JHVEPhoto

Stock picking is never more important than during a volatile market. It’s a great time, in my view, to weed out underperforming names and stack our portfolios with high-quality growth stocks that are currently trading at fire-sale levels.

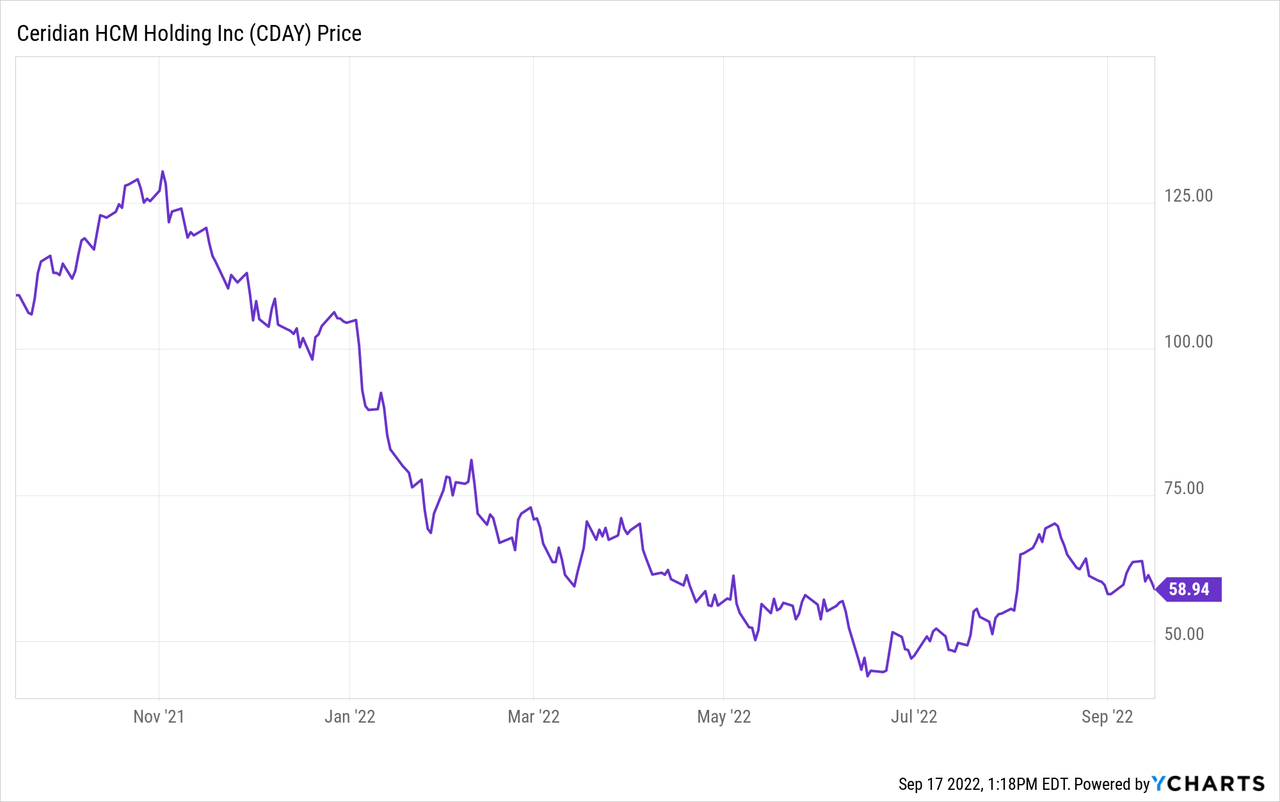

Sharp declines year to date, however, are quite merited for some names that have long traded at levels completely disconnected from their fundamental performance. Ceridian (NYSE:CDAY) is one such example here. The Canadian-based HCM and payroll software provider has shed 40% of its value year to date, yet I continue to believe the stock is quite generously valued for a company with relatively limited growth prospects and a second-rate brand.

Ceridian has recently rallied off year-to-date lows after a relatively strong Q2 earnings print, but I view this to be a rather feeble bear market rally that will soon be reversed.

Given Ceridian’s upward creep in valuation despite very limited fundamental improvements, I’m resuming a bearish stance on this stock: investors who are in this name now should cash in on the recent short-term gains and invest elsewhere.

Here’s a rundown of the reasons I remain skeptical on Ceridian:

- Weak profile vis-a-vis cloud competitors. HCM is a very crowded space, dominated by the likes of Workday and Oracle (ORCL), and Dayforce is barely a distant laggard.

- Heavily indebted. Unlike many SaaS peers that are carrying substantial net cash balances, Ceridian has a net debt balance of nearly $1 billion.

- Margin lags cloud peers. While Ceridian’s cloud revenue carries a low-70s gross margin like peers, the weighting of Ceridian’s revenue toward float and other lower-margin services puts Ceridian’s overall GAAP gross margin at just 54% in its most recent quarter, below most SaaS peers and justifying a significant discount in its valuation multiple.

- Confusing leadership structure, with Ceridian just having elevated its COO to co-CEO status, while still reporting to the original CEO (seems like a catalyst for boosted compensation to me). Recent examples like Salesforce (CRM) indicate a dual-CEO structure doesn’t often last or work out well.

Valuation remains the biggest impediment to an investment in Ceridian making good sense. At current share prices near $59, Ceridian trades at a market cap of $9.02 billion. After we net off the $371.2 million of cash and $1.22 billion of debt on Ceridian’s most recent balance sheet (an $852 million net debt position), the company’s resulting enterprise value is $9.87 billion.

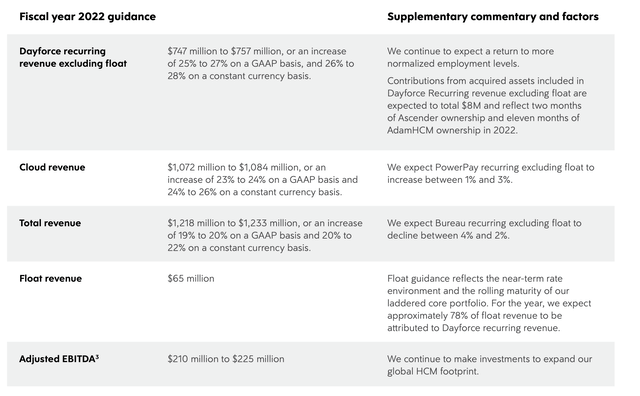

Meanwhile, for the current fiscal year, as shown in the chart below, Ceridian has guided to revenue of $1.218-$1.233 billion (+19-20% y/y), and adjusted EBITDA of $210-$225 million. This is slightly up on both counts relative to a prior outlook of $1.208-$1.230 billion in revenue and $190-$205 million in Adjusted EBITDA:

Ceridian guidance update (Ceridian Q2 shareholder letter)

This puts Ceridian’s valuation multiples at:

- 8.0x EV/FY22 revenue

- 45.4x EV/FY22 adjusted EBITDA

These are nonsensical multiples for a company of Ceridian’s relatively lower caliber. High teens/low 20s growth is not warranted to justify an 8x forward revenue multiple (there are SaaS stocks with a 30-40% growth range trading at similar multiples); nor is Ceridian’s EBITDA sufficient yet to justify its market value.

The bottom line here: I continue to see limited appeal for Ceridian. Its recent rally is more of a bear-market head fake rather than the beginnings of a rebound. Steer clear here and sell.

