aapsky

Introduction

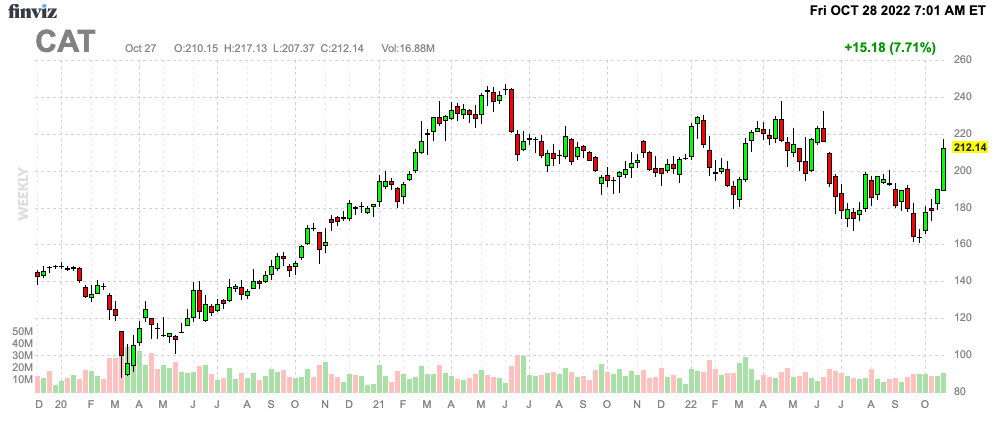

I start a lot of articles this way, but this macro environment is as fascinating as it is tricky. On the one hand, we have an incredibly tricky situation, consisting of high inflation, weakening economic fundamentals, and a Federal Reserve eager to hike until something breaks. On the other hand, we’re dealing with cyclical companies like Caterpillar (NYSE:CAT) that perform extremely well despite the aforementioned headwinds. In this article, we’re diving into Caterpillar’s earnings, which were even better than I expected. The company excelled at pricing, it saw easing supply chain issues, and surprisingly high demand as secular tailwinds persist. We’ll also incorporate the bigger economic picture as the company behind the CAT ticker isn’t just one of many industrials, but it is an incredible economic bellwether.

FINVIZ

So, let’s dive into the details!

A Big Surprise Despite Headwinds

Where to begin?

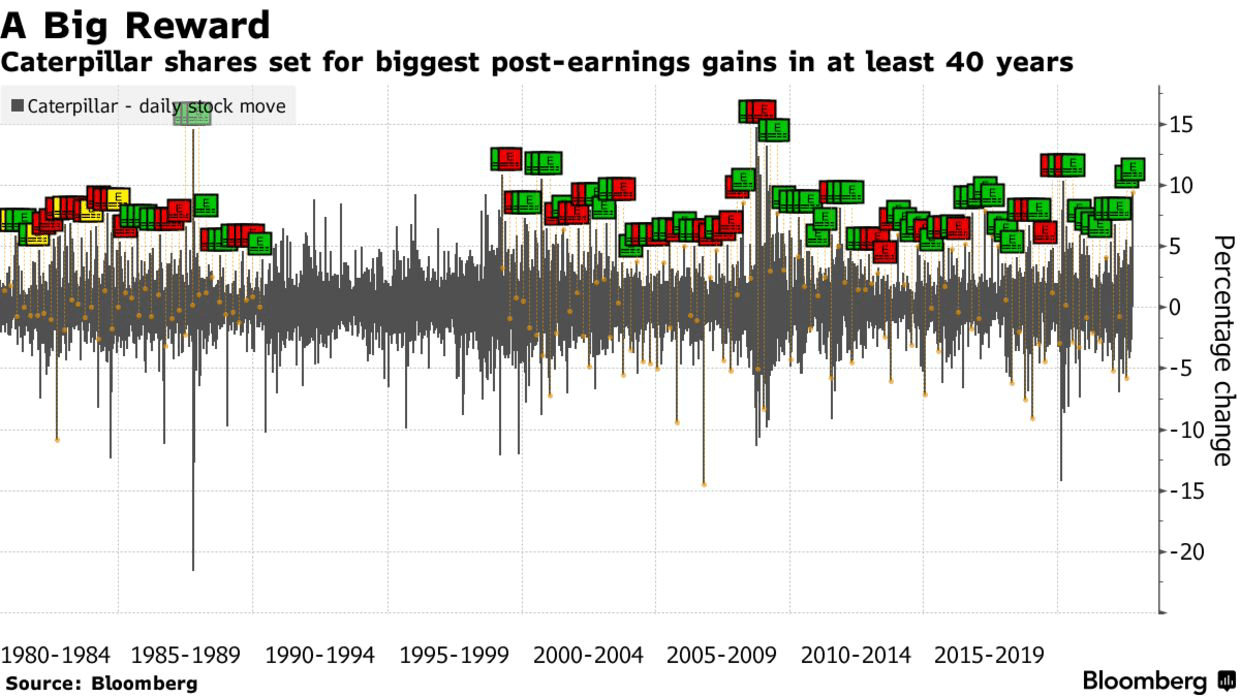

There’s so much to unpack here. So, let’s start with the most interesting thing investors noticed after the earnings release. Caterpillar shares rose almost 8%, which makes it one of the biggest gains of the past 40 years.

Bloomberg

What’s interesting is that this is happening while the US economy is about to enter a recession. Not only that, but the European economy is much worse, while even Chinese construction demand is slowing rapidly.

In the US, regional manufacturing surveys indicate manufacturing (industrial production) contraction. The ISM manufacturing index is now expected to fall below 50.

Wells Fargo

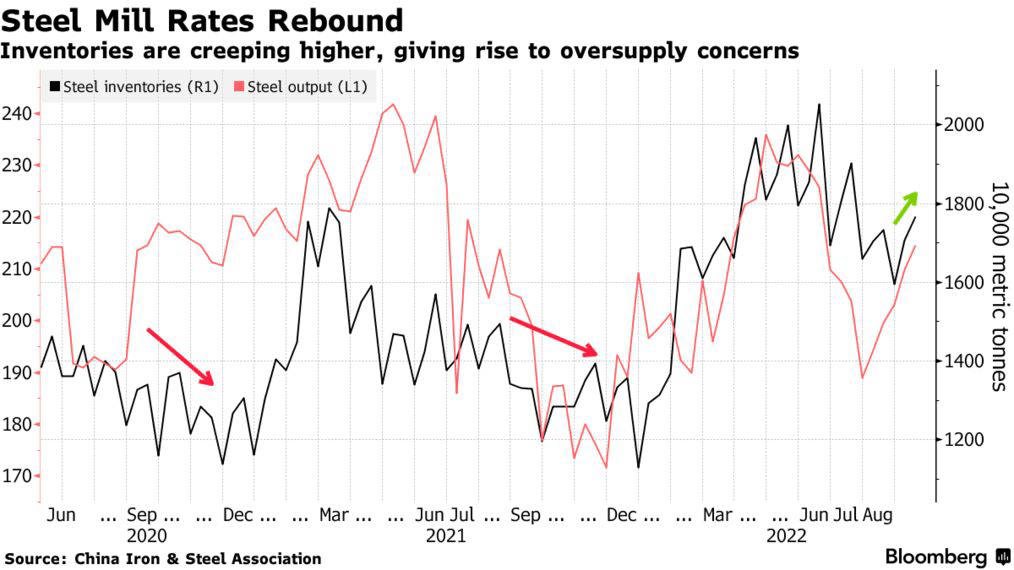

Not only that, but China, the leading driver of growth in Asia is dealing with significantly weakening construction demand causing inventories of metals to rise – that’s also bad for mining companies in the region.

Bloomberg

US manufacturing surveys and Chinese steel inventories are obviously just two examples of many, yet there’s no denying that the global economy is in a very tough spot as we will continue to discuss throughout this article.

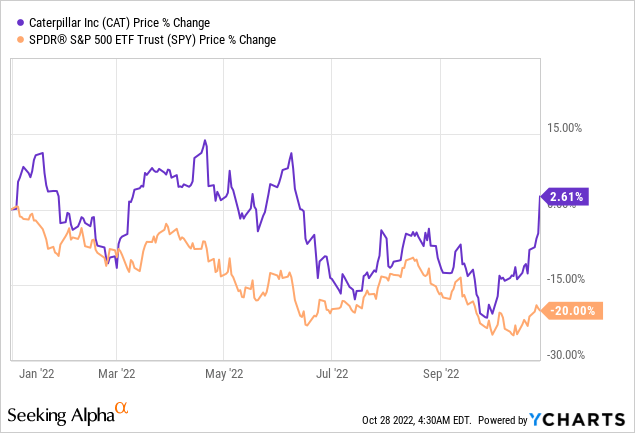

Yet, shares of the Texas-based machinery producer are up almost 3% year-to-date. Beating the S&P 500 by 23 points.

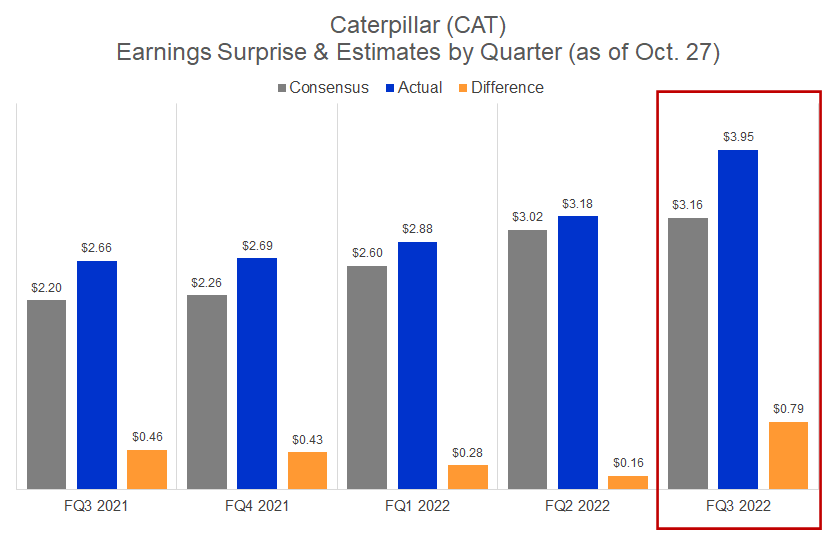

Even better, this move is backed by fundamentals. In 3Q22, Caterpillar generated $15 billion in sales, beating estimates by a whopping $620 million. The year-on-year sales growth rate was 21.0%, providing fertile ground for $3.95 in adjusted EPS. That’s $0.79 higher than expected.

As Seeking Alpha data shows, this earnings beat is one of the highest in recent history.

Seeking Alpha

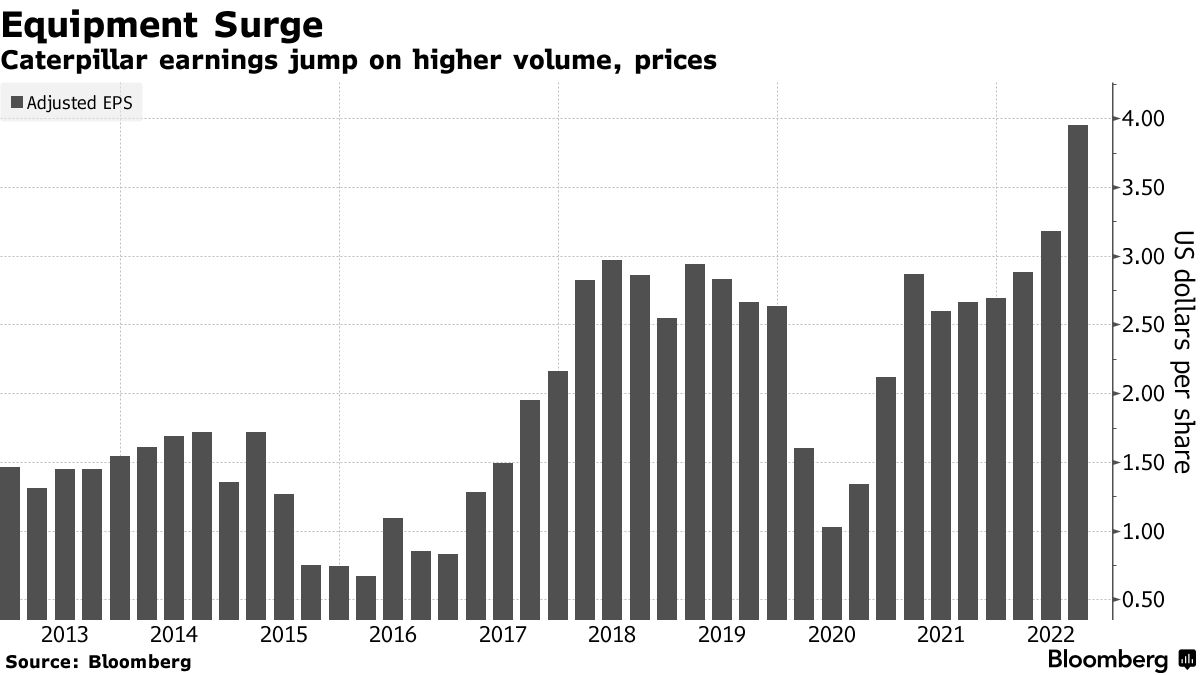

On top of that, the 3Q22 EPS result is the company’s best result ever after an already strong result in the second quarter of this year.

Bloomberg

As great as all of this is, it doesn’t mean that much going forward. After all, investors aren’t buying shares because the company had a good third quarter. What matters is what’s next.

Hence, we need to dig deeper.

Strong Sales With Secular Tailwinds

This economic environment isn’t just tricky because of slowing economic growth. It is also impacted by persistently high inflation. Companies across all segments need to grow sales in a slower-demand environment while protecting operating expenses against the aforementioned inflation. Especially a lot of tech stocks struggle with this as we’ve witnessed so far.

Moreover, a lot of machinery-related companies also need to deal with supply chain problems that are still persistent. Caterpillar competitor Deere & Company (DE), for example, struggled with that in its most recent quarter – as I discussed in this article.

Caterpillar also managed to deal with these issues as we will discuss next.

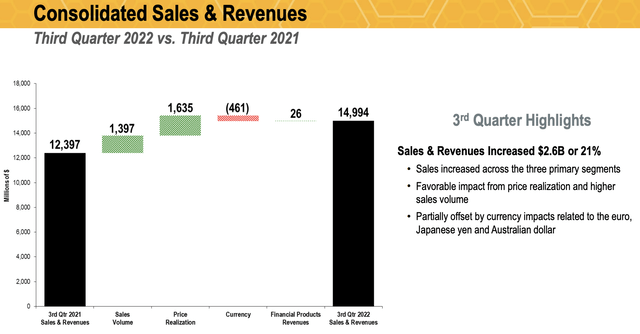

First of all, the 21% surge in revenues was caused by a strong sales volume and high price realization. That price realization would play a major role in this environment was expected. Healthy volumes are great news. Currency headwinds were $461 million, which is a result of a (very) strong dollar and the fact that the company sells more than 60% of its products outside of the United States.

Moreover, the company benefited from $1 billion worth of favorable changes in dealer inventories, which it does NOT control directly as dealers are independent. This is the result of slowly fading supply chain issues. Due to shortages, the company was not able to service demand in the past few quarters, leaving dealers with low inventory levels. Now, that’s changing.

Because of higher demand, the company is getting new orders faster than its ability to work on the existing backlog. This is resulting in a $1.6 billion increase in the backlog to a total value of $30 billion. That’s great news as it will keep the company busy going forward.

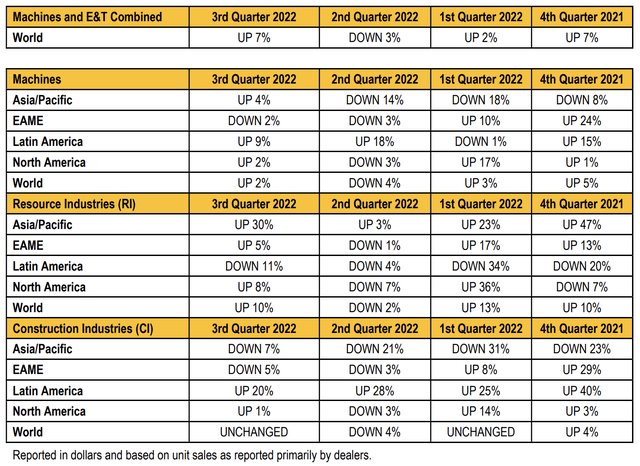

Overall sales to users increased by 7%, which is also highlighted in the table below. Three of the past four quarters saw positive sales growth.

The table also displays regional and segment differences. Overall, no segment saw negative retail sales growth. Construction was the weakest segment with consistent weakness in APAC countries. APAC contraction has been very significant for at least four quarters now, with EMEA starting to weaken as well. According to my sources and observations, that’s the result of labor and material shortages, sky-high energy costs, and lower demand.

Machines growth was up moderately with growth in all areas but EMEA.

Resource industries saw 10% growth with strong gains in APAC countries and North America. LATAM sales were down 11%.

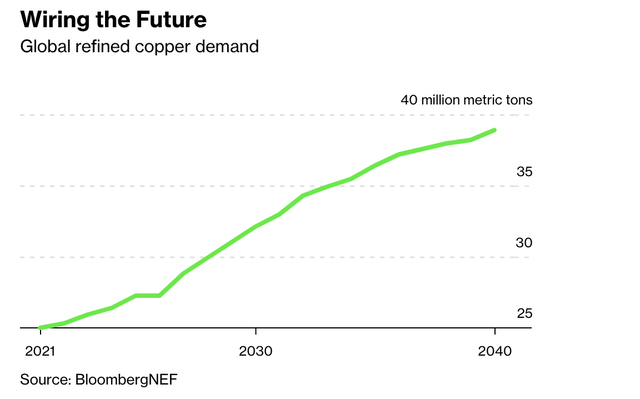

The resource segment is by far my favorite as I’m extremely bullish on the company’s long-term opportunities in that area due to a high expected increase in metals demand, deteriorating ore quality, and the related surge in expected demand. I discussed these issues in a recent CAT article, which I highly recommend.

This is what the company commented on the performance in this segment:

In Resource Industries, our mining customers continue to exhibit capital discipline. However, commodity prices remain supportive of continued investment despite trending lower recently. We expect production and utilization levels will remain elevated, and our autonomous solutions continue to gain momentum. I’ll highlight an example in a moment.

We expect the continuation of high equipment utilization and a low level of park trucks, which both support future demand for our equipment and services. We continue to believe the energy transition will support increased commodity demand, expanding our total addressable market and provided opportunities for profitable growth. In heavy construction and quarry and aggregates, we anticipate continued growth in the fourth quarter.

Despite economic headwinds, the company benefits from elevated commodity prices, the need to invest in new equipment due to a high average equipment age, and its ability to offer next-gen solutions like autonomous and electric equipment to miners like BHP (BHP). Caterpillar got a deal to replace all of BHP’s hauling trucks at its Escondida Mine in Chile, the world’s largest copper mine where BHP is operating over 160 trucks. Deliveries will start next year and take 10 years.

In its energy and transportation segment, the company boosted sales by 22% with double-digit growth in all sub-segments (power generation, industrial, transportation, and oil & gas).

According to the company:

Power generation orders remain healthy due to positive industry dynamics and continued data center strength. Industrial remains healthy with continued momentum in construction, agriculture and electric power. In rail, North American locomotive sales are expected to remain muted. We also anticipate growth in high-speed Marine as customers continue to upgrade aging fleets.

Higher Margins Despite High Inflation

With that in mind, the next slide matters almost more than the one showing higher sales growth. After all, in this environment, it’s easy to offset sales growth by failing to deal with rising operating costs.

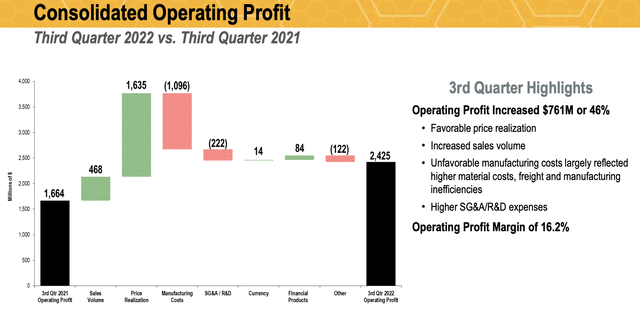

Luckily, Caterpillar didn’t struggle with that. In the third quarter, operating profit improved from $1.7 billion to $2.4 billion. That’s an increase of 46% despite a surge of $1.1 billion in manufacturing costs caused by higher material costs, as well as freight and manufacturing inefficiencies. In other words, the usual headwinds manufacturing companies have been dealing with since 2021. These costs were offset by $1.6 billion in pricing gains and roughly $500 million in higher sales (volume).

The operating profit margin rose to 16.2%, an increase of 280 basis points.

On top of that, the company saw higher margins in all of its segments:

- Construction industries: 16.5% -> 19.3%

- Resource industries: 11.8% -> 16.4%

- Energy & transportation: 13.9% -> 15.1%

In the financial products (financing) segment, the company grew revenues by 7% thanks to higher financing rates in North and South America. Segment profit increased by 27% as a result of lower provisions for credit losses. Roughly 2.00% of its loans are past due. That’s down from 2.41% at the end of 3Q21. In other words, despite a global surge in rates and slower economic growth, Caterpillar’s customers remain in good financial shape. That also says a lot about the industries the company is serving.

With regard to margins, what matters here is that margins are just starting to catch up. Total material and freight costs increased by 20% since 2020. The company’s gross margin of 28.5% in 3Q22 is now only getting back in line with levels seen in the third quarter of 2019.

Hence, it’s good news that the company remains upbeat going forward.

What’s Next?

While the company does not mention when it expects supply chains to go back to “normal” – which makes sense as predicting that comes with more risks than potential rewards – it remains very positive going forward.

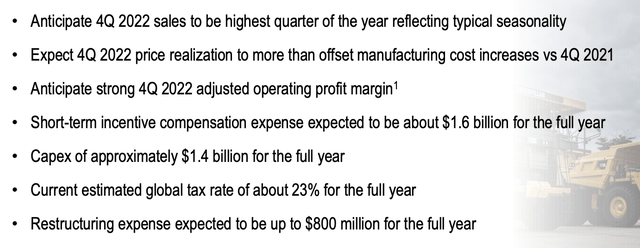

The company expects 4Q22 to exceed 3Q22 sales based on demand and seasonality. Price realization is expected to continue to offset manufacturing costs. Profit margins are expected to continue their uptrend.

This is what the company commented on its margins:

We expect adjusted operating profit margins to be significantly higher in the fourth quarter versus the prior year and slightly higher than in the third quarter. However, we now anticipate that our full year margins will be at the low end or slightly below the low end of the Investor Day target range.

The headwind is primarily due to ongoing manufacturing efficiencies related to supply chain constraints, ongoing inflationary pressures within manufacturing, cost and our conscious decision to continue to invest for profitable growth. That said, we expect to achieve our Investor Day ME&T free cash flow target range of $4 billion to $8 billion.

With that said, allow me to share a few more quotes from Caterpillar as the company’s comments tell us a lot about various segments and industries – especially in light of the macroeconomic background we discussed in the first part of this article.

Demand is expected to remain high despite a clear moderation in demand. While Chinese demand is expected to remain weak, the company sees higher demand for non-residential construction equipment as a result of government support.

Residential construction generally accounts for about 25% of sales in Construction Industries while non-residential is the remainder. In North America, residential construction is moderating due to tightening financial conditions but remains at relatively high levels.

We expect non-residential construction in North America to strengthen, supported by the impact of government-related infrastructure investments. In Asia-Pacific, excluding China, we expect moderate growth due to higher infrastructure spending and commodity prices. As we mentioned last quarter, weakness continues in China in the excavator industry above 10 tons.

Even in Europe, the situation isn’t *that* bad.

In EAME, business activity is expected to be flat to slightly down versus last year based on uncertain economic conditions in Europe. However, strong backlogs and announced infrastructure plans limits the decline. Construction activity in Latin America is expected to grow due to supportive commodity prices.

With regard to resource industries:

In Resource Industries, our mining customers continue to exhibit capital discipline. However, commodity prices remain supportive of continued investment despite trending lower recently. We expect production and utilization levels will remain elevated, and our autonomous solutions continue to gain momentum.

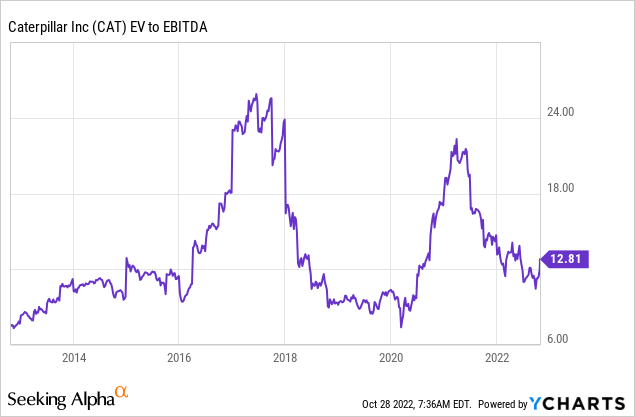

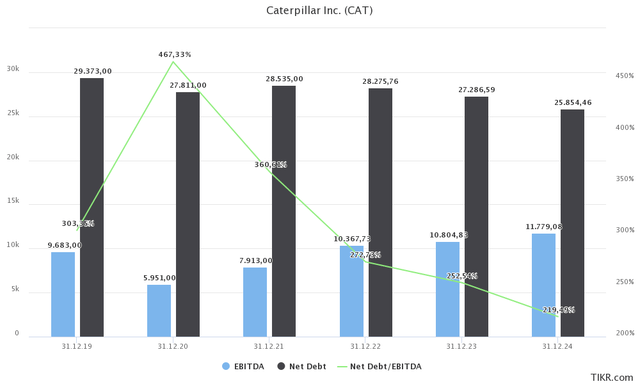

With regard to the valuation, the company is now trading at 13.4x 2023E EBITDA of $10.8 billion. That’s based on its $114.3 billion enterprise value, consisting of its $112 billion market cap, $5 billion in pension-related liabilities, and $27.3 billion in 2023E net debt.

This valuation is very fair, especially given the implied free cash flow yield of almost 8%. It means investors are not overpaying to get access to free cash flow.

However, I’m a bit more careful. The stock has done tremendously well after my most recent article as investors have priced in the good news. However, given economic headwinds, I remain a bit more careful urging investors to try to buy the stock at a valuation below 12X (forward) EBITDA.

Nonetheless, I remain bullish as that is my long-term outlook.

Takeaway

In this article, we discussed Caterpillar’s earnings in light of ongoing economic challenges. As the stock price surge suggests, the company had a tremendous quarter. Sales growth was high across the board, pricing power allowed the company to offset higher operating expenses, and management continues to be upbeat about its future.

The company now benefits from easing supply chain issues, allowing it to refill dealer inventories, secular demand trends in resource industries, strong pricing power, and an attractive valuation.

However, given economic headwinds, I do not recommend investors aggressively buy CAT shares after this surge. Watch out for stock price weakness, which I would use to accumulate shares.

I believe that CAT is poised for a major breakout the moment global economic demand improves again.

(Dis)agree? Let me know in the comments!

Be the first to comment