David Commins

CarParts.com, Inc. (NASDAQ:PRTS) recently built a new distribution center in Jacksonville, which indicates that sales growth will likely accelerate. In my opinion, further investments in customer’s mobile experience and more availability of products will likely bring free cash flow growth. Under my discounted cash flow models, risks from lack of supply or recession risks don’t matter that much. There is an upside potential in the CarParts.com stock price.

CarParts.com

CarParts.com runs an eCommerce business, with over 20 years of accumulated expertise, offering services and products to car owners.

After the recent announcement of a new distribution center in Jacksonville, in my view, it is a great time for reviewing CarParts.com’ business model. According to management, the number of new customers being served will increase significantly, which may lead to revenue generation and FCF/Sales margin improvement.

Recently expanding to Grand Prairie, Texas and with our newest distribution center opening in Jacksonville, Florida in Q2 2022, these expansions are bringing CarParts even closer to achieving our longterm goal of reaching 80% to 90% of customers within just one day. Source: Tear Sheet

I would also expect that new improvements in the company’s platform will bring larger customer engagement. Besides, further online traffic and customers will most likely accelerate economies of scale, which may be a great catalyst for the company’s free cash flow.

We are excited to build a trusted and disruptive platform where we can help our customers solve their auto repair and maintenance needs. Our goal is to become the number one destination for customers that need help fixing their vehicles. Source: Source: Press Release

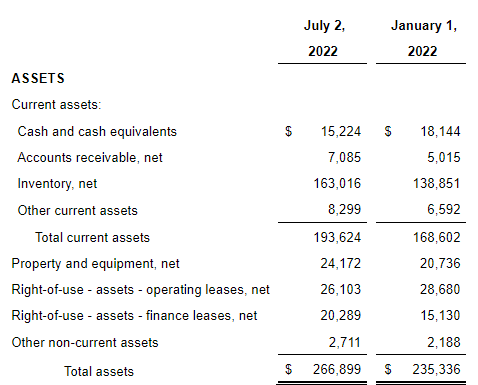

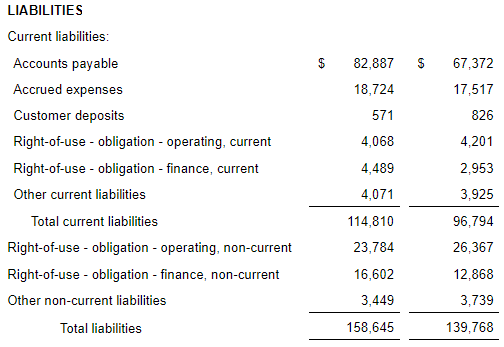

Balance Sheet

As of July 2, 2022, CarParts.com reported $15 million in cash and an asset/liability ratio close to 2x-3x. I believe that the balance sheet appears in a good shape.

Source: Press Release

With right of use obligations of $21 million and other non-current liabilities worth $3.4 million, the debt does not seem significant. In my view, if management needs more bank financing to support marketing campaigns, banks will offer their money.

Source: Press Release

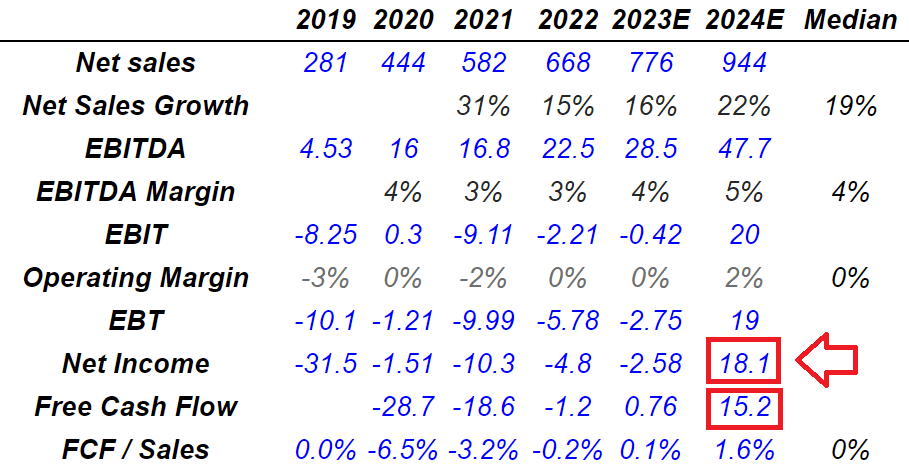

Expectations From Financial Analysts Are Also Improving With Positive FCF Coming In 2024.

