Ridofranz/iStock via Getty Images

Celsius Holdings, Inc. (NASDAQ:CELH) is recognized as pioneering the category of fitness-focused energy drinks which are a healthier beverage alternative. Celsius features a proprietary blend of ingredients backed by studies showing it burns calories, reduces fat, and increases metabolism. With a company history going two decades, sales ramped up significantly since 2020 benefiting from strong brand momentum and expanding distribution. Indeed, the stock has returned over 600% in just the last two years.

While shares have been volatile more recently amid the broader market selloff, the company’s recent quarterly report helped add a new boost of positive momentum by beating consensus estimates. The attraction here is a sense that the growth story is still in the early stages supported by overall solid fundamentals including accelerating profitability. We are bullish on the CELH which is well-positioned to continue outperforming.

CELH Financials Recap

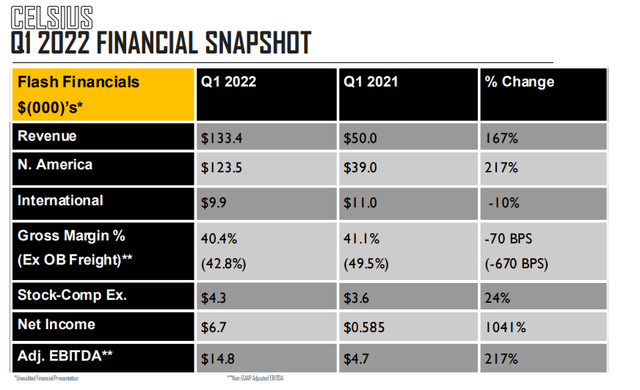

The company reported its Q1 earnings on May 10th with GAAP EPS of $0.09 which was $0.06 ahead of expectations. Revenue of $133 million was well ahead of estimates closer to $114 million and climbed 167% from the period last year. The strength of the company has been built around the North American market which currently represents over 92% of total sales, up 217% y/y to $123.5 million.

On the other hand, the smaller international business remains largely concentrated in the Nordic European region where Celsius maintains a dedicated corporate team to expand territory. In Q1, international sales declined by 10% to $9.9 million which management blamed on supply chain issues along with the timing of some larger orders. Favorably, there was more positive momentum in China with sales of $1.4 million, up 114% y/y where it maintains a royalty licensing model.

The firm-wide gross margin at 40.4% narrowed from 41.1% in the period last year. Part of that considers industry-wide inflationary cost pressures along with international expansion spending. The company also reports an adjusted gross margin measure excluding outbound freight that declined to 42.8% from 49.5% in Q1 2021. Nevertheless, the big takeaway here is that the company is profitable with a net income of $6.7 million surging by 1,041% y/y with the operating scale delivering an adjusted EBITDA of $14.8 million.

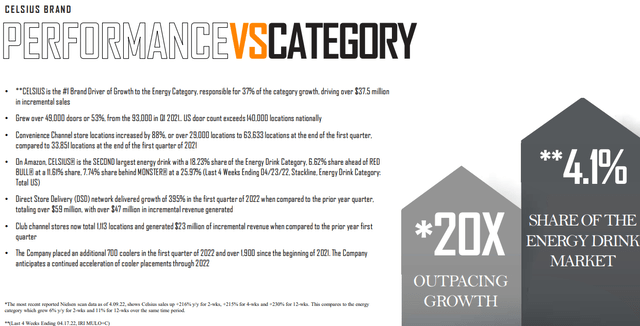

As mentioned, the main top-line driver is the expanding distribution network with Celsius now sold at over 140,000 retail locations in the U.S., up 53% from 93,000 in Q1 2021. The company maintains partnerships with major companies like Anheuser-Busch InBev SA/NV (BUD), Keurig Dr. Pepper Inc. (KDP), and even PepsiCo Inc (PEP) as wholesalers. The goal is to ultimately replicate this success worldwide with new partnerships.

This is important because the availability of the product at both small and large retailers, grocery stores, nutrition centers, fitness settings, and e-commerce channels has worked to build brand awareness. More consumers trying the line of beverages for the first time naturally build a cohort of repeat buyers that can evolve into potential lifelong customers.

While management is not providing financial targets, the messaging during the earnings conference call projected optimism. Efforts this year include new marketing efforts to reach more customers along with premium in-store advertising placements. The larger distribution is set to provide a growth runway over the next few quarters.

Finally, we note that Celsius benefits from a rock-solid balance sheet including $25.5 million in cash against zero financial debt. The internally funded growth has been impressive and represents a strong point in the company’s investment profile.

Is CELH A Good Long-Term Investment?

A big theme for the company is its position within “functional energy” with data suggesting consumers are shifting away from artificially flavored and high-sugar beverages. From the fitness boom observed during the early stages of the pandemic, a lasting legacy appears to be consumers sticking with healthier food and beverage options.

The long-term bullish case for the stock is that the company will become synonymous with its segment of energy drinks as privately-owned “Red Bull” or Monster Beverage Corp (MNST). For context, management notes that it is now the second-largest energy drink by sales on Amazon.com (AMZN) with an 18.2% share, ahead of Red Bull at 11.6% while catching up to Monster at 26.0%. A case can be made that Amazon represents a leading indicator for Celsius brand performance in all other channels. For reference, Monster has generated about $5.5 billion in sales over the last year. With still only a 4.1% reported share of the total “energy drink market”, Celsius sales are outpacing the category by 20x with plenty of upside.

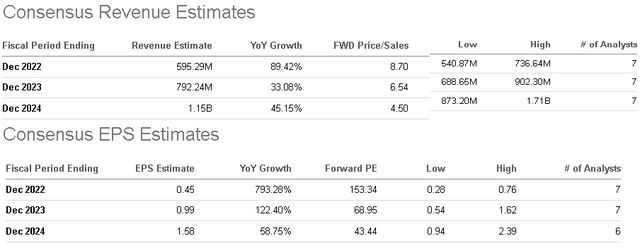

According to consensus estimates, the forecast is for sales to reach $595 million this year, up 89% from 2021. Growth is then expected to average 39% in each of the next two years to break $1.1 billion by 2024. What stands out is the earnings momentum with EPS ramping up from a forecast of $0.45 this year compared to $0.05 in 2021 and more than doubling in 2023 and climbing again 59% in 2024 to $1.58.

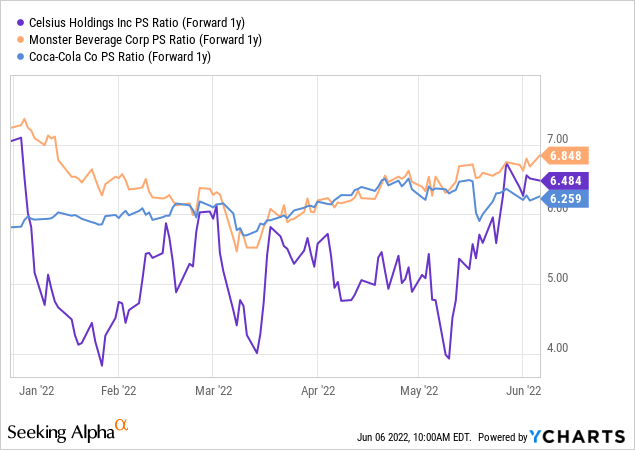

In terms of valuation, CELH may draw a sticker shock with some investors considering a 9x forward price to sales ratio and 153x forward P/E multiple on the 2022 consensus estimates. While objectively pricey by most measures, keep in mind that few companies in any sector have a similar growth outlook with sales expected to nearly double and earnings more than tripling over just the next two years.

We highlight that by focusing on the 2023 and 2024 consensus estimates, CELH begins to look attractive relative to some larger beverage industry peers. The 1-year forward price-to-sales multiple of 6.5x is in-line with Monster Beverage Corp (MNST) at 6.8x and even Coca-Cola Co (KO) at 6.3x. On the earnings side, getting into 2024, there is a case to be made that CELH even looks cheap at a 2-year forward P/E multiple of 43x. This is in the context of sales expected to climb 45% that year to $1.2 billion while earnings grow 59% that year to $1.58. A sales multiple of 4.5x in 2024 may even look cheap.

Again, these are market estimates and a lot can happen over the period but the latest numbers speak for themselves and it’s clear the drink is connecting with consumers who will continue to fuel growth. The call on whether CELH is under or overvalued largely depends on how much confidence we can place on the management team to execute its growth strategy. Equally as important is whether the consumer demand for Celsius beverages will continue to meet the expanding production capacity and distribution.

This latter point is filled with uncertainty and represents a key risk in the stock. In many ways, the success of Celsius in redefining this category has drawn the attention of other players that are keen to introduce alternative options. Any evidence that Celsius is slipping in terms of market share or the brand momentum slows will manifest through weaker than expected quarterly results. This will likely take several years to play out.

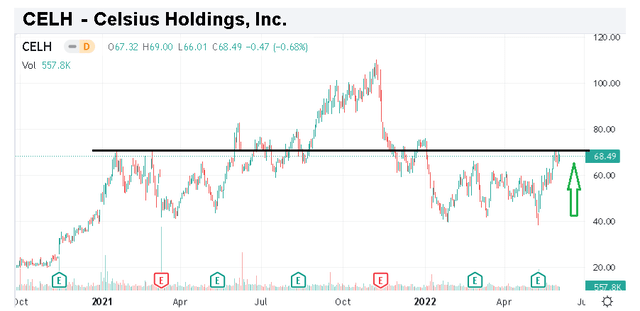

In the near term, we like the action in the stock which has rallied sharply since the Q1 earnings report when it briefly traded under $40.00 per share. The current share price level right around $69.00 has corresponded to some technical resistance going back to early last year. A breakout from here is a bullish technical setup.

Final Thoughts

We rate CELH as a buy with a price target of $95 for the year ahead representing a 9x price to sales multiple on the current consensus sales forecast for 2023. In our view, CELH should command a higher growth premium to the larger beverage industry comparables given its earnings trend and brand momentum. Even with concerns of a slowing economy or consumers being pressured by record inflation, Celsius can benefit from an ongoing shift away from traditional sodas and high-sugar energy drinks.

Be the first to comment