Rawf8/iStock via Getty Images

When you think of the drug development process, what do you envision? Creating a magical compound in a garage somewhere and then simply putting out a press release for the world to rejoice? Of course not, real life is not a 1990s movie.

Drug development is a truly painful and dreadfully slow slog of regulations, manufacturing, modeling, safety protocols etc. It can be summed up as 2 steps forward and 1.99 steps backwards, over and over again for around a decade.

Only a very, very few companies both have the resources, infrastructure and willpower to accomplish the feat of taking a potential drug from idea, through to the marketplace without the significant help of third parties. Enter Charles River Labs (NYSE:CRL).

Overview

This area between a drug idea and a drug reaching the consumer is where Charles River Labs shines. Charles River Labs, or “CRL” for short, originally built its reputation around providing the highest quality animal research models in the business.

Over time, the company consistently expanded its offering to include items such as complete drug discovery, preclinical testing, and manufacturing support and today it services nearly all top and mid-tier biopharma players in one form or another.

The company claims to have been a part of the development process of over 80% of FDA approved drugs in the last 3 years. This should demonstrate not only the breadth of the company’s reach, but also its ability to garner trust amongst its customers.

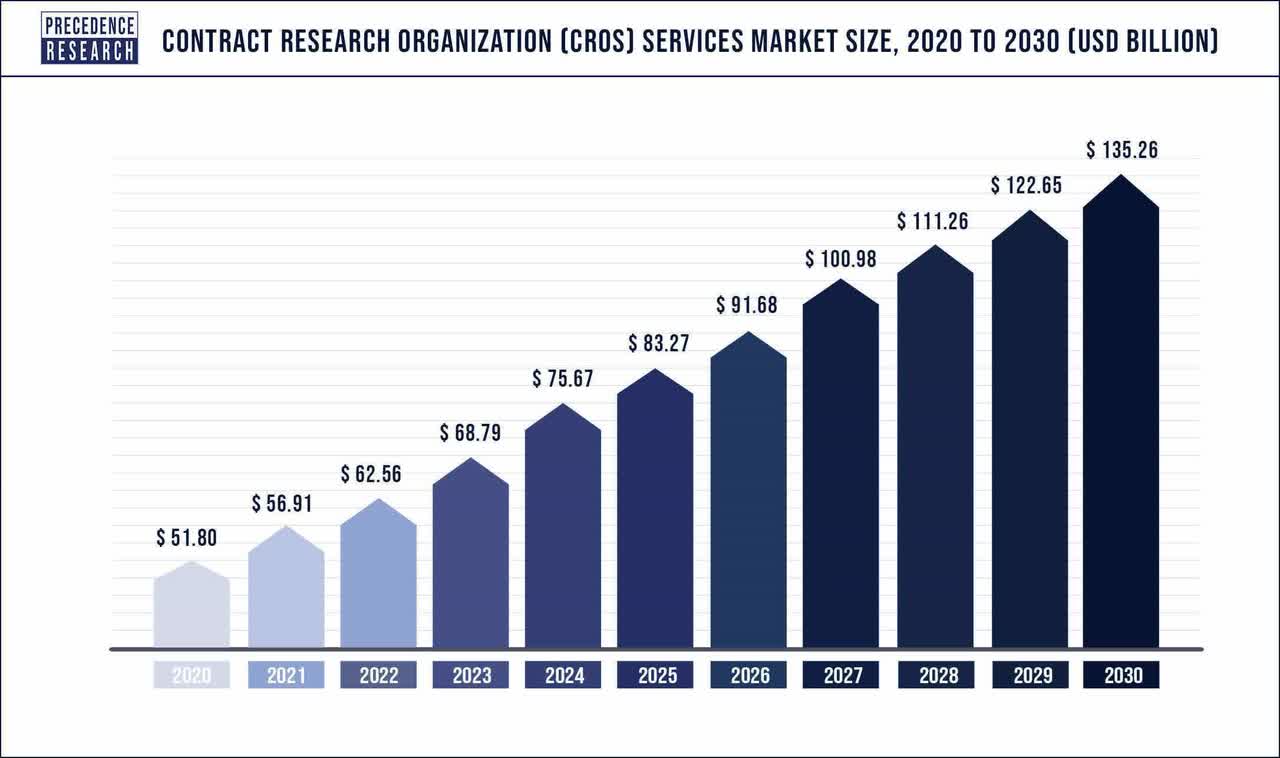

As of 2021, drug discovery and safety assessments make up nearly 60% of CRL’s revenue and the trend of outsourcing to CROs looks set to continue to increase for many years to come.

Precedence Research

With the rise of cell and gene therapies, along with innovative new drug mechanisms of action currently in development, the medical field looks to be on the cusp of a new golden age in drug development.

The reason why this is important to CRL is that in many cases, these new and exciting therapies in development require entirely new facilities and infrastructure to take a drug from a computer screen, through to the clinic and CRL has invested quite a bit in making sure that it can be the partner of choice for these newly developed programs.

The company in 2021 acquired two key pieces to the puzzle in the cell and gene therapy market by way of the acquisitions of Cognate Bioservices and Vigene Biosciences, which both specialize in the manufacturing and production of cell and gene therapy lines.

These purchases, along with the other investments the company has made in recent years have solidified CRL’s place in this emerging and exciting field going forward. CRL estimates that the cell and gene therapy field alone is currently a $2.5 billion opportunity that will grow at 25%+ rates over the next 5 years.

The company is certainly confident of its own prospects and at the 2021 investor day issued 2024 guidance of low double digit organic revenue growth, which would be an acceleration from the previous 5 year period. In addition, the company expects EPS growth to exceed revenue growth going forward thanks to improving margins and scale in the business.