Q2 download

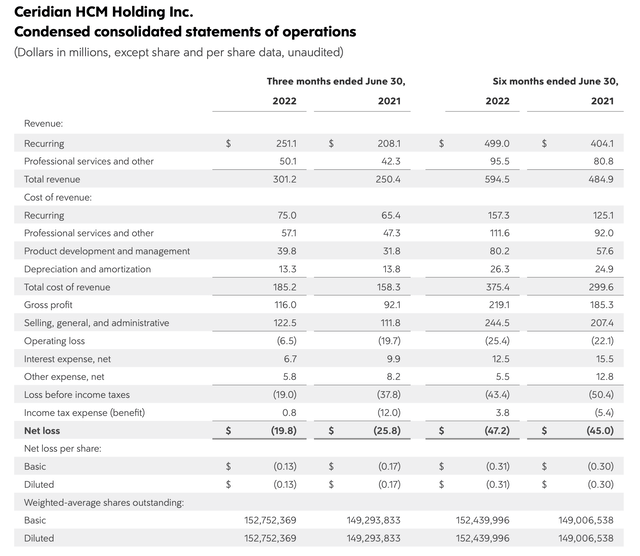

Let’s now cover Ceridian’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Ceridian Q2 results (Ceridian Q2 shareholder letter)

Revenue grew 20% y/y to $301.2 million in the quarter, slightly outperforming Wall Street’s expectations for $294.5 million in revenue (+18% y/y). We note that revenue growth decelerated five points relative to 25% y/y growth in Q1, which in turn had decelerated two points from 27% y/y growth in Q4.

Underneath the hood, Ceridian’s cloud revenue – which comprises of its core Dayforce product suite plus its PowerPay payroll solution – grew 26% y/y to $262.9 million, representing roughly 87% of revenue. Float-based revenue also grew to $14.7 million of the total, driven by a ~12% increase in customer float balances as well as a 28bps increase in yields earned on float.

So far, the company notes that tightening macro conditions have not impacted sales. Per co-CEO David Ossip’s prepared remarks on the Q2 earnings call:

A large part of our EBITDA beat came from the 230 basis point year-over-year increase in adjusted gross profit on Cloud recurring to 76.4%. On the macro side, we have not seen any slowdown in sales or any slowdown in decision making. Year-to-date sales are up significantly year-over-year and growth appears to be accelerating. We have seen continued momentum across all segments. Deals above $1 million are up 50% year-over-year. Mid-market sales are above plan. Add-on sales to the base continues to be a healthy 30%. The number of customers who have bought a suite is up to 36% and global traction continues with EMEA and APJ sales, both up year-over-year by more than 50%. In other words, we are firing on all cylinders and are quite confident on the outlook for the second half of the year.”

This being said, however, with many of Ceridian’s products being seat and headcount-based, we will want to cautiously watch how layoffs and slower hiring trends will impact the company’s revenue going forward.

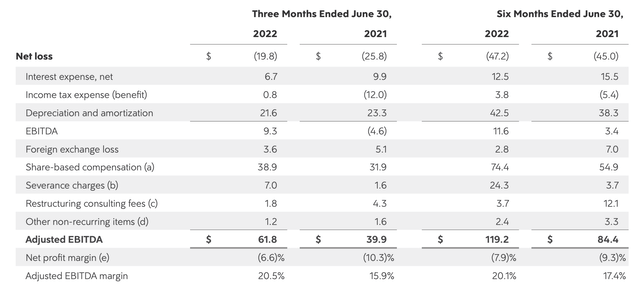

Adjusted EBITDA, admittedly, was a good story in Q2. Adjusted EBITDA grew 55% y/y to $61.8 million, representing a 20.5% margin – 460bps richer than in the year-ago quarter. This was driven by a nearly two-point boost in cloud gross margins as well as economies of scale on opex.

Ceridian adjusted EBITDA (Ceridian Q2 shareholder letter)

Key takeaways

For some reason, Ceridian continues to trade at elevated valuation multiples despite a fundamental profile that can at best be described as average. Now is the time to load up on beaten-down, high-quality growth stocks – and Ceridian doesn’t qualify here. Sell this name and invest elsewhere.

Be the first to comment