sefa ozel/E+ via Getty Images

During the Daily Journal’s recent annual meeting, billionaire Charlie Munger – one of history’s greatest investors and Warren Buffett’s right-hand man at Berkshire Hathaway (BRK.A) (BRK.B) – recently predicted that a painful crash is coming:

What we’re getting is wretched excess and danger for the country. Everybody loves it because it’s like a bunch of people getting drunk at a party; they’re having so much fun getting drunk that they don’t think about the consequences. Eventually, there will be considerable trouble because of the wretched excess, that’s the way it’s usually worked in the past.

This ominous warning comes on the heels of his previous warning of a “lost decade” for investors, emphasizing to investors that this is a concern that is clearly on Mr. Munger’s mind a lot.

Four Reasons Why A Painful Crash Is Coming

Why might he be concerned about the outlook for the stock market right now?

First and foremost, interest rates are much more likely to head higher than lower in the near term, which – as his colleague Warren Buffett likes to say – means that the force of gravity on equity valuations will be increased. In fact, if inflation continues to rage near its current four decade high levels, there is a high probability that interest rates will be forced meaningfully higher.

Second, with equity valuations already at nosebleed levels and the inflation rate soaring, the potential to generate impressive real returns is becoming increasingly challenging as multiple contraction is increasingly more likely than multiple expansion (due to the likelihood of rising interest rates in response to rising inflation) and the high inflation rate sets a higher bar for corporate growth and dividend payments to generate a real return net of inflation.

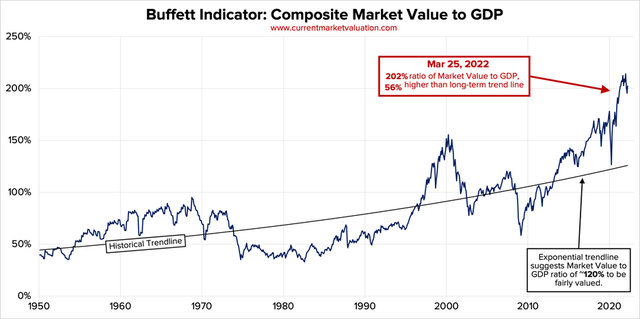

Third – building off of point two – the Buffett Indicator – one of Buffett’s favorite metrics for determining how attractive the collective market is – indicates that the market is way over valued and increasingly likely to generate disappointing returns moving forward:

Buffett Indicator (currentmarketvaluation.com)

Last, but not least, the “wretched excess” that Mr. Munger refers to in his comments means that – likely due to distorted interest rates, massive money printing, and government interference in the economy – there is gross misallocation of capital going on right now. In fact, at the same Daily Journal annual meeting Mr. Munger explained:

I would argue venture capital is throwing too much money too fast, and there’s a considerable wretched excess in venture capital and other forms of private equity… We have a stock market which some people use like a gambling parlor… There’s never been anything quite like what we’re doing now. We do know from what’s happened in other nations, if you try and print too much money it eventually causes terrible trouble.

Our Top Market Crash Portfolio Insurance Pick

With these cautions in mind and a desire to pay respect to Mr. Munger’s track record for investing excellence, we are becoming increasingly cautious of a potential market crash and the ramifications it might have for our portfolio.

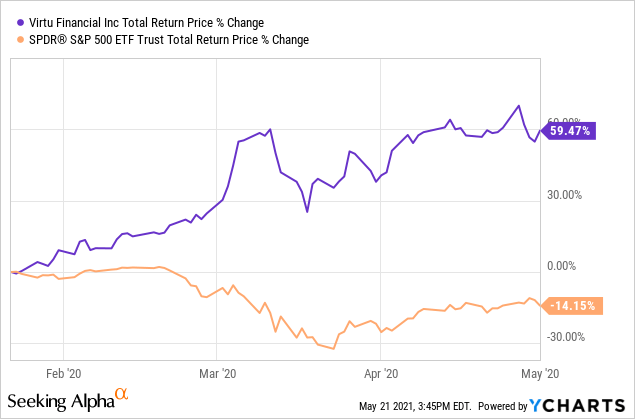

Our top market crash portfolio insurance pick is Virtu Financial (VIRT). It is a high-frequency trader that benefits from increased market volatility. It saw a massive surge in profitability during both the Great Financial Crisis as well as the COVID-19 crash. While it was privately held during the 2008-2009 era, its stock price soared even as the S&P 500 (SPY) (VOO), Nasdaq (QQQ), Dow Jones (DIA), and REITs (VNQ) crashed during the COVID-19 outbreak.

VIRT vs SPY (YCharts)

Even in recent months, as volatility has returned with soaring inflation and geopolitical tensions, VIRT has once again left the market in the dust. We bought heavily between late September and late October at a weighted average price of $24.48. Since then, the stock has generated total returns of ~54% while the SPY is up only 5%, VNQ has generated only ~5% returns, QQQ is up only ~1.5%, and DIA is up only ~2%.

Even still today, VIRT remains reasonably valued in a market of richly valued stocks, with a 10.8x forward P/E ratio and a 2.6% dividend yield. Even more impressively are its numerous high return on investment organic growth initiatives as well as its very aggressive share buyback program. In a little over a year since initiating the buyback program, VIRT has reduced its share count (net of stock-based compensation) by 6.4%.

On the most recent earnings call, the CEO expressed optimism that organic growth initiatives in areas like options, fixed income, and cryptocurrency in particular would continue to grow successfully and add to the company’s baseline profitability, and management hinted at continued strong performance by stating that they continue to outperform the broader market metrics.

While VIRT is way up for us from when we bought it for our real money portfolio at High Yield Investor, it remains an attractive pick for portfolio insurance. It is essentially a way of owning the S&P Volatility Index (VIX) but with the bonus of receiving a nice quarterly dividend and steady growth via organic growth initiatives, occasional strategic acquisitions, and share buybacks. VIRT remains firmly in BUY territory, and we plan to continue holding it as a nice portfolio diversifier.

If/when the next major market crash comes, we plan on capitalizing on the boost to VIRT by trimming our position and recycling the proceeds into attractive opportunities. For that reason, we currently hold an overweight position in VIRT.

Investor Takeaway

While we have been very blessed to have seen our portfolio rise substantially over the past six months even as the broader market has declined, we are not resting on our laurels or taking anything for granted.

Given Charlie Munger’s ominous musings concerning the stock market’s outlook, we are being more cautious than ever. We believe that by overweighting dividend paying stocks like VIRT that benefit from increased market volatility and have seen a surge in profitability (and share price) during past market declines, we are able to optimize our risk-reward.

As a result, we can remain fully invested in a portfolio of high quality undervalued stocks that pays a 5%-6% weighted average yield while sleeping well at night.

Be the first to comment