traveler1116/iStock via Getty Images

Transcript

A stampede of central banks raised interest rates last week, and this sent shockwaves through the market.

A flurry of central bank moves revealed many are ignoring the crushing effects that sharply higher rates could have on economies.

And this raises serious growth risks, and we now see the restart of the U.S economy stalling in the coming quarters.

1) Risk of Fed overtightening policy

The Fed seems determined to raise rates sharply this year. It’s responding to the “politics of current high inflation”: a chorus of voices calling for it to do something to get inflation down.

2) Risks to U.S. growth

We now see serious risks to U.S. growth early next year amid mounting challenges: the energy shock, growth slowdowns elsewhere and higher rates tightening financial conditions.

The Fed is raising rates so fast that there isn’t enough time for data to react to events. It will realize too late that it’s stalling the restart.

3) The politics of inflation

The politics of inflation will give way to harsh economic reality. And the Fed could reverse course next year.

It will be too late to rescue growth. But it will be enough to mean supply-driven inflation persists for quite some time.

A central bank blitz to raise rates poses serious risks of stalling the restart. So, we don’t think this is the time to buy the dip.

___________

A flurry of central bank moves last week has revealed many are ignoring the crushing effect this will have on growth. This dynamic raises serious growth risks, and we now see the U.S. restart of economic activity stalling over the coming quarters. The focus is on the Fed – and we think it will ultimately change course, but not before causing growth to stall. This raises the specter of growth weakness but still persistent inflation. We don’t see this as an environment for buying the dip.

Fed projections

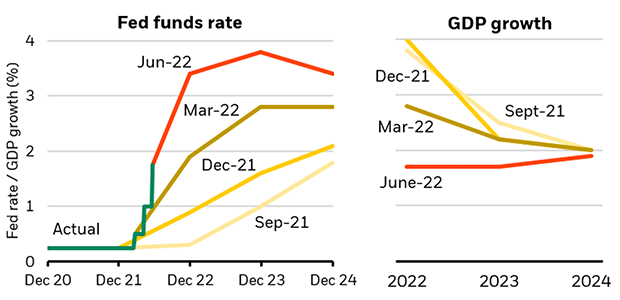

Fed Funds And GDP Growth Projections By Meeting (BlackRock Investment Institute and Federal Reserve, June 2022)

Notes: The charts show the progression of the Fed’s median projection for the Fed funds rate and GDP growth in its quarterly Summary of Economic Projections.

The Fed’s updated “dot plot” of the Fed funds projection shows it’s ready to push rates to nearly 4% by next year (red line, left chart). This takes rates well beyond neutral of around 2.5% – the level that neither stimulates nor decreases economic activity. Yet, the Fed continues to forecast trend-like growth (red line, right chart). Financial conditions are already quickly tightening. And with growth slowing elsewhere and higher energy prices, we expect a worsening macro environment for the rest of the year and into 2023. The Fed isn’t looking for a recession, even though, in our view, one would be needed if it wanted to drive inflation back down to 2%. So, we expect the Fed to change course once it becomes clear growth has stalled.

The Fed seems dead set on raising rates this year to levels that, in our view, would clearly slow the economy. It seems to be responding to the “politics” of current high inflation. But the Fed isn’t actually looking to slow the economy. Fed Chair Jerome Powell said the central bank is not trying to induce a recession. This reflects the Fed’s lack of acknowledgment of the policy trade-off. Current high core inflation rates reflect an imbalance of demand and supply broadly across the economy. It isn’t due to overheating demand but unusually low production capacity in an incomplete restart following the pandemic.

A policy trade-off

In fact, the Fed is facing an acute trade-off: either slam down activity or live with persistent inflation while production capacity recovers. The Fed hasn’t acknowledged this. It assumes that a rapid return of supply capacity will help resolve high inflation – so any upside surprise to inflation will push it toward tighter policy, and a downside surprise on inflation won’t necessarily slow it down. If the Fed jacks up rates and then changes course as we expect, it still raises the risk of zero or negative growth and persistent inflation. When the macro environment is shaped by production constraints, the Fed can’t avoid volatility. It can only trade inflation volatility for output volatility – a big theme at our 2022 Midyear Forum last week. We may be set for both, posing a further drag to risk assets.

How does the inflation/growth trade-off play out elsewhere? We think the European Central Bank (ECB) will be forced to confront reality sooner because the euro area will feel economic pain sooner. The ECB’s planned policy normalization underappreciates the risk of the energy crisis pushing the euro area into recession. The ECB’s troubles are seen in the peripheral bond volatility that sparked an emergency meeting last week to help steady financial conditions across the euro area. That comes as the Swiss central bank and the Bank of England (BOE) also raised rates last week, with the BOE warning of recession risks. The BOE is closer to acknowledging the policy trade-off and could decide to go slow on further rate hikes. The Bank of Japan bucked the trend, keeping its ultra-accommodative stance, largely because inflation remains low and Japan did not have harsh lockdowns driving the inflation volatility in other major economies.

What this all means for investments

We already reduced portfolio risk twice this year on growing concerns over the effect of the energy crunch on growth and central banks overtightening. This is why we don’t see the risk asset retreat as a reason to buy the dip – and expect more volatility ahead.

Market backdrop

The S&P 500 slid into bear market territory after the Fed lifted rates by the most in three decades. The Fed said it could push rates to 3.4% this year – a level that would hurt activity and could bring the restart to a halt, in our view. Other hawkish central bank moves followed. The Swiss National Bank unexpectedly hiked rates for the first time in 15 years. We think central banks’ failure to acknowledge policy trade-offs amid the politics of high inflation raises serious growth risks.

Services and manufacturing data in the U.S. and Europe will give an early read on growth momentum in June and help gauge the ongoing easing of supply chain disruptions. We think the risks to growth are escalating as many central banks steadfastly hike rates without fully acknowledging the high costs. UK inflation is likely to remain high in data out this week, fueling calls for a continued hawkish response from the Bank of England.

Be the first to comment