Cristian Storto Fotografia/iStock Editorial via Getty Images

Investment Thesis: Carrefour could see a longer-term rebound in upside as a result of encouraging growth in sales and cash flow.

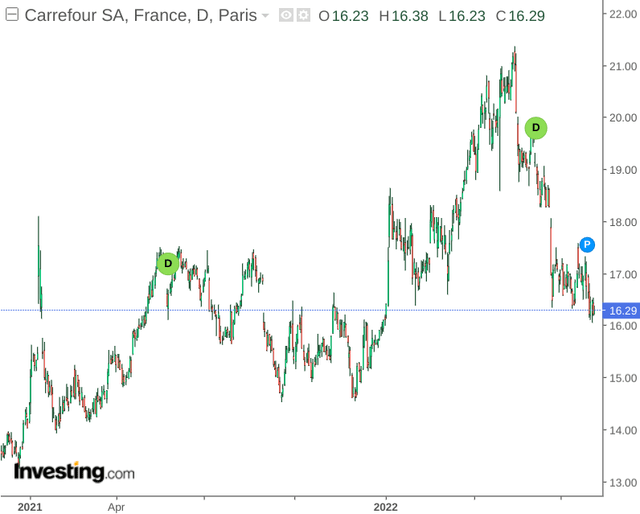

In a previous article back in May, I made the argument that Carrefour SA (OTCPK:CRRFY, OTCPK:CRERF) could see a decline going forward owing to a slowdown of French sales as well as a potential slowdown of sales growth across Latin America.

The stock has declined by just over 18% since my last article. While the stock saw growth for a significant portion of this year – the recent decline has been significant.

The purpose of this article is to investigate whether Carrefour could see scope for a rebound going forward – taking into account recent quarterly performance.

Performance

When looking at Carrefour’s cash position, we can see that the quick ratio (as defined by cash and cash equivalents plus trade receivables all over current liabilities) has improved slightly over the past year:

| June 2021 | June 2022 | |

| Cash and cash equivalents | 1294 | 2539 |

| Trade receivables | 2698 | 3402 |

| Current liabilities | 20170 | 24417 |

| Quick ratio | 0.198 | 0.243 |

Source: Figures sourced from Carrefour Q2 sales and H1 2022 results. Quick ratio calculated by author.

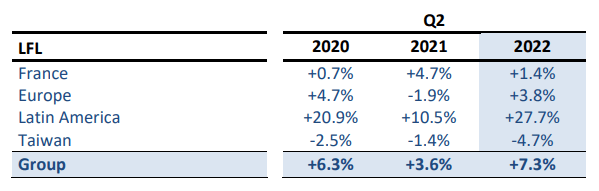

Moreover, sales growth across the company’s geographies have been encouraging this quarter, with LFL (like for like) sales having shown a 7.3% increase overall. French sales saw growth – albeit modest, while Latin America saw growth of over 27%:

Carrefour Q2 sales and H1 2022 Results

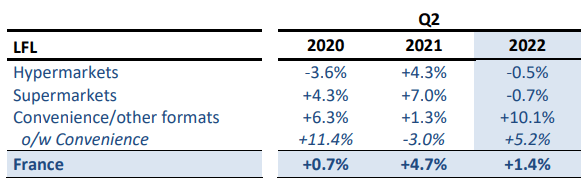

What is particularly notable is that growth in France was driven by convenience and other format stores – while that of supermarkets and hypermarkets showed slightly negative growth:

Carrefour Q2 sales and H1 2022 Results

The Taiwan branch accounted for just over 2.5% of overall sales in the second quarter of 2022, with like-for-like sales down 4.7% due in significant part to closures as a result of COVID-19. In this regard, the company announced last month that it will sell 60% of its stake in Carrefour Taiwan to Uni-President, in a transaction valued at €2 billion.

While this deal is still subject to regulatory approval from the Taiwanese competition authorities, Carrefour expects the deal to come to fruition in mid-2023 – which should bolster cash flow for the company and allow for a greater focus on the company’s major markets.

Looking Forward

Going forward – inflation is likely to be the main concern for Carrefour. While the company saw positive sales growth in the last quarter – further price rises could serve to dampen consumer demand.

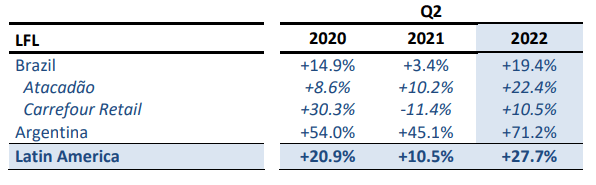

This is particularly a risk factor across the Latin American market – which accounted for over 23% of total sales in the most recent quarter. With the company operating in Brazil and Argentina (with the majority of revenue coming from Brazil), global inflationary forces could mean that customer demand drops by a greater margin should the economies of these countries prove to be more fragile.

With that being said, inflation has already seen strong spikes across Latin America and yet – sales growth has continued to remain quite strong.

Carrefour Q2 sales and H1 2022 Results

With sales across developed and emerging markets having remained strong heading into Q2 – I take the view that if Carrefour can sustain this pace of growth heading into the latter half of the year – then the stock could stand to see a significant rebound in upside.

In the case of the French market – the company cites that part of the reason for the boost in convenience sales has been an increase in tourism. There is a possibility that we could see sales growth wane in the winter months as tourism drops. However, should hypermarkets see a rebound in sales due to price and promotion offerings, then this could still lift French growth as a whole.

Conclusion

To conclude, Carrefour has shown impressive Q2 results, with strong sales growth and an improving cash position. My view is that a broader market downturn as a result of inflation might place pressure on the stock in the short to medium term. However, should we continue to see resiliency in terms of growth in sales and cash flow – then longer-term upside could be ahead for Carrefour.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment