VioletaStoimenova

As I mentioned in my last pieces on this company, Centene (NYSE:CNC) is the sort of company I like writing about, as well as investing in. This company is stone-solid, with the sort of foundation to its business that you want to be looking at and looking for. While I’ve been neutral on the company for some time, I do believe it’s time to revisit that stance in light of recent market facts, to see if we can get some better returns from the company.

Remember – Centene lacks a dividend, so your returns are all capital appreciation here. This is one of the very, very few companies I invest in that does this, and where I allow for this to be the case.

Let’s revisit Centene and see what the company gets us if we invest in it today.

Revisiting Centene

Centene is a 35+ year-old healthcare company, founded as a nonprofit Medicaid plan in 1984. The company went public in 2001. Centene assists in fulfilling a very basic need that, frankly speaking, the USA has struggled to provide universally to its citizens in ways seen in other western nations. The way healthcare is structured in the USA means that there can sometimes be difficulties for some gaining access to adequate care in times of need, because they may not have the money to pay for this. This is evidenced by the simple fact that prior to the introduction of the Affordable Care Act, tens of millions of citizens were without basic health insurance.

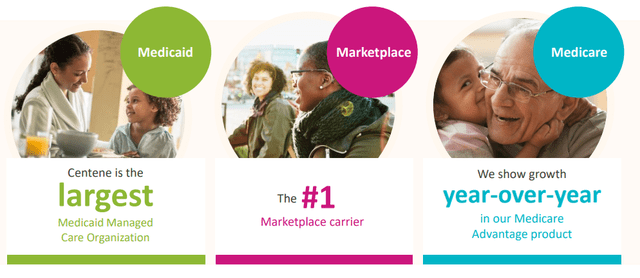

Centene seeks to fill a gap, by providing and being a leader in Medicaid and Marketplace with Medicare growth.

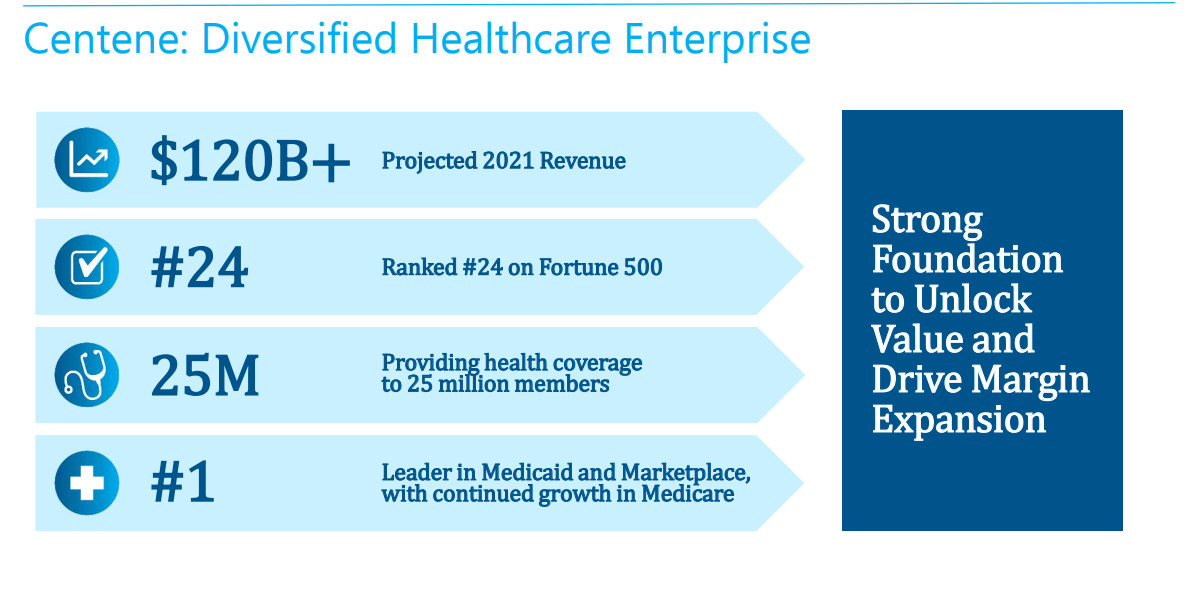

Centene Fundamentals (Centene IR)

Centene seeks to provide fully integrated, high-quality, and cost-effective healthcare services aimed at government-sponsored and commercial healthcare programs.

What differs Centene somewhat from its peers is the focus is on under-insured and uninsured individuals. Centene also provides education and outreach, helping its members to access appropriate services. Essentially, Centene is trying to make sure that its members, usually in worse situations than some, get the help they need.

They do this in two segments in terms of business, mostly aimed at Medicaid, Medicare, and some commercial products.

- Managed Care provides health plan coverage to individuals through subsidized government programs as well as commercial programs.

- Specialty Services contains companies and organizations providing healthcare services to the Managed Care segment and other external customers.

Given that they do this for 25M+ individuals and carry revenues of $120B, they are one of the biggest companies on the face of this earth in this segment.

As I mentioned, Centene does not pay a dividend. The company also “only” has a BBB- credit rating and operates in and outside of the US. The company’s differentiating factor – what makes it worth looking at for us as an investment, is its extensive expertise in government-sponsored healthcare, where it has 35 years of expert experience.

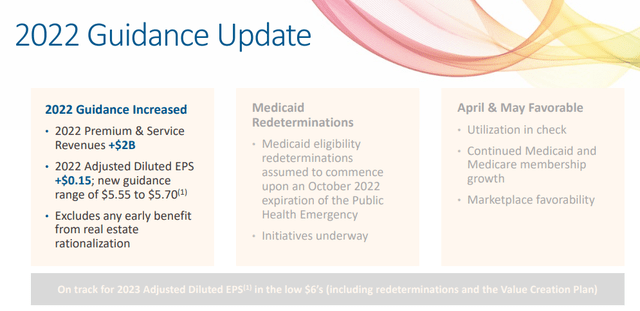

I described the company as an effective capital allocator with historically proven results. Its priorities are clear. First, Organic growth. Second, Capital management and M&As through debt reduction, M&As, and finally, share repurchase to increase returns. The company keeps delivering on this strategy. The company has recorded significant EPS growth, and targets a 48% growth in EPS from 2021 levels, in 2024E.

The company keeps focusing on its three core products.

And its operations have already seen some significant wins for the year, including wins in Nevada, reprocurement in Indiana and Louisiana, and new contracts/reprocurements in Missouri. The company has also become, and remains, a national leader in managed care for children cared for within the bounds of the CWS – where it has 5 speciality contracts across several states. This is the sort of quality that I care about, in part from an investor standpoint, but also because part of my professional background is in welfare organizations and consulting.

The simple fact is that Centene is performing well, and the company continues to outperform. A perfect example of this is the very recent (less than 2 weeks) guidance increase for 2022E.

Dividends have never been, nor are likely to be on the table for the foreseeable future – at least not under current management. Also, given the company’s business segments and customers, paying shareholders cash dividends may be contrary to their mission objective or set the company up for negative press. A company such as Centene has to be more aware than others of how they’re perceived, and I do understand the logic, if there is such logic, behind the decision to not pay out a company dividend in the form of cash.

Risks to the company are as clear as the potential upsides. Because the company is Medicaid/Medicare focused, any changes in eligibility determinations have the potential to seriously harm operations here. The same is true if political climates would somehow change the way these programs are managed or handled. I have difficulty seeing this, as even the more conservative voices are hesitant to touch the post-2010 changes to these programs given the political risks in doing so, but it’s certainly a risk. The company’s credit rating also isn’t that fantastic, and it would not be unfair to characterize Centene as a “volatile” investment overall.

As I mentioned in my original article, there is the simple fact that because of what Centene does, it’s barely making any money here. Operational cash flow and profits are low compared to other businesses in the same space – or most in any space. Centene is basically doing what the government should be doing – making healthcare more effective, and given that it’s not exactly carving out El Dorado for shareholders, management, or investors, it’s very hard to see any politician taking an issue with Centene or its operations.

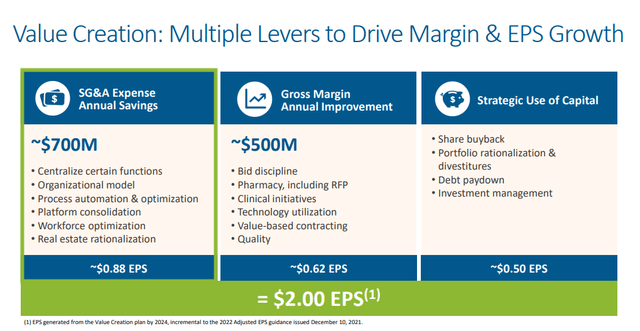

Centene is simply what it looks like – a very effective company in a field that doesn’t allow for massive amounts of profit, and with a history of growing through very effective capital allocation and M&As. The company continues to make progress on its value creation progress here – so investors can expect more share repurchases here, and the company intends to pull several levers in order to enhance margin and EPS growth, resulting in shareholder value.

