peshkov/iStock via Getty Images

(Note: This article was released to the newsletter on April 30, 2022 and has been updated with recent information).

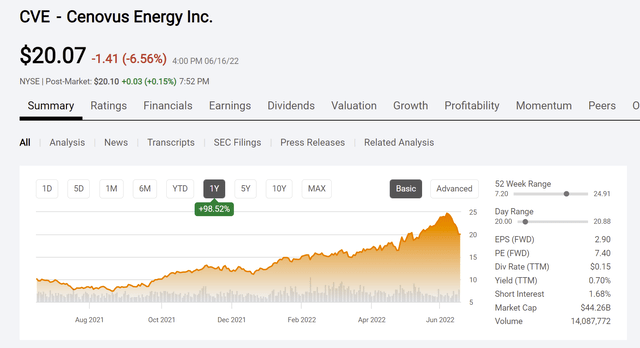

For long term followers of Cenovus Energy (NYSE:CVE), the last four to five years have been very frustrating. Back when I wrote the first article, Cenovus reported funds flow in the C$1 billion range. Despite the growth in production and cash flow, the stock languished as the market worried about other headlines. Disappointment in stock price movement despite profitability progress was a routine event here until now.

Cenovus Energy Common Stock Price History And Key Valuation Measures (Seeking Alpha Website June 16, 2022.)

Now that cash flow is many times the amount of four years ago when the first accretive deal was made, Mr. Market is finally noticing the increased profitability. Now we will see if the stock price makes up for all those years of ignored profitability progress. The latest pullback can be expected after far more upward progress than I have seen in this stock in ages.

The most interesting part of this is that well run thermal companies tend to generate a lot of free cash flow because thermal projects demand a lot of cash up front to get started. Therefore, depreciation tends to be substantial even if the company is not profitable. That depreciation of those starting costs protects a lot of cash flow from taxation as the first large, fixed costs can be recovered before the company reports profits. For all the market emphasis about free cash flow, clearly the market never cared about all the free cash flow generated by this company until now.

Cash Flow

Cash flow is likely to show sharply positive comparisons this fiscal year. This company will benefit from higher commodity prices as does the rest of the industry. It will also benefit from the continuing acquisition assimilation and operational optimization. The company will also benefit when the Superior Refinery ramps up after construction is completed (from the fire). That means that this company will likely post superior financial performance to much of the industry.

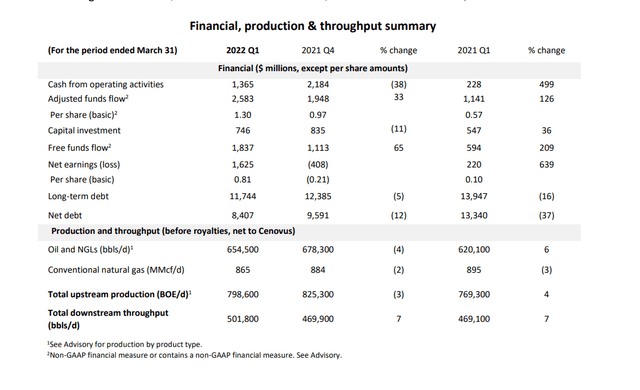

(Canadian Dollars Unless Otherwise Stated)

Cenovus Energy Performance Of Key Operational Performance Measures For The First Quarter 2022. (Cenovus Energy First Quarter 2022, Earnings Press Release.)

The company now reports more cash flow in one quarter than it reported in the full year before the company acquired the rest of the partnership from ConocoPhillips (COP). This happened even though the company sold off noncore parts to reduce debt quickly. The ability to increase cash flow more will happen as the hedging program comes to an end. The safety provided by hedging is not needed at lower debt levels.

Management is again following a similar strategy with the latest acquisition. They are again selling noncore parts of the company while optimizing the rest of the acquisition.

There will be some working capital needs that will depress cash flow from operating activities. Increased working capital needs is a legitimate use of generated cash flow. That should be expected during a time of rising commodity prices (let alone the business expansion from an acquisition). The adjusted funds flow is before the change in working capital. Those adjusted funds flow indicates the cash generated by the business before the working capital financing.

Sales Comparisons

Quarterly sales of product may not be easily comparable because this company will store production or even delay production if conditions warrant such a strategy. Management has many times stated that such strategies do not damage the product or the wells. The company can then play “catch-up” the following quarter.

In this case, management has sold some production as well. So there is likely a combination of factors influencing the production and sales volumes comparison. The sale is mentioned as the dominant cause in the press release. But several companies in the industry have mentioned the severe weather in the winter causing challenges.

The other consideration is that weather can play a part in production. Severe weather, as was the case last winter, can cause some temporary production declines until repairs are made.

What To Expect

The second quarter in Canada is typically a fairly weak comparison due to Spring Breakup. This year is likely to be no exception. Operating activities are at a minimum (and typically big projects like turnarounds are scheduled). Management has been busy assimilating the acquisition. Therefore, more growth projects are likely to resume later in the fiscal year or next year.

Even so shareholders should expect that the income and cash flow statement will increasingly reflect the ongoing business as merger related charges fade. There will likely be some one-time startup expenses of the Superior Refinery at some point. So, there could be an earnings setback for a quarter or so for that. Other than that, the ongoing robust commodity prices should ensure one of the better years posted by the company in a very long time.

As an aside, the Superior Refinery could hardly be beginning operations at a better time. More refinery capacity is sorely needed. This is a brand-new refinery with all the modern equipment. Once it gets going, costs could be among the best in the industry with the latest equipment

The conventional business has largely been ignored by the continuing spate of acquisitions. That may change in the future as management has a lot of acreage that can be explored for potential condensate production. Any thermal producer has a large need for condensate to mix with thermal production so that the production flows through pipelines. Since this company buys condensate, the ability to produce its own from its own assets may be a very profitable source of growth in the future.

Last but not least, management tripled the dividend. Canadian companies are not as wedded to maintaining dividends as companies in the United States. However, this dividend appears to be a low enough percentage of cash flow that the company may try to maintain it during industry downturns. Management likely would use a special dividend as needed for extra returns to shareholders.

The Future

Management has found more badly needed refining capacity in the form of the latest acquisition. Still more refining capacity will be available when the Superior Refinery has been completely rebuilt and begins operations. The company really has now joined competitors Suncor Energy (SU) and Imperial (IMO) in the degree of vertical diversification.

Management has also bought out another partner. This time it is BP (BP) that is getting bought out for C$600 million, a variable payment, and the surrender of an interest in another project. This is yet another oil sands project that will likely show improved costs because Cenovus now has the partnership shackles removed. The company seems to have much better operational reporting when it has sole possession of an operation than it does with partners.

There is also the restart of the offshore White Rose project.

Cenovus is admittedly “the new kid on the block” so the market will likely demand a track record of the company as it is now. That company is nothing like the company of four years ago that was largely dependent upon a partnership with ConocoPhillips. But Mr. Market tends to see ghosts where others see opportunity.

The market perception of the company may be changing though. As management makes this newly combined company work as it should, then the shares should command a valuation multiple similar to both Imperial and Suncor. That would be a far more favorable valuation than has been the case as cash flow improved while the stock price languished.

Shareholders should therefore expect a sharply asymmetric return over the next several years. The downside risk, even after the latest rally, appears minimal because cash flow is rapidly improving from the benefits of the acquisitions made. Those benefits should result in a superior corporate performance even if commodity prices eventually weaken. That means the upside potential of the stock still remains significant because there are several years of reported financial improvements that have yet to be priced into the stock.

Be the first to comment