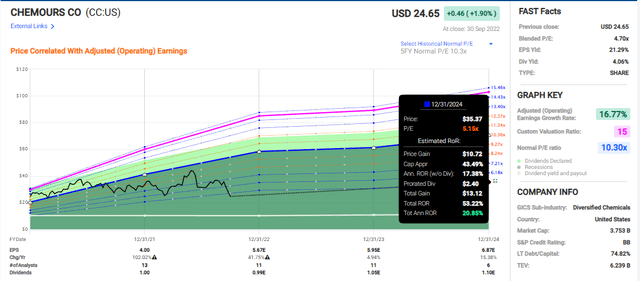

For the past few months and since early 2022, Chemours (NYSE:CC) has been declining further and further, to where it now trades below a 5x P/E multiple. This is a near-insane valuation given that the company is expecting significant EPS growth as we move forward. Despite this forecast, the company is moving in the opposite direction, in terms of price.

Let’s see if there is any possible justification for this.

Updating on Chemours

A 20%+ drop in valuation warrants a valuation update for the company.

Chemours Article (Seeking Alpha)

Not many other contributors (none) have covered the company for the past year. I can understand the reasoning behind this. This is a risky company. This is a company that doesn’t exactly fulfill my demands in the context of fundamentals and historical safety.

Taking the plunge and investing in the company requires some risk tolerance, and also being clear about what you can expect from Chemours. There’s no doubt that Chemours remains a very volatile business. But as with other chemical businesses I invest in, this might eventually be enough to give us an upside here.

However, the market is treating the company as though it doesn’t work in some of the more important areas in terms of chemicals, including AC, Foam, Chillers, Commercial Refrigerants, Fire Suppression systems, and the like. Chemical companies are volatile – no doubt it. But they come back to the “base case” over and over again – consumers can’t do without their products – at least this goes for the quality chemicals companies.

My argument is that Chemours is a quality company, despite its volatility. There are risks to any company – CC included – but focusing on these comes at a cost of ignoring what is obviously a significant potential long-term positive in terms of demand.

Chemical companies have seen these sorts of positive demand trends for over a year now. Companies, CC included, have been able to push price increases in order to retain their margins and offset the cost increases that we’re currently seeing across the entire market. These trends remain, and these trends are why the analysts following the company are expecting an adjusted EPS growth for 2022 of 42% YoY, despite a 102% EPS growth in 2021.

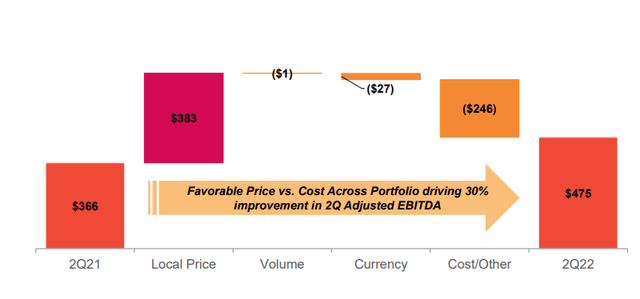

This marks what I believe to be a “new normal” for the company in terms of EPS from which it will grow. The company delivered strong 2Q22 results, and we’re expecting strong 3Q22 results as well, with adjusted EBITDA growth of around 30% YoY.

The company is doing this on the back of Opteon expansion, significant net sales increase, and its raising FCF guidance to $575M+ for the year – or more. Net sales were up 16% YoY for 2Q22, reflecting this demand strength across the company’s portfolio.

Not only that, the company managed to push margins to 25% up from 22% YoY, due to APM mix increase and refrigerant strength. FCF was up 21%, which is in line with company expectations.

These are improvements that come primarily due to pricing. The company is managing to push more than the current cost increase trends to consumers.

The company also expects the cost/other portion of things to keep being an impact, and potentially even grow somewhat going forward.

Safeties are a big concern for a BB-rated company. I will continue to argue that Chemours gives ample of safeties in the form of a strong cash balance of nearly $1.3B. This comes to gross debt of around $3.7B, meaning around $2.5B net, or net leverage on a TTM of 1.6x. This is not a worrying level at all, as far as I am considered.

The company sold non-core assets of around $40Mduring the quarter, and its dividend consumes around $166M on a quarterly basis.

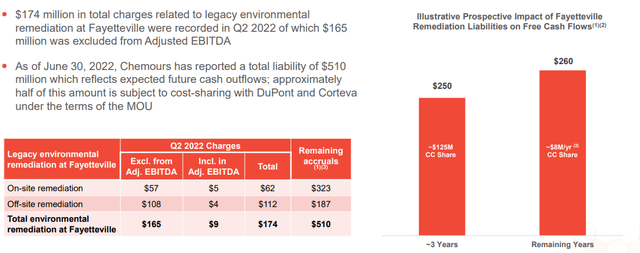

Risk is still a big question here. While many things are going the right way – specifically, the 2Q22 period is a continuation of the 1Q22 “win” with things going the right way. The company still has ongoing risks – such as the ongoing remediation at Fayetteville…

…which all need to be accounted for and discounted when we discuss valuation. However, none of these risks take away from some of the amazing trends that we’re seeing here. Net sales in Titanium tech for instance are up 13% to a record nearly a billion in quarterly sales, and the company is continuing to successfully fight inflation through cost increases. Thermal solutions were even better – up 52% in terms of net sales. Aside from pricing, regulator dynamics are pushing things in the right direction here, and the company managed to increase EBITDA margins by 700 bps.

If any of the upside assumptions, such as recovery, starts materializing, CC expects an EPS that trends slightly north of $5.5 and over half a billion in free cash flow with adjusted EBITDA of over $1.4B – this has been realized as of 2Q22.

As I mentioned, the company isn’t a big dividend bumper. FCF goes to shareholders in the form of buybacks. Given the current company share price, this is actually a pretty good use of capital – and even the yield is now up over 4%.

We do have negative news in the form of the company expecting “no more” than 1.45B USD in adjusted EBITDA, down around $100M, but this would still reflect the growth of close to double digits in terms of YoY. The somewhat weakening demand in 2H22 means that the company is adjusting its production somewhat, as well as doing other cost actions to make sure the company remains competitive.

What I want to clarify with regards to this adjustment, as many analysts call it a “slashing” of guidance. I would closer quantify this as an “adjustment” of guidance, all things considered. Titanium tech was the weaker segment in terms of growth, after all.

So while I understand the decline in valuation as a result of this, I don’t necessarily agree with the degree of decline we’ve seen. Chemicals do remain volatile – and this is a good example of this.

Let’s look at the updated valuation thesis for the company.

Chemours – The updated valuation

There still is no doubt to my mind that there is plenty of upsides to be had for Chemours.

I haven’t had a heavy position in the company for many years, but at this valuation below 5x, I’m going in and buying the company’s common shares. You could go for options as well, but at this price, I believe you might as well go for the common share.

Remember – COVID-19 lows were extreme for the company, just as this valuation drop has been extreme. If you invested during the COVID-19 crash, your current RoR for Chemours would be nearly 250% – and this might be a repeat performance here. Remember also, that Chemours quite often beats estimates.

I view it as entirely possible that the company might deliver much better results than we expect them to do. Even if they do not, and results are more moderated or towards the negative, you’ll still have bought one of the world’s more significant refrigeration gas/product companies at what can only be described as a significant discount.

10-12x P/E is a bit high to expect from this company at this valuation – it would be more than double. But I would consider it likely that this company can average 5x P/E.

Wouldn’t you?

Based on a 5x P/E forward valuation, the upside for Chemours here is higher than 10% annually.

In fact, it’s even higher than 20%.

Chemours Upside (F.A.S.T. Graphs)

There comes an inflection point in every dividend-paying business when the potential downside becomes so small that the cost for investing in the form of risk becomes worth it, because even on a completely base-level flat thesis, you’re likely to generate good returns.

I believe Chemours has reached a point where it should no longer be ignored by investors. I would argue that the company most likely has that sort of upside here. There are A-rated companies with higher upsides and almost 3x the yield available on the market today in exactly the same, or other sectors. But at this price, which is 25%+ below my last stance, with an expectation that now includes massive earnings growth, and a set of expectations that I actually consider quite plausible, I’m now finally ready to buy the common share of the Chemours Company.

This is reason enough for this article, and this is why I’m writing this. Because as of now, I’m starting to expand my position in the common share, not just potential option contracts.

Current Thesis

My current thesis for Chemours Company is the following:

- The company is fundamentally appealing due to its chemical portfolio but is hounded by potential legal issues and risks – both future and historical, as well as an unappealing liability profile. This needs to be discounted for, but it’s entirely possible to do so – just keep your targets below 11-13x P/E and a share price of $40/share.

- Improved outlooks have proven my initial bearishness to be exaggerated. I change accordingly and give the company allowance for future outperformance. I bump my price target here.

- I keep CC as a “BUY” and “Bullish” rating, with an overall price target of $35, below the current analyst average, but considered fair on a peer and risk/reward comparison.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

This company is overall qualitative. This company is fundamentally safe/conservative & well-run. This company pays a well-covered dividend. This company is currently cheap. This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment