fotokostic/iStock via Getty Images

A farmer is a magician who produces money from the mud.” – Amit Kalantri, Wealth of Words

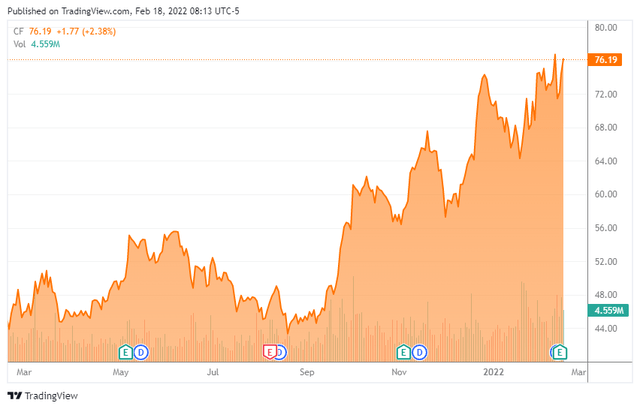

Today, we dig into CF Industries Holdings (CF). This agricultural commodity play has been one of the few big winners in the market over the past month and just reported quarterly numbers. However, the stock has seen its share of insider selling in recent months and most of the analyst community is not that sanguine about the company’s near-term prospects. What should an investor do with these ‘mixed signals‘ being sent? We attempt to answer that question within the analysis below.

CF – One Year Stock Chart (Seeking Alpha)

Company Overview:

CF Industries is based just outside of Chicago. The company manufactures and sells hydrogen and nitrogen products primarily to the agricultural industry. Its core products include anhydrous ammonia, granular urea, urea ammonium nitrate, and ammonium nitrate as well as compound fertilizer products with nitrogen, phosphorus, and potassium. The stock currently trades just over $76.00 a share and sports an approximate market capitalization of $16.3 billion.

Fourth Quarter Highlights:

On February 15th, CF Industries reported fourth quarter results. The company reported GAAP earnings of $3.47 a share, which was 40 cents a share light of the consensus. For the full FY2021 year the company had earnings of $4.24 a share. This included a one-time non-cash impairment charge of $521 million related to the Company’s U.K. operations. Solid performance given natural gas prices (a large cost input for manufacturing of its products) had a big rise in FY2021. It should be noted that higher NG prices in Europe, hurt its competitors on that continent worse. Revenues soared more than 125% from the same period a year ago to $2.5 billion, but still came in $40 million under expectations.

CF – Fourth Quarter Highlights (February Company Presentation)

Analyst Commentary & Balance Sheet:

Over the past month, four analyst firms including JP Morgan have reissued Hold ratings on CF Industries. Price targets proffered range from $75 to $83 a share. Both Goldman Sachs ($88 price target, from $79 previously) and UBS ($85 price target, up from $83 previously) have reiterated Buy ratings over that time, both with upward price target revisions. Numerous insiders were heavy sellers of the stock in the fourth quarter of last year, selling tens of millions worth of shares. In several officer’s cases, these sales were a good chunk of their overall holdings. Another insider unloaded just over $2 million of his stock in CF on February 2nd, representing approximately 30% of his overall stake in the firm. One has to go back to 2016 to find any significant insider purchases in the shares.

Full year net cash from operating activities came in at $2.87 billion, free cash flow came in at $2.17 billion, an all-time record for CF Industries in FY2021. The company also bought back nearly $500 million worth of stock in the fourth quarter, basically exhausting a $1 billion stock buyback authorization.

Capital Management – CF Industries (February Company Presentation)

The company’s goal is to lower gross debt by $3 billion by 2023. Currently CF Industries has approximately $3.5 billion in long term debt on its balance sheet. All things being equal, free cash flow should increase as the firm’s net debt continues to be reduced as does the interest costs to service it.

Verdict:

The analyst consensus is all over the place for what lies ahead for CF in FY2022. Earnings per share range from approximately $6.00 to $11.50 a share with revenues anywhere in the $6.7 billion to $10 billion range.

CF – Free Cash Flow Yield (February Company Presentation)

Based on cash flow in FY2021, the shares sell for a free cash yield in the low-teens so the company appears cheap on that metric which management pointed out in its latest investor presentation. CF Industries has done a commendable job recently in reducing both its debt and outstanding float.

That said, insider activity points to some trimming their stakes significantly. The stock/company have continued to benefit from the rise as fertilizer prices, complicated further by the threat of a Russia-Ukraine conflict. Giant Belarus potash miner and competitor Belaruskali just had to declare force majeure as it cannot meet its existing contracts thanks in a large part to U.S. sanctions as well.

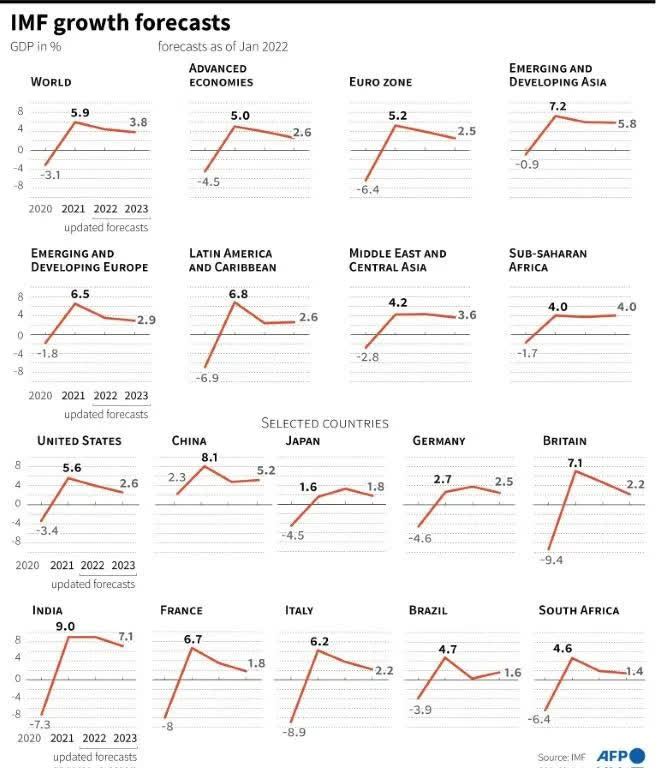

First quarter economic growth in the United States is set to slow dramatically in the first quarter. After an initial read of 6.9% GDP growth in the fourth quarter in the United States, the Atlanta Fed’s GDPNow model is currently predicting just 1.3% growth in the first quarter of this year.

Global Growth Forecast (IMF) The IMF earlier this month ratcheted down its global growth forecast in 2022. Given the current valuation heading into a period of growth uncertainty, that leads me to shy away from any investment recommendation on CF Industries despite its significant free cash flow and solid execution. Some insiders also seem to be signaling the shares are fully valued at current trading levels as well and analysts are not sanguine overall. A lot of things have fallen right for the company recently, which is why the stock is up 67% over the past six months. The chances of this rosy scenario seems unlikely to continue. Therefore, if I owned shares in CF, I would probably follow insiders and use the recent rally to do some profit taking.

A type of humility marks a real farmer. Those of us who battle nature all year must ultimately accept the hand we’re dealt.“― David Mas Masumoto

Bret Jensen is the Founder of and authors articles for The Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment