martin-dm/E+ via Getty Images

Theme parks have had a rather tumultuous last few years thanks to the COVID pandemic and resulting shutdowns. For a decent period of time, many investors were convinced that companies such as Cedar Fair (NYSE:FUN) would perhaps be forced into bankruptcy.

Thankfully for investors and millions of park enthusiasts across the country, that did not happen, and in this article, I would like to present my opinion as to why I believe the company is likely to emerge stronger than ever before and may present a compelling investment going forward.

Overview

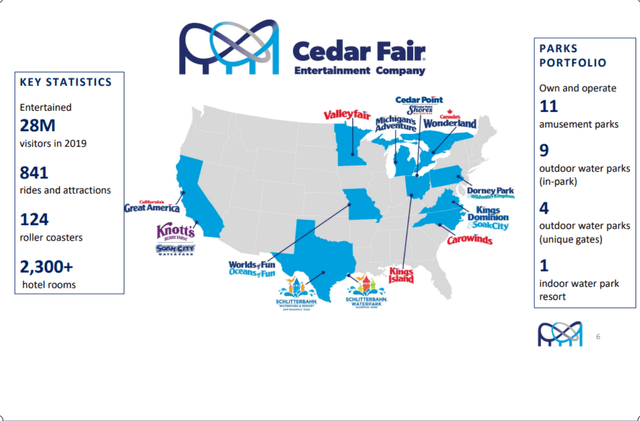

Cedar Fair is a pure-play theme park operator. The company was founded in 1983 giving the business a 39-year operating history. The business is based around major regional theme parks spread across the USA and a single park in Canada.

The company, like all other experiential-focused companies, was absolutely hammered during the initial COVID pandemic with revenues dropping like a stone from $1.47 billion in 2019 all the way to just $181 million in 2020.

To stay afloat, management opted to almost immediately take on substantial debt of over $800 million and completely eliminate the generous cash distribution of $3.74 a share. In essence, they went into full turtle shell mode!

This was done out of necessity given the highly volatile operating environment for nearly every business around the country at the time, and this cash cushion allowed the company to ride out the storm.

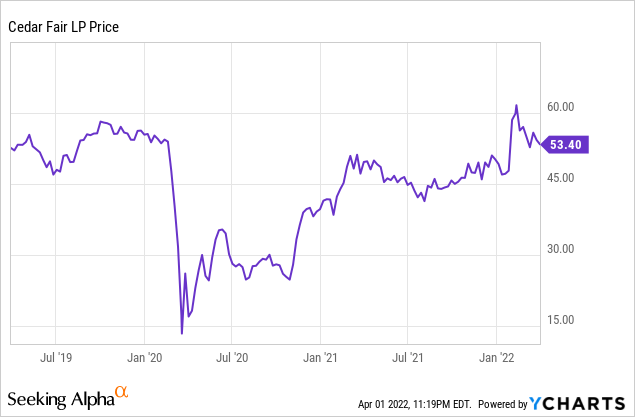

As you can see, the stock price in March of 2020 dropped from the mid-$50s all the way to a bottom of $13.45 for a whopping 75.5% loss in the immediate aftermath of COVID.

A Stronger Cedar Fair

The company’s management has long been praised as perhaps the best operators in the theme park industry and during the pandemic “downtime”, the company once again proved why it will not go quietly into the night and set forth planning for a better and stronger Cedar Fair once the pandemic ended.

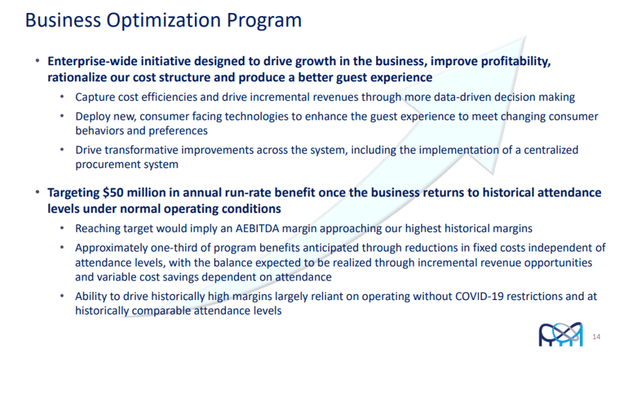

Central to this plan is the implementation of technology to optimize not only the guest experience but to assist in right-sizing the labor force. The basic details of the plan center around a greater emphasis towards direct-to-consumer online ticketing and significant labor management capabilities.

Labor at Cedar Fair’s parks accounts for roughly 35% of the total cost structure of the business, so if a given park has its full complement of 300 staff members scheduled for a given day and that park only sees 65% attendance, you are wasting quite a bit of money.

However, if you are able to predict, based on online ticket sales, more accurately, your staffing needs, you can optimize your workforce and perhaps only schedule 200 staff members on a given day thus dramatically increasing your parks’ earnings power and leverage.

The total opportunity management has identified may end up being as much as $50 million worth in the near future, which given prior 2019 EBITDA levels of $505 million is quite substantial indeed.

In addition to the above, the company is striving to build a much greater online presence, thus cutting out the partner program it has historically used to sell tickets. Naturally, these ticket sales were heavily discounted in the past to account for a commission to the sales agent or promoter and greater direct sales to customers will result in a higher average selling price net to the company.

As business began to return in mass during late 2021, we are beginning to see green shoots in regards to the retooled Cedar Fair showing up in the results.

In 2021, the company reported total system-wide sales of $1.34 billion, which is over 91% of 2019 pre-pandemic numbers. This 91% performance was achieved with only 70% of 2019 (85% operating day comparable) attendance.

