shaunl

Note: Our previous article in November 2021 was covered by another analyst who is no longer with our service. Therefore, this article provides readers with a fresh take on Caterpillar.

Thesis

Leading machinery player Caterpillar Inc. (NYSE:CAT) stock has demonstrated remarkable resilience in 2022, despite worsening macro headwinds and weaker demand from China.

As a result, it has outperformed the SPDR S&P 500 ETF (SPY), as CAT posted a YTD total return of -10.4% against the SPY’s -17.3% return. Caterpillar’s diversified business model has helped it gain exposure across multiple industries, leveraging the resurgence in its mining and energy customers.

Despite that, CAT was overvalued in early 2021 after a rapid surge from its COVID bottom. Therefore, we believe the market has been digesting its growth premium, de-risking its valuation, and giving the company more buffer to prove its solid execution despite a looming global recession over the horizon.

Management’s commentary in its Q2 earnings card suggests that Caterpillar is confident that its strong pricing leadership could continue to help it overcome the cost headwinds. Furthermore, our analysis of global supply chain headwinds indicates that it has moderated significantly from the highs. Therefore, we believe it could be accretive to Caterpillar’s margins profile through FY23, as it captures more of the spread from the mitigation of inflationary pressures.

CAT’s valuation remains relatively well-balanced and, therefore, not undervalued. However, we postulate that the improvement in its profitability profile and still robust outlook should sustain its valuation.

Furthermore, management has continued to buy back shares aggressively, coupled with stable dividend payouts. Moreover, its ongoing $15B repurchase authorization should continue to offer management a sizeable war chest to capitalize on dislocation due to market volatility.

As such, we rate CAT as a Buy.

Caterpillar’s Growth Should Reaccelerate In H2

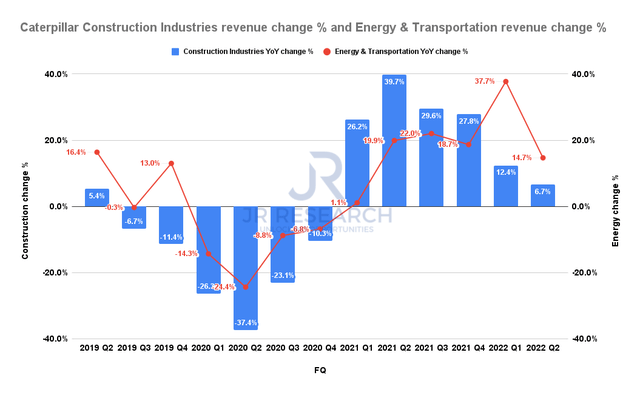

Caterpillar Construction Industries revenue change % and Energy & Transportation revenue change % (Company filings)

Caterpillar’s operating metrics recovered remarkably from its COVID malaise in 2021, which set up highly challenging comps for the company to lap in 2022.

As a result, we noted that its growth in its two critical revenue segments moderated significantly, as seen above. Construction Industries grew just 6.7% YoY, impacted by China’s slowdown. The surge in Energy & Transportation has also slowed markedly, as revenue increased by 14.7% YoY in Q2. However, we postulate that Caterpillar’s growth should reaccelerate in H2, as it laps challenging comps, coupled with easing supply chains and global freight costs.

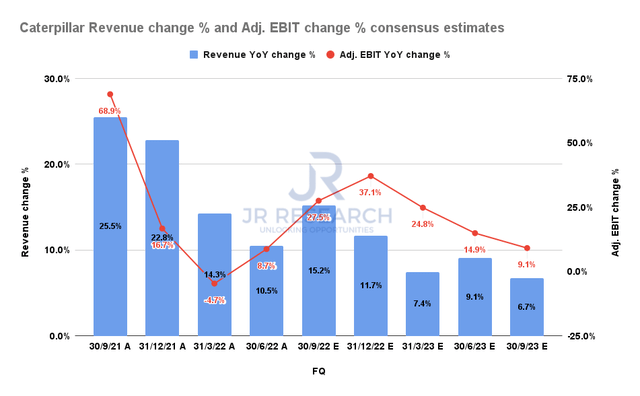

Caterpillar Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

Accordingly, the consensus estimates (bullish) indicate that Caterpillar’s revenue growth should accelerate in H2, which would also lift the trajectory of its adjusted EBIT growth.

Management’s commentary indicates they are optimistic about a strong H2, corroborated by a robust order backlog. Also, concerns about its cost headwinds have been featured repeatedly in its earnings commentary. Despite that, Caterpillar’s competitive moat has allowed it to pass on much of its cost headwinds to its customers, riding on its robust order book.

Furthermore, we gleaned that the global supply chain pressure eased off substantially in August, as it fell toward the levels last seen in early 2021. Moreover, global freight costs have continued to moderate through September over the past three months, falling more than 30%. Hence, we are confident that there could be upside surprises on Caterpillar’s profitability profile moving ahead.

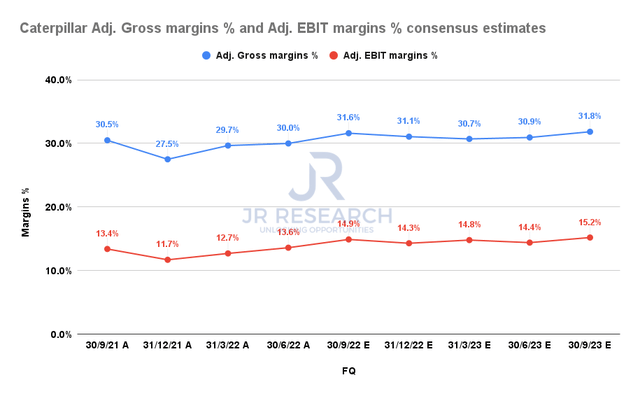

Caterpillar Adjusted gross margins % and Adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Therefore, we believe the acceleration in its operating leverage in H2 is credible and in line with management’s guidance. Consequently, we urge investors to pay attention to its Q3/Q4 commentary on whether it expects the accretion to continue through FY23.

Given management’s confidence in its order backlog, it should provide strong revenue visibility through FY23, despite the prospects of a global recession next year. Notwithstanding, we believe the consensus estimates are prudent, as it modeled for a revenue growth moderation in FY23.

Is CAT Stock A Buy, Sell, Or Hold?

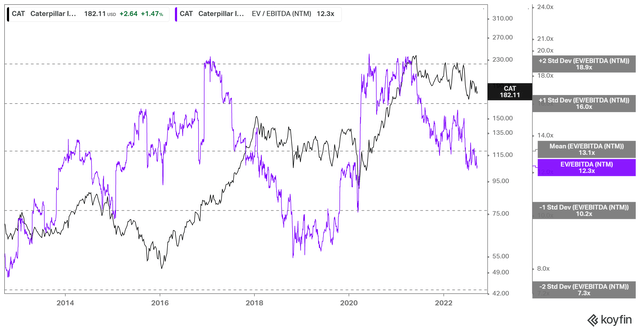

CAT NTM EBITDA multiples valuation trend (koyfin)

We gleaned that CAT’s NTM EBITDA multiples are in line with its 10Y mean after falling from the overvalued zones of 2021.

Therefore, we deduce that it’s pretty well-balanced. Notwithstanding, given the demand and cost tailwinds moving ahead, we believe it should underpin its valuations at the current levels.

Furthermore, Caterpillar still has an ongoing $15B authorization from May 2022. With its stable dividend yields, CAT posted a TTM shareholder yield of 7.6% in Q2, its highest since late 2019. Therefore, we believe it should continue to underpin its valuations at the current levels, as CAT is no longer overvalued.

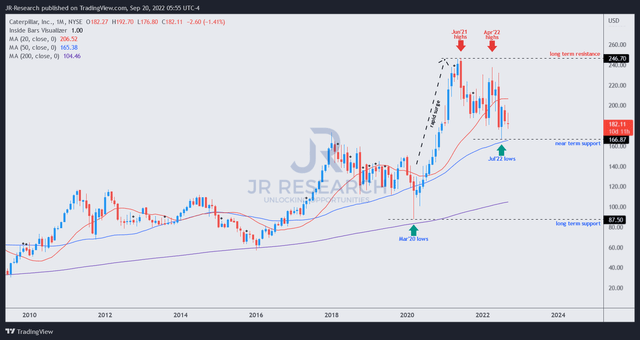

CAT price chart (weekly) (TradingView)

We gleaned that CAT was supported along its 50-month moving average at its July lows. Investors should observe that the dynamic support level has underpinned CAT’s bullish bias since 2016, including the bear trap (indicating the market denied further selling downside decisively) in March 2020.

Notwithstanding, we observed that the rapid surge from its COVID lows is a red flag that investors need to consider. We posit that the company’s strong forward fundamentals and well-balanced valuation should support its buying momentum. However, worsening global macro headwinds could be worse than expected, leading to a further de-rating of CAT’s well-balanced valuation multiples. We need to highlight that critical risk investors need to consider if they add at the current levels.

We rate CAT as a Buy.

Be the first to comment