FikMik/iStock via Getty Images

On most metrics, Celsius Holdings (NASDAQ:CELH) appears an expensive beverage stock to avoid in this market environment. The healthy energy drink company continues to report explosive growth and a new distribution partnership with PepsiCo (PEP), possibly warrants a higher valuation regardless of normal valuation metrics. My investment thesis is Neutral on the stock, though one should look at buying the hot stock on dips.

Boom Times

Celsius continues to highlight that companies can report strong growth in all economic environments. The proven functional energy drink fairs favorably compared to other energy drinks, especially industry leader Monster Beverage (MNST).

For Q3’22, Celsius reported that revenue surged nearly 100% to $188.2 million. The company again smashed analysts estimates by $26.2 million in the quarter following a history of exceeding estimates by up to 10%.

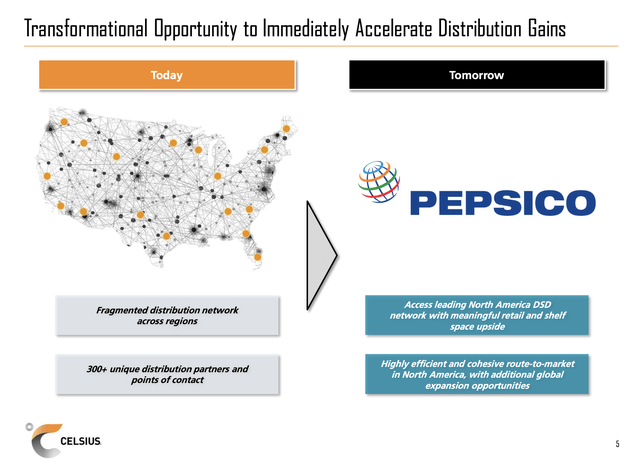

The story has an even more intriguing aspect with the recent agreement for PepsiCo to become the global distributor of Celsius drinks. Not only did Pepsi make a $550 million investment into preferred stock for an 8.5% position in the company, but also the deal started on October 1. The company provided the following positive indications of the initial distribution results on the Q3’22 earnings call:

We officially commenced our distribution partnership with PepsiCo subsequently to the third quarter with the distribution to most of our retail accounts transitioning as of October 1, 2022, while early initial track data on both ACV and items carried per store growth indicate impressive gains already gained and exceeding our actual expectations on both these tangible metrics.

In addition, Celsius has seen an approximately 11% increase in ACV, since October 1, 2022, and the initial launch with the PepsiCo distribution network with average items carried per store increasing from an average of 7.7% to 8.3% over the same three week timeframe. The convenience store channel, Celsius has seen the largest gain with approximately a 23% increase in ACV since October 1 of this year.

A big transformational deal in such a short time typically runs into hiccups. The agreement was only announced on August 1 and Celsius had to take a $155.4 million charge in Q3 for early distribution termination fees, but the opportunity is clearly enormous. Amazingly, the company had 300+ distributors and is now converting the business to PepsiCo with increases to retail and shelf space in the process. Over time, the deal will even provide access to the international market.

Source: Celsius/PepsiCo presentation

For Q3, Celsius reported North America revenues of $179.5 million and International revenue of $8.7 million. Even with the 100% growth, the International revenue dipped from the prior year despite the company only scratching the service outside of the US. The PepsiCo distribution deal should line up some strong possibilities into International expansion in the future.

Next Path

Celsius has clearly set the next path for the business as much higher due to the improved distribution network. The stock becomes hard to value due to the hot growth rates that ultimately won’t be sustainable and the market is currently leery of such scenarios following some of the recent blowups with the Covid boosts in prior years.

In addition, the energy drink company only reported a Q3’22 EBITDA of $24.8 million and just $57.5 million for the YTD period. Celsius did grow gross margins in the quarter to 49.6% when excluding OB freight charges, up 230 basis points from last year.

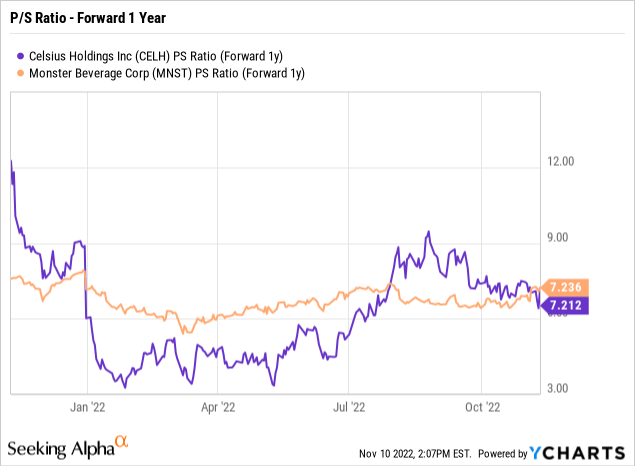

The company is showing some leverage on the revenue pop with EBITDA up 152% for the quarter versus ~100% sales growth. Where the stock story gets more interesting is that Celsius trades at a similar forward P/S multiple of Monster Beverage at slightly above 7x forward sales targets.

The stock appears expensive with the market cap up at $7.1 billion with 2023 revenue targets at slightly below $1.0 billion and limited EBITDA, but the Monster stock price has been consistently trading at this multiple with much slower growth now. In fact, analysts only forecast Monster to grow 10% next year while Celsius is set for 50% growth and the PepsiCo deal might juice growth rates.

Celsius ended the quarter with a cash balance topping $700 million and inventories at $154 million. The company has actually seen inventories dip since the start of the year when Celsius wasn’t well funded with an inventory balance of only $16 million.

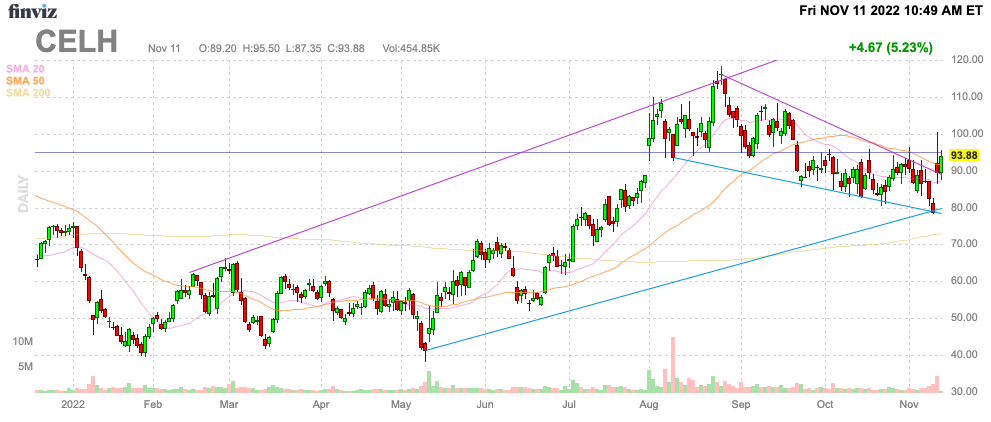

The stock couldn’t even top $100 on the good earnings report and a stock market rallying over 5%. The chart doesn’t look particularly strong with what appears strong selling pressure on any rally.

Source: FinViz

Takeaway

The key investor takeaway is that Celsius continues to execute by all measures. The PepsiCo distribution deal likely takes the company to a far higher level, but the stock isn’t acting well here.

Investors should use further weakness to start loading up on Celsius rather than chasing the stock higher.

Be the first to comment