8vFanI/iStock via Getty Images

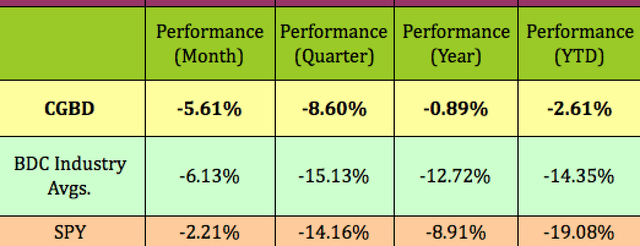

Looking for a high-yield income vehicle that will benefit from higher rates? Take a look at Carlyle Secured Lending (NASDAQ:CGBD), which has outperformed the BDC industry and the S&P 500 over the past month, quarter, year, and so far in 2022:

Hidden Dividend Stocks Plus

Profile:

CGBD is structured as an externally managed, non-diversified closed-end investment company. It’s managed by The Carlyle Group, a major global alternative asset manager with $276B in Assets Under Mgt, AUM.

Carlyle recently changed CGBD’s name from the confusing alphabet soup name of TCG BDC, to Carlyle Secured Lending, better leveraging the Carlyle name in this BDC.CGBD provides debt investments in the U.S. middle market companies, which comprise 90% of its regional exposure.

It also invests in first lien and second lien senior secured loans, middle market junior loans, such as corporate mezzanine loans, equity co-investments, syndicated first lien and second lien senior secured loans, high-yield bonds, structured finance obligations, and other opportunistic investments. The company was founded in 2012 and is headquartered in New York, New York.

Holdings:

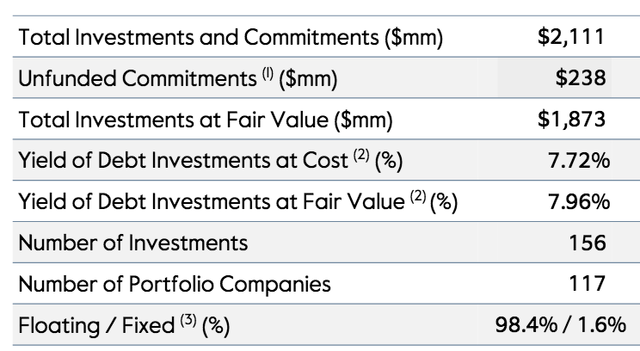

CGBD has a $1.87B portfolio with an overall fair value yield of 7.96%. It holds 117 companies, with 156 total investments, 98.4% of which are at floating rates – a key point in the current rising rate environment:

CGBD site

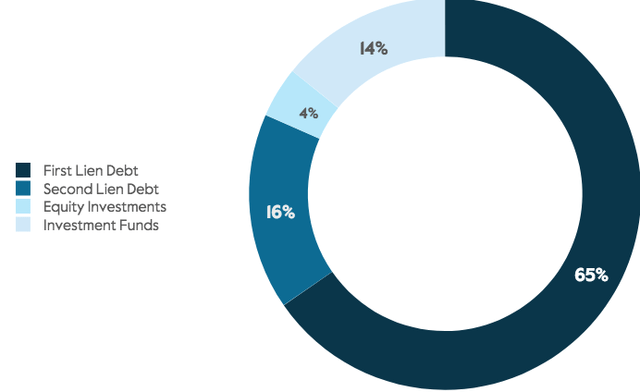

65% of the portfolio is 1st Lien Debt, followed by 16% in 2nd Lien, 4% in its 2 JV Investment Funds, and 4% in Equity Investments:

CGBD site

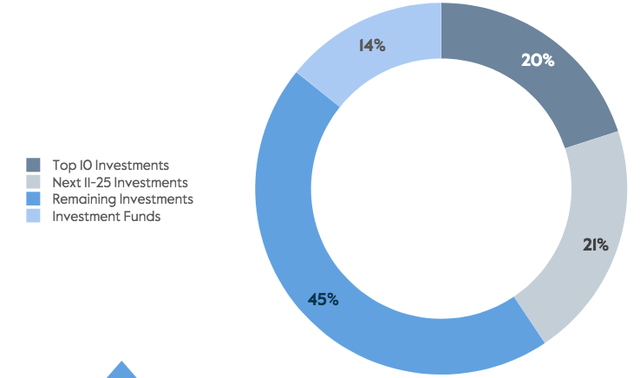

CGBD’s top 10 investments comprise 20% of the portfolio, with the next 15 investments forming 21% and the remaining investments at 45%. The two credit funds, Middle Market Credit Fund, LLC (“Credit Fund”), and Middle Market Credit Fund II, LLC (“Credit Fund II”) form 14% of the portfolio.

CGBD site

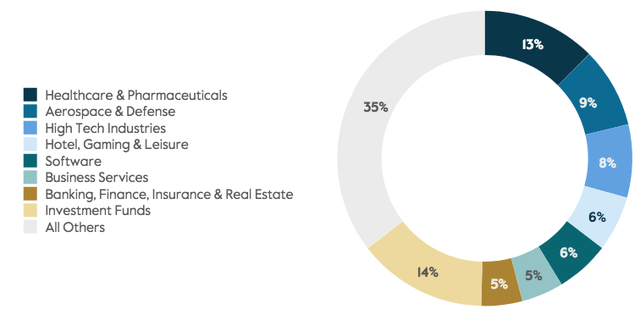

Management has moved more into Healthcare over the past three quarters, increasing it to 13% vs. 10% in Q2 ’21. High Tech has decreased from 10% to 8%, while Aerospace/Defense has increased from 8% to 9%, and Hotel, Gaming & Leisure now forms 6%. All Other Industries comprises 35% of its exposure, down from 38% in Q2 ’21:

CGBD site

Ratings:

The financial health of BDCs held private companies is a key concern for investors, and was the main reasons that BDCs were discounted so heavily in the 2020 COVID Crash – no one knew how well these private companies would hold up. As it happens, the better-run BDCs experienced increasingly stable performance in their private holdings in 2021.

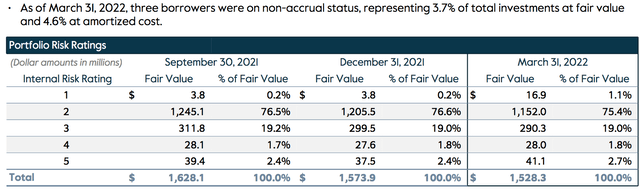

CGBD’s rating system runs from low, Tier 1, to high, Tier 5. The best-rated Tiers 4 and 5 increased from 67.5% as of 9/30/21, to 69.1% as of 3/31/22, while the lowest-rated Tier 1 companies increased from 0.2% to 1.1% of the total portfolio in Q1 ’22.

As of March 31, 2022, three borrowers were on non-accrual status, representing 3.7% of total investments at fair value and 4.6% at amortized cost.

CGBD has “no consequential known direct exposure to business operations in Russia, Ukraine or Eastern Europe broadly.” (Q1 ’22 call)

CGBD site

Earnings:

CGBD has eight consecutive quarters of NAV increases, and its NAV stands 3.3% higher than pre-COVID levels. Total investment income for the first quarter was $48 million, up from $44 million in the prior quarter. Upside performance was primarily driven by the income received from the exit of CGBD’s investment in SolAero, which had been a non-accrual position.

