ClaudineVM

Earnings of Cathay General Bancorp (NASDAQ:CATY) will most probably surge this year on the back of healthy loan growth. Robust economic activity in the company’s markets will drive loan growth. Further, interest income will benefit from the rising rate environment. Overall, I’m expecting Cathay General to report earnings of $4.59 per share for 2022, up 21% year-over-year. For 2023, I’m expecting earnings to grow by 13.7% to $5.22 per share. The year-end target price suggests a moderate upside from the current market price. Based on the total expected return, I’m adopting a buy rating on Cathay General Bancorp.

Loan Growth To Revert To The Historical Norm

Cathay General’s loan portfolio grew by 8.8% during the first half of 2022, partly driven by the acquisition of HSBC Bank USA’s West Coast retail and consumer banking business. Apart from the acquisition, organic loan growth also remained high compared to previous years. The management is projecting loan growth to be between 10% to 12% this year, as mentioned in the second quarter’s earnings presentation. This target is reasonable given the acquisition of HSBC’s business during the first quarter of this year.

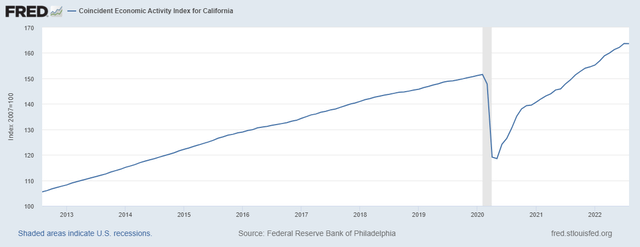

Further, good economic activity in Cathay General’s markets will keep loan growth afloat. The loan book is graphically well diversified, as the bank has a presence in nine states, from California to New York. Further, Cathay General has some presence in Hong Kong, Beijing, Shanghai, and Taipei. As borrowers from California and New York together make up a majority of the loan book, it’s best to consider the economic activity of both states to determine credit demand. As shown below, trendlines of the economic activity of both states are currently steeper than they were before the pandemic.

The Federal Reserve Bank of Philadelphia

The Federal Reserve Bank of Philadelphia

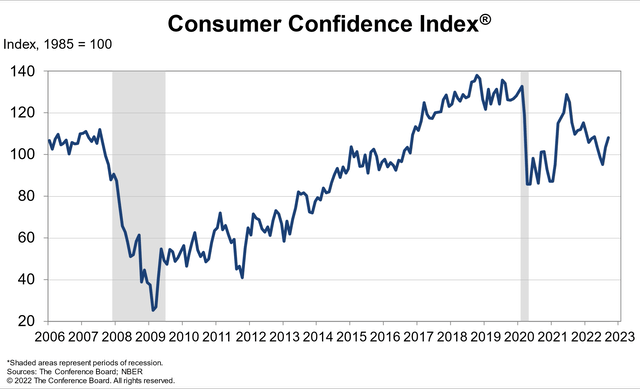

On the other hand, the ongoing interest rate up-cycle will dampen credit demand. Moreover, despite recent improvements, consumer confidence is still low from a historical context. Low consumer confidence is likely to hurt credit demand in upcoming quarters.

The Conference Board

In past years, loan growth has been in the mid-to-high-single-digit range. Considering the factors given above, I’m expecting loan growth to revert to the historic norm. I’m expecting the loan portfolio to grow by 1.25% every quarter till the end of 2023. Meanwhile, I’m expecting other balance sheet items to grow somewhat in line with loans. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 13,872 | 14,952 | 15,475 | 16,202 | 18,077 | 18,998 |

| Growth of Net Loans | 8.9% | 7.8% | 3.5% | 4.7% | 11.6% | 5.1% |

| Other Earning Assets | 1,955 | 1,914 | 2,343 | 3,443 | 2,319 | 2,413 |

| Deposits | 13,702 | 14,692 | 16,109 | 18,059 | 18,747 | 19,702 |

| Borrowings and Sub-Debt | 737 | 844 | 293 | 193 | 274 | 280 |

| Common equity | 2,122 | 2,294 | 2,418 | 2,446 | 2,562 | 2,852 |

| Book Value per Share ($) | 26.0 | 28.6 | 30.3 | 31.1 | 34.0 | 37.9 |

| Tangible BVPS ($) | 21.4 | 23.9 | 25.6 | 26.3 | 28.9 | 32.8 |

| Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) | ||||||

High Deposit Beta To Limit The Benefit Of Rising Interest Rates

Apart from loan growth, Cathay General’s top line will also benefit from the ongoing up-rate cycle. The Federal Reserve has already increased the fed funds rate by 300 basis points so far this year and is projecting another 125 to 150 basis points hike by the end of 2023. Higher rates will boost earnings on variable-rate loans. Further, Cathay General has a sizable cash balance that could benefit immediately from rate hikes. Cash and cash equivalents made up 5% of total assets at the end of June 2022.