This result shows the company’s rather dramatic ability to drive increased revenue through a retooled food and drink offering (28% increase compared to 2019) along with a greater online-focused ticketing process.

One must remember that these very encouraging results for 2021 come on the heels of a very rough start to 2021. The early theme park season was basically destroyed as much of the country continued lockdowns or simply would not let Cedar Fair’s parks open given the rise of the Delta variant and subsequent surge of cases, so the 2021 numbers truly only represent around 60 to 70% of the park season.

The newest bear case against the company comes in the form of recession worries now that COVID has been firmly pushed in the rear-view mirror by the majority of the country and inflation has firmly slapped the country across the face like Will Smith.

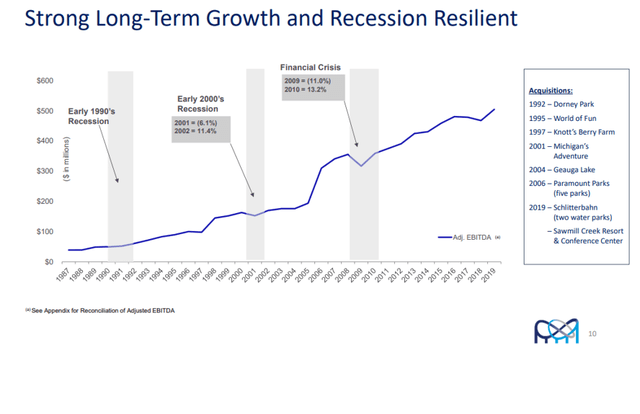

Historically, much has been made of the idea that theme parks suffer terribly in recessions or in times of economic distress, however, this is simply not true, at least not in Cedar Fair’s operating history.

In fact, using the above graph, it would appear that Cedar Fair specifically is extremely resilient to tough economic times. If you can remember just how economically stressed the USA was during the financial crisis, then you notice that Cedar Fair took only an 11% EBITDA hit in 2009 and then subsequently recovered all of that drop plus 2% in 2010, it certainly puts one’s mind at ease to these worries.

Another common theme from bear arguments involves the debt the company took on during the pandemic and how this will hamper the company in the long term. Let’s dig into that a bit more.

The Debt and Valuation

Shortly after the pandemic began, Cedar Fair took on roughly $800 million in debt to shore up cash reserves to sustain the company. This debt increased the total debt from $2.15 billion in 2019 to nearly $3 billion during the end of 2020. Because of this added debt, the company’s interest expense rose from $100 million in 2019 to over $184 million in 2021.

However, recently, the company has taken significant action to deleverage the balance sheet now that good times are expected to be back in full swing. In November of 2021, the company announced the full prepayment of $450 million in 5.375% 2024 notes, bringing the total debt down to $2.56 billion as of Q4 2021.

This was a huge sign not only of confidence by management but in the deleveraging potential of the business going forward. Management has stated that they expect to reach 2019 debt levels of roughly $2 billion in the near future, aided by a strong 2022 outlook and the significant cash generation of the business.

In addition, the long-suspended distribution to unitholders is expected to resume (likely at a reduced level) in Q3 of 2022. I expect that the distribution will be ramped up, perhaps back to 2019 levels as the balance sheet is deleveraged towards the $2 billion target debt level which based on projected results may occur as soon as mid to late 2023.

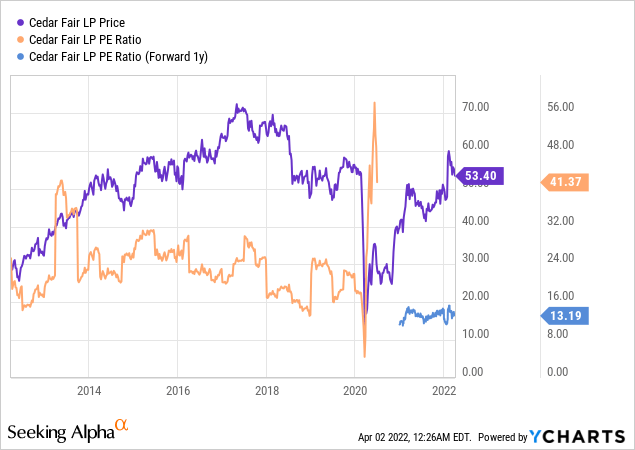

Valuations at Cedar Fair currently look quite attractive to me. Based on 2022 estimate, the company is currently selling for a 15.14 PE ratio, well below historical levels.

Given the uncertainty of exactly what the new year will bring for the company, a certain discount is likely warranted to historical levels, however, this is a company with ample catalysts going forward with the potential resumption of the distribution, to go along with improved earnings power and rapid deleveraging.

The historical 10-year PE looks to be in the 22-24 range, making the current 2022 estimate of 15.14 nearly 35% below historical averages. To me, that is just too much of a discount for such a strong company.

Bottom Line

In my opinion, Cedar Fair presents a compelling long-term total return potential. I view management at the company to be the best in the business and during the pandemic, they have certainly been earning their salary.

Threats to the very survival of the business, as Cedar Fair has faced during these last two years, have a way of reinvigorating a management team to find new efficiencies and to think of new ways to run a business.

In Cedar Fair’s case, management made the correct moves during the pandemic in temporarily loading up on debt quickly to ensure the company’s survival and in retooling the operation into a tech savvy, efficient powerhouse built to come out the other side of the pandemic a stronger, more profitable enterprise.

Theme parks are most certainly not going away anytime soon, and I prefer to have my capital invested in the best of breed. In my opinion, you cannot find a better operator than Cedar Fair.

Let me know your thoughts in the comments below. Thank you for reading and good luck to all!

Be the first to comment