Editor’s note: Seeking Alpha is proud to welcome Sweet Minute Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Marko Geber

Introduction

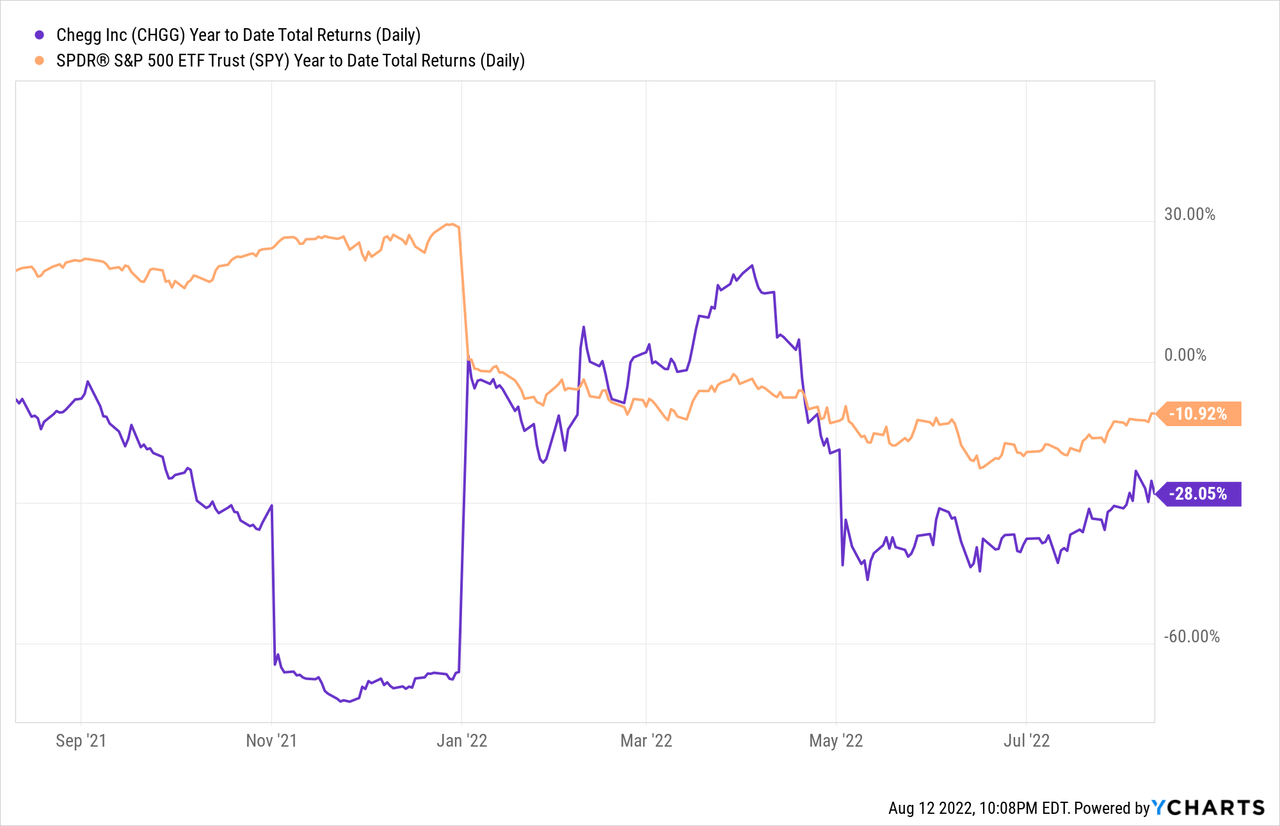

Chegg, Inc. (NYSE:CHGG) has seen a volatile yield, and despite the recent market rally, the stock is still down nearly 30% YTD as of the time of this writing. In our view, the company has been unfairly punished and treated by the market as similar to companies with little to no earnings and with an unproven business model. However, Chegg, Inc. has shown to be a profitable business during the last few quarters of uncertainty, and the company is poised to become a Wall Street darling once macroeconomic conditions stabilize and investors see the company’s market opportunities.

[object HTMLElement]

Chegg’s Rapid Expansion of Services

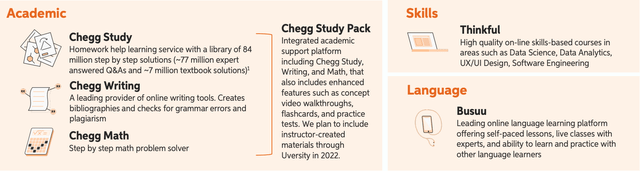

Chegg, Inc. used to be a simple website with access to solutions to textbook problems only a little while ago. Now, with stellar strategic execution and aggressive acquisitions, Chegg, Inc. now offers a full suite of services to subscribers, such as tools like Chegg Math, skills-based learning platforms like Thinkful, and an online language service called Busuu – a recent acquisition. Management has already signaled for more acquisitions to come, and we believe that the uncertain macroeconomic environment will allow a fairly well-capitalized company like Chegg (~more than $1.5 billion in current assets) to make accretive acquisitions that fit in with the business strategy over the next few years. The continued scaling of content provided and the healthy financials will allow the company to expand its operations and appeal to non-US markets, and fill in any void left by the dismantling of Chinese education companies by the Chinese government.

Robust Financial Performance

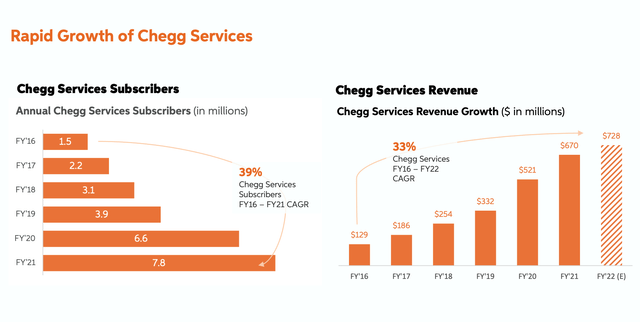

Despite the ugly macroeconomic backdrop and the decline of pandemic-related tailwinds, Chegg, Inc. has continued to grow its business, increasing its core services revenue by 29% YoY (Year-over-Year) and its subscriber base by 18% YoY to 7.8 million subscribers in the Fiscal Year 2021 as reported recently on 2022 Q2 earnings announcements. It is interesting to note here that Chegg now has 1.5 million international subscribers, and 11% of its revenue comes from non-US markets – which shows the global reach of the edTech business. In addition to the top-line growth, the company has solid Free Cash Flow generation, and management has recently guided $225 million to $235 million in Adjusted EBITDA for the Fiscal Year 2022, with a roughly 50% – 60% FCF margin. That is outstanding FCF generation for a company operating in an unfavorable environment. It is no surprise that given the financial performance, Chegg has initiated an expansion of its previous buyback program of $2 billion, up from $1 billion from its previous announcement. This buyback program will continue to increase shareholder value for investors for the foreseeable future.

Unrealized Monetization Potential

According to the recent earnings announcement, Chegg, Inc. has seen 39% CAGR of Chegg Services Subscribers from the Fiscal Year 2016 to the Fiscal Year 2021. The subscriber growth will prove to be key business strategy in the long run, as given the recent 2021 FY revenue of $670 million, the revenue per subscriber only stands at $85.90. Though Chegg has amassed 7.8 million subscribers, Chegg still has great opportunities for growth. For example, in the United States alone, there are nearly ~50 million public school students (K-12). As more and more students rely on education resources online and as students become more ingrained in education technology (and traditional forms of in-person education get displaced), Chegg, Inc. will see not only its number of subscribers rise, but the company will have ample opportunities to increase the revenue per subscriber as they put out more offerings and expand its value proposition by packaging more services and cross-selling services to its subscriber base. With more scale, Chegg, Inc. has the potential to be an unstoppable force in the burgeoning edTech industry.

Valuation

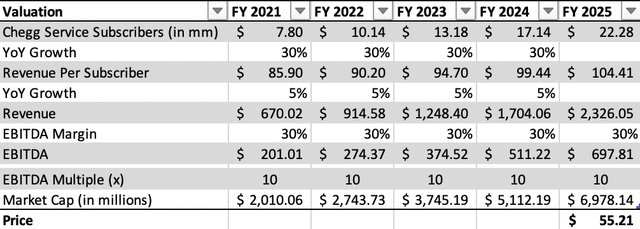

We derive the value of the company’s market capitalization in 2025 by assuming a 30% CAGR in the Chegg Services Subscribers and a modest growth in the revenue per subscriber. Assuming a 30% CAGR from the number of subscribers in 2021, by Fiscal Year 2025, the company will have 22 million subscribers globally. With a 5% growth in revenue per subscriber (which would be in-line with short-term inflation expectations), the revenue per subscriber would sit at around ~$100. This would mean that by 2025, the company will be generating $2.2 billion in revenue, which would translate to roughly ~$700 million in adjusted EBITDA assuming the same adjusted EBITDA margin as FY 2021. With an 8.0x – 10.0x P/EBITDA multiple (lower-bound of industry EBITDA multiples), the company would be valued at around $5.6 billion to $7.0 billion in FY 2025 which represents a share price of $44.17 to $55.21. Based on our conservative assumptions, the investment thesis presents a 100% to 150% upside from its current levels.

Risks & Competitive Landscape

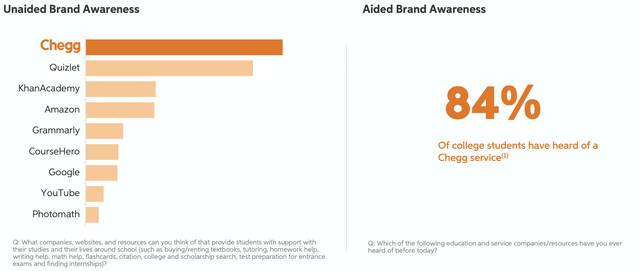

We believe that the biggest risk facing Chegg, Inc. is threat from competition. There are numerous players in the space given that the industry is relatively nascent, and there are many established incumbents and growing start-ups that could potentially affect Chegg’s business and/or its pricing power. For example, Datacamp and Coursera (COUR) are all examples of companies that could potentially launch services/products similar to Chegg, Inc. and create competitive pressures that will impact its long-term financial results. However, we believe Chegg is well positioned to withstand competitive pressures given that the market as a whole is growing at a rapid rate (~17.8% CAGR until 2029) and Chegg has some of the highest brand recognition among consumers. For example, Chegg reports that 84% of college students have heard of a Chegg service. Brand recognition is important, as Chegg will have an advantage gaining new customers through its brand, in contrast to new start-ups that would need to spend heavily to increase their brand awareness.

Conclusion

Chegg, Inc. has had eye-watering growth in the past decade, and the company is well poised to come out stronger after the turbulence in the market ends. Even during the past few quarters of uncertainty, the company has printed positive adjusted EBITDA, and management has shown confidence in the company with a large stock buyback program. In addition, based on reasonable growth assumptions based on historic performance, the company presents an outstanding risk-reward proposition thesis in an industry of secular growth.

Be the first to comment