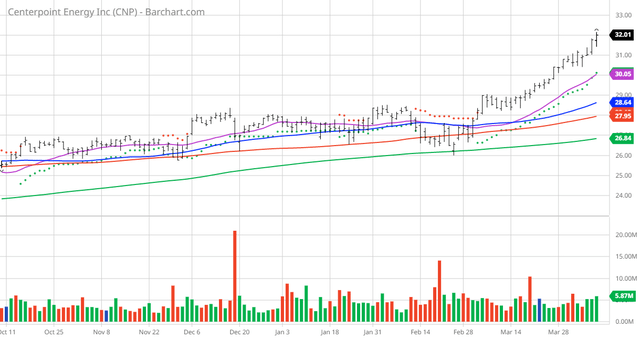

The Technical Analysis Pick of the Day belongs to the regulated electric utility CenterPoint Energy (CNP). I found the stock by using Barchart’s powerful screening function to find the stocks with the highest Weighted Alpha and technical buy signals that are closest to their 52-week highs, then used the Flipchart function to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 3/4, the stock gained 10.54%. The stock is near its 52-week high and only .05% below that.

CNP Price vs. Daily Moving Averages (Barchart.com)

CenterPoint Energy, Inc. operates as a public utility holding company in the United States. The company operates through Electric and Natural Gas segments. The Electric segment includes electric transmission and distribution services to electric customers and electric generation assets, as well as assets in the wholesale power market. The Natural Gas segment provides natural gas distribution services, as well as home appliance maintenance and repair services to customers in Minnesota; and home repair protection plans to natural gas customers in Arkansas, Indiana, Mississippi, Ohio, Oklahoma, and Texas and Louisiana through a third party. This segment also engages in the sale of regulated intrastate natural gas, and transportation and storage of natural gas for residential, commercial, industrial, and transportation customers. As of December 31, 2021, it served approximately 2.7 million metered customers; owned 239 substation sites with a total installed rated transformer capacity of 71,241 megavolt amperes; operated approximately 1,00,000 linear miles of natural gas distribution and transmission mains; and owned and operated 285 miles of intrastate pipeline in Louisiana, Texas, and Oklahoma. The company was founded in 1866 and is headquartered in Houston, Texas. (Source: Seeking Alpha)

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Analysts and Investor Sentiment — I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock, it’s hard to make money swimming against the tide:

Although using Seeking Alpha Quant Rating and Technical Analysis may not be suitable for all investors, it appears that SA’s Quant Rating and numerous technical indicators are in agreement that this stock may be suitable for aggressive investors with a high risk tolerance.

Be the first to comment