This has resulted in the following valuation situation.

Centene’s Valuation

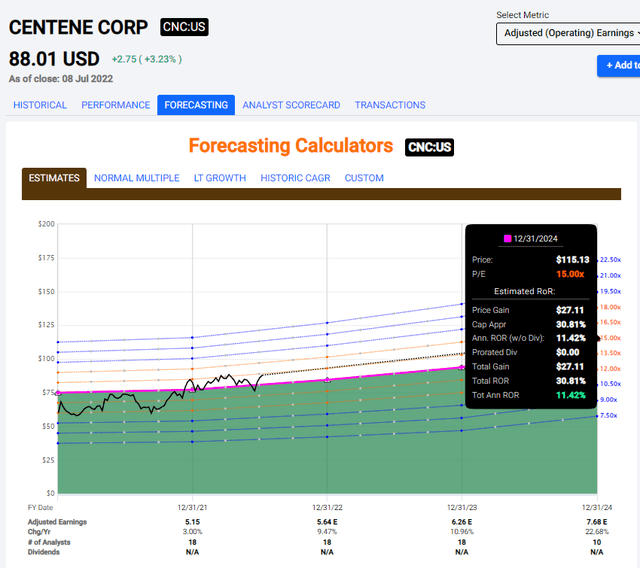

Despite delivering good returns since my last article, the fact of the matter is that Centene remains at a conservative multiple of around 16.3X. Why is this conservative, when we usually go by 15X?

Because Centene has grown by 21% annually over the past few years and is expected to grow double digits for the foreseeable future as well. We can certainly go by 15X P/E here, and even on that basis, there is a lot to like about Centene here.

Centene Upside (F.A.S.T graphs)

The simple fact is that Centene has a double-digit upside even on the basis of very conservative forecasts. There is no dividend here – so you have to be a bit more careful and considerate as to your investments. Previously, I’ve targeted Centene as an options investment, and this is still possible. Instead of going for the common share, you can sell “put” options. However, given the relative price/exposure of a contract here, I would consider it unfavorable in this market environment to put that much capital at risk in Centene, as it could potentially drop a lot farther, leaving you at an unfavorable investment.

Instead of options, the way to invest in Centene here, if you’re interested in the company, is through common share investments – though it’s important to note that the upside here isn’t as high as in one of several other companies I follow and write about.

If the company had even a slight dividend, I’d be willing to accept a somewhat bullish thesis for Centene here. But the fact is we’re talking about a company that typically trades below 15X P/E, currently trading at almost 17X. We’re talking about a company that carries a BBB- in credit rating. These two facts don’t make for an appealing combo in my book. While Centene’s earnings aren’t exactly terrible in terms of stability – they’re damn stable – the share price hasn’t been. The problem is that even in the case of that positive 2024E, you’re getting 11% annualized RoR from a zero-yield, BBB- rated company with a volatile share price history.

In the end, that’s why I can’t get behind Centene as a bullish investment at this time, even if the market has grown more volatile since my first overall investment. I like the company and love the future here, but I don’t think the fundamentals are good enough to justify this multiple, and the lack of a yield and BBB- doesn’t help.

I’m at a “HOLD” rating now, and my PT is $83/share, going to the lower-end target that S&P global has here. I can see how you might consider Centene with a higher target, but I don’t agree with the risk calculation when you compare what’s available on the market.

Analysts have an unfortunate tendency to allow for a premium here, with S&P Global averaging at about 10-15%. That’s exactly the sort of premium in its targets that would have prevented investors from selling and making money here.

If you look at the company’s valuation, you’ll see that the company is still at a more expensive level than what I would consider buyable here.

S&P Global has a current target of $95/share, and 10 out of 19 analysts have the company at a “Buy” here. This is within the historical 10% overvaluation/premium that analysts have on this company, and that I previously mentioned.

While Centene could be a “BUY” here if you’re willing to go for a premium, there are enough question marks for me that I consider this to not be valid for the long term, or at least to be better overall alternatives out there.

Because of this, this company is a “Hold” here.

Thank you for reading.

Be the first to comment