edsongrandisoli/iStock via Getty Images

This Article was researched and written by January Mbuvi.

Investment Thesis

Central Puerto S.A. (NYSE:CEPU) stock price has outperformed the market by more than 62% YTD, showing strong growth capabilities. The company is trading at $4.67, slightly below its 52-week high of $5.08.

Its share price has also seen considerable growth this year, probably due to increasing industrial activity post-Covid 19 as companies try to reach pre-Covid production levels, resulting in higher demand for power in Brazil.

In terms of its top-line growth and profitability, CEPU has registered pleasing results, which they attribute to the high and increasing demand for electricity in the country. Power consumption will likely grow at an average rate of 3.5% yearly over the next decade in Brazil and this bodes well for the company’s top-line growth and profitability in the future. It is for this reason that I am bullish on the stock.

The company’s relative valuation metrics point out that the stock is cheap, offering a reasonable entry point to this company. Potential investors looking for a profitable company in the Brazilian energy sector should seize this opportunity to enter the industry at a discount.

The Brazilian Electricity industry

Brazil is the largest electricity market in Latin America, and with 173.2 GW, it is the seventh largest electricity market in the world. The country generates and distributes electricity to 85 million residential, commercial, and industrial consumers, more than South America combined. By 2029, the Brazilian electrical sector will receive an investment of $94 billion.

According to the source cited above, Brazil has a total installed capacity of 173.2 GW, and 84% of that comes from renewable sources, most of which are hydropower. This capacity will likely grow by 15GW by 2025.

The same source states that hydropower is 63% of Brazilian electricity. Wind power is Brazil’s second-largest energy source, with 15 GW installed and 4.6 GW committed or under construction and anticipated to come online by 2023. 601 wind farms and 7,000 turbines are in Brazil too.

These two top power sources are significant sources of electricity for CEPU. As mentioned earlier in this section, the heavy investment will be made in this industry in the coming years as the industry keeps expanding. This investment should be the best news to any investors as the company is poised to continue with its current good top-line and profitability, if not better.

Top-line growth and profitability

Although the company has a drop of 22.97% in revenue growth YoY, its compounded annual revenue growth over the last three years is 11.32%. I attribute the CAGR growth rate to Brazil’s strong demand for electricity. The worrying YoY revenue growth rate may be probably due to:

- The 37% decrease in Spot/Energia Sales from ARS 10.2B in Q2 2021 to ARS 6.4B in Q2 2022. The company’s production scale-up plan and the increasing electricity demand will help reverse the situation. In my view, this justifies the company’s revenue growth [FWD] of 18.60%.

- The 10% decrease in energy generation in Q3 ’22 down to 33,452gigawatts from 37,059gigawatts in Q3 ’21. The decline in energy generation was due to technical failures which I believe will be addressed due to the synergy from the acquisition of CAMMESA[To be discussed in my follow-up article later].

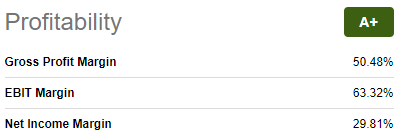

In terms of profitability, the company has significant profit margins. To begin with, they have a gross margin of 50.48%, an EBIT margin of 63.32%, and a net income margin of 29.81%.

Seeking Alpha

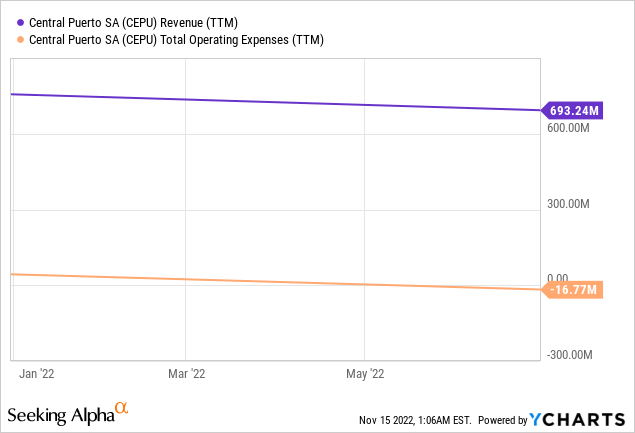

These high-profit margins result from high revenues compared to low operating expenses.

The company has also successfully translated its growth into cash; its levered FCF growth YoY is 55.92%. Currently, their operating cash flow on a quarterly basis stands at $123 million, up from $70.1 in the last quarter in June. The growth in the operating cashflows resulted from reduced payables, which have been declining significantly over the past years, and reduced cost, which resulted from the cancelation of debt from Brigadier Lopez Financial Trust.

Brigadier Lopez Financial Trust was concerned. The scale and majority of this indebtedness were August 2022 and was canceled in April as a liability management policy with the aim to reduce financial cost.-Federico Bozhori.

Similarly, the company’s quarterly levered free cash flow is at $59.1million, up from $28.7million in June. As earlier mentioned, this performance was primarily due to the reduced operating costs.

Looking at these figures at present moments though helpful, is more important to look at them from the future perspective. Given that background, Brazilian electricity will face massive investment at a time in which it is growing. This growth would raise demand and possibly drive sales up. CEPU is increasing production, which will improve sales as demand grows. The additional sales will primarily aid top-line development and profit margins provided the company maintains low operating costs.

Valuation

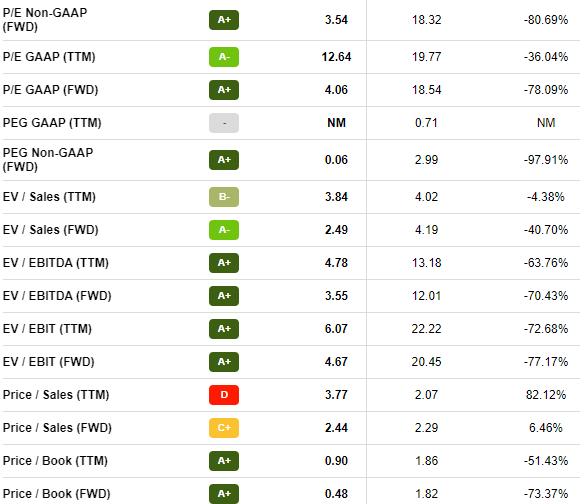

The company’s relative valuation multiples are much lower than the sector median due to the high-profit margins.

Seeking Alpha

Investors can get into this highly potential company at a lower cost because of the cheap valuation metrics. The company’s earnings might grow, resulting in even lower valuation metrics relative to the sector median; thus, late entrants shouldn’t be too worried.

Conclusion

The Brazilian electricity industry is dominated by hydroelectric power and wind energy. The industry’s future is promising, with massive investment in the pipeline. The industry is expected to grow at an average rate of 3.5% yearly in the next decade.

CEPU currently has high-profit margins, and compounded annual revenue growth over the last three years is 11.32%. This performance though very pleasing has to be sustainable in the long run for investors to commit to the company. To justify sustainability, I draw the attention of investors to industry growth, which will increase demand. To match the demand, the company is scaling up productivity as well as acquiring CAMMESA, something which will improve the company’s top and bottom lines in the future. The company is maintaining low total operating costs, which speaks loudly about how its profit margins will remain high in the long run. It is for this reason that I am bullish on the stock.

The company’s cheap valuation offers a reasonable entry point for potential investors; however, they should be wary of the challenge of the debt canceled by the company, which may affect their profitability in the future. That may not be a significant problem because I anticipate the company will have improved its financial strength significantly due to the promising industry outlook. Therefore, financing the debt would be much easier.

Be the first to comment