Unfortunately, Cathay General’s deposit cost is quite rate-sensitive. Interest-bearing checking, savings, and money market accounts altogether made up 49% of total deposits at the end of June 2022. These deposits will reprice quickly after every rate hike.

Despite the ongoing up-rate cycle, the management isn’t too optimistic about the margin. As mentioned in the presentation, the management expects the margin to be between 3.50% to 3.65% this year. In comparison, the margin was at 3.52% during the second quarter of 2022. Further, the results of the management’s interest-rate sensitivity analysis given in the 10-Q filing show that a 200-basis point hike in interest rate could boost the net interest income by 13.7% over twelve months.

Considering these factors, I’m expecting the margin to grow by 10 basis points in the second half of 2022 and by a further 10 basis points in 2023.

Expecting Earnings To Surge By 21%

The anticipated loan growth and margin expansion discussed above will boost earnings through the end of 2023. On the other hand, the provisioning expense will return to a normal level this year following large provision reversals last year. This normalization will limit earnings growth in 2022. Further, non-interest expenses will rise in line with balance sheet growth.

Overall, I’m expecting Cathay General to report earnings of $4.59 per share for 2022, up 21% year-over-year. For 2023, I’m expecting earnings to grow by 13.7% to $5.22 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Summary | ||||||

| Net interest income | 566 | 575 | 552 | 598 | 702 | 783 |

| Provision for loan losses | (5) | (7) | 58 | (16) | 21 | 20 |

| Non-interest income | 32 | 45 | 43 | 55 | 61 | 54 |

| Non-interest expense | 264 | 277 | 283 | 287 | 300 | 316 |

| Net income – Common Sh. | 272 | 279 | 229 | 298 | 346 | 393 |

| EPS – Diluted ($) | 3.33 | 3.48 | 2.87 | 3.80 | 4.59 | 5.22 |

| Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) | ||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Moderately High Total Expected Return Warrants A Buy Rating

Cathay General is offering a dividend yield of 3.2% at the current quarterly dividend rate of $0.34 per share. The earnings and dividend estimates suggest a payout ratio of 26% for 2023, which is below the five-year average of 37%. The below-average payout ratio suggests that there is plenty of room for a dividend hike. Nevertheless, I’m not expecting any change in the dividend level because Cathay General does not often increase its dividends.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Cathay General. The stock has traded at an average P/TB ratio of 1.51 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Tangible BVPS ($) | 21.4 | 23.9 | 25.6 | 26.3 | ||

| Average Market Price ($) | 41.0 | 35.9 | 27.2 | 40.4 | ||

| Historical P/TB | 1.92x | 1.50x | 1.06x | 1.54x | 1.51x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $28.9 gives a target price of $43.6 for the end of 2022. This price target implies a 2.3% upside from the October 14 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.31x | 1.41x | 1.51x | 1.61x | 1.71x |

| TBVPS – Dec 2022 ($) | 28.9 | 28.9 | 28.9 | 28.9 | 28.9 |

| Target Price ($) | 37.8 | 40.7 | 43.6 | 46.5 | 49.4 |

| Market Price ($) | 42.6 | 42.6 | 42.6 | 42.6 | 42.6 |

| Upside/(Downside) | (11.3)% | (4.5)% | 2.3% | 9.1% | 15.9% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 10.7x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 3.3 | 3.5 | 2.9 | 3.8 | ||

| Average Market Price ($) | 41.0 | 35.9 | 27.2 | 40.4 | ||

| Historical P/E | 12.3x | 10.3x | 9.5x | 10.7x | 10.7x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $4.59 gives a target price of $49.1 for the end of 2022. This price target implies a 15.3% upside from the October 14 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.7x | 9.7x | 10.7x | 11.7x | 12.7x |

| EPS 2022 ($) | 4.59 | 4.59 | 4.59 | 4.59 | 4.59 |

| Target Price ($) | 39.9 | 44.5 | 49.1 | 53.7 | 58.3 |

| Market Price ($) | 42.6 | 42.6 | 42.6 | 42.6 | 42.6 |

| Upside/(Downside) | (6.3)% | 4.5% | 15.3% | 26.0% | 36.8% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $46.3, which implies an 8.8% upside from the current market price. Adding the forward dividend yield gives a total expected return of 11.7%. Hence, I’m adopting a buy rating on Cathay General Bancorp.

Be the first to comment