Aaron Davidson

I once signed up for a gym class where the instructor, who doubles up as the establishment’s marketer, kept parroting the mantra “you have one life, be fit for it.” After a few weeks of attending workout sessions, I realized everyone at the gym, especially those who had been customers for long, lived by that mantra both in the gym and outside of it. This experience convinced me that a passion for health and fitness can alter our thoughts, values, attitudes and even behaviors – sometimes positively, depending on how you judge it.

For example, most people who are enthusiastic about fitness do not take chances with their diet and have unique lifestyle choices that inform what they eat and drink. They are picky shoppers who are highly loyal to food and beverage brands that they believe offer a particular edge or health benefit vs. other brands in the same category.

One beverage brand that has in recent years gained notable recognition and acceptance among fitness enthusiasts in the US is Celsius, a fitness supplement drink that is produced and sold by Celsius Holdings (CELH).

The Florida-based soft drinks company markets its flagship Celsius energy drink as a proprietary clinically proven blend that accelerates metabolism and burns calories while providing energy. As one of the pioneering names in the fitness energy drinks segment, CELH has played an instrumental role in the category’s rapid growth in recent years.

Emerging as an energy drink category leader

CELH is a fast growing brand in the energy drink category and in Q3 posted record revenue of $188.2 million, up 98% from $94.9 million in Q3 2021. In his opening remarks at the Q3 earnings call on Nov 3, CEO John Fieldly discussed how CELH is shaping up to become a dominant player in the category.

Citing data from data analytics firm IRI and other sources, Fieldly noted that as of October 22, Celsius was the third largest energy drink in the United States. The brand is also popular on Amazon (AMZN) where it was the second largest energy drink with an 18.5% share of the energy drink category ahead of Red Bull at a 12.01% share and trailing Monster (MNST) at a 26.2% share on a year-to-date basis ending October 22.

The company enjoys strong distribution across all retail channels in the US, including the largest retailers in the grocery and nutrition channels as the screenshot below shows.

Some of Celsius distribution partners (Investor Presentation)

Thanks to its reach and product availability, the company is positioned to continue growing robustly. Nine analysts covering the stock expect its revenue to come in at $651.30 million in FY 2022 (a 107% jump from $314.1 million in 2021) and to end FY 2023 at $979.06 million, bringing it closer to the $1 billion turnover level that is a critical milestone in every growth company’s journey.

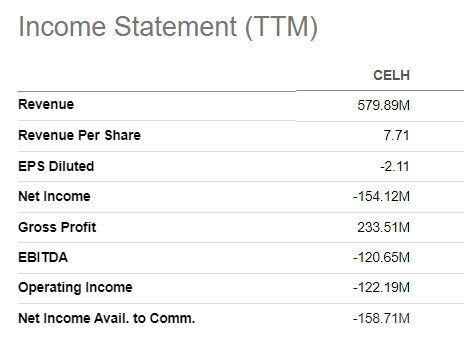

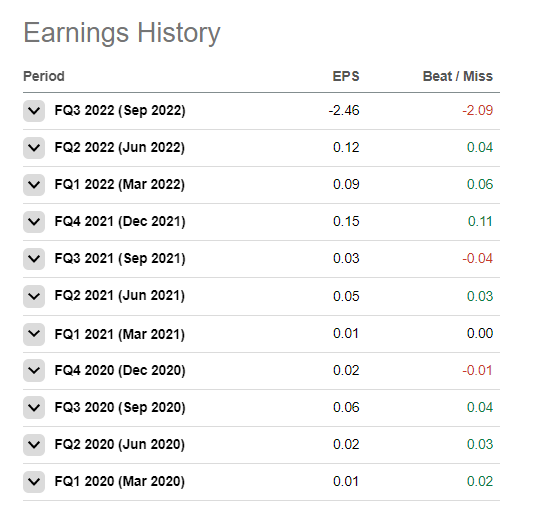

CELH’s bottom line is, as you would expect, not impressive given it is a growth company that is yet to attain its optimal level of scale. Below is a snapshot of its income statement for the trailing twelve months as well as its earnings history to give a sense of how profitability has evolved in the past two years.

Seeking Alpha Seeking Alpha

Analysts expect CELH’s EPS to improve considerably to $1.13 in 2023 and $1.91 in 2024, reflecting expectations that the projected growth in the top line will translate to meaningful growth in earnings.

The optimism over CELH’s prospects has increased following the investment and distribution deal the company got into with PepsiCo (PEP) in August 2022 where PEP purchased an 8.5% stake in CELH for $550 million. The deal has given CELH access to PEP’s larger and more established distribution network

The company noted on the Q3 earnings call that its U.S. store count now totals 174,000 locations nationwide, growing over 60,000 doors or 54% from 114,000 doors as reported in the third quarter of 2021 with additional expansion planned throughout the rest of the year and into 2023, accelerated by the PepsiCo distribution agreement.

PEP’s investment could be a gamechanger if you look at how another energy maker, Monster, benefited from a similar but larger investment and distribution deal with Coca-Cola (KO). In 2015, KO purchased a 16.7% equity stake in the company for a $2.15 billion cash payment and became Monster’s preferred distribution partner globally. Since then, MNST has gone from delivering revenue of $2.72 billion in 2015 to revenue of $6.4 billion expected in 2022.

Bulls perhaps hope for a similar outcome for CELH after the PEP deal. The fact that PEP’s stake in CELH is just 8.5% suggests there could be room for the beverage giant to increase its holdings and get more involved in the success of CELH.

Not a good investment

Investors who have held onto CELH in the past three years amid this growth and expansion have been rewarded with exceptional returns. From trading below $5 per share in 2019, the stock is up an unbelievable 20x since then. Such a return is enough to deliver life-changing money assuming you rode it and had a reasonable stake.

These unusually great returns in a space of just three years have in recent months attracted short traders. CELH’s short interest has been growing steadily. It was in the mid-teens in August but is now at 27.50%.

I see no reason to be pessimistic on the underlying business. In fact, I believe it will continue growing. The stock, however, seems to have moved up too quickly and could face trouble in coming quarters. This could be why bearish bets have increased in recent months.

While I have nothing but admiration for how CELH’s management has grown the business, the stock is simply too expensive for me to consider it a buy. It has an astonishingly high EV/EBITDA (‘fwd’) of 102.86x and a P/S of 12.54x, which is 21% higher than its 5 year average.

Moreover, the fact that it pays no dividends and lacks a history of profits offers limited downside protection should the sales outlook suddenly change and investor sentiment shifts to the negative.

CELH is a great business but long-term investors looking to make money here may need to wait for a pullback. The stock is not a good investment and could disappoint investors who buy at these levels in the hopes of future returns.

Be the first to comment