While the company certainly has a rosy outlook for the future, the current picture is a bit more muddied given short term headwinds of massive currency fluctuations, rising interest rates and a retooling of a manufacturing facility that previously was producing COVID-19 vaccines.

These headwinds contributed in a muted 2022 outlook and exacerbated the decline in shares so far this year. The company has indicated that these truly are temporary headwinds and that the long-term picture remains fully intact, however in the current environment, it would not surprise me if more near term turbulence is experienced in the short-term given the disruption of shifting from COVID-19 to regular business.

Valuation

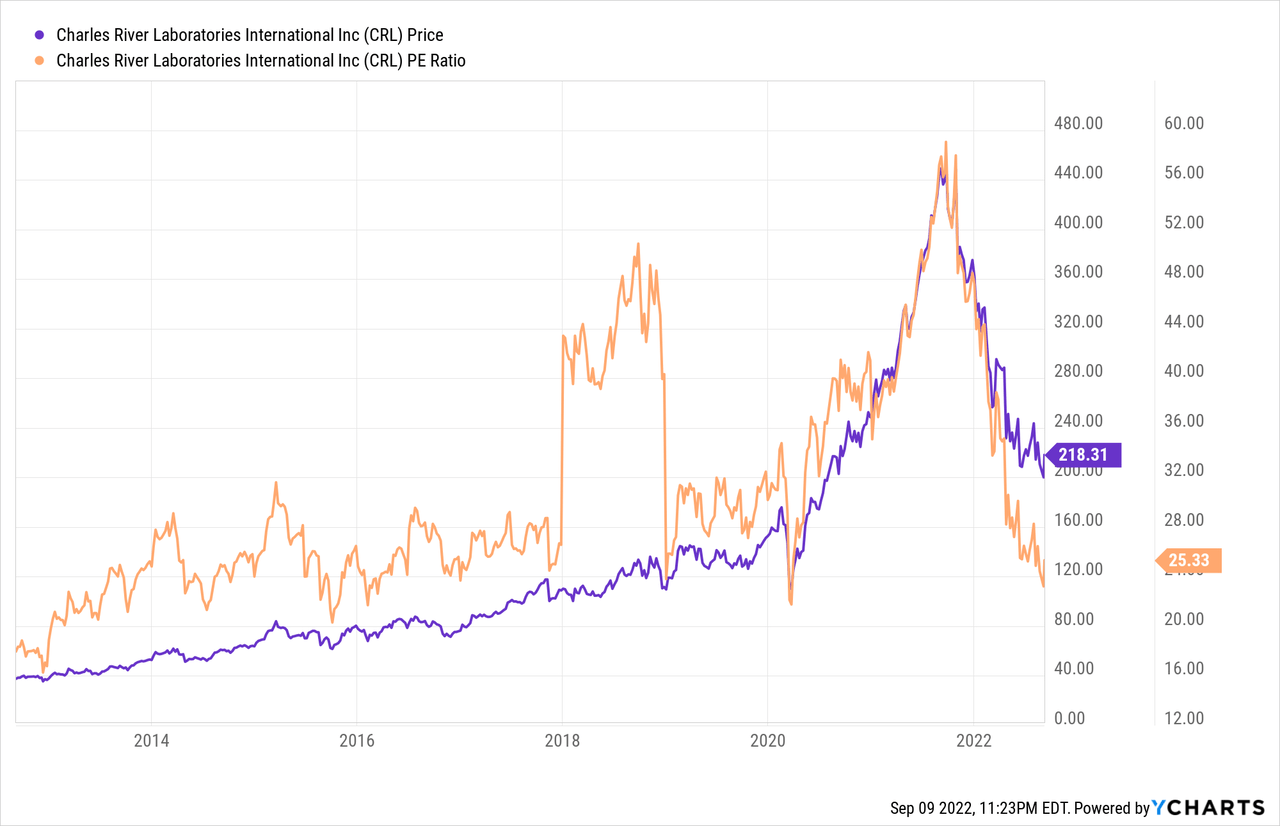

Charles River Labs has been a truly phenomenal long-term investment for those lucky enough to have invested many years ago, but if you were unfortunate enough to have invested in late 2021 or so far this year, you are likely not a happy camper.

CRL shares appeared to have been shot out of a cannon in early 2020 during the pandemic, rising to over $450 a share before the current precipitous, but predictable decline ensued.

As you can see by the very interesting chart above, the company has completed a full round trip in valuation levels as measured by the PE ratio. The 10 year average PE ratio of the company sits around 28, firmly above the current 25.33. In addition, the 2022 forward PE ratio is only 20.23, which is well below the company’s long term trend line.

The company does carry a bit of debt, currently sitting at $3.4 billion, however the company has produced roughly $430 million in free cash flow on average over the past 4 years and the debt maturity profile is very reasonable. The one caveat to this is that the company has exposure to floating rate debt, which makes the steady rise in interest rates a bit of a concern.

Management has stated that it does plan to address the floating rate debt concern and plans to further deleverage the balance sheet in the near term. This will be important to monitor going forward.

Bottom Line

Charles River Labs has a long and robust history of making smart acquisitions, generating attractive shareholder returns and holding the quality of its offerings to the highest standard. These attributes have attracted me to this company for several years now.

Given the recent share price declines and short term headwinds the company is facing, I believe that now is the opportune time to begin to build a position in this name and as such have opened a long position with plans to strategically add to this holding upon weakness.

The long-term trends in the industry that the company resides appear durable and with the recent investments the company has made in emerging growth areas like gene and cell therapies, I believe CRL is positioned well to accelerate its growth coming out of the current near-term period. I look forward to holding my shares in CRL for many years to come.

I look forward to your comments below. Thank you for reading and good luck to all!

Be the first to comment