Ari Widodo

A Quick Take On Cascade Copper Corp.

Cascade Copper Corp. (CACC:CA) has filed to raise $740,000 in a Canadian IPO of its units of common stock and warrants, according to a SEDAR registration statement.

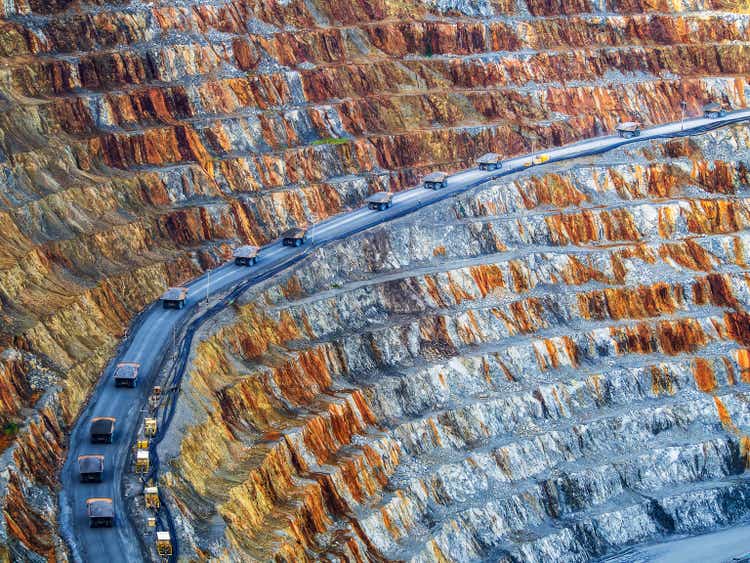

The firm is developing copper, gold, and silver mineral interests primarily in British Columbia and Canada.

The Cascade Copper IPO is extremely speculative as are its development plans.

My outlook on the IPO is on Hold, due to the firm’s ultra-high-risk profile at its current stage.

Cascade Overview

Vancouver, Canada-based Cascade Copper Corp. was founded to develop the Rogers Creek Property, and others, for their potential for valuable metal commodities.

Management is headed by President and CEO, Jeffrey S. Ackert, who has been with the firm since May 2022 and was previously President and CEO of C3 Metals.

The company’s primary interests include:

-

Rogers Creek Property

-

Bendor Project

-

Fire Mountain Project

As of June 30, 2022, Cascade has booked a fair market value investment of $462,199 from investors including Pan Pacific Resource Investments Ltd. and others.

Cascade’s Market & Competition

According to a 2022 market research report by Research and Markets, the global market for copper was an estimated $160 billion in 2020 and is forecast to reach $243 billion by 2027.

This represents a forecast CAGR of 6.2% from 2020 to 2027.

The main drivers for this expected growth are continued strong growth in building and construction use of copper conduits.

Also, the global transportation market is expected to grow at a rate of 6.2%.

By region, China is expected to reach a market size of $51 billion by 2027, accounting for a 9.6% CAGR from 2020 to 2027.

Major competitive or other industry participants include:

-

Anglo American

-

Antofagasta

-

BHP Billiton Group

-

Codelco

-

First Quantum Minerals

-

Grupo México

-

Jiangxi Copper Co.

-

JX Nippon Mining & Metals Corp.

-

KGHM Polska MiedŸ

-

KME AG

-

Mitsubishi Materials Corp.

-

Mitsui Mining & Smelting Co.

-

Norilsk Nickel

-

OM Group

-

Rio Tinto Group

-

Sumitomo Metal Mining Co.

-

Teck Resources Ltd.

-

UMMC-Holding Corp.

-

Vale

The company may also operate in the gold and silver mining markets.

Cascade Copper Corp.’s Financial Performance

Below are relevant financial results derived from the firm’s registration statement (in Canadian Dollars):

Company Statement Of Operations (SEDAR)

As of June 30, 2022, Cascade had $54,045 in cash and $49,120 in total liabilities.

Free cash flow during the twelve months ended June 30, 2022 was negative ($125,685).

Cascade Copper Corp.’s IPO Details

Cascade intends to raise $740,000 in gross proceeds from a Canadian IPO of its units of common stock and warrants, offering 10 million units at a proposed price of $0.074 per unit.

The IPO is not being marketed to investors outside of Canada. No U.S. SEC filings have been made.

The units consist of one share of common stock and one warrant to purchase one share of common stock at a price of 150% of the IPO price, or approximately $1.11 per share.

No existing shareholders have indicated an interest to purchase units at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $1.0 million, excluding the effects of agent over-allotment options.

The float to outstanding shares ratio (excluding agent over-allotments) will be approximately 37.45%. A figure under 10% is generally considered a ‘low float’ stock, which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows (in Canadian Dollars):

Proposed Use Of Proceeds (SEDAR)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not a party to any legal or regulatory actions and is not aware of any contemplated actions.

The listed agent of the IPO is Leede Jones Gable Inc.

Commentary About Cascade’s IPO

CACC:CA is seeking Canadian public market investment to fund its further exploration efforts of various suspected copper, gold, and silver mineral deposits.

The company’s financials have shown no revenue or operating results; rather, the company has spent on G&A and R&D costs associated with its initial development efforts.

Free cash flow for the twelve months ended June 30, 2022 was negative ($125,685).

The firm currently plans to pay no dividends and to retain any future earnings to reinvest back into its growth and expansion initiatives.

The market opportunity for copper and gold mining is large and features many large industry incumbents.

The primary risks to the company’s outlook are its tiny size, thin capitalization, and lack of development history.

As for valuation, management is asking investors to pay an Enterprise Value of approximately $1 million. This is so low due to the firm’s ultra-early stage of development.

The Cascade Copper IPO is extremely speculative as are its development plans.

My outlook on the IPO is on Hold, due to its ultra-high-risk profile.

Expected IPO Pricing Date: To be announced.

Be the first to comment