Photoboyko/iStock via Getty Images

Not many other sectors have as much promise as CBD, but no other sector has struggled as much in the last couple of years. Charlotte’s Web Holdings (OTCQX:CWBHF) is a leading brand in the sector and hasn’t seen the business grow in nearly 3 years. My investment thesis remains ultra Bullish on the FDA or Congress finally regulating CBD in food products.

Another Bad Quarter

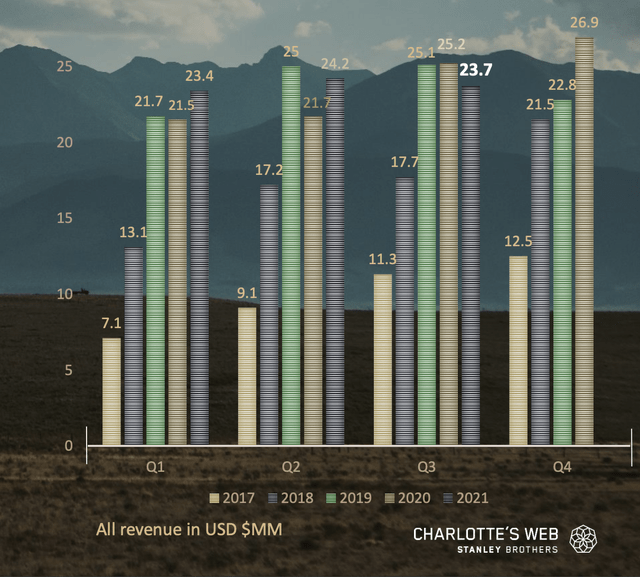

CWH has moved into new CBD products, yet the company has made absolutely no progress in growing revenues since revenues last jumped in 2019. The company reported Q4’21 revenues grew 5% sequentially, but revenues fell by nearly 8% from the prior year level.

Since 2019, CWH has struggled to grow revenues beyond the $25 million quarterly rate. The last 3-years have been very painful for a stock that once traded above $20 on the hype of CBD sales surging following the 2018 Farm Bill approval legalizing hemp.

Source: CWH Q3’21 presentation

The problem isn’t exactly the fault of the company. The CBD (cannabidiol) market hasn’t gone anywhere in 3 years, but investors need to use the opportunity to prepare investments for the future market opportunity.

CWH has a distribution agreement in Israel, grows hemp in Canada and just signed a retail distribution agreement in the U.K. to help the company move beyond a reliance on a slow developing U.S. market. Along with the U.S. pet market, the company has the growth opportunities in the CBD space, but the U.S. market has been far too tough to top declines in the sector.

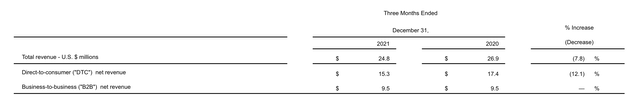

A prime example of how tough the domestic CBD market has become is that CWH added over 1,000 doors in the December quarter and B2B net revenues were flat YoY at $9.5 million. With about 15,000 retail locations and 8,000 healthcare practitioners’ offices, the comp sales would’ve fallen ~4% during the quarter, assuming these new stores were running at average sales rates.

Source: CWH Q4’21 earnings release

Even the passing of California Assembly Bill 45 added 400 doors for CWH CBD products during the quarter, but the business didn’t grow YoY. The bill legalized hemp CBD in the state and promises to offer CBD a path to legalization similar to how THC products have become legal in certain U.S. states while the Federal government still hasn’t approved marijuana.

Steep Discount

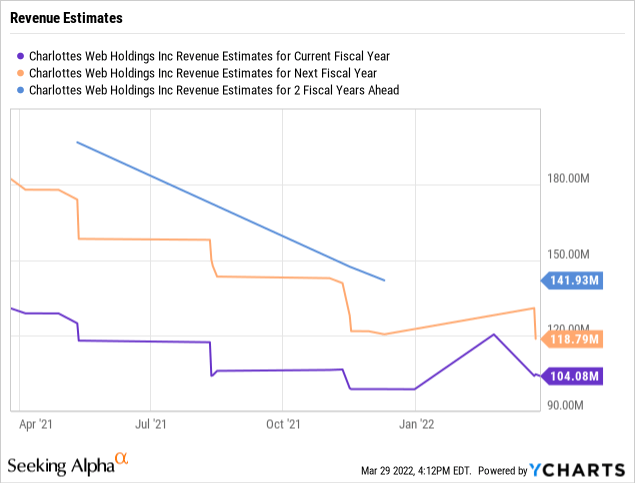

The stock trades barely above $1 for a market cap of just $180 million now. The company has a revenue run rate of $100 million with limited growth potential due to the current legal issues in the U.S., but the long-term opportunity hasn’t changed.

CWH has long suggested the food/drug/mass, or FDM, market segment offers up to 85% of the sales potential in the CBD market. Currently though, the company obtains over 60% of sales from the DTC channel due to the lack of FDM stores selling hemp-infused ingestibles due to regulatory concerns.

The stock isn’t going to rally much in this environment with the limited cash balance. The risk for an investor staying on the sidelines is missing a big rally on the approval of a bill such as Federal Bill H.R. 841 or strong sales in any international location.

The market saw the rally in some of the cannabis stocks last week on prospects for a vote on a cannabis bill unlikely to obtain Senate approval. The much smaller CBD leader would see a similar, if not larger rally, on a CBD bill. The big downside risk remains an extended period of Federal inaction requiring the company to raise more cash via the ATM. CWH raised $8 million during the year to boost working capital currently only sitting at $30 million, including the $10 million tax refund from the IRS.

Takeaway

The key investor takeaway is that CWH faces a tough period due to Federal inaction. The stock is cheap and likely not to rally any time soon, but an investor on the sidelines is likely to miss any ultimate rally on the FDA finally regulating CBD.

Be the first to comment