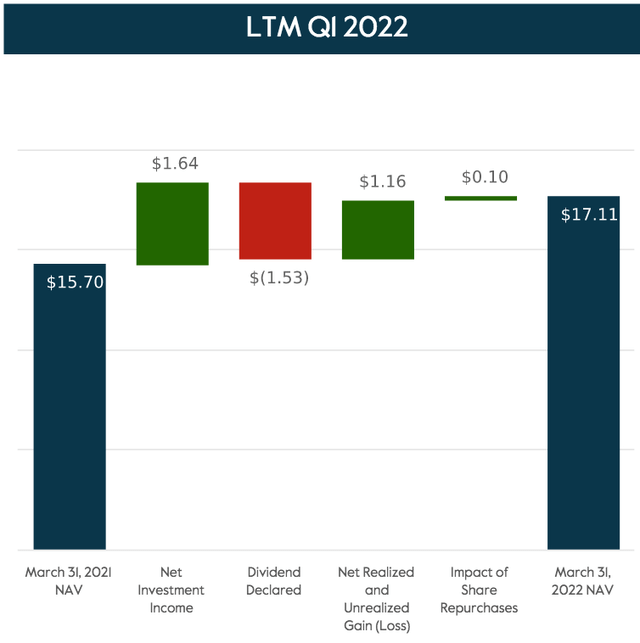

Over the last 12 months, CGBD has earned $1.64/share in Net Investment Income, NII, $1.16 in Net Realized and Unrealized Gains, and $.10/share due to share repurchases, vs. $1.53 in dividends declared, resulting in a ~9% gain in NAV/Share year over year.

CGBD site

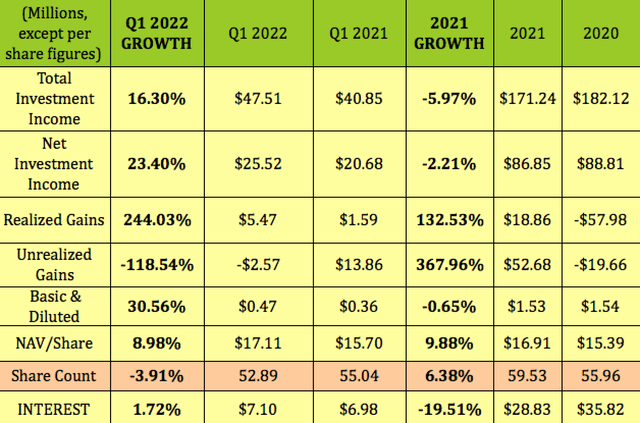

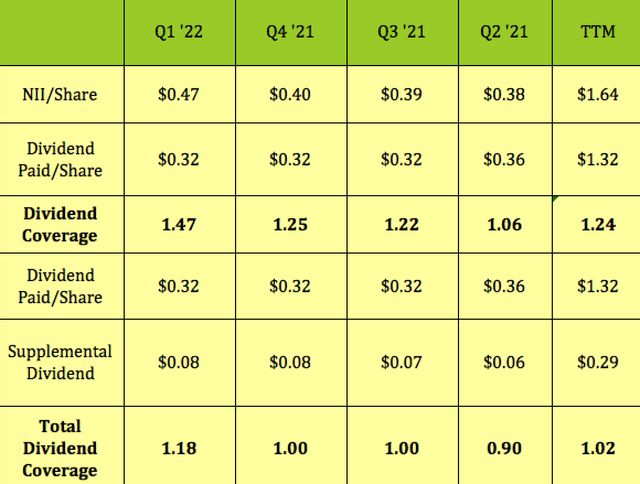

Q1 ’22 total Investment Income rose 16.3%, while NII rose 23.4% in Q1 ’22 vs. Q1 ’21. Net investment income for the first quarter of $25M, or $0.47/share, which matches the highest level in CGBD’s history.

The share count fell -3.9%, which also supported the rise in NAV/Share. Interest Expense rose slightly in Q1 ’22, up 1.7%. Realized Gains, which are lumpy from quarter to quarter, jumped from $1.59M to $5.47M, primarily due to the exit from the investment in SolAero, which had been a non-accrual position. Total dividend income from the two JVs was again $7.5M, in line with the last few quarters.

CGBD’s financial performance was down slightly in 2021, facing tough comps from 2020, a year which saw private companies seeking large amounts of financing from the BDC industry. Top-line growth was -6%, while NII held up better, down -2.2%, and NAV/share rose 9.88%. A notable savings occurred in Interest Expense in 2021, which fell -19.51%:

Hidden Dividend Stocks Plus

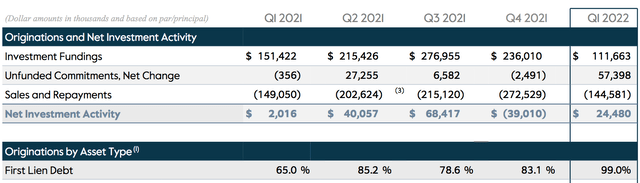

New Business In Q1 2022:

CGBD funded $114M of new investments in Q1 ’22, 99% of which were in a first-lien position, its lowest amount over the past five quarters. This compares with repayments and strategic sales of $159 million during Q1 ’22. It ended the quarter with just under $1.9 billion of investments, essentially flat vs. last quarter.

Management commented on the lending environment on the Q1 ’22 call: “After exiting a record year in 2021, M&A leverage loan and high yield volumes market wide were down in Q1 2022 by 17%, 9%, and 38% respectively quarter-over-quarter. Private transactional markets are healthy, but they’re also facing tough comps and took a bit of a breather after a hectic Q4.

Currently, we have a strong transaction pipeline developing in Q2. This is a time to be highly selective on new investments until better clarity develops on the impact of this inflationary environment.”

CGBD site

Dividends:

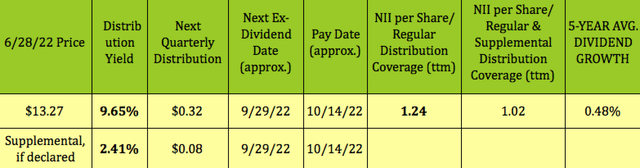

CGBD’s Board declared the regular $.32 dividend and the second straight $.08 supplemental distribution, both of which went ex-dividend on 6/29/22, with a 7/15/22 pay date.

There’s no declaration yet for the September dividend, so we broke it into two parts. At $13.27, the regular dividend yield is 9.65%. If management declares another $.08 supplemental dividend, the total yield would be 12.06%.

It looks like there’s a pretty good chance for another supplemental dividend in Q3. Management said on the Q1 ’22 call: “We are generating consistent income well in excess of our base dividend. And we expect that to continue.”

Hidden Dividend Stocks Plus

NII/Dividend coverage for the regular quarterly dividend was 1.47X in Q1 ’22, with a trailing average of 1.24X over the past four quarters, while the overall coverage, including the supplemental dividends, was 1.18X in Q1 ’22, and has averaged 1.02X over the past four quarters:

Hidden Dividend Stocks Plus

Taxes:

CGBD’s April 2022 distribution was characterized as a non-qualified dividend, in line with its Q4 ’21 payout.

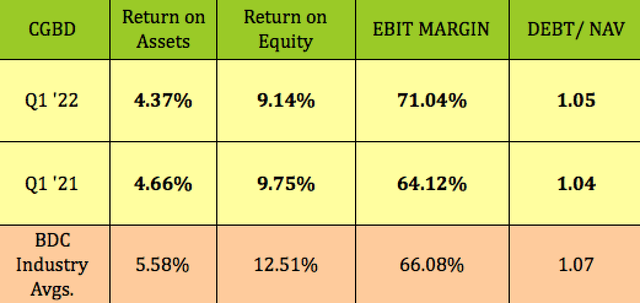

Profitability and Leverage:

ROA and ROE were both down slightly vs. a year ago, and were a bit below BDC industry averages, while CGBD’s EBIT Margin improved to 71%, and was higher than avg. Its Debt/NAV leverage has been steady, and is in line with BDC industry averages.

Hidden Dividend Stocks Plus

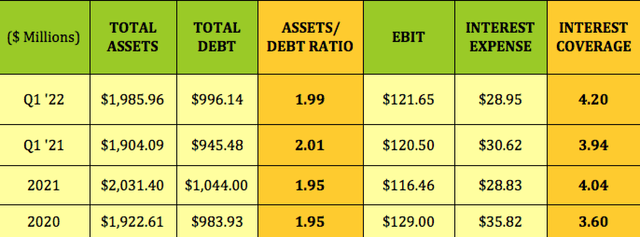

The Assets/Debt ratio held ~steady over the past year, at 1.95X, while EBIT/Interest coverage improved from 3.6X to 4X. Q1 ’22’s Asset/Debt ratio was similar to a year earlier, at 1.99X, while EBIT/Interest coverage improved from 3.94X to 4.2X:

Hidden Dividend Stocks Plus

Debt:

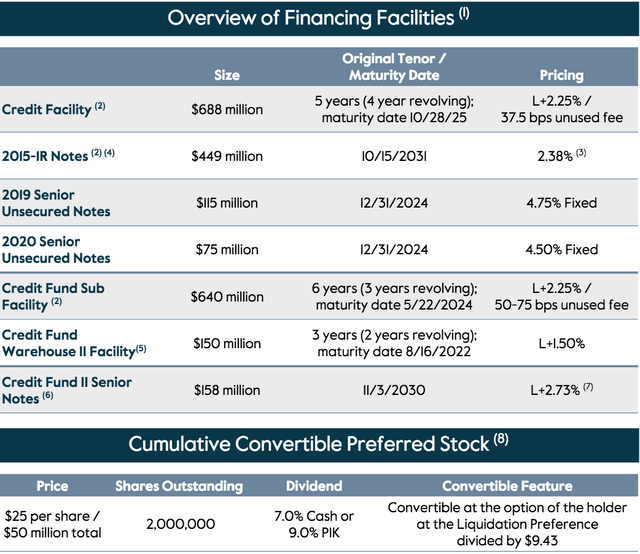

CGBD’s Credit Fund II $150M facility will mature on 8/16/22. They should have no trouble refinancing it, given the Carlyle Group’s access to capital. Beyond that, the next debt maturity isn’t until 5/22/24:

CGBD site

Valuations:

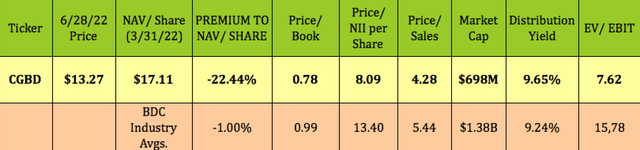

At its 6/28/22 price of $13.27, CGBD is priced at a -22.44% discount to its 3/31/22 NAV of $17.11, far below the BDC industry avg. discount of -1% over NAV/Share.

More importantly, since it values earnings, CGBD’s Price/NII of 8.09X is also much cheaper than the BDC avg. of 13.4X. The EV/EBIT of 7.62X is less than half of the BDC industry’s 17.13X average, while its 9.65% regular dividend yield is over 40 basis points higher than average:

Hidden Dividend Stocks Plus

Market Price Targets:

As usual, analysts’ targets lag CGBD’s financial performance and discounted valuations. The average $15.20 price target is 11% below CGBD’s NAV/share of $17.11. In fact, even the $16.00 highest price target is 6.5% below that NAV/share value.

At $13.27, CGBD is 5% below the lowest price target of $14.00, and 12.7% below the $15.20 average price target:

Hidden Dividend Stocks Plus

Parting Thoughts:

With 98.4% of its investments on floating rates, CGBD should benefit from further rate hikes. As a reference, the current three-month LIBOR rate is now 2.15%, vs. just 0.13% a year ago.

Management referenced this on the Q1 ‘call: “In the back half of 2022, we begin to see a net positive impact. For every 33 basis points of additional increase in LIBOR, we’ll experience a $0.01 increase in NII each quarter. And away from LIBOR, as Taylor mentioned, we also expect the positive earnings impact this year from further improvement in our current non-accrual loans.”

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment