Joel Carillet

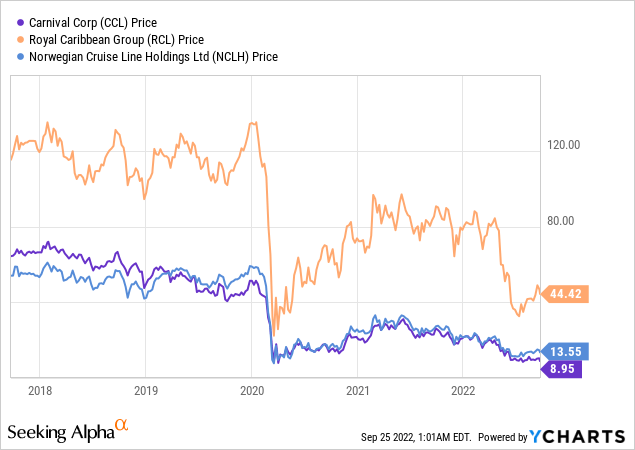

Carnival Corporation (NYSE:CCL) was famously battered during the Covid-19 Pandemic. Due to the nature of the virus, tourism-related businesses like Carnival suffered through a disproportionately high amount of pain. As the world moved past the pandemic, the cruise line industry mounted an impressive recovery, but with the Fed adopting a hawkish stance to address runaway inflation, broader macroeconomic headwinds have once again brought stocks in the segment down to historic lows.

There are signs that the underlying businesses off cruise lines are in much better shape than they were two years ago. Today, we’ll take a look at Carnival’s current situation and discuss what investors can expect over the short to medium term.

Company Outlook & Earnings Download

Carnival is coming off of a solid Q2 earnings report, where revenue increased by roughly 50% sequentially. The revenue improvement was supported by strong occupancy figures. Occupancy for the second quarter stood at 69%, which was a notable increase over the 54% figure from the prior quarter. There were also strong booking volumes during the second quarter, nearly doubling the volumes of the prior quarter. This drove a positive free cash flow of roughly $1.4 billion for the quarter, which was partly attributable to the large booking uptick.

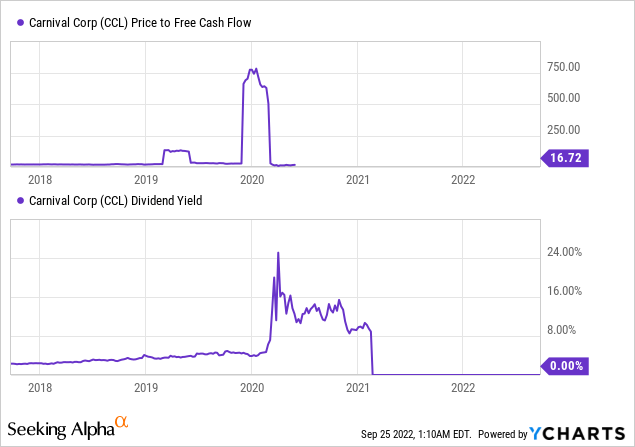

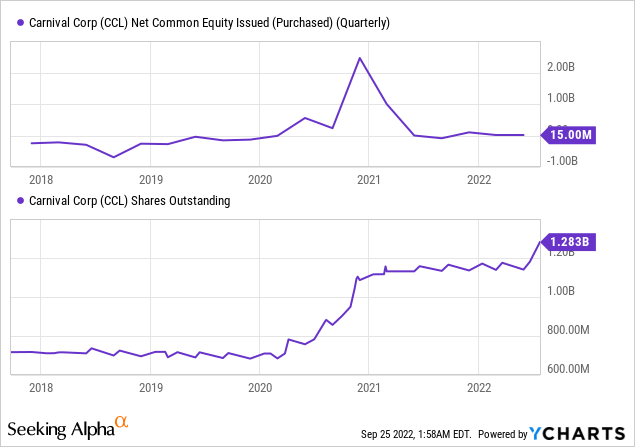

The company also posted a robust $7.5 billion of liquidity and has since improved that position further after offering another $1 billion worth of stock in July. The move to raise cash was probably prudent by the leadership team, but investors will have mixed feelings about the offering. Carnival was once a free cash flow generating machine and a favorite among dividend investors.

The Covid-19 pandemic quickly rewrote that story, and now the company is relying on cash from offerings and debt to fund operations. When the pandemic hit, we did not envision Carnival seeing disruptions for this long. This is through no fault of the leadership team, but the virus has had a sticky negative impact on the cruise line business, and a financial crisis when the industry is just beginning to move past the pandemic would be incredibly unlucky timing. Nevertheless, the leadership team must play with the cards they have been dealt, and for this reason, I believe investors should be patient with the offerings. That said, the offerings have more than doubled the number of shares outstanding before the pandemic, and the recovery has been far from straightforward so far.

It cannot be overstated that the leadership team has had little alternative to these offerings. Had they not raised, we would seriously be questioning Carnival’s ability to survive even a mild recession. The Carnival leadership team has always put the long-term best interests of the shareholders first, and I do believe that they will continue to do so as we navigate a global economic slowdown.

In the upcoming report, expected to be released on September 30, I expect the strong recovery to continue. Other cruise companies have been showing positive signs of booking and occupancy recovery, and with the relaxed Covid regulations, we should see continued improvements. The main thing investors will want to pay attention to is any insight on the concessions, if any, that the company is making to drive bookings. We will also want to see if booking trends have been negatively impacted in any meaningful way by the looming recession. Management will likely want to maintain its hard-earned liquidity position to navigate the recession, so it is unlikely to expect any great surprises concerning dividends or share repurchases.

Valuation & Forward-Looking Commentary

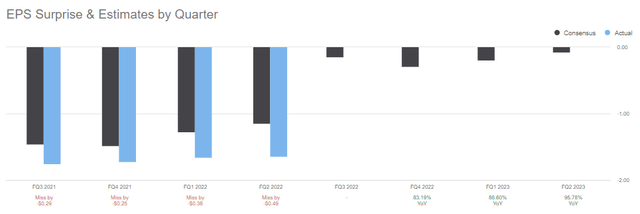

Investors can also look forward to EPS losses narrowing. The company has done a poor job lately of delivering to EPS estimates, missing in four of the last four quarters. It is likely that the firm may miss big again in the upcoming report, but the main focus should be on any solid indication suggesting that EPS figures will be heading in the right direction soon.

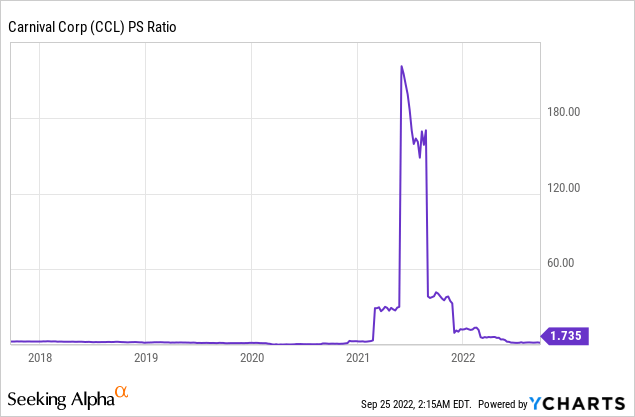

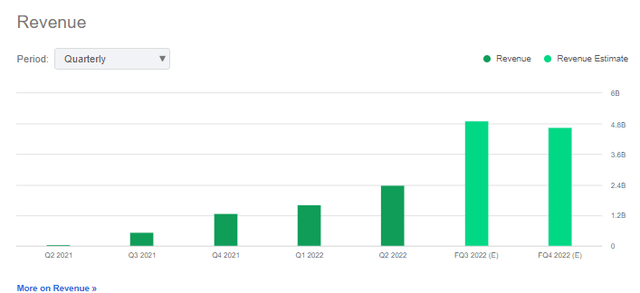

We can see that revenue trends are expected to be more favorable in the coming quarters, but it is also important to know that a global economic slowdown could change expectations very quickly.

We can also see that the company isn’t exactly known for treating that reach price sales multiples. But again, the revenue story should improve over the coming quarters, barring a widespread financial shock. From a multiple standpoint, the stock is cheap for a reason.

It is understandable that, with the negative EPS trends, unpredictability and revenue, and gloomy economic climate, investors may not want to pay rich multiples for a hospitality stock going into a slowdown. This is because hospitality is among the most cyclical industries in the world. Put another way, the success of individual operators is heavily pegged to the state of the overall economy. When consumers lack confidence in the economy or are being forced to make financial trade-offs, vacations are often viewed as nonessential luxury purchases, which is why they are often the first to go. Carnival will likely see much better days, but over the short term, it is easy to see a path to significant downside, which adds a speculative layer to the investment thesis even at these levels.

The Takeaway

Carnival is trading at depressed levels, but there are some plausible reasons for the low valuation. In the long term, the stock will likely see much better days, but there are some prominent short-term risks that an investor should consider. This does not make the stock buyable, but it does make it a speculative opportunity. The ideal investment here will likely require a large risk tolerance and some serious patience, but there is room for some substantial upside down the line. I rate Carnival Cruise Line as a speculative buy.

Be the first to comment