Marcus Lindstrom/E+ via Getty Images

There were some positive and some negative news coming out of Castellum’s (OTCPK:CWQXF) Q3 Results. On the positive side, occupancy remains quite high at 93.4% and the company saw positive net lettings for the eleventh consecutive quarter. Anther bit of good news: the company reported seeing an increase in returns to the office after the pandemic. On the negative side, financing conditions have deteriorated and Castellum decided to allow CEO and Board member Rutger Arnhult to sell shares through M2 Asset Management AB. We are also disappointed at the negative results from associated companies, which consists of Castellum’s share of Entra’s (OTCPK:ENTOF) earnings. Castellum owns 60 million shares in Entra, corresponding to 33.3 per cent of the voting rights and capital. Entra owns and manages modern office properties in central locations in Norway, and delivered negative earnings for the interim period from January to September 2022, as well as a decrease in net asset value per share (NOK 210 per share compared to NOK 218 per share at the start of the year).

The company is putting high priority on energy-saving measures as a result of rising energy prices. These high prices, and inflation in general, are having a negative effect on costs. At the same time inflation is promoting significant increases in income owing to the contractual indexing component in the leases. Even though times are tough for many companies, Castellum believes that its various customer segments – with a large proportion of public authorities and state agencies, numerous public office customers and logistics operators – can withstand this.

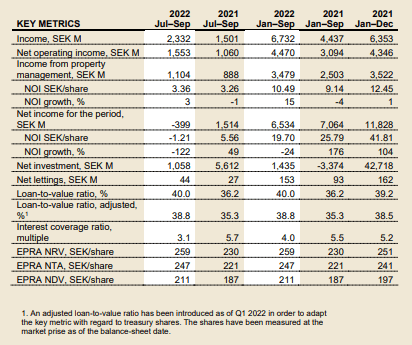

Looking at the key metrics provided by the company, we see that for the third quarter the company had a loss of 1.21 SEK per share, as compared to a profit of 5.56 SEK per share in the previous year quarter. So far results for the year have not been that bad, with a 9 month total profit of 19.70 SEK per share. Book value managed to increase, with the most conservative measure, EPRA NDV, rising to 211 SEK per share.

Castellum Investor Presentation

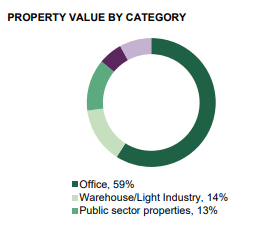

Castellum remains heavily weighted to office properties, with ~59% of property value assigned to this category. Given the global work-from-home trend that is taking hold, we were at least reassured that occupancy remains high and net lettings were positive.

Castellum Investor Presentation

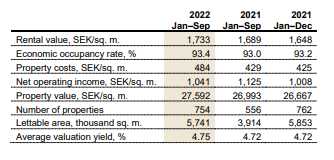

As can be seen in the table below, the company has been making small but consistent gain in occupancy. It was at 93% a year ago, and that has improved now to 93.4%. The number of properties and the lettable have seen significant increases y/y.

Castellum Investor Presentation

Financing & Balance Sheet

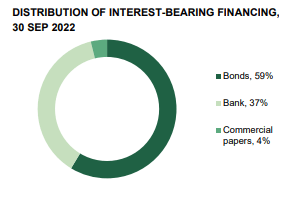

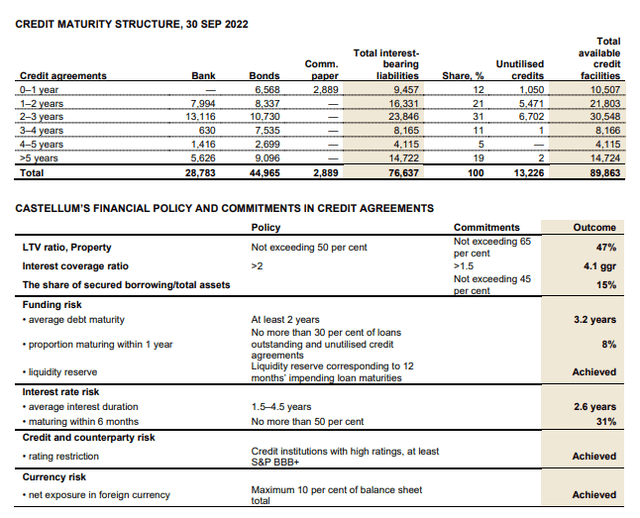

There is a great deal of focus on financing at this current time with the bond market very weak. The company says that should it need to do so it can replace bonds with existing credit facilities. In its report, the company reassured investors that it has a secure financing situation despite the turbulent financial market. Currently the company relies on bonds for most of its interest bearing financing.

Castellum Investor Presentation

There are some trends that worry us, like the deteriorating interest coverage ratio. Although that was to be expected given the interest rate increases that have been taking place to combat inflation. The interest coverage ratio is currently 4.1x on a rolling 12-month basis compared to 5.4x in the previous year. On a more positive note, the loan to value ratio remains quite reasonable, with the adjusted loan-to-value ratio less treasury shares at 38.8% compared to 38.5% in the previous year period. The average remaining interest-rate and debt maturity is down to only 2.6 years from 3.3 previously. Adjusted for financing from credit decisions, total debt maturity is 3.9 years. Still, we view debt maturity as relatively short, and are getting a bit worried about refinancing.

The company reported that the capital market during the quarter was volatile, with low levels of liquidity and widening credit margins. Fortunately Castellum has a healthy amount of contingency liquidity with SEK 15.3 billion in cash and bank balances as well as credit facilities, with which it can cover all maturities in 2022 and 2023. The company said it will rely more on bank loans, and is seeking to increase their proportion by just over SEK 10 billion, and there have already been credit decisions for half of that amount. The company’s updated credit maturity structure and financial policy can be seen below.

Castellum Investor Presentation

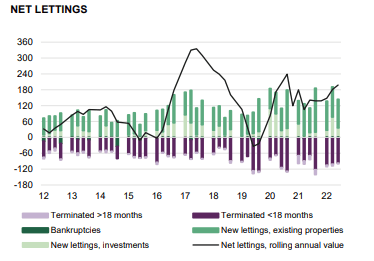

Lettings

We remain impressed with Castellum’s excellent letting performance, which despite the tough operating environment remains positive. We are also reassured that Castellum’s exposure to the credit risks of individual tenants is extremely low, with a lease portfolio that has a large spread across many different tenants, customer sizes and industries. This spreads the risk for rent losses and vacancies. The Group has approximately 8,000 commercial leases and approximately 500 residential leases.

Castellum Investor Presentation

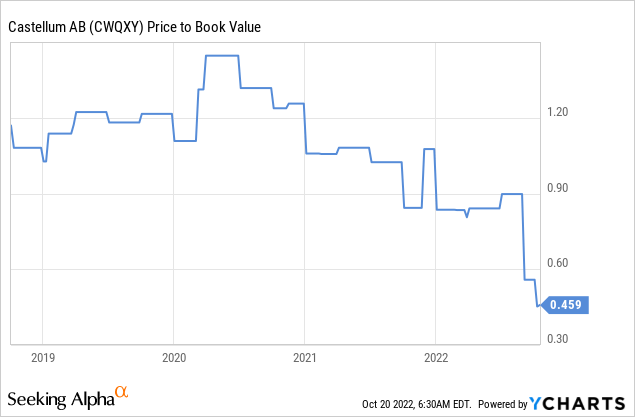

Castellum Valuation

At this point it is obvious that the valuation is extremely low, and that the market is very worried about financing risks. The company is trading at about half its book value, and with a dividend yield above 6%. The question at this point is whether the company can successfully refinance its debt on good terms. On the positive side, the business continues performing well, with positive lettings and high occupancy. The balance sheet remains solid, with a relatively low loan-to-value ratio, but it has a very short average maturity and will need significant refinancing.

Risks

We continue to see shares offering an attractive risk/reward, but it is important to note that we believe risk has meaningfully increased. Should credit markets continue deteriorating, the company could find itself in a difficult position with so much debt to refinance.

Conclusion

As we mentioned at the start, going through Q3 results gave us mixed feelings. The operating performance of the company remains excellent, but risks are mounting and we are now very concerned about the refinancing situation. If the refinancing risk recedes, we believe shares will re-rate much higher, given that the valuation is extremely low at the moment. However, investors should be aware that risks have significantly increased and that refinancing could be a big issue for the company.

Be the first to comment