Investment analysts are expecting that CarParts.com will likely report around 16%-22% sales growth in 2023 and 2024. The median sales growth from 2021 to 2024 would also be equal to 19%, which appears impressive.

Investment analysts also believe that the EBITDA margin will increase to up to 5%, and the operating margin would stand at around 2% in 2024. Finally, by 2024, the company would deliver free cash flow (“FCF”) around $15.2 million and net income of $18 million. In my view, as more traders learn about the financial expectations for 2024, demand for the stock will likely trend north.

marketscreener.com

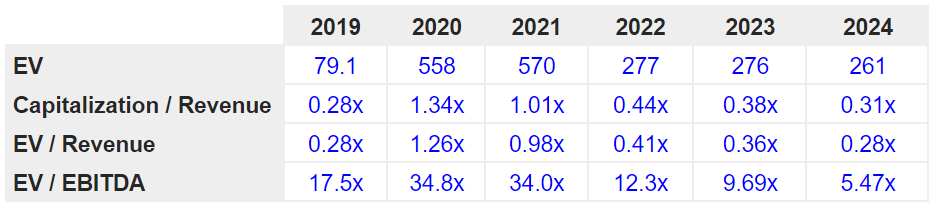

With the previous expectations of revenue and EBITDA, investors believe that both the EV/Revenue and EV/EBITDA will decline if the market capitalization does not increase.

marketscreener.com

More User-friendly Online Tools And Improvement Of Product Availability Would Lead To A Valuation Of $12 Per Share

In my opinion, what matters to customers and CarParts.com is product selection. If management continues to offer an extensive selection of SKUs, clients will come back. In my view, if clients have in mind that you can find almost everything related to cars in CarParts.com, revenue growth will continue:

We believe our user-friendly flagship website provides customers with a favorable alternative to the brick-and-mortar shopping experience by offering a comprehensive selection of approximately 731,000 SKUs with detailed product descriptions, attributes and photographs combined with the flexibility of fulfilling orders using both drop-ship and stock-and-ship methods. Source: Annual Report

Targeting a total market of more than $23 billion, CarParts.com noted recently that it is well positioned to offer online services to new incoming clients. If CarParts.com successfully communicates that buying online is cheaper and more convenient than brick-and-mortar shopping, free cash flow will trend north. In this regard, I believe that the company is quite optimistic:

The U.S. Auto Care Association estimated that overall revenue from online sales of auto parts and accessories would reach almost $23 billion by 2024. Improved product availability, lower prices and consumers’ growing comfort with digital platforms are driving the shift to online sales. We believe that we are well positioned for the shift to online sales due to being a leading source for aftermarket automotive parts through our flagship website and online marketplaces. Source: Annual Report

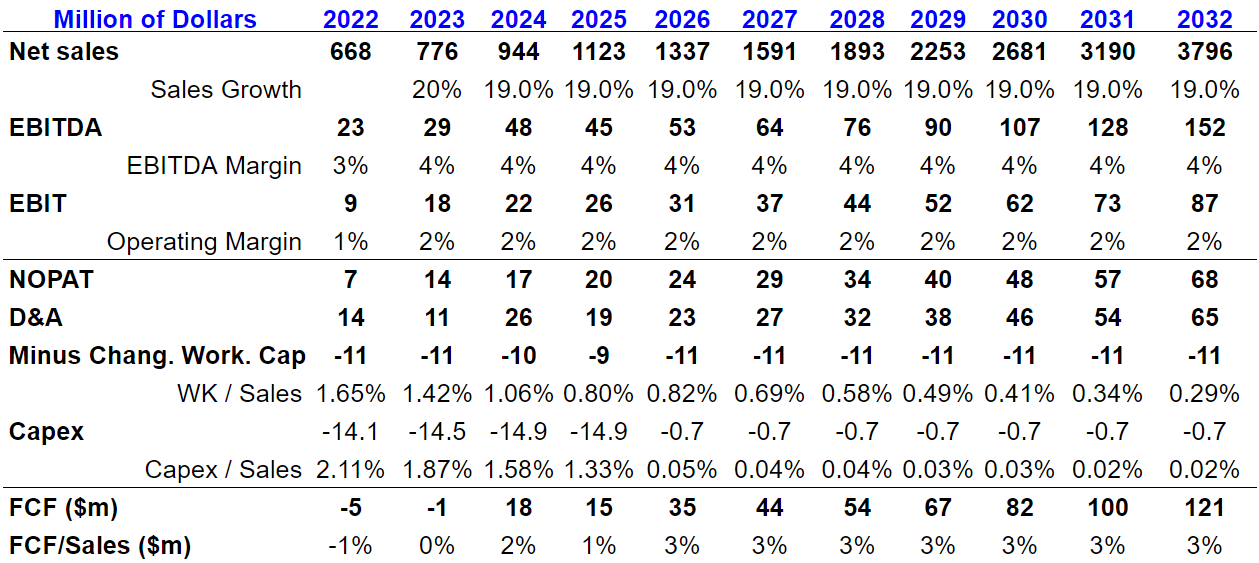

Under the previous conditions, I included sales growth of 19%, an EBITDA margin of 4%, and operating margin close to 2%. With working capital/Sales around 1.6% and 0.3% and declining capital expenditures, I obtained free cash flow around $18 million in 2024 and $121 million in 2032. Note that the FCF/sales margin stands at 2%-3%. My numbers are not far from what CarParts.com reported in the past.

Author’s DCF Model

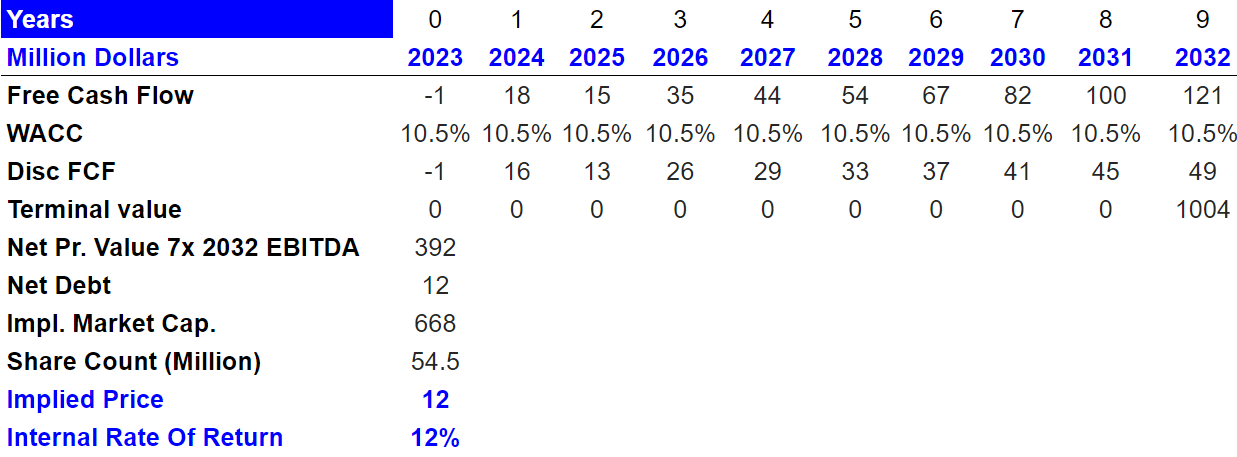

Summing future free cash flow from 2023 to 2032 and assuming a discount of 10.5% and an exit multiple of 7x EBITDA, the implied market capitalization would be $668 million. Finally, the implied fair price with a share count of 54 million would stand at $12 per share.

Author’s DCF Model

Lack Of Supply, Shipping Complications, or Lack Of Sufficient Innovation Could Imply A Valuation Of $3.7 Per Share

Under all the risks that could affect the company’s net income line, in my opinion, lack of supply would be the worst. The company receives a number of products from Asia, so any problem in that region would be a disaster for CarParts.com:

We source our products from two primary regions: our house brands product sourced primarily through manufacturers and distributors in the Asia-Pacific region, and our branded product sourced primarily through drop-ship manufacturers and distributors located in the United States. Source: Annual Report

Besides, most products are obtained from manufacturers in China and Taiwan, and the company does not sign long-term contracts. Suppliers may find more interesting offering products to other companies in other countries as a result of new taxes in the frontier. Suppliers could also easily try to negotiate new contracts with CarParts.com, which would significantly reduce the FCF/Sales margins.

We acquire a majority of our products from manufacturers and distributors located in Taiwan and China. We do not have any long-term contracts or exclusive agreements with our foreign suppliers that would ensure our ability to acquire the types and quantities of products we desire at acceptable prices and in a timely manner or that would allow us to rely on customary indemnification protection with respect to any third-party claims similar to some of our U.S. suppliers. Source: Annual Report

Finally, let’s also note that shipment of products is executed by third parties. If these parties try to negotiate prices, or they don’t offer services, CarParts.com may reduce the amount of supply to customers. A loss of reputation would likely lead to a decrease in future revenue growth.

We rely on third parties for the shipment of our products, both inbound and outbound shipping logistics, and we cannot be sure that these relationships will continue on terms favorable to us, or at all. Source: Annual Report

Moreover, if the company can’t offer an innovative customer’s mobile experience in the coming years, revenue growth may be lower than expected. With the mobile phone becoming more useful everyday for making online purchases, CarParts.com really needs to invest in these matters. Management talked very seriously about this fact:

If we are unable to continue to adapt our mobile device shopping experience from desktop based online shopping in ways that improve our customer’s mobile experience and increase the engagement of our mobile customers our sales may decline and our business and financial results may suffer. Source: Annual Report

Finally, let’s note that CarParts.com’s business model is mainly related to the car industry, which suffers seasonal fluctuations. In recessions, CarParts.com may sell less products, which may lead to a decline in free cash flow growth:

We believe our business is subject to seasonal fluctuations. We have historically experienced higher sales of body parts in winter months when inclement weather and hazardous road conditions typically result in more automobile collisions. These historical seasonality trends could continue, and such trends may have a material impact on our financial condition and results of operations in subsequent periods. Source: Annual Report

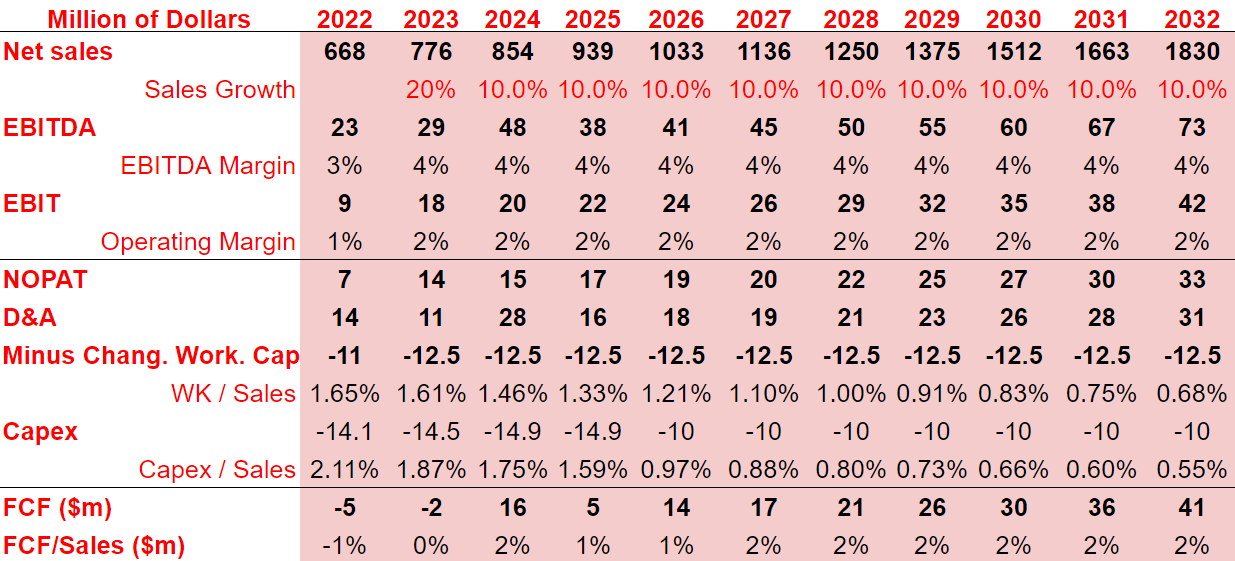

Under the previous risks, I believe that sales growth of 10% is appropriate. I also included an EBITDA margin close to 3.5% and an operating margin of 2%. If we also assume capital expenditures close to $10 million from 2025 to 2032, the FCF would stand at $41 million in 2032.

Author’s DCF Model

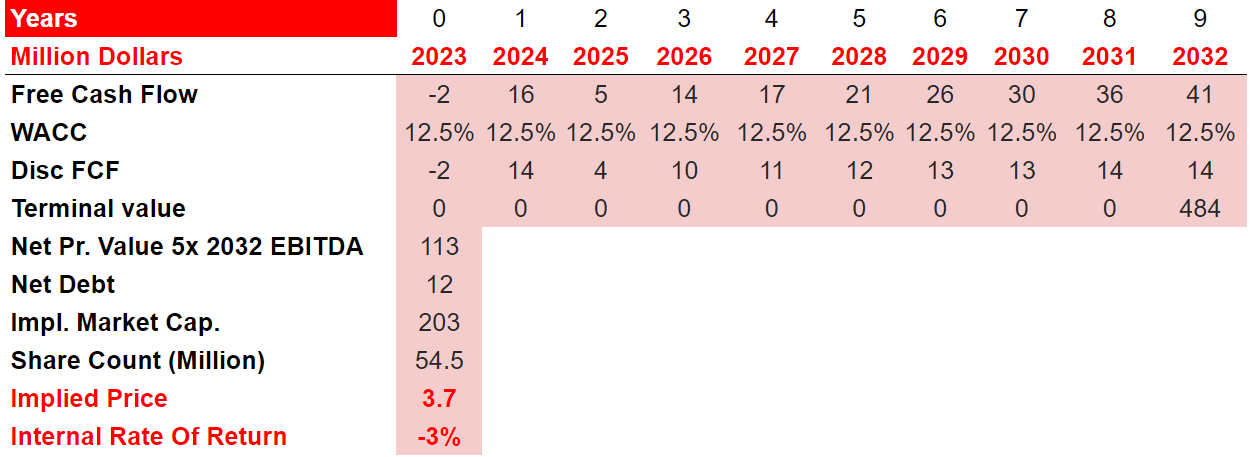

Now, with a discount of 12.5% and a terminal value of 5x, the implied equity would stand at $203 million, and the fair price would be $3.7 per share. The internal rate of return in this case would stand at around -3%.

Author’s DCF Model

My Takeaway

Recently, CarParts.com built a new distribution center in Jacksonville, which will most likely help serve more clients and enhance business. Also, if the company continues to invest in innovative customer’s mobile experience, and the number of products available increases, revenue will trend north. Under my discounted cash flow (“DCF”) models, I believe that even considering risks from lack of supply or shipping issues, the upside potential in the stock price appears much more significant.

Be the first to comment