SeregaSibTravel/iStock Editorial via Getty Images

The only part of the puzzle holding Carnival Corp. (NYSE:CCL) and the cruise line sector back from a full recovery were some lingering Covid restrictions. The sector got extremely good news from a couple of very restrictive areas on Monday. My investment thesis remains ultra Bullish on the stock due to a more than full recovery in the sector ongoing while the stock trades at the recent lows.

Covid Restrictions Disappearing

My last research discussed how the removal of certain U.S. covid restrictions, such as the requirement of a vaccine, helped boost bookings. The industry got more good news on Monday as two of the most restrictive areas in China and Canada moved forward with the removal of travel restrictions.

The biggest news was probably Canada. The restrictive country announced the removal of all Covid restrictions for travel effective October 1.

Travelers will no longer be required to submit public health information through a government app or website, provide proof of vaccination, take pre- or on-arrival tests or quarantine or isolate. This pronouncement should completely open up cruise travel in Canada and even makes the restrictions in Canada less severe than a cruise in the U.S. that still requires a negative test for non-vaccinated passengers.

At the same time, regulators signaled an e-visa for mainland China travelers and tour groups to visit the gambling hub. The news is a good sign that China might finally reopen for global travel without restrictions.

Outside of some travel restrictions in Eastern Europe due to the war in Ukraine, the global cruise industry is getting closer and closer to normal. Carnival was already surpassing 2019 booking levels with recent trends.

Carnival already jumped on board in Canada with Princess Cruises announcing the reopening of Princess’ Alaska cruises with Canada as a feature destination. The cruise line is picking the right time to bring new ships on board.

Sailing Past 2019

The stock is struggling below $10, but CFO David Bernstein has discussed the potential for sailing past 2019 EBITDA levels in 2023. The CFO made this statement on the FQ2’22 earnings call prior to the recent bookings boost from the removal of Covid restrictions:

So I said that quite a number of times. I think we are — what I’ve always said is we have the potential for EBITDA to be greater in 2023 than 2019. That one big wildcard, of course, is the price of fuel which has risen quite a bit in the last few months.

Adjusted EBITDA strips out interest expenses, so naturally the profit picture isn’t necessarily improved due to higher debt levels and rising interest rates. Still, the cruise ship stocks are basically left for dead or bankruptcy, yet the companies are forecasting 2023 levels topping prior highs.

Analysts target FY22 revenues of $22.0 billion and FY23 reaching $24.1 billion. The FY19 peak revenues were a record at $20.8 billion, up from just $18.9 billion in the prior year.

Investors need to let these numbers sink in when the FY24 revenue target is for revenues to rise $3.2 billion above the prior record numbers. Carnival definitely faces higher expenses due to inflation and higher fuel prices along with the interest expense hit.

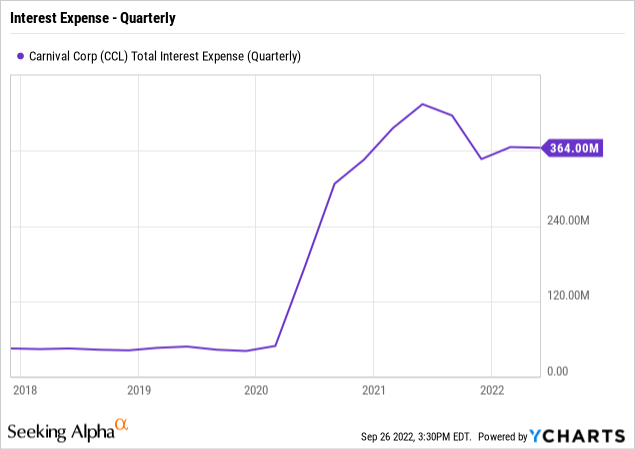

Interest expenses were running at a $50 million quarterly rate back in FY19 and the expenses have soared to over $360 million now. The difference is extraordinary, but Carnival had expectations for generating $5.5 billion in annual cash flows from operations back in FY20 before Covid hit.

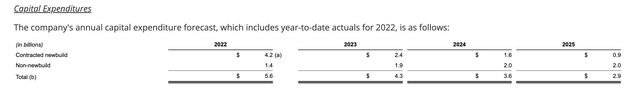

Even a $1.2 billion increase in interest expenses can be absorbed with those cash flows, especially on a much higher revenue base. The company is unfettered by the higher debt issues with the large push to expand capacity with the capex spending not slowing until 2024 and 2025.

Source: Carnival FQ2’22 business update

The big key to the upcoming FQ3 results will be discussions turning to normalized cash flows in FY23. The cruise lines are losing all of the covid restrictions that left uncertainty in financial results. Carnival can now count on higher bookings and have far more confidence in the forward numbers.

The stock incredibly trades at only $9 when all of the uncertainty is leaving the sector. The PE dips to 6x FY24 EPS targets of $1.52, but that number was up above $2.50 at the start of the year.

Some of the slow removal of Covid restrictions pushed out the rebound from FY22 to FY23, but the numbers should now normalize to the point that the only unknown is the interest rate impact on whether Carnival can further cut interest expenses to boost profits and cash flows.

The prior estimates were for the cruise line to return to a full earnings power of $2.50 To $3.00 when the additional interest expenses are stripped out.

Takeaway

The key investor takeaway is that Carnival is far too cheap here. The stock is priced for bankruptcy, yet the cruise line is heading back to record revenues leading to strong cash flows and profits.

Be the first to comment