peterschreiber.media/iStock via Getty Images

We are what we pretend to be, so we must be careful about what we pretend to be.”― Kurt Vonnegut

Today, we take a deeper look at a name that comes up from time to time in comments from Seeking Alpha followers. We last posted an article on this small-cap name in December after it had recently garnered a key FDA approval. We follow up on how the company is progressing in the analysis below.

Company Overview:

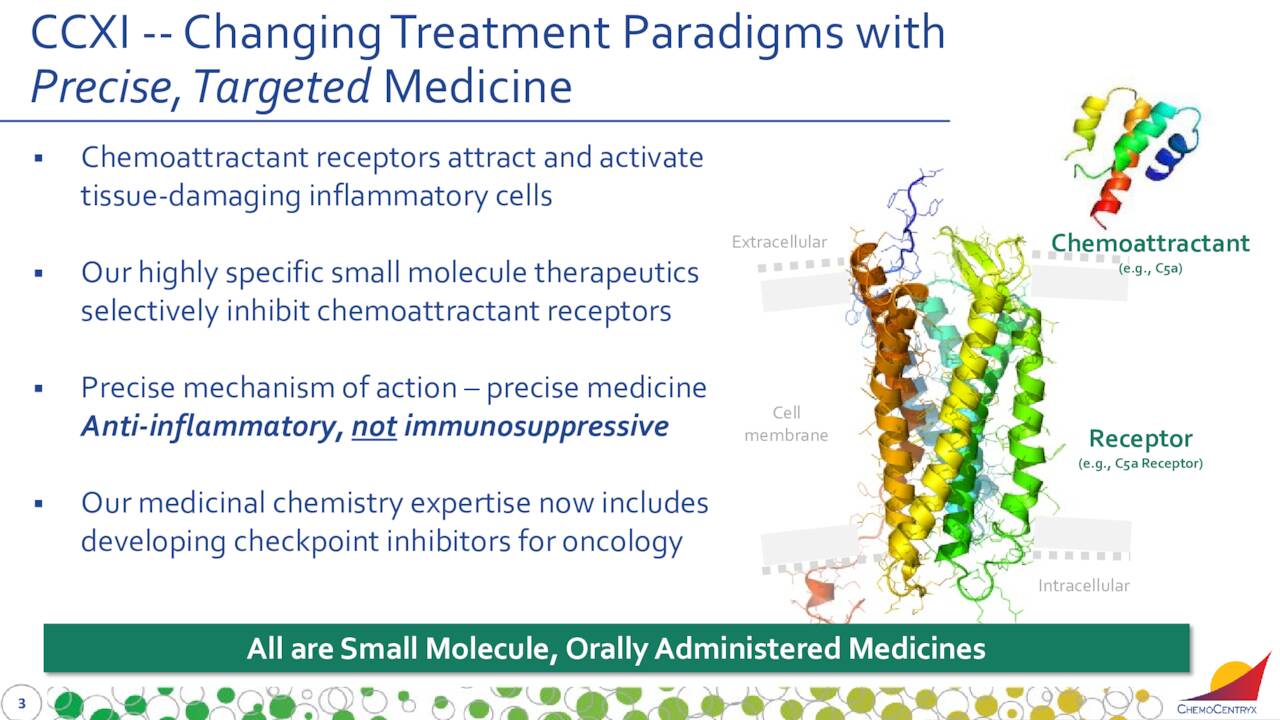

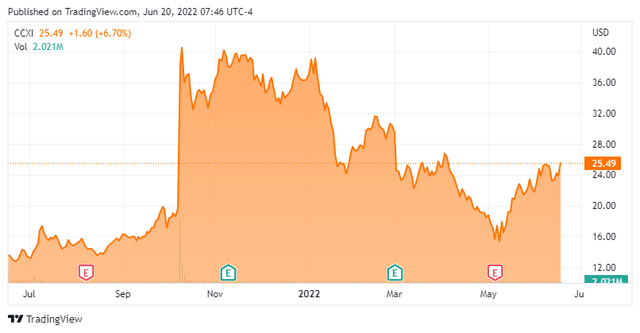

ChemoCentryx, Inc. (NASDAQ:CCXI) is focused on the development and commercialization of new medications for inflammatory disorders, autoimmune diseases, and cancer. The firm is based just outside of San Francisco. The equity currently trades around $25.50 a share and sports an approximate market capitalization of $1.8 billion.

May Company Presentation

When we last looked at this company, it was only two months removed from seeing the FDA approving its primary drug candidate TAVNEOS as an adjunctive treatment of adult patients with severe active antineutrophil cytoplasmic autoantibody-associated vasculitis (ANCA vasculitis), in combination with standard therapy.

This was a big win for the company even as the drug is targeted at a small subset of the vasculitis population. The drug has been launched in the United States where it owns all rights. TAVNEOS has also been launched in Germany and Austria by partner Vifor Pharma, which owns rights outside of the United. ChemoCentryx gets royalties in the mid-teens to mid-twenties on all sales outside this country. TAVNEOS has also garnered approval in the U.K. and Canada.

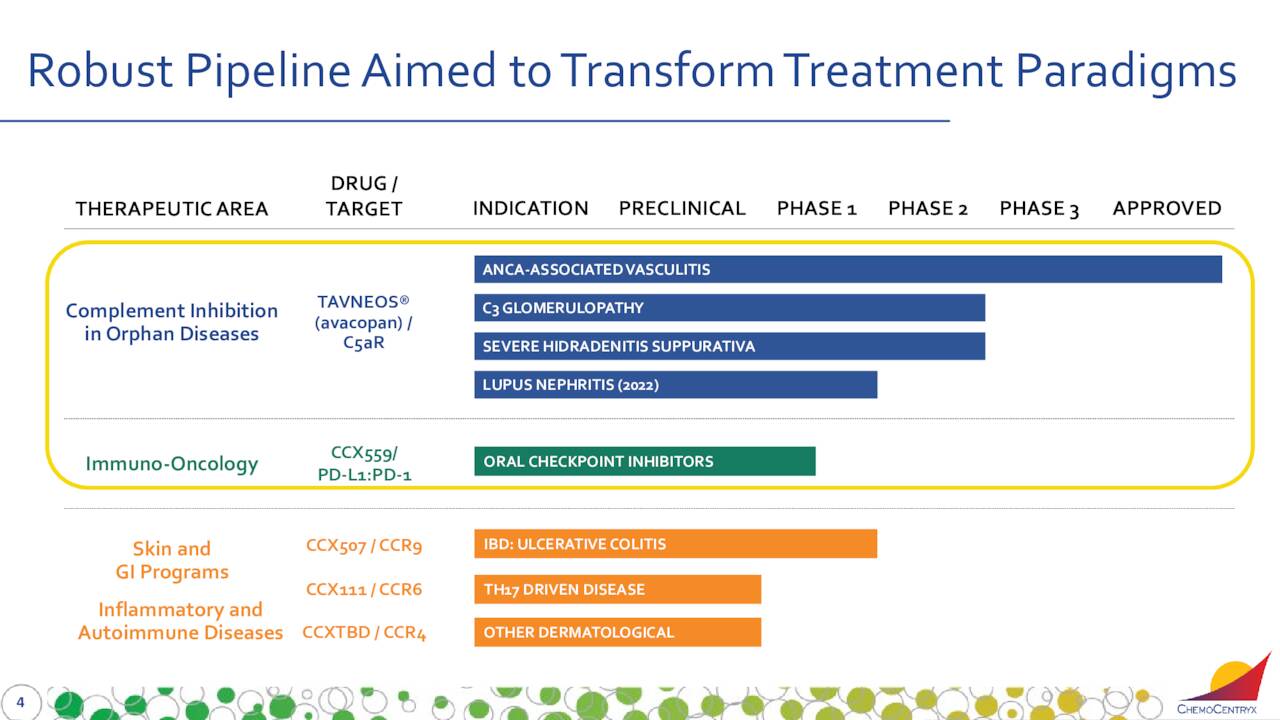

May Company Presentation

TAVNEOS is also being developed for other afflictions. The company has other compounds in earlier stage development, but they will not be germane to this analysis.

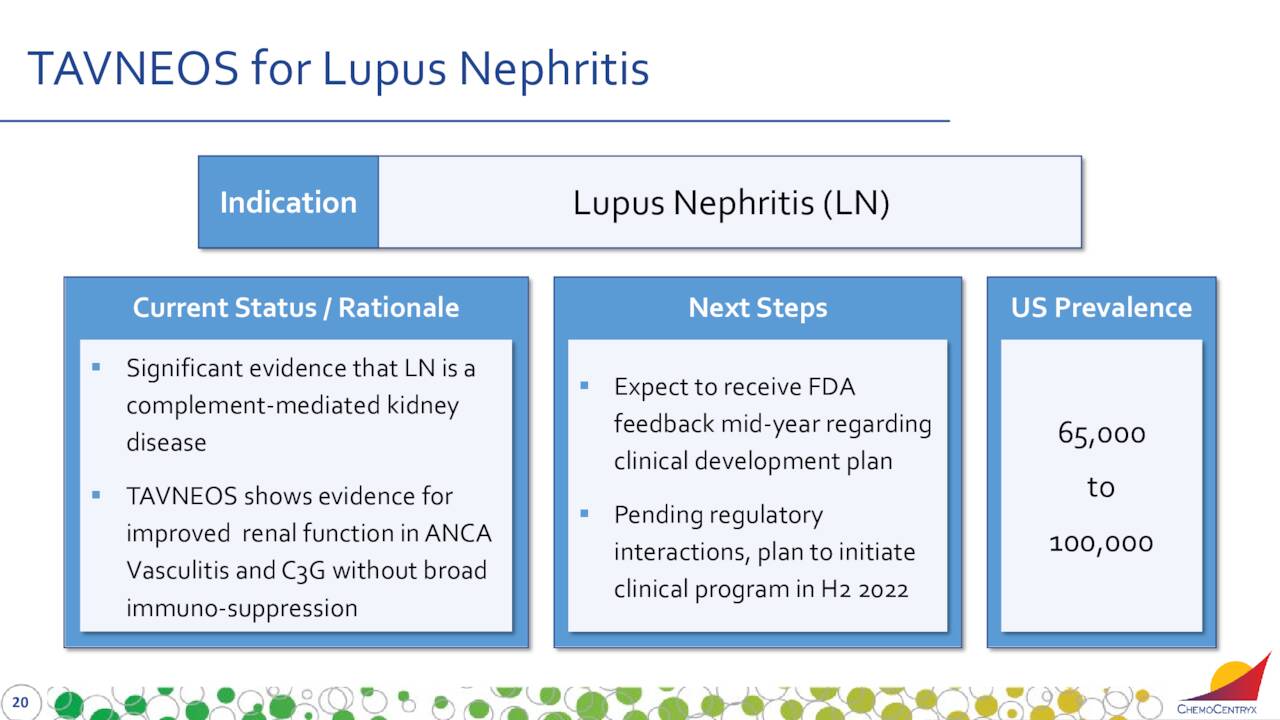

This compound is targeting Lupus nephritis or LN. LN is a kidney inflammation caused by systemic lupus erythematosus (SLE or lupus).

May Company Presentation

ChemoCentryx expects to receive feedback from the FDA soon regarding the clinical development plan for this indication, which it plans to initiate during the second half of 2022.

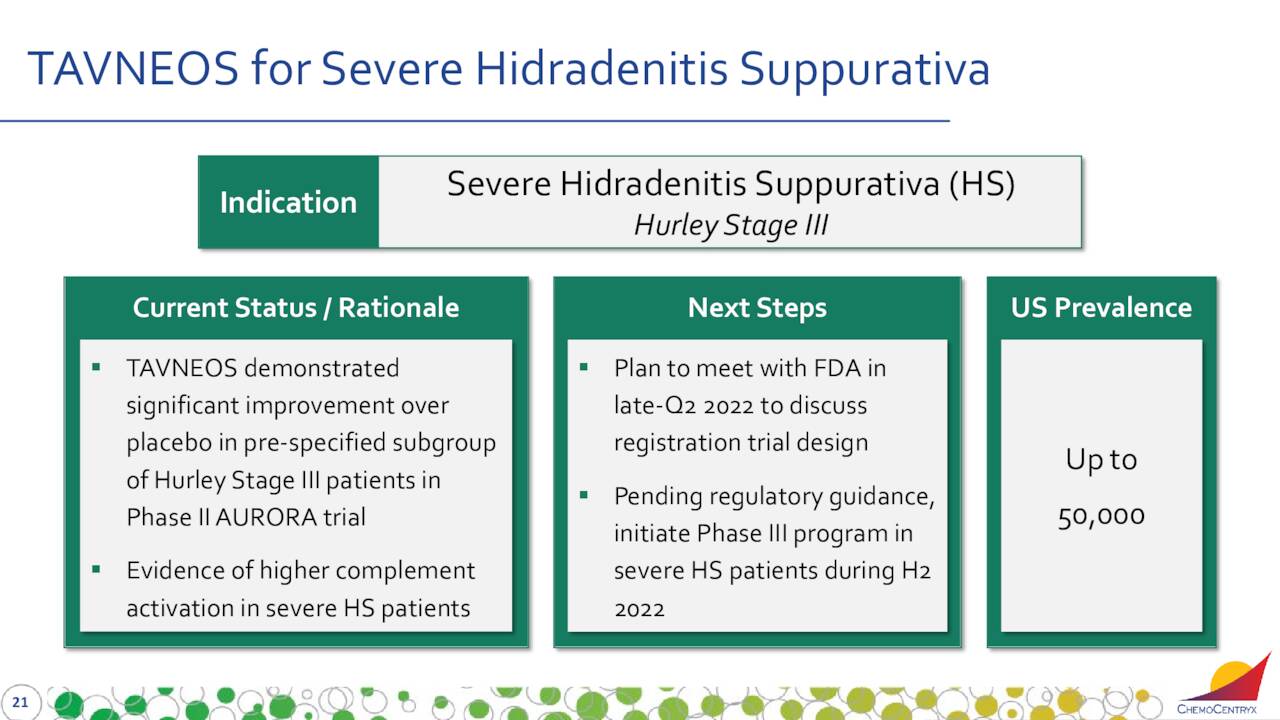

TAVNEOS is also being developed to treat severe hidradenitis suppurativa (HS). This is a chronic skin disease, which causes painful, boil-like lumps that form under the skin and often secrete pus and blood.

May Company Presentation

The Company plans to meet with the FDA to discuss the Phase III development of TAVNEOS in patients with Hurley Stage III (severe) HS late in the second quarter. Leadership has a goal of initiating a Phase III clinical trial in those patients in the second half of this year.

Finally, TAVNEOS is aimed at C3 glomerulopathy or C3G. There are no FDA-approved therapies for C3G, which is a group of related conditions that cause the kidneys to malfunction. Management anticipates meeting with the FDA during the second half of this year to discuss the dataset from a Phase II clinical trial ‘ACCOLADE’ of TAVNEOS to treat C3G.

First Quarter Results:

On May 5th, the company posted first quarter numbers. ChemoCentryx posted a GAAP loss of 55 cents a share on revenues of just under $5.5 million. Both top and bottom line numbers missed expectations significantly. Net product sales in the U.S. rose more than 500% from the fourth quarter to $5.4 million. Collaboration and license revenue made up the rest of sales.

A $45 million regulatory milestone payment ChemoCentryx garnered for TAVNEOS approval in Europe during the first quarter of 2022 will be recognized over an approximate four-year period. The timing of recognition was most likely the primary factor behind the company’s first quarter ‘headline‘ miss. Royalties from sales in Europe should start to flow in and be reported starting in the second quarter earnings report.

Analyst Commentary & Balance Sheet:

Over the past six weeks, four analyst firms, including Raymond James and Stifel Nicolaus have reissued Buy ratings on the stock. Price targets proffered range from $64 to $106 a share. On May 10th, JPMorgan maintained their Hold rating on the stock but boosted their price target from $30 to $34 a share.

Just over eight percent of the outstanding float in this equity is currently held short. Insiders have sold a little less than $100,000 worth of shares so far in 2022. There has been no insider purchases of the shares this year. The company ended the first quarter with just over $370 million in cash and marketable securities on its balance sheet against negligible long-term debt after posting net loss of $38.6 million during the first quarter.

Verdict:

The current analysis consensus has ChemoCentryx posting a net loss of just under two bucks a share as revenues more than double to nearly $70 million in FY2022. Further improvement is projected in FY2023 with revenues soaring to north of $190 million and the net loss being cut to some 75 cents a share.

May Company Presentation

The company seems to be executed well on the development and rollout of TAVNEOS. The balance sheet appears to be in solid shape and quarterly cash burn should start to come down as TAVNEOS gains sales traction. Initial rollouts always seem to have some hiccups, especially for small-cap companies in this pandemic age. Analyst firms are modeling impressive revenue growth for this company.

We concluded our first article on ChemoCentryx stating it deserved a small ‘watch item‘ position. That continues to be the case as the company pushes TAVNEOS development ahead. Options are available against the equity and they are both liquid and lucrative. Therefore, I will continue to hold my small position in this name via covered call holdings.

We delight in the beauty of the butterfly, but rarely admit the changes it has gone through to achieve that beauty.”― Maya Angelou

Be the first to comment